August 29, 2024

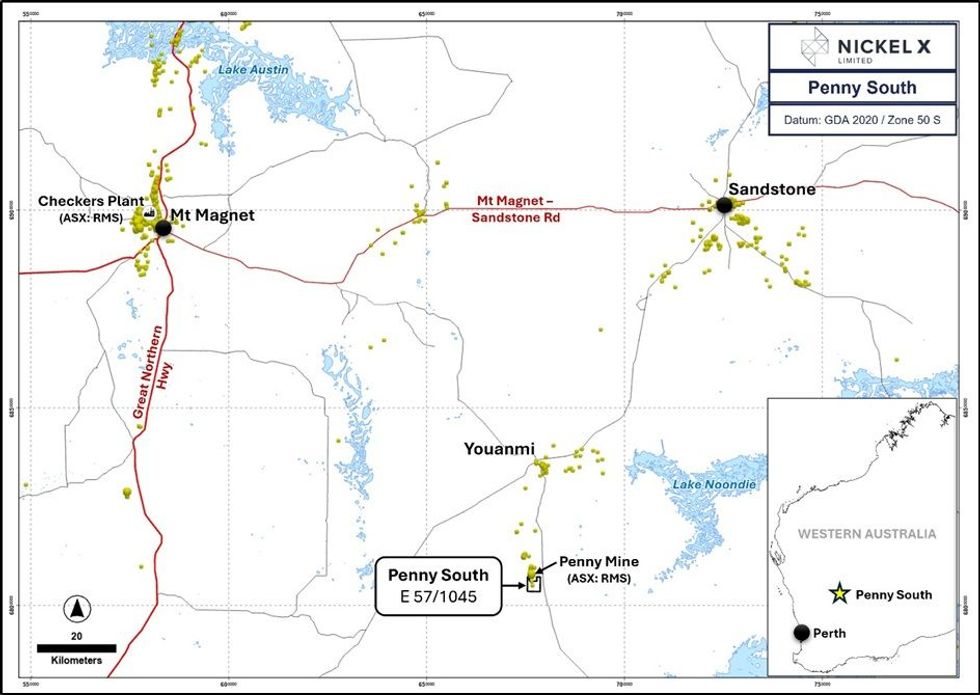

NickelX Limited (“NickelX”, “NKL” or “The Company”) is pleased to announce that it has entered into a binding tenement sale agreement to acquire 100% of tenement E57/1045 known as the Penny South Gold Project.

HIGHLIGHTS

- Binding Tenement Sale Agreement to acquire 100% of the Penny South Gold Project (E57/1045) to bolster West Australian Gold exploration portfolio

- Penny South Gold Project located in world class gold district and ~550m south of one of Australia’s highest grade producing gold mines1, the Penny West/North Gold Mine (“Penny”), owned and operated by Ramelius Resources Limited (ASX:RMS) (“Ramelius”):

- The Penny West mine produced 154,000t at 18g/t Au (89,000 Au) in the early 1990’s2.

- The initial Penny North deposit of 569,000t at 16.8g/t (306,000oz) was discovered by Spectrum Metals Limited and subsequently subject to a takeover by Ramelius for >$200M during 20203, with the deposit now being mined and extended.

- The Penny West Shear, which hosts the Penny deposits, continues south into the Penny South Project (E57/1045) with ~2.5km of strike contained in E57/1045.

- Average historical drill hole depth across E57/1045 is ~42m, with only 18 holes deeper than 100m and 7 holes deeper than 200m4 5, with no diamond drilling.

- Historic drilling within E57/1045 has encountered various significantly anomalous intersections of gold mineralisation5.

- Review of all available data to generate high priority drill targets underway.

Commenting on the acquisition Managing Director Peter Woods said:

“We are extremely pleased to have reached an agreement for the acquisition of the Penny South Project. The addition of this exciting gold exploration asset next door to one of the highest-grade gold mines in production in Western Australia, and in a district seeing current M&A activity, greatly enhances our existing portfolio. Given the minimal deeper drilling and lack of diamond drilling, it is the Company’s view there may be substantial value to be unlocked at depth and we are eager to execute a path forward to test the theory as the momentum for gold continues.”

Penny South Gold Project, WA

The Penny South Gold Project (E57/1045) (Map 1) lies only 550m south of Ramelius’ operating Penny West/North gold mine project (Map 2), which is estimated to contain 440,000t of ore at 22g/t Au (320,000oz Au) (“Penny”)6. NKL’s Penny South Gold Project captures a ~2.5km strike extension of the Penny West Shear immediately south of Ramelius’ Penny deposits, southern Youanmi Greenstone Belt (Map 3).

Click here for the full ASX Release

This article includes content from NickelX Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

NKL:AU

The Conversation (0)

10h

Armory Mining To Conduct a Series of Airborne Geophysics Surveys at the Ammo Gold-Antimony Project

(TheNewswire) Vancouver, B.C. TheNewswire - February 9, 2026 Armory Mining Corp. (CSE: ARMY) (OTC: RMRYF) (FRA: 2JS) (the "Company" or "Armory") a resource exploration company focused on the discovery and development of minerals critical to the energy, security and defense sectors, is pleased to... Keep Reading...

06 February

Editor's Picks: Is Gold and Silver's Price Correction Over?

It's been a wild couple of weeks for gold and silver. After surging to record highs at the end of January, prices for both precious metals saw significant corrections, creating turmoil for market participants.This week brought some relief, with gold bouncing back from its low point and even... Keep Reading...

06 February

Blackrock Silver to Present at the Precious Metals and Critical Minerals Virtual Investor Conference on February 10th 2026

Blackrock Silver Corp. (TSXV: BRC,OTC:BKRRF) (OTCQX: BKRRF) (FSE: AHZ0) ("Blackrock" or the "Company") is pleased to announce that Andrew Pollard, President & Chief Executive Officer of the Company, will present live at the Precious Metals & Critical Minerals Virtual Investor Conference hosted... Keep Reading...

05 February

Experts: Gold's Fundamentals Intact, Price Could Hit US$7,000 in 2026

Gold took center stage at this year's Vancouver Resource Investment Conference (VRIC), coming to the fore in a slew of discussions as the price surged past US$5,000 per ounce. Held from January 25 to 26, the conference brought together diverse experts, with a focus point being the "Gold... Keep Reading...

05 February

Barrick Advances North American Gold Spinoff After Record 2025 Results

Toronto-based company Barrick Mining (TSX:ABX,NYSE:B) said it will move ahead with plans to spin off its North American gold assets after a strong finish to 2025.The company's board has authorized preparations for an initial public offering (IPO) of a new entity that would house its premier... Keep Reading...

05 February

Peruvian Metals Secures 6 Year Agreement with Community at Mercedes Project

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) (OTC Pink: DUVNF) ("Peruvian Metals or the "Company") is pleased to announce that the agreement between San Maurizo Mines Ltd. ("San Maurizo"), a private Manitoba company which holds a 100% direct interest in the Mercedes Property, and Comunidades... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00