May 03, 2022

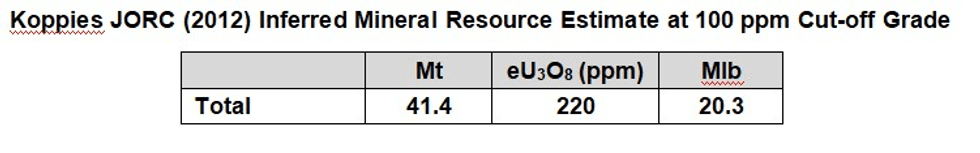

Elevate Uranium Limited (“Elevate Uranium”, or the “Company”) (ASX:EL8) (OTC:ELVUF) is pleased to announce an initial JORC Inferred Mineral Resource Estimate (“MRE”) of 20.3 million pounds (“Mlb”) eU3O8 for its Koppies Uranium Project in Namibia.

Key Highlights:

- Initial Koppies JORC Inferred Mineral Resource Estimate (“MRE”) of 20.3 Mlb eU3O8.

- Potential for significant extensions to this mineralisation, beneath and adjacent to the 20.3 Mlb eU3O8 resource envelopes.

- Recent exploration drilling has identified a large new mineralised zone outside of the MRE envelopes.

- Elevate’s total uranium mineral resources have increased by 22% to 115 Mlb U3O8.

Elevate Uranium’s Managing Director, Murray Hill, commented:

“The Company is pleased with the 20.3 Mlb eU3O8 mineral resource estimate for Koppies but is even more encouraged by the significant potential for an expansion of this resource.

Conventional exploration strategy for palaeochannel hosted uranium mineralisation is to assume that uranium mineralisation only occurs within the confines of a palaeochannel. However, as detailed analysis of drilling results at Koppies progressed, it became apparent that many holes outside of the palaeochannels and in basement rocks, were mineralised. The March/April 2022 drilling program confirmed mineralisation beneath and on the banks of the palaeochannels and led to a change in strategy to drill deeper and beyond the palaeochannel extents.

In addition, the March/April 2022 drilling also discovered uranium mineralisation at least one kilometre beyond the MRE envelopes. The mineralisation is open to the northeast and southwest. These outcomes are exciting as they indicate significant potential for the mineralised zones to expand with further drilling. This new discovery has not been included in the MRE envelopes.

We have now adapted our exploration techniques by extending the target areas outside of the paleochannels, which will have the potential to increase the Koppies mineralised areas. We are excited about the possibility of further extensions to the Koppies mineralised area, both below and outside of the known palaeochannels.

This 20.3 Mlb eU3O8 MRE for the Koppies Uranium Project increases the Company’s total uranium resources to 115 Mlb.” (See Resource Table 3)

The Company’s exploration has been focussed on the detection and delineation of uranium mineralisation within palaeochannels. Ground and airborne electromagnetic (“EM”) surveys have been used to map these palaeochannels by virtue of the fact that the palaeochannels are more conductive than the surrounding metamorphic rocks. Palaeochannels were systematically drilled to confirm the interpretation of EM data and to detect mineralisation within them. Drillholes were typically halted after drilling 2 m of unmineralised metamorphic “basement” rocks at the base of the palaeochannels or when unmineralised metamorphic “basement” rocks were intersected immediately below the surface.

