July 29, 2024

Anax Metals Limited – “consolidating base metals production in the Pilbara”

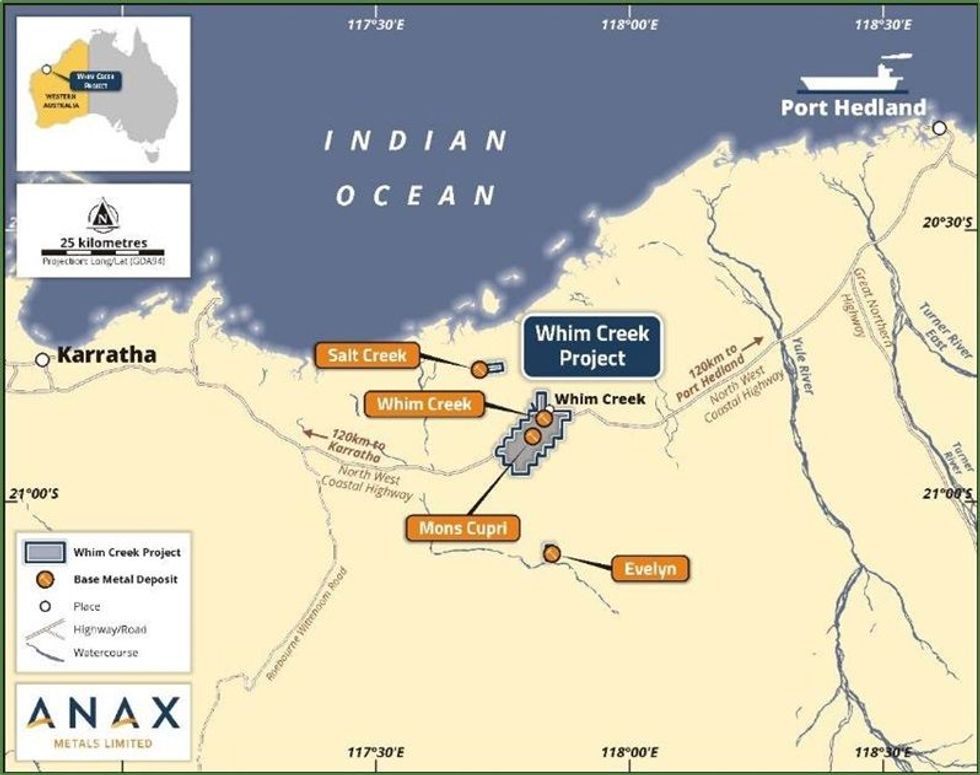

Anax Metals Limited (ASX: ANX, Anax, or the Company) continues to advance its flagship Whim Creek Copper-Zinc JV Project (the Project) located in the Pilbara region of Western Australia (Figure 1).

Highlights of the Quarter ended 30 June 2024

- Whim Creek production hub strategy gathering momentum

- Promising heap leach results from Sulphur Springs

- Memorandum of Understanding (MOU) executed with GreenTech Metals Ltd over the Whundo VMS Project

- Drilling contract with part payment of drilling services in equity up to $1 million executed with Topdrill Pty Ltd

- Rig mobilised to the high-grade Evelyn deposit in July (post quarter)

- Expanded focus on base metal exploration in the next quarter

Project Development – Whim Creek Project (ANX 80% - DVP 20%)

The Whim Creek DFS (April 2023) demonstrated a technically and economically robust polymetallic project and strategic processing hub development in the Pilbara.1 The DFS considered processing sulphide ore from the Mons Cupri, Whim Creek, Evelyn and Salt Creek deposits through a proposed new 400 kilo-tonnes per annum (ktpa) concentrator.

In addition to the sulphide concentrate production, Anax also intends to use the fully permitted existing heap leach facility to produce copper cathode and zinc sulphate. Heap leaching is anticipated to begin in the second year of operation and the modest refurbishments costs would be funded out of operational cashflow.

