February 26, 2025

A junior explorer with projects in tier-one jurisdictions, Adavale Resources (ASX:ADD) focuses on gold and copper alongside valuable uranium and nickel licences. The transformative acquisition of assets in the prolific Lachlan Fold Belt in New South Wales puts the company on a growth trajectory, presenting a compelling investment opportunity for savvy investors.

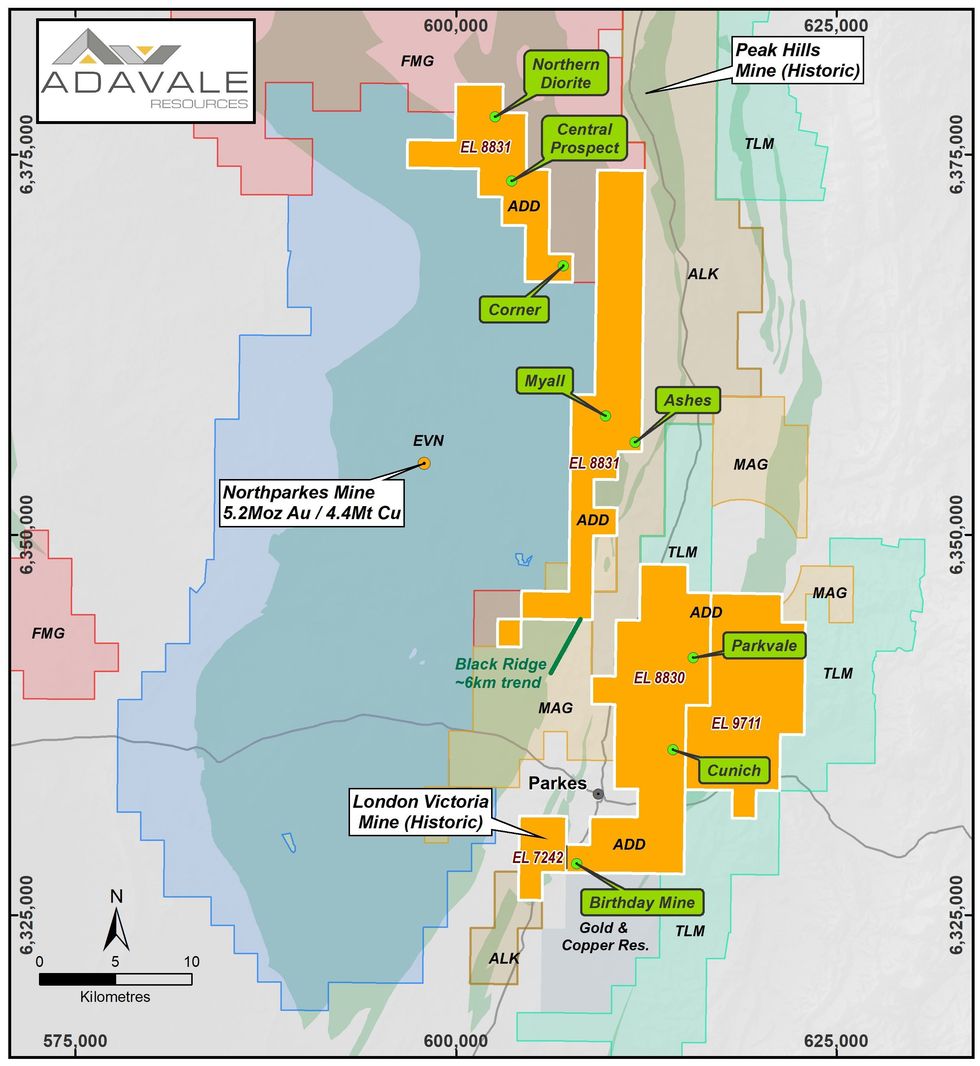

The company's portfolio spans 354.15 sq km and comprises four tenements: EL7242, EL8830, EL8831 and EL9711. The acquisition of these assets represents a transformational opportunity, strategically positioning Adavale Resources in one of the world’s richest gold and copper belts.

