August 05, 2025

Asra Minerals (ASX:ASR) is unlocking the value of its resource portfolio and underexplored prospects in Western Australia’s renowned Leonora Goldfields. The company holds one of the largest and most prospective land positions in the district, strategically located near major gold producers, including Genesis Minerals (ASX:GMD) with its 8.9 Moz Leonora Operations, Vault Minerals (ASX:VAU) with the 1.9 Moz Darlot and 4.1 Moz King of the Hills mines, and Northern Star (ASX:NST), operator of the 4.2 Moz Thunderbox mine.

A strategic reset in late 2024 brought in a new CEO, technical team, and a focused drilling strategy targeting resource growth and project consolidation. With strong gold prices supported by global uncertainty and Western Australia’s stable regulatory environment, Asra’s historically underexplored and fragmented ground is now well-positioned for discovery, growth, and long-term value creation.

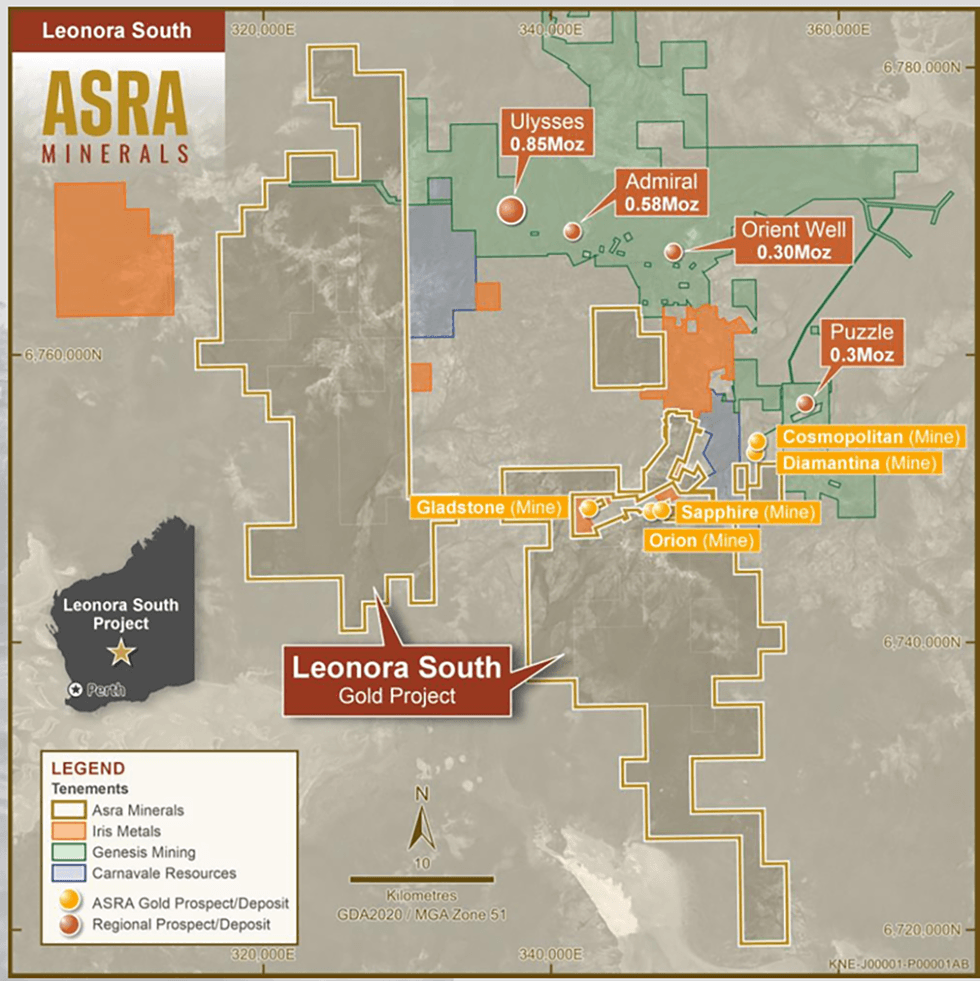

Asra Minerals’ flagship Leonora Gold Project covers over 936 sq km in Western Australia’s prolific Eastern Goldfields, one of the country’s most productive gold regions. The project is divided into the Leonora North and Leonora South areas and is strategically located near world-class gold operations, including Genesis Minerals’ Leonora Operations, Vault Minerals’ King of the Hills, and Northern Star’s Thunderbox mine—all within trucking distance. Asra’s tenements lie along highly prospective granite-greenstone contacts and major fault zones, including the Ursus Fault, a key structural control for high-grade orogenic gold mineralization.

Company Highlights

- District-Scale Gold Project in Tier-One Jurisdiction: 936 sq km landholding in WA’s Leonora region, proximal to more than 15 Moz of gold resources across neighboring major mines.

- JORC Resource of 200 koz at 1.8 g/t gold: Existing resource includes high-grade shallow mineralization at Orion, Sapphire, Mt Stirling and Stirling Well.

- Aggressive Growth Strategy: Targeting >500 koz resource base in 2025 through near-resource and greenfield drilling.

- Ongoing Exploration: Systematic exploration underway across the portfolio with multiple high-priority targets identified for further follow-up.

- New High-impact Leadership: Rebuilt management and technical team in late 2024, including renowned gold discoverers behind Gruyere (6.2 Moz) and Raleigh (1 Moz).

