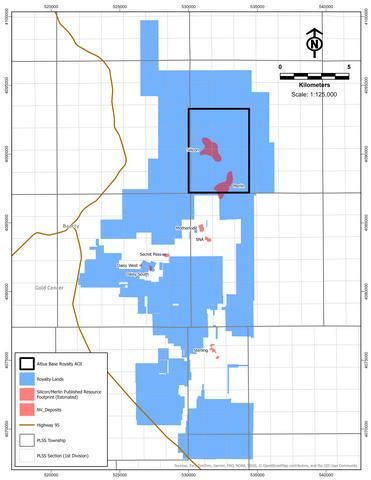

Altius Minerals Corporation (TSX: ALS) (OTCQX: ATUSF) ("Altius") reports that its wholly owned subsidiary, Altius Royalty Corporation ("ARC"), has received a contingent payment of US$25 million, less withholding taxes, relating to its recently announced sale of a partial royalty interest in the Arthur Gold Project to a wholly owned subsidiary of Franco-Nevada Corporation ("Franco-Nevada") (TSX & NYSE: FNV). The payment follows the conclusion of an arbitration process that has defined the extent of royalty lands associated with the project in satisfaction of conditions set out in the agreement that was completed between the parties in July. Altius and Franco-Nevada hold respective 1/3 and 2/3 interests in a 1.5% NSR royalty, which has now been confirmed to cover an approximate 195.6 km 2 area within the mineral district.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20251120541144/en/

Arthur Royalty Map

Altius also congratulates the teams of AngloGold Ashanti plc ("AngloGold"), Renaissance Gold, and Callinan Royalties for being honoured as the recipients of the PDAC's 2026 Thayer Lindsley award ( https://pdac.ca/about-pdac/awards/thayer-lindsley-award ). The award, which recognizes a team of explorationists for an international mineral discovery, acknowledges the discovery of the Silicon and Merlin gold-silver deposits (Arthur Gold Project) as "one of the most significant greenfield gold discoveries in the United States in over a decade". Currently, Mineral Resources at the Arthur Gold Project are 12.1 million ounces gold (Moz) Inferred at Merlin plus 3.4 Moz Indicated and 0.8 Moz Inferred at Silicon. AngloGold is currently completing an extensive drilling program targeting the conversion of Mineral Resources to Mineral Reserves by year end to support delivery of a prefeasibility study in early 2026. It has also indicated plans to expand on known mineralized structures between Silicon and Merlin and to test several additional resource expansion targets in 2026-27.

Forward Looking Statements

This news release contains forward‐looking information. The statements are based on reasonable assumptions and expectations of management and Altius provides no assurance that actual events will meet management's expectations. In certain cases, forward‐looking information may be identified by such terms as "anticipates", "believes", "could", "estimates", "expects", "may", "shall", "will", or "would". Although Altius believes the expectations expressed in such forward‐looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or developments may differ materially from those projected. Readers should not place undue reliance on forward-looking information. Altius does not undertake to update any forward-looking information contained herein except in accordance with securities regulations.

Qualified Person

Lawrence Winter, Ph.D., P.Geo., Vice President, Generative and Technical for Altius, a Qualified Person as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects, is responsible for the scientific and technical data presented herein and has reviewed, prepared and approved this release.

About Altius

Altius's strategy is to create per share growth through a diversified portfolio of royalty assets that relate to long life, high margin operations. This strategy further provides shareholders with exposures that are well aligned with global growth trends including increasing electricity-based market share within energy usage, global infrastructure build and refurbishment growth, increased EAF based steelmaking, steadily increasing agricultural fertilizer requirements and the enhanced appetite for financial asset diversification through precious metals ownership. These macro-trends each hold the potential to cause higher demand for many of Altius's commodity exposures including potash, high purity iron ore, renewable energy, base metals, and gold. In addition, Altius runs a successful Project Generation business that originates mineral projects for sale to developers in exchange for royalties and that has a demonstrated track record of driving outsized direct returns from its overall royalty investment portfolio. Altius has 46,276,054 common shares issued and outstanding that are listed on Canada's Toronto Stock Exchange. It is a member of both the S&P/TSX Small Cap and S&P/TSX Global Mining Indices and the S&P/TSX Canadian Dividend Aristocrats Index.

View source version on businesswire.com: https://www.businesswire.com/news/home/20251120541144/en/

For further information, please contact:

Flora Wood

Email: Fwood@altiusminerals.com

Tel: 1.877.576.2209

Direct: 1.416.346.9020