Adavale Resources recently acquired a 72.5 percent interest in the Parkes project, located in the highly prospective Lachlan Fold Belt of New South Wales. Adavale’s flagship project encompasses 354.15 sq km across four tenements in the Lachlan Fold Belt, a region that has produced over 80 million ounces (Moz) of gold and 13 million tonnes (Mt) of copper historically. The London-Victoria gold mine (EL7242) is a cornerstone of this portfolio, with historical production of 200,000 ounces of gold at an average grade of 2 grams per ton (g/t). London-Victoria (EL7242) also recently received a successful renewal until November 2030.

Company Highlights

- A junior explorer, with projects in tier-one jurisdictions; focused on gold and copper, Adavale also holds valuable uranium and nickel licences .

- The January 2025 acquisition of the Parkes project in the Lachlan Fold Belt, spanning 354.15 sq km, strategically positions Adavale to expand on the historic orogenic gold resource (124 koz gold) and make a major epithermal and/or porphyry gold and copper discovery in this tier-1 mining jurisdiction. The Lachlan Fold Belt assets are strategically located near world-class mining operations, including Cadia, Northparkes and Cowal.

- The company’s extensive uranium tenements span 4,959 sq km across the Flinders Ranges and Eyre Peninsula, regions known for hosting tier-one uranium deposits.

- Adavale’s nickel projects in Tanzania’s East African Nickel Belt are strategically located adjacent to the Kabanga nickel project — the world’s largest undeveloped high-grade nickel sulphide deposit.

- Drilling and resource-definition programs in 2025 will target key gold, copper and uranium assets, building on the company’s diversified growth strategy.

This Adavale Resources profile is part of a paid investor education campaign.*

Click here to connect with Adavale Resources (ASX:ADD) to receive an Investor Presentation

ADD:AU

The Conversation (0)

16 November 2025

Major Resource Growth Uncovered at London Vic

Adavale Resources (ADD:AU) has announced Major Resource Growth Uncovered at London VicDownload the PDF here. Keep Reading...

31 October 2025

Quarterly Activities and Cashflow Report

Adavale Resources (ADD:AU) has announced Quarterly Activities and Cashflow ReportDownload the PDF here. Keep Reading...

26 October 2025

Transformational Appointment to Drive Gold & Copper Growth

Adavale Resources (ADD:AU) has announced Transformational Appointment to Drive Gold & Copper GrowthDownload the PDF here. Keep Reading...

21 October 2025

100% Native Title Consent for Marree Project Achieved

Adavale Resources (ADD:AU) has announced 100% Native Title Consent for Marree Project AchievedDownload the PDF here. Keep Reading...

24 September 2025

Wide Gold Intercepts Confirm Open Mineralisation

Adavale Resources (ADD:AU) has announced Wide Gold Intercepts Confirm Open MineralisationDownload the PDF here. Keep Reading...

8h

Investor Presentation

Aurum Resources (AUE:AU) has announced Investor PresentationDownload the PDF here. Keep Reading...

9h

Dr. Adam Trexler: Physical Gold Market Broken, Crisis Unfolding Now

Dr. Adam Trexler, founder and president of Valaurum, shares his thoughts on gold, identifying a key issue he sees developing in the physical market. "There's a crisis in the physical gold market," he said, explaining that sector participants need to figure out how to serve investors who want to... Keep Reading...

10h

How Near-term Production is Changing the Junior Gold Exploration Model

Junior gold companies have traditionally been defined by exploration: identifying prospective ground, drilling to delineate a resource and, ideally, monetising that discovery through a sale or joint venture with a larger producer. While this model has delivered success in the past, changing... Keep Reading...

10h

Gold Exploration in Guinea: An Emerging Opportunity in West Africa

While much of West Africa’s gold exploration spotlight has historically fallen on countries like Ghana and Mali, Guinea is increasingly emerging as a quiet outlier — a country with proven gold endowment, expansive underexplored terrain and a growing number of active exploration programs. Despite... Keep Reading...

09 February

Armory Mining To Conduct a Series of Airborne Geophysics Surveys at the Ammo Gold-Antimony Project

(TheNewswire) Vancouver, B.C. TheNewswire - February 9, 2026 Armory Mining Corp. (CSE: ARMY) (OTC: RMRYF) (FRA: 2JS) (the "Company" or "Armory") a resource exploration company focused on the discovery and development of minerals critical to the energy, security and defense sectors, is pleased to... Keep Reading...

06 February

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00