November 17, 2022

American Copper Development Corp. (CSE:ACDX) is poised to become a key player in US domestic copper production, with a significant land package in a tier 1 jurisdiction. Its flagship Lordsburg Project has the potential to become a source of domestic copper to supply US demand.

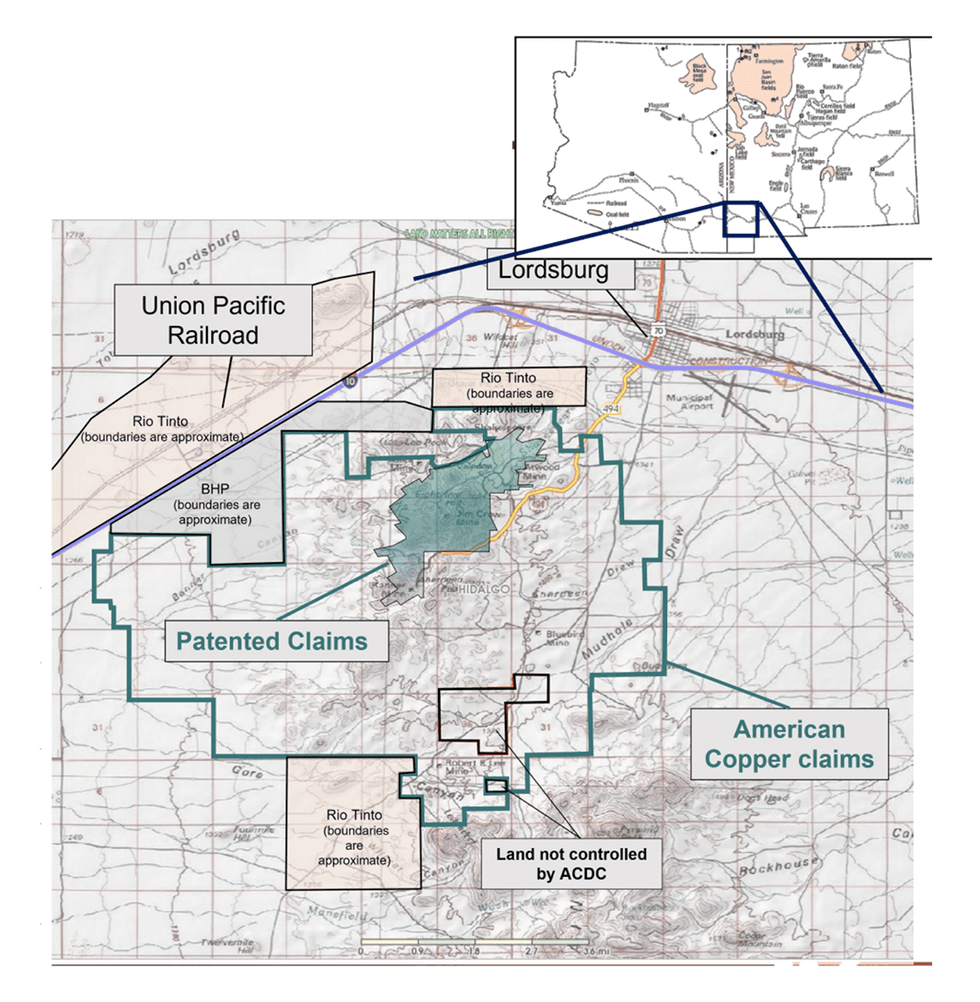

Located in copper porphyry country in the American Southwest, the Lordsburg Project has a historical production of 150.3 million lbs of copper between 1904 to the 1970s, which has not been actively explored using modern technology and exploration techniques.

Company Highlights

- American Copper is an exploration and development mining company with a significant land package in New Mexico, a tier-1 jurisdiction, and a secondary asset in British Columbia.

- The company has the advantage of a robust technical team leading the exploration and development of its promising assets, which includes Rick Van Nieuwenhuyse, Andy Bowring and Curt Freeman, recognized leaders credited with significant discoveries worldwide.

- The Lordsburg project, the company’s flagship asset, is a district-scale opportunity at the intersection of two prominent copper lineaments. These lineaments are known to control 80 percent of copper production in the US.

- American Copper is well-capitalized, completing a $10-million financing in Q2 2022.

- The company’s Chuchi South project in British Columbia creates additional opportunities for future discoveries.

- The experienced management team has generated billions of investor returns through its decades of experience and expertise throughout the mining industry.

This American Copper Development Corp. profile is part of a paid investor education campaign.*

ACDX:CC

The Conversation (0)

16 November 2022

American Copper Development

Developing a High-grade Copper District in the US

Developing a High-grade Copper District in the US Keep Reading...

26 February

T2 Metals Acquires High-Grade Aurora Gold-Silver Project in the Yukon from Shawn Ryan

Past Drilling Results Include 3.4m @ 24.45 g/t Au at AJ Prospect

T2 Metals Corp. (TSXV: TWO) (OTCQB: TWOSF) (WKN: A3DVMD) ("T2 Metals" or the "Company") is pleased to announce signing of an Option Agreement (the "Option") with renowned explorer Shawn Ryan ("Ryan") and Wildwood Exploration Inc. (together with Ryan, the "Optionor") to earn a 100% interest in... Keep Reading...

25 February

Copper Prices Rally on Tariff Fears, Weak US Dollar

Copper prices continue to rise, driven by supply and demand fundamentals and boosted by tariff fears.Prices for the red metal reached a record high on January 29, and while they have since moderated somewhat, several factors have injected fresh concerns and volatility into the market.Among them... Keep Reading...

25 February

Top 10 Copper-producing Companies

Copper miners with productive assets have much to gain as supply and demand tighten. The price of copper reached new all-time highs in 2026 on both the COMEX in the United States and the London Metals Exchange (LME) in the United Kingdom. In 2025, the copper price on the COMEX surged during the... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00