July 23, 2023

Miramar Resources Limited (ASX:M2R, “Miramar” or “the Company”) is pleased to advise that it has received Programme of Work (POW) approval for drilling at the 100%-owned Mount Vernon Ni-Cu-PGE Project in the Gascoyne region of Western Australia.

The Mount Vernon Project is one of several granted or pending Exploration Licences which make up the Company’s 100% owned Bangemall Project.

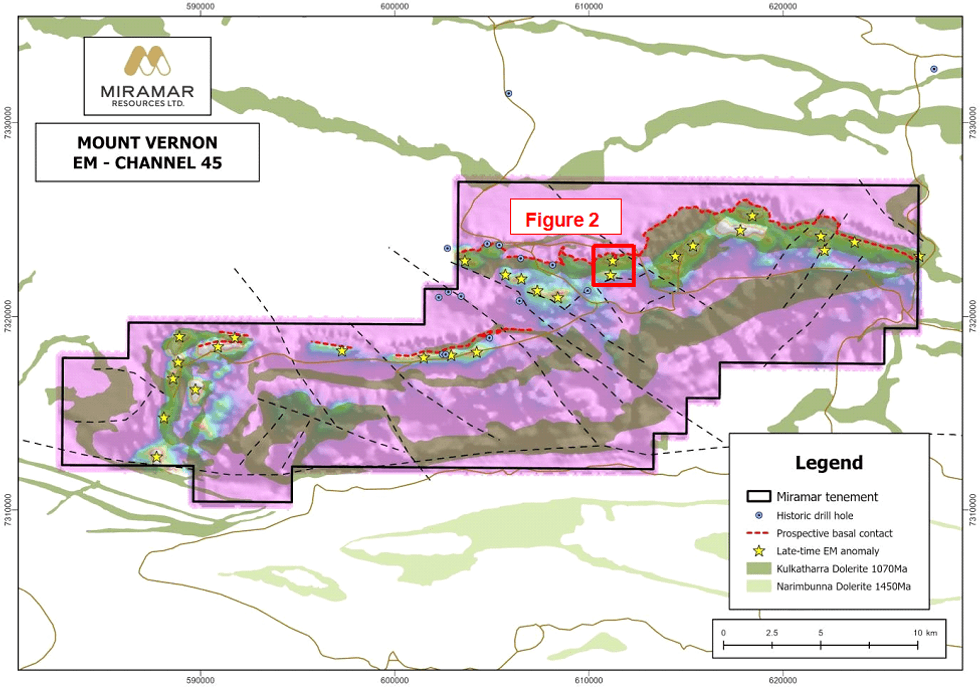

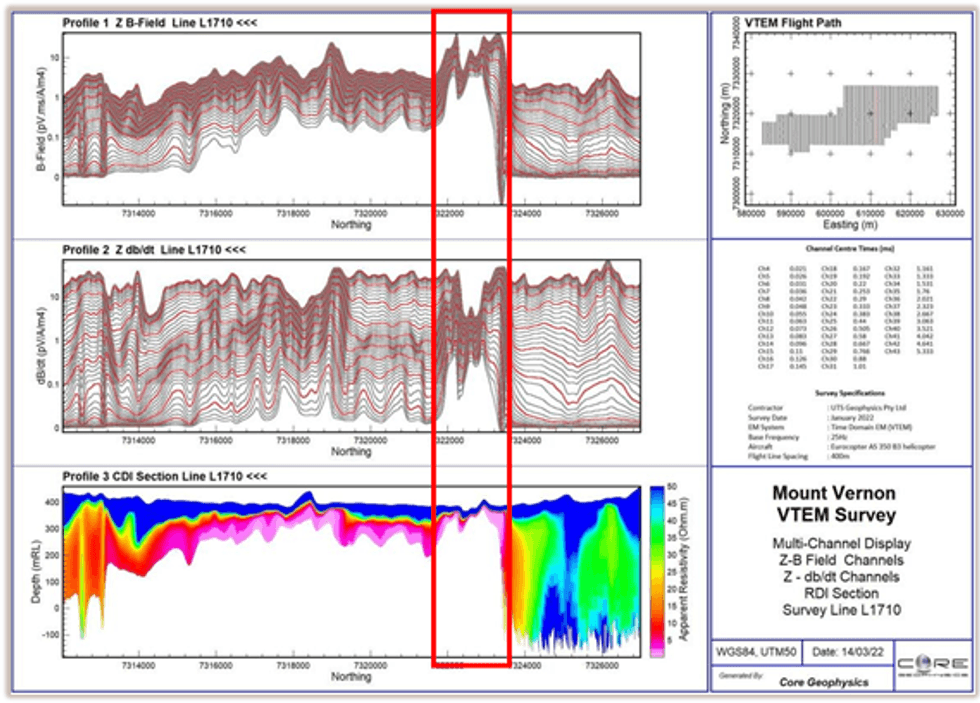

The Company has received POW approval for RC and/or diamond drilling at Mount Vernon which will test Ni-Cu-PGE targets associated with Kulkatharra Dolerite sills and highlighted by historic geochemical sampling and Miramar’s 2022 airborne EM survey (Figure 1).

