May 22, 2025

Description:

Brightstar Resources (ASX:BTR) is fast emerging as one of the most compelling gold development stories on the ASX, underpinned by a large-scale resource base, disciplined execution, and multiple near-term catalysts, according to a new report from analyst firm East Coast Research. With production ramping up and a pivotal definitive feasibility study (DFS) on the horizon, investors are increasingly focused on the company’s potential to transition into a +200,000 oz per annum gold producer by 2029.

Key Highlights:

- Strong Valuation Upside – East Coast Research lifted Brightstar’s 12-month target price to AU$1.787 per share, representing a 227.94 percent upside from the current price of AU$0.545. The base case valuation of AU$1.746/share and bull case of AU$1.828/share reflect rising gold prices, robust project fundamentals, and a clean capital structure following a 1-for-25 share consolidation.

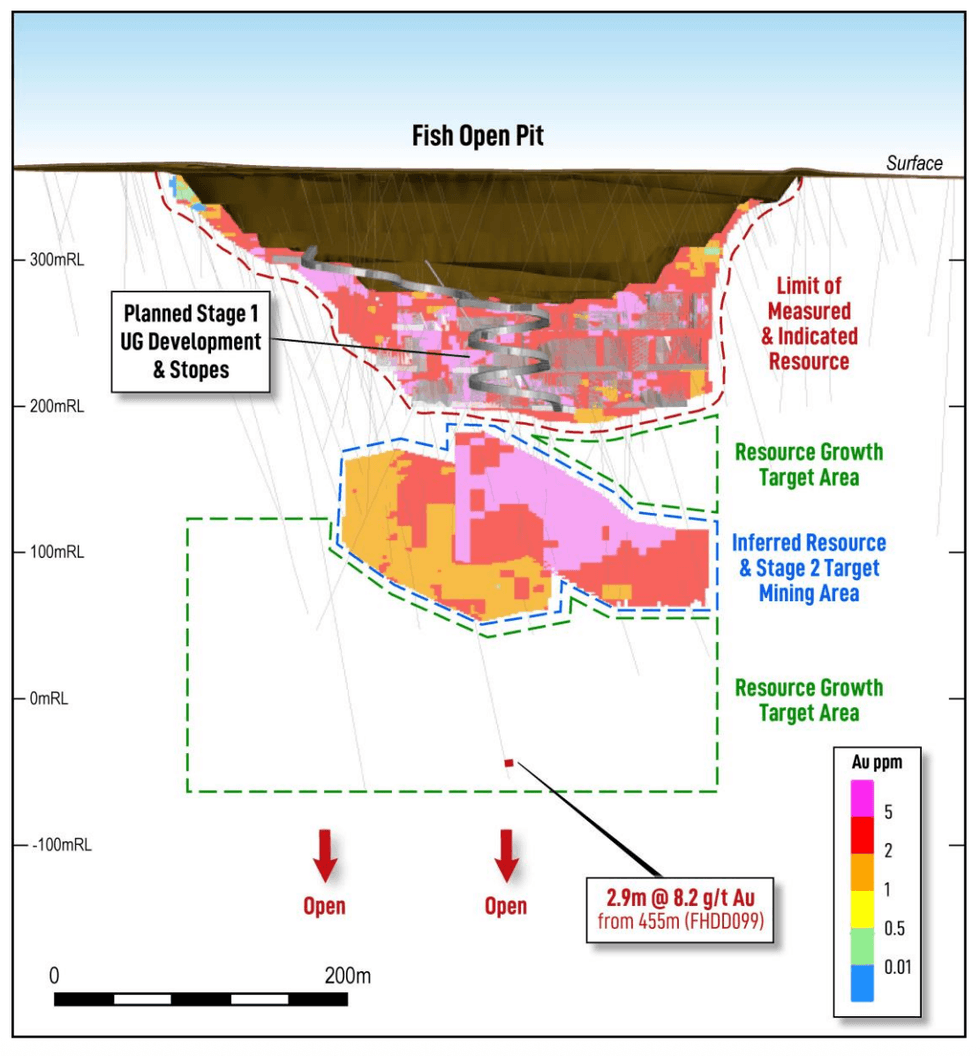

- Production Momentum – The Fish underground mine development is running ahead of schedule and under budget. First ore is expected in June 2025, with production expected to double current output to 40,000 oz per annum. Ore from Fish will be processed through an ore purchase agreement with Genesis Minerals, providing early cash flow without the need for capex-heavy infrastructure. To support this phase, Brightstar secured an US$11.5 million (AU$18 million) stockpile finance facility with Ocean Partners, adding financial flexibility without diluting equity holders.

- DFS to Define Laverton-Menzies Development – A major catalyst for Brightstar is the upcoming DFS on its Laverton-Menzies gold project, scheduled for completion in the first half of FY2025. This study will cover key deposits including Cork Tree Well, Lord Byron, and Alpha, and is expected to significantly de-risk the company’s path to sustained production.

- Sandstone: A Transformational Third Hub – Brightstar’s Sandstone gold project is a high-potential growth asset with a current JORC resource of 1.05 Moz @ 1.5 g/t gold. The company has launched a fully funded 80,000 metre drilling campaign, part of a broader 134,000 metre exploration strategy across its portfolio. With a pre-feasibility study due in FY2026 and first production expected in 2H FY2028, Sandstone is expected to become the company’s third production hub.

For the full analyst report, click here.

This content is intended only for persons who reside or access the website in jurisdictions with securities and other applicable laws which permit the distribution and consumption of this content and whose local law recognizes the scope and effect of this Disclaimer, its limitation of liability, and the legal effect of its exclusive jurisdiction and governing law provisions [link to Governing Law section of the Disclaimer page].

