July 23, 2023

Miramar Resources Limited (ASX:M2R, “Miramar” or “the Company”) is pleased to advise that it has received Programme of Work (POW) approval for drilling at the 100%-owned Mount Vernon Ni-Cu-PGE Project in the Gascoyne region of Western Australia.

The Mount Vernon Project is one of several granted or pending Exploration Licences which make up the Company’s 100% owned Bangemall Project.

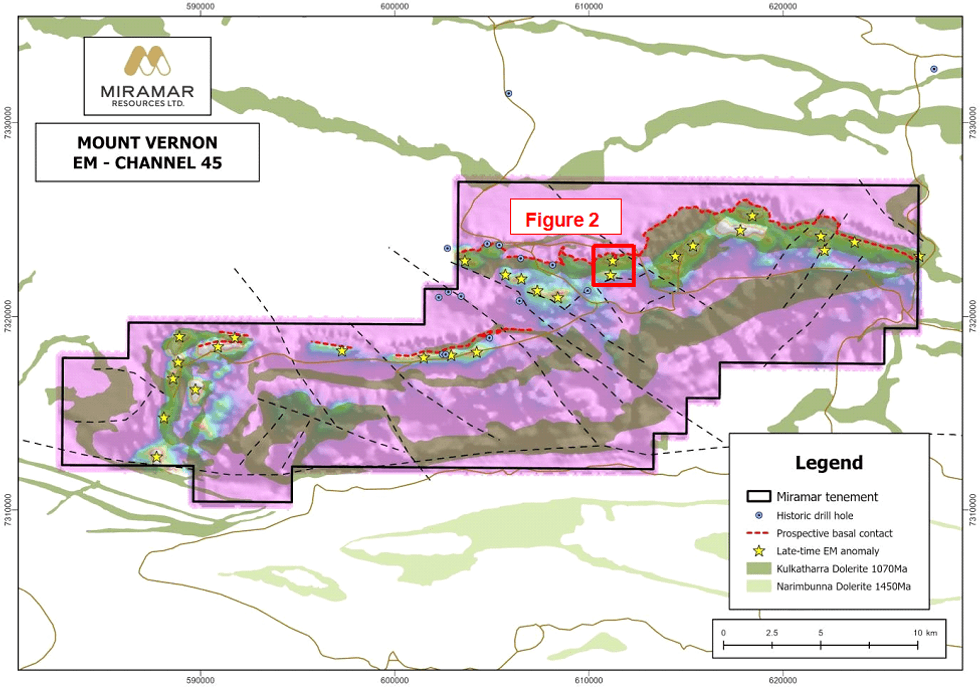

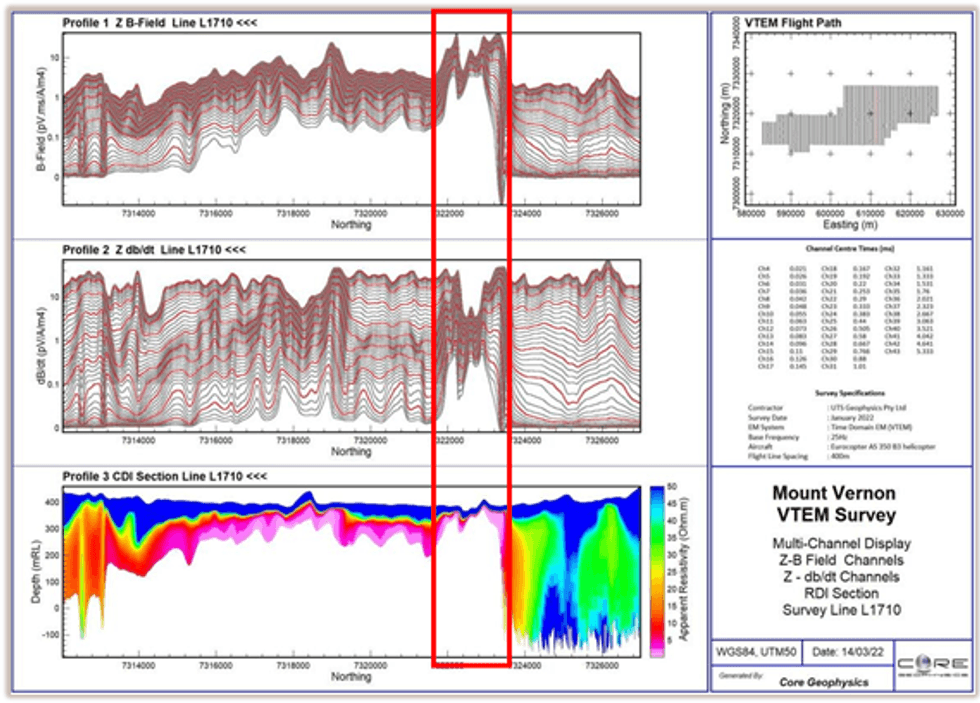

The Company has received POW approval for RC and/or diamond drilling at Mount Vernon which will test Ni-Cu-PGE targets associated with Kulkatharra Dolerite sills and highlighted by historic geochemical sampling and Miramar’s 2022 airborne EM survey (Figure 1).

