August 18, 2024

Elixir Energy Limited (“Elixir” or the “Company”) is pleased to provide an update on the expansion of its 100% owned Project Grandis through the formal award of a 100% working interest in ATP 2077.

HIGHLIGHTS

- ATP 2077 awarded by Queensland Government

- ATP is prospective for both deep and shallow gas

- Independently certified 2C resources of 173 billion cubic feet

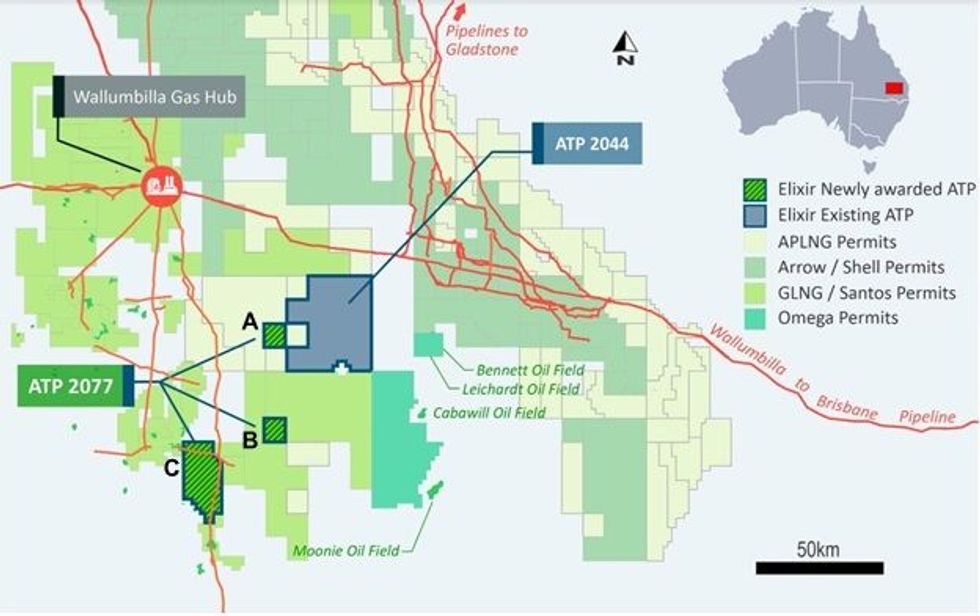

As advised to the market on 20 June 2024, Elixir was appointed as Preferred Tenderer for a new exploration area (PLR2023-1-7) in Queensland located adjacent to its existing ATP 2044 licence (see map below). This tender block has now been formally awarded to Elixir as ATP 2077.

The licence has an initial term of 6 years, has been awarded to Elixir on a 100% basis and does not contain any Government domestic market restrictions. The licence has 3 geographically separate sub-blocks as follows:

- Sub-block A – this is located immediately proximate to ATP 2044 and contains similar Taroom Trough geology. The recent work undertaken on Project Grandis has underpinned an independently certified contingent resource booking in this sub-block - summarized in this announcement.

- Sub-block B – this also overlies the Taroom Trough. However, given the distance from Project Grandis it has been considered premature to book contingent resources on this area at this point in time. Elixir will assess the prospective resources for this block in due course.

- Sub-block C – this area lies outside the Taroom Trough and is adjacent to existing gas infrastructure such as the currently largely dormant Silver Springs gas storage asset. Work undertaken by Elixir’s technical team to date has identified some possible shallow drilling targets in this Sub-block.

Based on the work undertaken by Elixir in ATP 2044, the Company sought an independently certified contingent resource estimate (from international firm ERC Equipoise Pty Ltd – “ERCE”) for ATP 2077 Sub-block A – see table below. The subclass of Contingent Resources (as defined under the PRMS) is “Development Unclarified”, as of 16th August 2024.

Click here for the full ASX Release

This article includes content from Elixir Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

EXR:AU

The Conversation (0)

02 May 2024

Elixir Energy

Early-mover in natural gas exploration and appraisal in Australia and Mongolia.

Early-mover in natural gas exploration and appraisal in Australia and Mongolia. Keep Reading...

11h

Angkor Resources Commences Trenching Program At CZ Gold Prospect, Ratanakiri Province, Cambodia

(TheNewswire) GRANDE PRAIRIE, ALBERTA (February 24, 2026) TheNewswire - Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") announces the completion of a trenching and sampling program at the CZ Gold Prospect in Ratanakiri Province, Cambodia. As previously announced (see... Keep Reading...

23h

PEP 11 Update - Federal Court Proceedings

MEC Resources (MMR:AU) has announced PEP 11 Update - Federal Court ProceedingsDownload the PDF here. Keep Reading...

23 February

Kinetiko Energy Poised to Address South Africa’s Gas Supply Gap: MST Access Report

Description:A research report by MST Access highlights Kinetiko Energy (ASX:KKO) as an emerging participant in South Africa’s domestic gas sector, supported by a base-case valuation of AU$0.49 per share. The company’s project covers 5,366 sq km, located 200 km southeast of Johannesburg within an... Keep Reading...

18 February

Half Yearly Report and Accounts

MEC Resources (MMR:AU) has announced Half Yearly Report and AccountsDownload the PDF here. Keep Reading...

17 February

Syntholene Energy Corp Appoints International Geothermal Leader Eirikur Bragason as Lead Project Manager

Bragason has held senior leadership roles in 650 mW+ of Geothermal Energy Infrastructure Deployment Totalling ~$3.3b, Including the World's Largest Geothermal Power Plant, Hellisheidi in Iceland.Syntholene Energy CORP (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) ("Syntholene"), announces... Keep Reading...

17 February

Syntholene Energy Corp Appoints International Geothermal Leader Eirikur Bragason as Lead Project Manager

Bragason has held senior leadership roles in 650 mW+ of Geothermal Energy Infrastructure Deployment Totalling ~$3.3b, Including the World's Largest Geothermal Power Plant, Hellisheidi in Iceland.Syntholene Energy CORP (TSXV: ESAF,OTC:SYNTF) (FSE: 3DD0) (OTCQB: SYNTF) ("Syntholene"), announces... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00