April 01, 2024

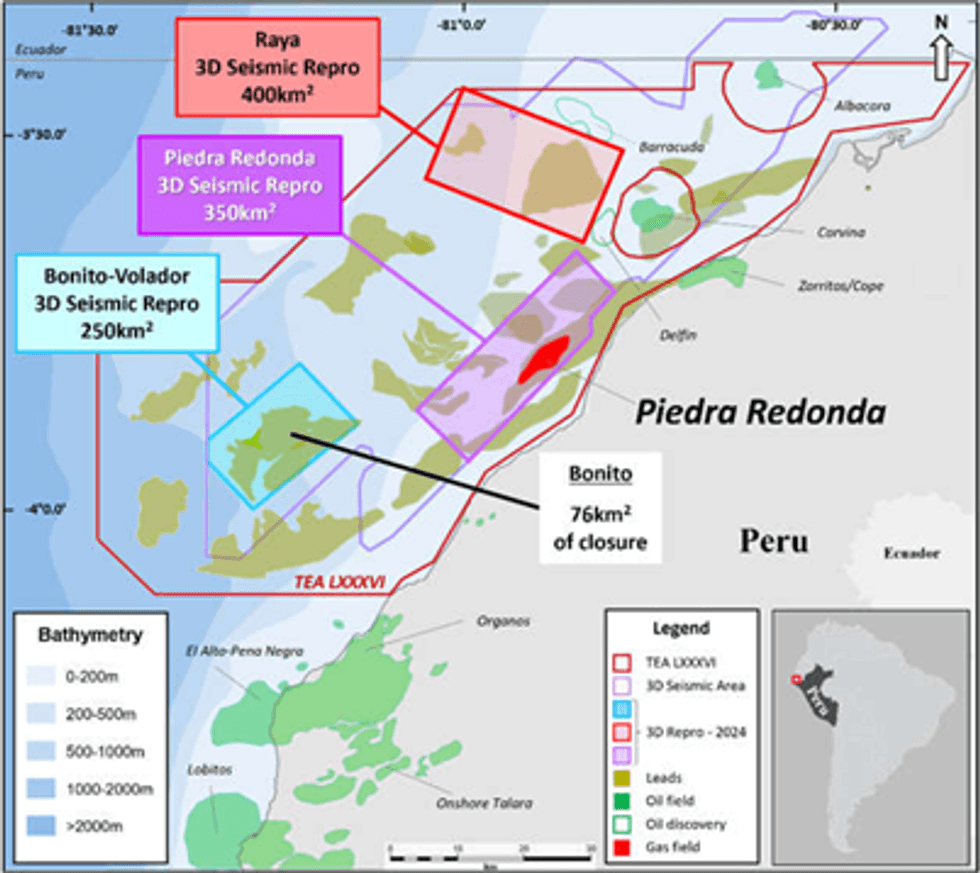

Global Oil & Gas Ltd (ASX:GLV) (Global or the Company) is pleased to provide an update on exploration activities on its (80% held) 4,585km2 Tumbes Basin Technical Evaluation Agreement (TEA or block) offshore Peru.

Highlights

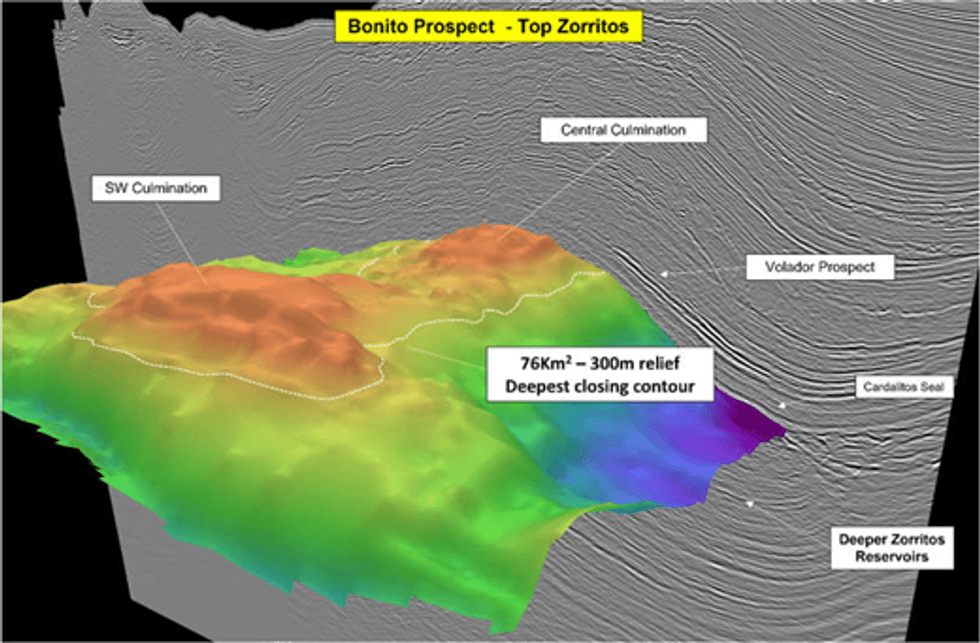

- Additional deeper stacked targets identified in the proven oil-bearing Zorritos Formation represents significant upside for the Bonito Prospect