Miramar’s Executive Chairman, Mr Allan Kelly, said the Mount Vernon Project had several high-priority drill targets which could result in the discovery of a new style of nickel mineralisation in WA.

“Geoscience Australia and the GSWA both identified the potential for the Kulkatharra Dolerite sills to host significant Ni-Cu-PGE mineralisation such as the giant Norilsk deposits in Siberia,” Mr Kelly said.

“Despite this, very little relevant project-scale work has been completed to date,” he added.

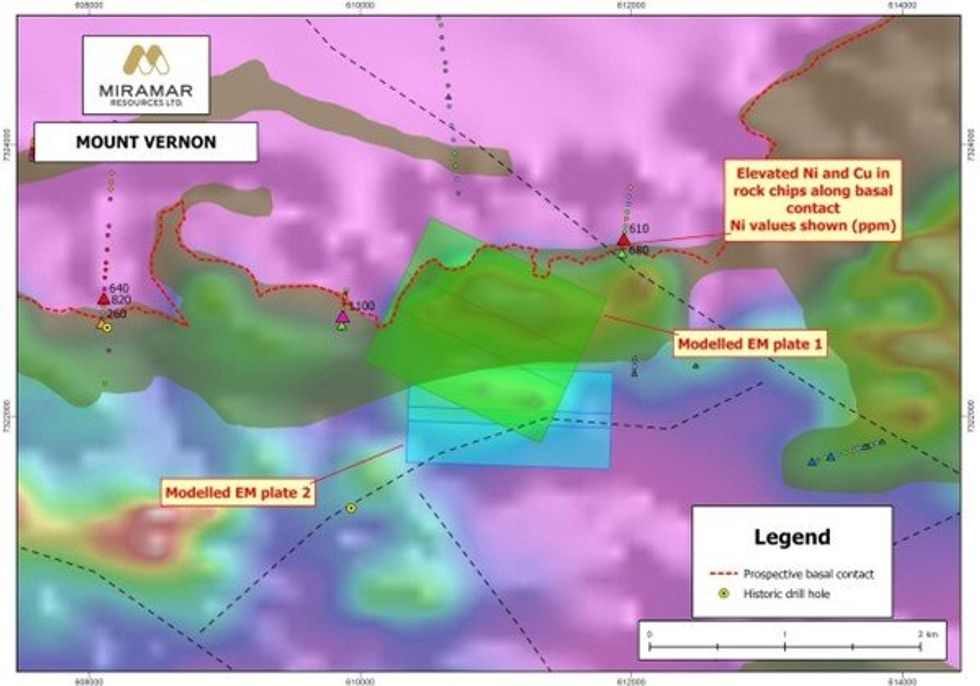

“At Mount Vernon, our detailed magnetic and EM survey highlighted a number of highly conductive late- time EM anomalies inboard of the outcropping basal contact of a dolerite sill which has several significant historic nickel and copper results in soil and rock chip samples,” Mr Kelly said.