Miramar’s Executive Chairman, Mr Allan Kelly, said the Mount Vernon Project had several high-priority drill targets which could result in the discovery of a new style of nickel mineralisation in WA.

“Geoscience Australia and the GSWA both identified the potential for the Kulkatharra Dolerite sills to host significant Ni-Cu-PGE mineralisation such as the giant Norilsk deposits in Siberia,” Mr Kelly said.

“Despite this, very little relevant project-scale work has been completed to date,” he added.

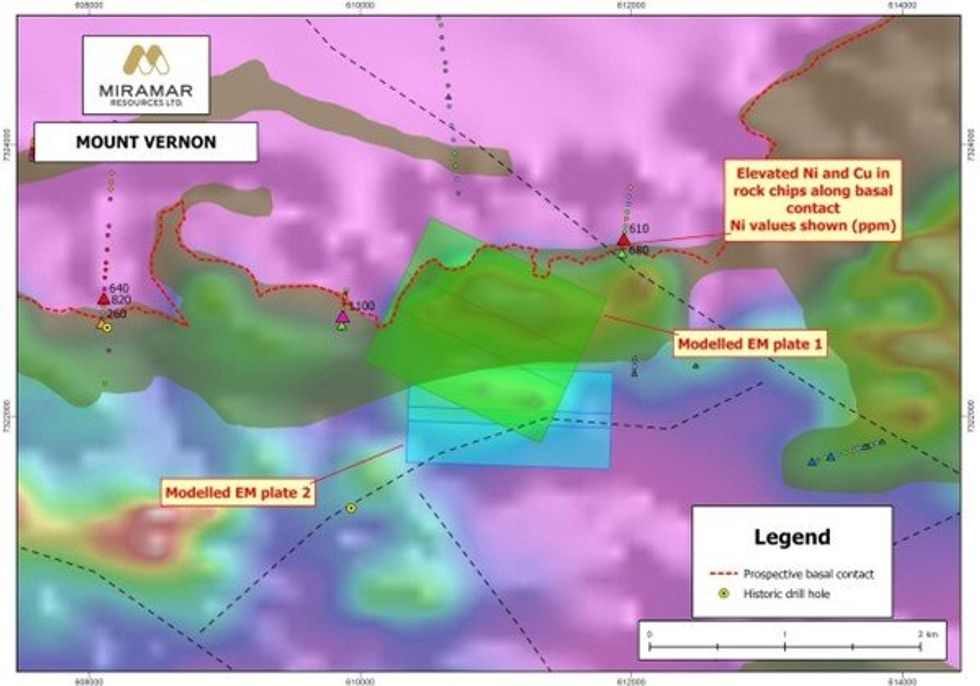

“At Mount Vernon, our detailed magnetic and EM survey highlighted a number of highly conductive late- time EM anomalies inboard of the outcropping basal contact of a dolerite sill which has several significant historic nickel and copper results in soil and rock chip samples,” Mr Kelly said.