- Undervalued Opportunity: With a ~$10 million market cap, Asra offers substantial re-rating potential amid rising gold prices and renewed institutional interest.

This Asra Minerals profile is part of a paid investor education campaign.*

Click here to connect with Asra Minerals (ASX:ASR) to receive an Investor Presentation

ASR:AU

The Conversation (0)

09 September 2025

Review at Leonora North Provides Clear Focus for Future Work

Asra Minerals (ASR:AU) has announced Review at Leonora North Provides Clear Focus for Future WorkDownload the PDF here. Keep Reading...

08 September 2025

Successful $3.25M Placement to Accelerate Leonora Projects

Asra Minerals (ASR:AU) has announced Successful $3.25M Placement to Accelerate Leonora ProjectsDownload the PDF here. Keep Reading...

03 September 2025

Trading Halt

Asra Minerals (ASR:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

01 September 2025

Drilling Success Confirms & Extends Gold System

Asra Minerals (ASR:AU) has announced Drilling Success Confirms & Extends Gold SystemDownload the PDF here. Keep Reading...

22 August 2025

Orion and Sapphire Drilling Results (Updated)

Asra Minerals (ASR:AU) has announced Orion and Sapphire Drilling Results (Updated)Download the PDF here. Keep Reading...

27 February

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

27 February

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

27 February

OTC Markets Group Welcomes RUA GOLD INC. to OTCQX

OTC Markets Group Inc. (OTCQX: OTCM), operator of regulated markets for trading 12,000 U.S. and international securities, today announced Rua Gold INC. (TSX: RUA,OTC:NZAUF; OTCQX: NZAUF), an exploration company, has qualified to trade on the OTCQX® Best Market. Rua Gold INC. upgraded to OTCQX... Keep Reading...

27 February

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

27 February

American Eagle Expands South Zone 750 Metres to the East and Further Demonstrates Continuity Within High-Grade Core, Intersecting 618 Metres of 0.77% CuEq from Surface

Highlights: 618 m of 0.77% CuEq from surface in NAK25-80, linking high grade, at-surface gold rich mineralization to high-grade core at depth. Continuity from surface to depth: NAK25-80 builds on prior long-intervals, including NAK25-78: 802 m of 0.71% CuEq from surface, and strengthens... Keep Reading...

26 February

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Obonga Project: Wishbone VMS Update

27 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00