“The modelled plate over the highest priority target has a similar footprint to the ground EM anomaly outlined at Nova-Bollinger prior to the discovery drill hole,” he added.

Upcoming Work Programme

The Company is planning the following at Mount Vernon following completion of drilling at Whaleshark:

- Rock chip and/or soil sampling along the basal contact

- Orientation ground EM surveys over selected airborne EM anomalies

- Finalising drill hole locations based on the above results

COMPETENT PERSON STATEMENT

The information in this report that relates to Exploration Targets or Exploration Results is based on information compiled by Allan Kelly, a “Competent Person” who is a Member of The Australian Institute of Geoscientists. Mr Kelly is the Executive Chairman of Miramar Resources Ltd. He is a full-time employee of Miramar Resources Ltd and holds shares and options in the company.

Mr Kelly has sufficient experience that is relevant to the style of mineralisation and type of deposits under consideration and to the activity being undertaken to Qualify as a “Competent Person” as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’.

Click here for the full ASX Release

This article includes content from Miramar Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

06 February 2024

Miramar Resources

Aiming to create shareholder value through the discovery of world-class mineral deposits

Aiming to create shareholder value through the discovery of world-class mineral deposits Keep Reading...

2h

Gold-Copper Consolidation Continues as Eldorado Moves to Acquire Foran

Eldorado Gold Corporation (NYSE:EGO,TSX:ELD) and Foran Mining (TSX:FOM,OTCQX:FMCXF) have agreed to combine in a share-based transaction that would create a larger, diversified gold and copper producer with two major development projects set to enter production in 2026Under the deal, Eldorado... Keep Reading...

4h

Stellar AfricaGold Intersects Multiple Gold-Bearing Zones and Confirms Structural Controls at Tichka Est, Morocco - Drilling Resumed on January 30, 2026

(TheNewswire) Vancouver, BC TheNewswire - February 3rd, 2026 Stellar AfricaGold Inc. ("Stellar" or the "Company") (TSX-V: SPX | FSE: 6YP | TGAT: 6YP) is pleased to report additional assay results and an updated interpretation from its ongoing diamond drilling program at the Tichka Est Gold... Keep Reading...

19h

Gold and Silver Prices Take a U-Turn on Trump's Fed Chair Nomination

Gold and silver prices have experienced one of their most savage corrections in decades. After hitting a record high of close to US$5,600 per ounce in the last week of January, the price of gold took a dramatic U-turn on January 30, dropping as low as US$4,400 in early morning trading on Monday... Keep Reading...

20h

Bold Ventures Kicks Off 2026 with Diamond Drilling Program at Burchell Base and Precious Metals Project

Bold Ventures (TSXV:BOL) has launched a diamond drilling program at its Burchell base and precious metals property in Ontario, President and COO Bruce MacLachlan told the Investing News Network.“We just started drilling a couple of weeks ago, and we’ll be drilling for a while,” MacLachlan said,... Keep Reading...

20h

Providence Gold Mines CEO Highlights Growth Catalysts at La Dama de Oro Gold Property

In an interview during the Vancouver Resource Investment Conference, Providence Gold Mines (TSXV:PHD,OTCPL:PRRVF) President, CEO and Director Ron Coombes said 2026 will be a pivotal year for the company. Providence Gold Mines is entering a key growth phase as funding, permitting and technical... Keep Reading...

02 February

Randy Smallwood: The Case for Gold Streaming in Today's Price Environment

Gold streaming took center stage at the Vancouver Resource Investment Conference last week as Randy Smallwood, president and CEO of Wheaton Precious Metals (TSX:WPM,NYSE:WPM), laid out why the model is drawing renewed investor attention amid today's high gold and silver prices.Speaking during a... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00