January 23, 2025

Description

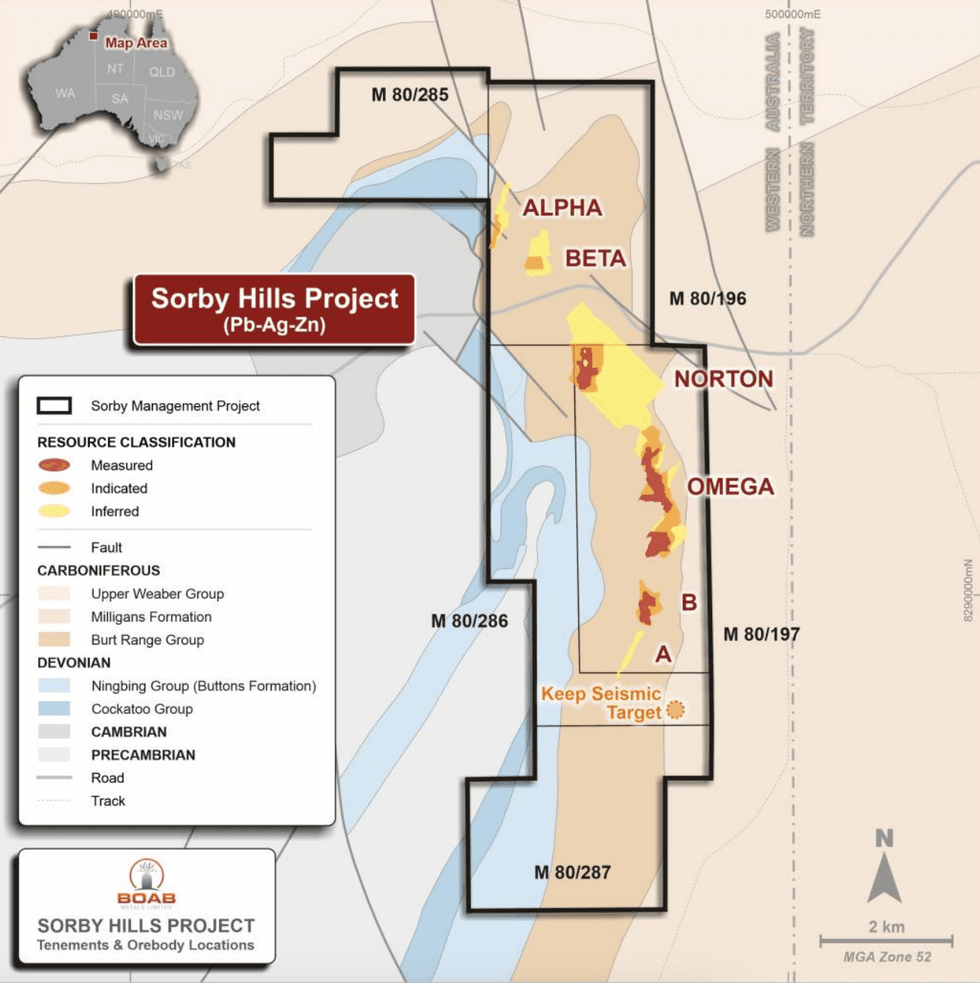

Euroz Hartleys has reinforced its confidence in Boab Metals (ASX:BML) following significant progress at the Sorby Hills lead-silver project in Western Australia. In its report, dated December 20, 2024, the firm maintains a "speculative buy" recommendation, revising its valuation to AU$0.50 per share (down from AU$0.62) and adjusting the price target to AU$0.55, reflecting updated timelines and funding requirements.

Financially, Sorby Hills is poised to deliver strong returns, with projected net cash flows of AU$778 million over its life and an average annual EBITDA of AU$126 million. The upfront capital expenditure is estimated at AU$264 million, reflecting an increase of 8 percent from the definitive feasibility study, but this is offset by improved operating cost efficiencies.

Boab Metals anticipates making a final investment decision in the second half of 2025, with construction commencing later that year and production targeted for 2027. The company is in advanced discussions with potential financiers, including the Northern Australia Infrastructure Facility, Export Finance Australia, and commercial banks, to secure funding for the project.

