August 28, 2024

AuKing Mining (ASX:AKN) is an exploration and development company with a portfolio focused on uranium, copper and critical minerals in Western Australia, Tanzania and British Columbia, Canada. AuKing Mining aims to become a mid-tier producer with assets including the Koongie Park copper-zinc project in Western Australia, the Mkuju uranium project in Tanzania, and the recently acquired Myoff Creek niobium-REE project in British Columbia, Canada.

AuKing Mining completed a Stage 1 exploration program at Mkuju which comprised a combination of rock chip, soil geochemistry sampling, shallow auger drilling and initial diamond drilling. Some very encouraging results were obtained from this program which have formed the basis for a proposed 11,000m drilling program that is about to commence at Mkuju.

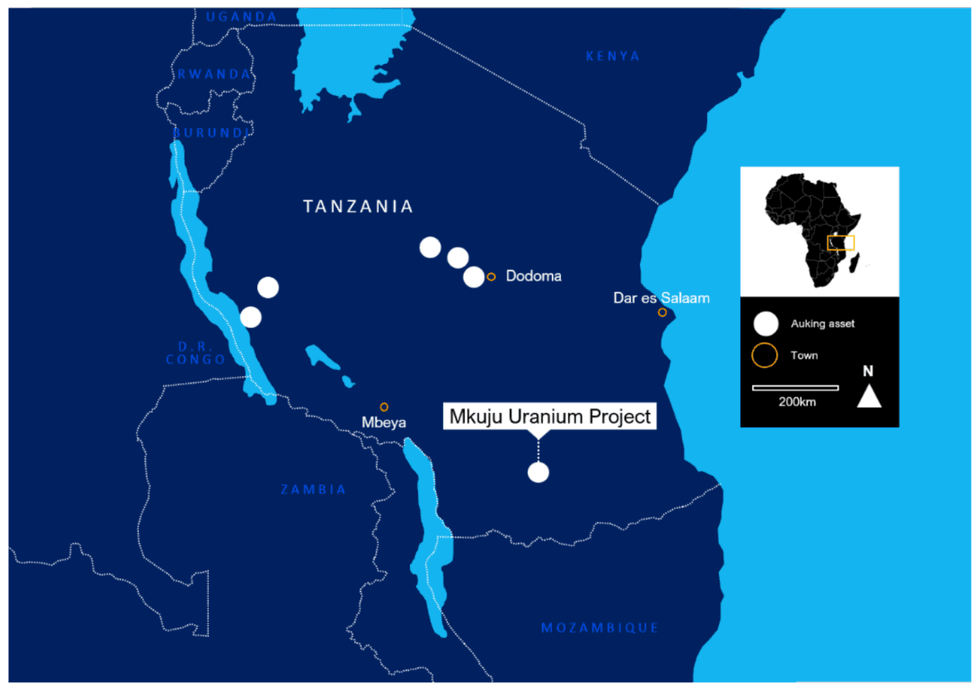

Mkuju project location

Mkuju project locationIn July 2024, AuKing Mining completed the acquisition of the Myoff Creek niobium/REE project in British Columbia, Canada, known for its rich mineral deposits. The site offers excellent accessibility with well-maintained road infrastructure. The project highlights near-surface carbonatite mineralization that spans an area of 1.4 km by 0.4 km with high-grade historic drilling intercepts that include 0.93 percent niobium and 2.06 percent total rare earth oxides.

Company Highlights

- AuKing Mining is an exploration and development company with a portfolio of exploration assets focused on uranium, copper and critical minerals.

- The company holds a diverse portfolio of advanced exploration assets in Western (Koongie Park), Tanzania (Mkuju) and British Columbia, Canada (Myoff Creek)

- Koongie Park has a mineral resource estimate totalling 21.1 Mt across three well-explored deposits - Onedin, Sandiego and Emull.

- AuKing is led by a highly experienced management team executing the company’s strategies to increase shareholder value.

This AuKing Mining profile is part of a paid investor education campaign.*

Click here to connect with AuKing Mining (ASX:AKN) to receive an Investor Presentation

AKN:AU

Sign up to get your FREE

AuKing Mining Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

27 August 2025

AuKing Mining

Advancing the Cloncurry Gold Project in North Queensland with large-scale exploration and near term gold production , while holding interests in copper, uranium and critical metals assets in other regions.

Advancing the Cloncurry Gold Project in North Queensland with large-scale exploration and near term gold production , while holding interests in copper, uranium and critical metals assets in other regions. Keep Reading...

03 February

Share Placement Update

AuKing Mining (AKN:AU) has announced Share Placement UpdateDownload the PDF here. Keep Reading...

28 January

Acquisition of Tin and Silver Prospects

AuKing Mining (AKN:AU) has announced Acquisition of Tin and Silver ProspectsDownload the PDF here. Keep Reading...

19 January

Quarterly Activities Report

AuKing Mining (AKN:AU) has announced Quarterly Activities ReportDownload the PDF here. Keep Reading...

19 January

Quarterly Cashflow Report

AuKing Mining (AKN:AU) has announced Quarterly Cashflow ReportDownload the PDF here. Keep Reading...

14 January

$1.5M Share Placement

AuKing Mining (AKN:AU) has announced $1.5M Share PlacementDownload the PDF here. Keep Reading...

05 February

Ranger Uranium Mine Rehabilitation Gets Green Light from Australia

Minister for Resources and Northern Australia Madeleine King has issued a new rehabilitation authority to Energy Resources Australia (ASX:ERA) for the continuation of rehabilitation activities at the Ranger uranium mine in the Northern Territory.“This new authority means that Energy Resources... Keep Reading...

04 February

Uranium Bull Market Isn’t Over, but Volatility Lies Ahead

Uranium’s resurgence has been one of the resource sector's most durable stories of the past five years, but as prices hover near multi-year highs, investors are increasingly asking the same question: How late is it?At the Vancouver Resource Investment Conference (VRIC), panelists Rick Rule, Lobo... Keep Reading...

02 February

Eagle Energy Metals Corp. and Spring Valley Acquisition Corp. II Announce Effectiveness of Registration Statement and Record and Meeting Dates for Extraordinary General Meeting of Shareholders to Approve Proposed Business Combination

Eagle, a next-generation nuclear energy company with rights to the largest open pit-constrained measured and indicated uranium deposit in the United States, and SVII, a special purpose acquisition company, today announced that the SEC has declared effective the Registration Statement, which... Keep Reading...

30 January

Spot Uranium Passes US$100, Extends Year-Long Rally

Uranium prices surged back above US$100 a pound this week, extending a year-long rally that is reshaping the uranium market after more than a decade of underinvestment.Spot price of uranium climbed US$7.75 to US$101 a pound after the Sprott Physical Uranium Trust... Keep Reading...

29 January

Quarterly Activities/Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Quarterly Appendix 5B Cash Flow Report

Basin Energy (BSN:AU) has announced Quarterly Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

AuKing Mining Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00