- Deeper targets proven in adjacent producing oil fields evident on seismic data at Bonito

- Reprocessing of 3D seismic data over Bonito area is well advanced

- Prospective Resource estimates will incorporate reprocessed seismic data and deeper targets

The block incorporates over 3,800km2 of existing 3D seismic data which the Company is currently reviewing; with an aggregate of 1,000km2 currently prioritised and undergoing reprocessing and interpretation across three discrete highly prospective areas (one of which includes the Bonito Prospect) (see Figure 2). Reprocessing will include pre-stack depth migration (PSDM) work across each of the three areas.

The Bonito Prospect was first identified in the early 2000s. Previous Operators focussed exclusively on the Upper Zorritos reservoir demonstrating that it had potential to contain significant hydrocarbon volumes.

However, deeper Zorritos Formation reservoirs have also been identified and proven in discoveries and other wells drilled in the Tumbes Basin, as demonstrated by production from the Lower Zorritos Formation in the Albacora field, as well as pay zones identified in the Delfin discovery and non-pay reservoirs identified in the Piedra Redonda gas field (Figure 3). Further, intra-formational seals identified within the Zorritos Formation in the Delfin discovery, suggest that the Lower Zorritos levels possess genuine potential as independent targets.

At the Upper Zorritos level the faulted three-way dip closure trapping geometry at Bonito measures 76km2 with approximately 300m of vertical relief. Should the lower Zorritos levels prove viable, the additional vertical relief of the stacked reservoirs could be substantial.

Seismic reprocessing of the Bonito area (250km2) is well underway and will result in improvements in data quality that will facilitate precise depth mapping and enhance lithology and fluid discrimination.

It is anticipated that a Prospective Resource estimate for the Bonito Prospect incorporating the reprocessed seismic data and the newly identified deeper targets will be released once completed and additional work undertaken to mature Bonito to drill-ready status.

Click here for the full ASX Release

This article includes content from Global Oil & Gas Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GLV:AU

The Conversation (0)

27 February

US-Iran Tensions Put Europe’s Gas Storage Plans at Risk

Escalating tensions between the United States and Iran are reviving a risk energy markets have long feared: a potential closure of the Strait of Hormuz, the narrow Gulf passage that carries roughly 20 percent of global LNG trade and 25 percent of seaborne oil.New modelling from energy analytics... Keep Reading...

25 February

QIMC Intersects Major Subsurface Fault Corridor with Elevated H2 Readings at 142m Depth

Pressurized Formation Water and Visible Gas Bubbling Confirm Active Structural System in First of Five-Hole Systematic Drill Program

Quebec Innovative Materials Corp. (CSE: QIMC) (OTCQB: QIMCF) (FSE: 7FJ) ("QIMC" or the "Company") is pleased to report significant initial results from the first 300 metres of its planned 650-metre diamond drill hole DDH-26-01 at its West Advocate Eatonville Project, Nova Scotia. Drilling... Keep Reading...

24 February

Angkor Resources Commences Trenching Program At CZ Gold Prospect, Ratanakiri Province, Cambodia

(TheNewswire) GRANDE PRAIRIE, ALBERTA (February 24, 2026) TheNewswire - Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") announces the completion of a trenching and sampling program at the CZ Gold Prospect in Ratanakiri Province, Cambodia. As previously announced (see... Keep Reading...

23 February

PEP 11 Update - Federal Court Proceedings

MEC Resources (MMR:AU) has announced PEP 11 Update - Federal Court ProceedingsDownload the PDF here. Keep Reading...

23 February

Kinetiko Energy Poised to Address South Africa’s Gas Supply Gap: MST Access Report

Description:A research report by MST Access highlights Kinetiko Energy (ASX:KKO) as an emerging participant in South Africa’s domestic gas sector, supported by a base-case valuation of AU$0.49 per share. The company’s project covers 5,366 sq km, located 200 km southeast of Johannesburg within an... Keep Reading...

18 February

Half Yearly Report and Accounts

MEC Resources (MMR:AU) has announced Half Yearly Report and AccountsDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00