Key highlights of the report:

- Offtake Agreement Secured: A key milestone for Boab Metals is the binding offtake agreement secured with Trafigura Asia Trading. This agreement covers 75 percent of the lead-silver concentrate production from Sorby Hills, totaling 531,000 tonnes over seven years. In addition, Trafigura will provide a US$30 million prepayment facility with competitive terms, including an interest rate of SOFR plus 5 percent per annum. The facility is structured for long-term repayment, with an 18-month interest-only period followed by equal monthly installments over 42 months.

- Strategic Acquisitions: In a move to solidify its position, Boab Metals has agreed to acquire the remaining 25 percent interest in Sorby Hills from its joint venture partner, Henan Yuguang, China's largest lead smelting company. The acquisition, valued at AU$23 million, will be paid in installments tied to project milestones, including the final investment decision and initial concentrate sales. With this deal, Boab gains full ownership of the project, maximizing its exposure to its economic potential.

- Project Development: The recently completed front-end engineering and design study highlights the significant production potential of Sorby Hills. The study envisions a large-scale open-pit operation processing 2.3 million tonnes of ore annually. Average lead production is expected to exceed 64,000 tonnes per year, with peak production reaching 80,000 tonnes. The project also benefits from competitive C1 costs, estimated at US$0.36 per pound, and silver credits further enhancing its economics.

For the full analyst report, click here.

This content is intended only for persons who reside or access the website in jurisdictions with securities and other applicable laws which permit the distribution and consumption of this content and whose local law recognizes the scope and effect of this Disclaimer, its limitation of liability, and the legal effect of its exclusive jurisdiction and governing law provisions [link to Governing Law section of the Disclaimer page].

Any investment information contained on this website, including third party research reports, are provided strictly for informational purposes, are general in nature and not tailored for the specific needs of any person, and are not a solicitation or recommendation to purchase or sell a security or intended to provide investment advice. Readers are cautioned to seek the advice of a registered investment advisor regarding the appropriateness of investing in any securities or investment strategies mentioned on this website.

BML:AU

The Conversation (0)

09 January 2025

Boab Metals Limited

Advancing toward near-term lead and silver production in Western Australia

Advancing toward near-term lead and silver production in Western Australia Keep Reading...

07 September 2025

Extension of Option to Acquire 100% of Sorby Hills

Boab Metals Limited (BML:AU) has announced Extension of Option to Acquire 100% of Sorby HillsDownload the PDF here. Keep Reading...

03 September 2025

EPBC Approval Granted for Sorby Hills

Boab Metals Limited (BML:AU) has announced EPBC Approval Granted for Sorby HillsDownload the PDF here. Keep Reading...

30 July 2025

Quarterly Activities/Appendix 5B Cash Flow Report

Boab Metals Limited (BML:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

23 June 2025

Completion of Capital Raising

Boab Metals Limited (BML:AU) has announced Completion of Capital RaisingDownload the PDF here. Keep Reading...

16 June 2025

A$6 Million Placement to Advance the Sorby Hills Project

Boab Metals Limited (BML:AU) has announced A$6 Million Placement to Advance the Sorby Hills ProjectDownload the PDF here. Keep Reading...

23 February

Stefan Gleason: Silver Wakeup in the West — What's Happening, What's Next

Stefan Gleason, CEO of Money Metals, breaks down recent silver and gold dynamics, discussing trends in the US retail market, as well as backups at refineries. While the situation has begun to normalize, he sees potential for further disruptions in the future. Don't forget to follow us... Keep Reading...

19 February

Mercado Minerals Provides Exploration Update on Copalito; Reveals New Vein Discoveries

Mercado Minerals Ltd. (CSE: MERC) ("Mercado" or the "Company") is pleased to report continued progress from ongoing exploration activities at its flagship Copalito Project ("Copalito" or the "Project"). The Company's technical team in Mexico has been actively mapping, sampling, and advancing... Keep Reading...

16 February

How Rick Rule Reinvested His Silver Gains: 5 Silver Stocks He Owns

Over the past year, the spot price of silver has surged past a 40 year record and into triple-digit territory, reaching a high of US$121 per ounce this past January.For silver investors who bought into the physical market when the price was low, this first leg of the silver bull market has... Keep Reading...

16 February

Silver Institute: Market Heading for Sixth Straight Deficit in 2026

Silver surged past US$100 per ounce for the first time in January before retreating below the US$80 level, marking a volatile start to 2026 as the precious metal faces renewed investor appeal.In its latest annual outlook, published on February 10, the Silver Institute notes that the rally comes... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00