Any investment information contained on this website, including third party research reports, are provided strictly for informational purposes, are general in nature and not tailored for the specific needs of any person, and are not a solicitation or recommendation to purchase or sell a security or intended to provide investment advice. Readers are cautioned to seek the advice of a registered investment advisor regarding the appropriateness of investing in any securities or investment strategies mentioned on this website.

BTR:AU

Sign up to get your FREE

Brightstar Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

08 January

Brightstar Resources

Emerging gold producer and district-scale resource developer in Western Australia

Emerging gold producer and district-scale resource developer in Western Australia Keep Reading...

04 February

High grade assays continue from Sandstone RC drilling

Brightstar Resources (BTR:AU) has announced High grade assays continue from Sandstone RC drillingDownload the PDF here. Keep Reading...

01 February

Strategic $180M capital raising funds Goldfields development

Brightstar Resources (BTR:AU) has announced Strategic $180M capital raising funds Goldfields developmentDownload the PDF here. Keep Reading...

30 January

Quarterly Activities/Appendix 5B Cash Flow Report

Brightstar Resources (BTR:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

29 January

Updated Goldfields Feasibility Study

Brightstar Resources (BTR:AU) has announced Updated Goldfields Feasibility StudyDownload the PDF here. Keep Reading...

29 January

Updated Goldfields DFS Presentation

Brightstar Resources (BTR:AU) has announced Updated Goldfields DFS PresentationDownload the PDF here. Keep Reading...

11h

Armory Mining To Conduct a Series of Airborne Geophysics Surveys at the Ammo Gold-Antimony Project

(TheNewswire) Vancouver, B.C. TheNewswire - February 9, 2026 Armory Mining Corp. (CSE: ARMY) (OTC: RMRYF) (FRA: 2JS) (the "Company" or "Armory") a resource exploration company focused on the discovery and development of minerals critical to the energy, security and defense sectors, is pleased to... Keep Reading...

06 February

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Toronto-based company Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The company's board has authorized preparations for an initial public offering (IPO) of a new entity that would house its premier... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

Latest News

Sign up to get your FREE

Brightstar Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00