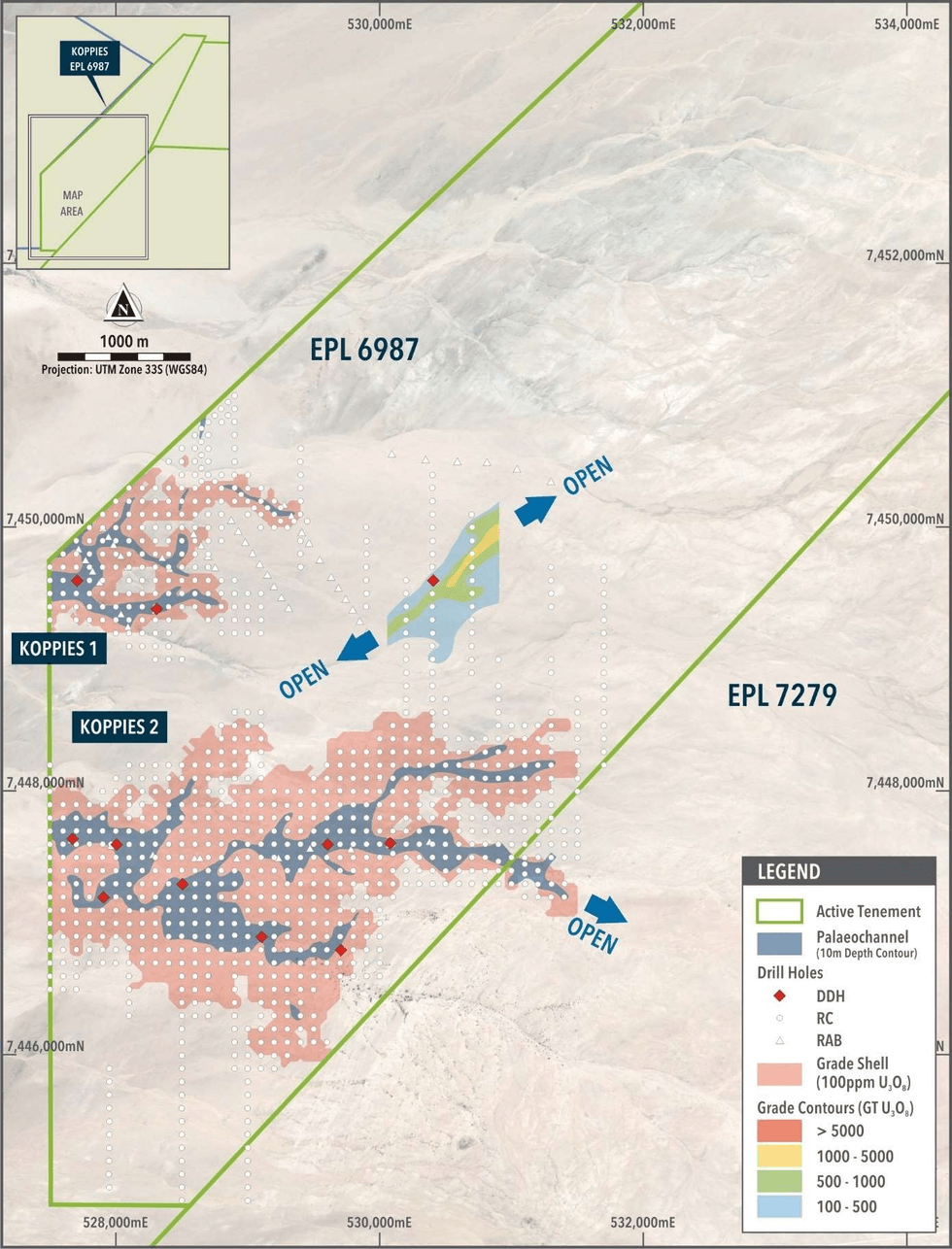

As drilling at Koppies progressed, however, it became apparent that more and more holes in basement rocks were mineralised. For this reason, some holes in the March/April 2022 drilling program were deepened and drilling extended beyond the palaeochannels. This change in approach recently lead to the discovery of a significant flat-lying body of uranium mineralisation centred 1.6 km east of Koppies I (see Figure 1) which currently extends over 1 km in a NE-SW direction and is 400 m wide. This body is open to the SW and to the NE and is between 2 and 16 m deep. Most of the uranium is hosted by metasedimentary rock which makes this deposit unique in the Erongo district.

The new basement-hosted discovery has not been included in the current MRE as further drilling is required to fully define its extent. Additional mineralisation may also be present underneath the currently defined palaeochannels, requiring additional deeper holes to overlap the holes previously drilled.

The recognition of this new type of target is significant as it cannot be detected by EM surveys and requires a different exploration approach. The geological team is currently reviewing all exploration data and planning future exploration programs including deeper drilling to delineate additional mineralised areas around the current resource and the new discovery.

U-pgrade™ Metallurgical Compatibility

The Company completed metallurgical testing on uranium mineralisation within basement ore from the Marenica Uranium Project during development of the U-pgradeTM beneficiation process and confirmed the applicability of U-pgradeTM on the basement mineralisation from that project. The Company expects U-pgradeTM to work on this ‘new’ style of mineralisation at Koppies.

Figure 1 shows the drilling completed to date, the outline of the resource and the new discovery (in the centre of Figure 1) which appears to be widening to the northeast. The holes drilled to the north and east of the new discovery are mostly 2 metres deep, but as discussed above, there is potential for mineralisation below 2 metres.

The proximity of Koppies to the Company’s other tenements in the Namib area is shown in Figure 2.

Figure 1 Koppies Resource Outline and New Discovery

Click here for the full ASX Release

This article includes content from Elevate Uranium, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

EL8:AU

The Conversation (0)

21h

Definitive Agreement for the Sale of the Marshall Project

Basin Energy (BSN:AU) has announced Definitive agreement for the sale of the Marshall projectDownload the PDF here. Keep Reading...

26 February

Denison Greenlights First Major Canadian Uranium Mine in 20 Years

Denison Mines (TSX:DML,NYSEAMERICAN:DNN) has approved construction of what it says will be Canada’s first new large-scale uranium mine in more than 20 years, setting the stage for work to begin next month at its flagship Phoenix project in northern Saskatchewan.The company announced that its... Keep Reading...

25 February

Uranium American Resources

Uranium American Resources Inc. is a mining company. The Company maintains mining leases on properties in Nevada. The Company is engaged in mining activities in the mineable resource of gold and silver remains in the Comstock Mining District. Its Comstock project is located in northwestern... Keep Reading...

25 February

US Nuclear Growth at Risk as Enrichment Supply Gap Looms

A looming shortage of uranium enrichment services could threaten US nuclear expansion plans, according to the leader of Centrus Energy (NYSE:LEU), one of the country’s largest suppliers of enriched uranium.Amir Vexler, president and CEO of Centrus, is warning that rising demand from existing... Keep Reading...

24 February

Eagle Energy Metals and Spring Valley Acquisition Corp. II Announce Closing of Business Combination

Eagle Energy Metals Corp. (“Eagle”), a next-generation nuclear energy company with rights to the largest conventional, measured and indicated uranium deposit in the United States, today announced that it has completed its business combination with Spring Valley Acquisition Corp. II (OTC: SVIIF)... Keep Reading...

23 February

Basin Energy Hits 1,112 ppm TREO, Fast Tracks 2026 Uranium and REE Strategy at Sybella-Barkly

Basin Energy (ASX:BSN) is moving to accelerate its 2026 exploration efforts following "exciting" results from its maiden drilling program at the Sybella-Barkly project in Queensland. In a recent interview, Managing Director Pete Moorhouse revealed that the company has confirmed a significant... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00