“The modelled plate over the highest priority target has a similar footprint to the ground EM anomaly outlined at Nova-Bollinger prior to the discovery drill hole,” he added.

Upcoming Work Programme

The Company is planning the following at Mount Vernon following completion of drilling at Whaleshark:

- Rock chip and/or soil sampling along the basal contact

- Orientation ground EM surveys over selected airborne EM anomalies

- Finalising drill hole locations based on the above results

COMPETENT PERSON STATEMENT

The information in this report that relates to Exploration Targets or Exploration Results is based on information compiled by Allan Kelly, a “Competent Person” who is a Member of The Australian Institute of Geoscientists. Mr Kelly is the Executive Chairman of Miramar Resources Ltd. He is a full-time employee of Miramar Resources Ltd and holds shares and options in the company.

Mr Kelly has sufficient experience that is relevant to the style of mineralisation and type of deposits under consideration and to the activity being undertaken to Qualify as a “Competent Person” as defined in the 2012 Edition of the ‘Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves’.

Click here for the full ASX Release

This article includes content from Miramar Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

06 February 2024

Miramar Resources

Aiming to create shareholder value through the discovery of world-class mineral deposits

Aiming to create shareholder value through the discovery of world-class mineral deposits Keep Reading...

27 February

Lahontan Gold Eyes Resource Update as Production Nears

Lahontan Gold (TSXV: LG,OTCQB:LGCXF) is drawing investor attention as it advances toward renewed production at its historic Santa Fe Mine in Nevada. A revised mineral resource estimate is expected soon, offering a potential catalyst, according to a recent report by News Financial.... Keep Reading...

27 February

Peruvian Metals Invites Shareholders and Investment Community to Visit Them at Booth 2624B at PDAC 2026 in Toronto, March 3-4

Peruvian Metals Corp (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals" or the "Company") is pleased to invite investors and shareholders to Booth #2624B at the Prospectors & Developers Association of Canada's (PDAC) Convention at the Metro Toronto Convention Centre (MTCC) from Tuesday,... Keep Reading...

27 February

OTC Markets Group Welcomes RUA GOLD INC. to OTCQX

OTC Markets Group Inc. (OTCQX: OTCM), operator of regulated markets for trading 12,000 U.S. and international securities, today announced Rua Gold INC. (TSX: RUA,OTC:NZAUF; OTCQX: NZAUF), an exploration company, has qualified to trade on the OTCQX® Best Market. Rua Gold INC. upgraded to OTCQX... Keep Reading...

27 February

RUA GOLD Begins Trading on the OTCQX Best Market in the United States

Rua Gold INC. (TSX: RUA,OTC:NZAUF) (NZ: RGI) (OTCQX: NZAUF) ("Rua Gold" or the "Company") is pleased to announce that that its common shares have begun trading today on the OTCQX® Best Market under the symbol 'NZAUF'. U.S. investors can find current financial disclosure and Real-Time Level 2... Keep Reading...

27 February

American Eagle Expands South Zone 750 Metres to the East and Further Demonstrates Continuity Within High-Grade Core, Intersecting 618 Metres of 0.77% CuEq from Surface

Highlights: 618 m of 0.77% CuEq from surface in NAK25-80, linking high grade, at-surface gold rich mineralization to high-grade core at depth. Continuity from surface to depth: NAK25-80 builds on prior long-intervals, including NAK25-78: 802 m of 0.71% CuEq from surface, and strengthens... Keep Reading...

26 February

Pause in Trading

Zeus Resources Limited (ZEU:AU) has announced Pause in TradingDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00