The heap leach Scoping Study (September 2023), was underpinned by column leaching test work that achieved copper extraction of 80% and zinc extraction of 90% from low grade sulphide ore.2,3

The Whim Creek Project is forecast to produce an average of 12,000 tonnes of Copper Equivalent** (CuEq) per annum consisting of 62Kt of copper, 97Kt of zinc and 20Kt of lead over an 8-year mine-life

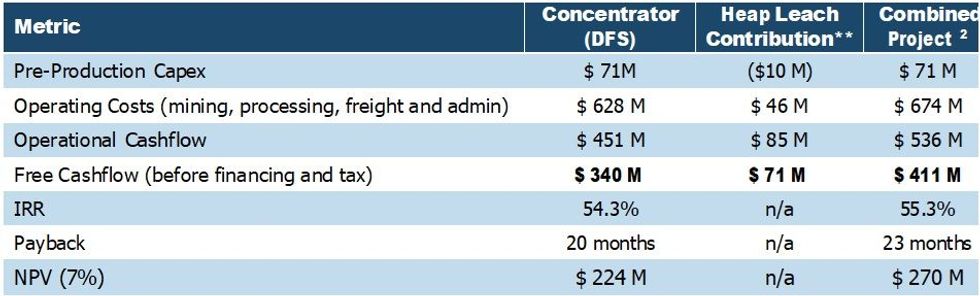

A summary of the key financial metrics of the previously released studies are presented below in Table 1.

*Reported on a 100% Project Basis. ANX has an 80% interest in the project and will contribute 80% of costs and receive 80% of financial outcomes.

*Copper US$9,100, Zinc US$3,000, Lead US$2,100, Silver US$25, Gold US$1,800 US AUD 0.68.

**Refer to Copper Equivalent calculation later in this announcement.

The Whim Creek Project remains a robust development option that would be highly profitable in the current commodity price environment.

The Company is continuing Project financing discussions with several parties, including commodity traders, mining funds, and multi-nationals. Indicative non-binding terms have been received from several parties. Anax will continue to evaluate the options received to date and those that the Company expects to receive in the coming quarter.

While financing discussions continue, the Company will focus on pursuing Project growth opportunities, through Consolidation and Exploration.

Click here for the full ASX Release

This article includes content from Anax Metals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

ANX:AU

The Conversation (0)

28 July 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Anax Metals Limited (ANX:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

02 July 2025

Anax withdraws from arbitration

Anax Metals Limited (ANX:AU) has announced Anax withdraws from arbitrationDownload the PDF here. Keep Reading...

05 May 2025

ANX secures commitment for funding from cornerstone investor

Anax Metals Limited (ANX:AU) has announced ANX secures commitment for funding from cornerstone investorDownload the PDF here. Keep Reading...

01 May 2025

Trading Halt

Anax Metals Limited (ANX:AU) has announced Trading HaltDownload the PDF here. Keep Reading...

30 April 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Anax Metals Limited (ANX:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

8h

ASX Copper Mining Stocks: 5 Biggest Companies in 2026

Copper prices have been volatile throughout 2025 and into 2026, fueled by economic uncertainty from an ever-changing US trade policy and strong supply and demand fundamentals. The International Copper Study Group, the leading copper market watcher, reported an apparent refined copper surplus of... Keep Reading...

8h

What Was the Highest Price for Copper?

Strong demand in the face of looming supply shortages has pushed copper to new heights in recent years.With a wide range of applications in nearly every sector, copper is by far the most industrious of the base metals. In fact, for decades, the copper price has been a key indicator of global... Keep Reading...

19 February

Northern Dynasty Shares Plunge as DOJ Backs EPA Veto of Alaska’s Pebble Mine

Northern Dynasty Minerals (TSX:NDM,NYSEAMERICAN:NAK) shares plunged on Wednesday (February 18) after the US Department of Justice (DOJ) filed a court brief backing the Environmental Protection Agency’s (EPA) January 2023 veto of the company’s long-contested Pebble project in Alaska.The brief... Keep Reading...

18 February

BHP Reports Strong Half-Year Copper Results, Boosts Guidance for 2026

BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has published its financial results for the half-year ended December 31, 2025.The mining giant said its copper operations, which span multiple continents, accounted for the largest share of its overall earnings for the first time, coming in at 51 percent of... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00