August 09, 2022

Maiden JORC Resource set for release next month; Latest results, which significantly extend known lodes and reveal gold in previously unmodelled zones, will form part of subsequent Resource update

Labyrinth Resources Limited (ASX: LRL) (‘Labyrinth’ or ‘the Company’) is pleased to announce that assays received for the first three holes of the maiden surface exploration program at its flagship Labyrinth Gold Project in Quebec, Canada contain high-grade results which extend the mineralisation significantly.

Key Points

- Assays received for first three holes of the maiden surface program at Labyrinth significantly extend the many currently defined lodes at depth and along strike

- Drilling also intersected mineralisation in previously unmodelled zones, indicating potential for substantial increases in scale of the deposit

- The initial outstanding result (reported previously – refer ASX Announcement 25 July 2022) in hole LABS-22-01A, located 125m down-dip of the defined Front-West lode, was:

- 2.2m @ 10.67g/t from 143.5m including 0.5m @ 44.12g/t, part of a broader mineralised interval of 8.1m @ 4.05g/t from 143.5m

- This result is strongly supported by the latest assays, with hole LABS-22-02 delivering an excellent result 375m down-dip of the defined Boucher lode of:

- 1.4m @ 13.32g/t from 652.3m including 0.9m @ 20.53g/t

- Visual quart and pyritic mineralisation observed in LABS-22-04 and LABS-22-05 indicate further down-dip and along strike extensions to existing modelled lodes, with assays pending

- Drilling at Labyrinth remains only shallow compared to other significant projects in the region, which are host to multi-million ounce deposits (refer figure 2)

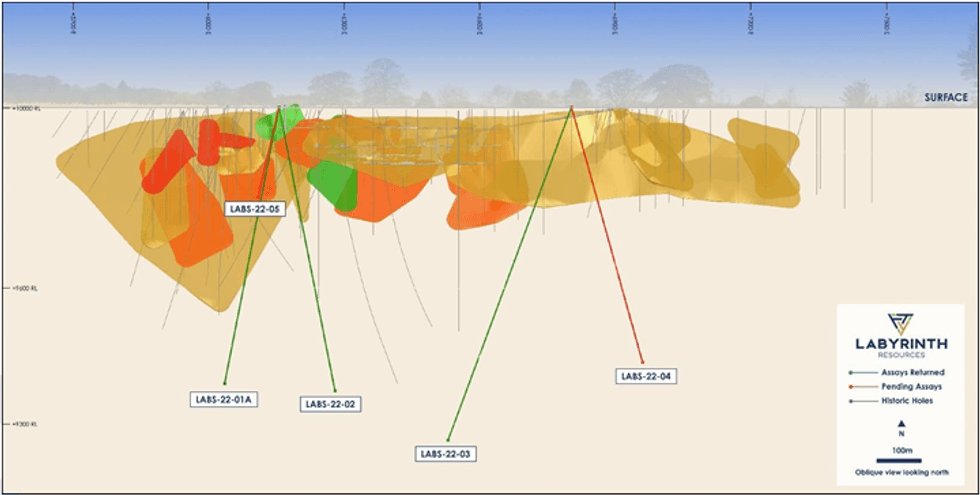

Figure 1 – Maiden surface exploration targeting mineralisation extensions to depth of up to ~700m below surface

Highlights include 20.53g/t in LABS-22-02, which extends the Boucher lode by a significant 375m down- dip.

This follows the previously reported result of 44.12g/t in LABS-22-01, which was 125m down dip of the currently defined Front-West lode (Refer ASX Announcement 25 July 2022).

Drilling of phase one is now successfully complete, with 3,135m drilled across 5 holes in just 44 days, under budget and with no safety incidents.

Assays are pending for LABS-22-04 and LABS-22-05.

Quartz and pyritic mineralisation characteristic to Labyrinth has been observed across multiple lodes, with results confirming the mineralisation extends up to 375m down dip and to a depth of ~550m below surface, remaining open at depth and along strike.

Labyrinth is on track to publish its maiden JORC Resource next month. These latest assays and those pending will form part of a subsequent Resource update.

Labyrinth Chief Executive Matt Nixon said: “These are outstanding results which highlight the scope for substantial growth in the deposit, both along strike and at depth.

“We are in the throes of finalising our maiden JORC Resource and already we have established substantial mineralisation which sits outside these parameters, paving the way for a subsequent Resource update.

“We have barely scratched the surface at Labyrinth compared with the drilling completed at other major deposits in the Abitibi region. The scale of these endowments shows the upside we have at Labyrinth”.

Click here for the full ASX Release

This article includes content from Labyrinth Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

LRL:AU

The Conversation (0)

31 August 2023

Labyrinth Resources

Developing underexplored gold assets in the prolific Canadian Abitibi Gold Belt and the Yilgarn Craton of Western Australia.

Developing underexplored gold assets in the prolific Canadian Abitibi Gold Belt and the Yilgarn Craton of Western Australia. Keep Reading...

13h

Flow Metals to Acquire the Monster IOCG Project in Yukon

Flow Metals Corp. (CSE: FWM) ("Flow Metals" or the "Company") is pleased to report that it has entered into an option agreement dated February 9, 2026 (the "Option Agreement") with Go Metals Corp. ("Go Metals") to acquire the Monster IOCG project (the "Monster Project"), located approximately 90... Keep Reading...

09 February

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

09 February

Dr. Adam Trexler: Physical Gold Market Broken, Crisis Unfolding Now

Dr. Adam Trexler, founder and president of Valaurum, shares his thoughts on gold, identifying a key issue he sees developing in the physical market. "There's a crisis in the physical gold market," he said, explaining that sector participants need to figure out how to serve investors who want to... Keep Reading...

09 February

Trevor Hall: Bull Markets Don’t Always Mean Big Returns

Clear Commodity Network CEO and Mining Stock Daily host Trevor Hall opened his talk at the Vancouver Resource Investment Conference (VRIC) with a strong message: It is still possible to go broke in a bull market.“I want to start with the simple but uncomfortable truth: most investors don't lose... Keep Reading...

09 February

How Near-term Production is Changing the Junior Gold Exploration Model

Junior gold companies have traditionally been defined by exploration: identifying prospective ground, drilling to delineate a resource and, ideally, monetising that discovery through a sale or joint venture with a larger producer. While this model has delivered success in the past, changing... Keep Reading...

09 February

Gold Exploration in Guinea: An Emerging Opportunity in West Africa

While much of West Africa’s gold exploration spotlight has historically fallen on countries like Ghana and Mali, Guinea is increasingly emerging as a quiet outlier — a country with proven gold endowment, expansive underexplored terrain and a growing number of active exploration programs. Despite... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00