April 21, 2022

Queensland Pacific Metals Ltd (ASX:QPM) (“QPM” or “the Company”) is pleased to announce that significant progress has been made on QPM’s ability to utilise residue from the TECH Project in commercial application as engineered fill.

Highlights

- QPM has made significant advancements in reaching its stated goal of having zero solids waste at the TECH Project as a result of positive testwork and discussions with regulators.

- The combination of zero solids waste and negative carbon credentials would be a feat that is unheard of in the resources sector and position QPM and the TECH Project as a global leader in ESG credentials.

- Preliminary testwork undertaken by James Cook University (“JCU”) has indicated that the residue would be suitable for use as engineered fill and has strong potential to meet regulatory guidelines.

- Positive discussions held with the Queensland Department of Environment and Science (“DES”) regarding the approvals process to operate under a Queensland Government End of Waste Code (“EOW Code”), whereby residue would be recognised as a resource rather than a waste stream.

In the TECH Project, all valuable metals will be leached into solution and then recovered and refined into saleable products. The remnant residue is only ~25% of the dry ore feed and it is typically comprised of silicates including quartz sand. The ability to utilise this residue as an engineered fill would mean that 100% of the ore processed by the TECH Project reports to a commercial application, effectively positioning the TECH Project as zero solids waste. Such a feat would be an industry first in the resources sector, particularly in nickel laterite processing which typically requires large tailings dams that leave significant environmental footprint. Such tailings dams usually have to hold more than 1.2 tonnes of tailings per tonne of feed ore.

James Cook University Residue Testwork

Residue from the TECH Project is neutralised, filtered prior to storage or alternative use. QPM is working with JCU to undertake testwork on the TECH Project residue. The testwork conducted had two main areas of focus:

- Mixing varying levels of simple binding agents with the residue and testing structural properties to determine suitability as engineered fill; and

- Undertaking leaching chemical content tests of the residue to ensure it met regulatory guidelines.

From JCU’s testwork, it has been determined that, with a simple binder, the residue from the TECH Project demonstrated the requisite structural properties and can be used as engineered fill.

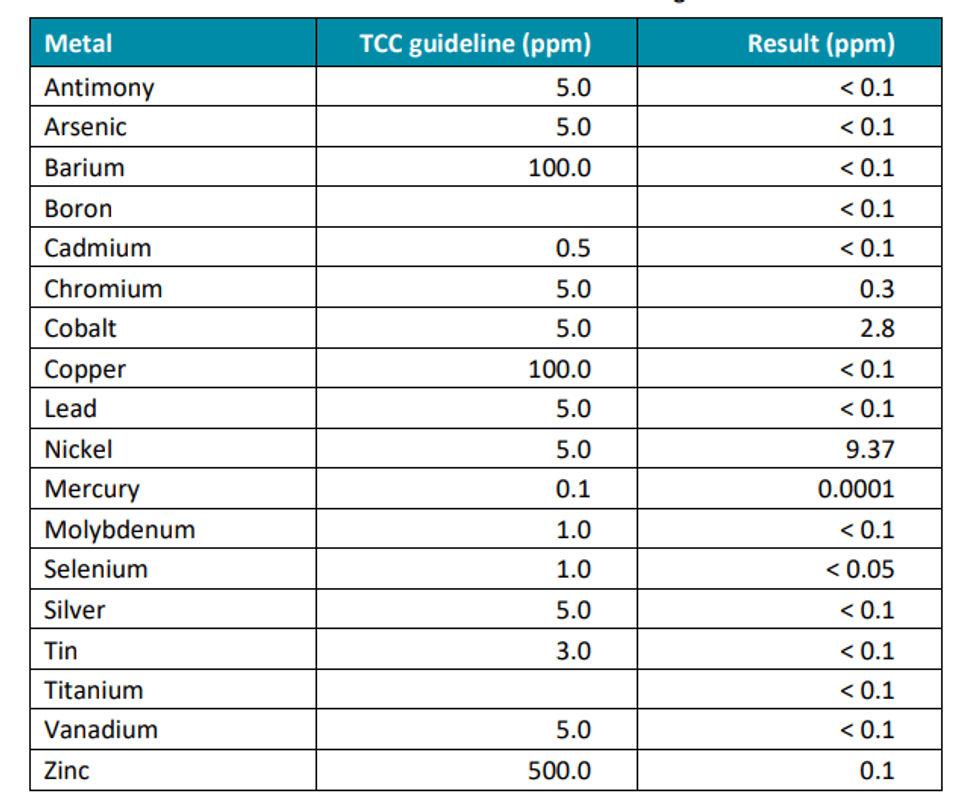

The chemical leaching tests undertaken by JCU involved:

- Toxicity Characteristic Leaching Procedure (“TCLP”);

- Inductively coupled plasma mass spectrometry (“ICP-MS”); and

- X-Ray powder diffraction.

This testwork demonstrated that under the Townsville City Council (TCC) guidelines, QPM comfortably met the threshold for all elements of potential concern except nickel. QPM and JCU are confident that nickel levels will also be reduced to below the threshold with additional washing.

Click here for the full ASX Release

This article includes content from Queensland Pacific Metals Ltd , licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

QPM:AU

Sign up to get your FREE

Queensland Pacific Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

20 April 2022

Queensland Pacific Metals

Developing a Sustainable and High-Purity Battery Materials Refinery Project

Developing a Sustainable and High-Purity Battery Materials Refinery Project Keep Reading...

Keep reading...Show less

12 February

Bahia Metals Corp. Completes Initial Public Offering of $5,750,000, with Full Exercise of Over-Allotment Option

Bahia Metals Corp. (CSE: BMT) ("Bahia" or the "Company") is pleased to announce that it has successfully completed its initial public offering (the "IPO") of 11,500,000 units of the Company (the "Units") at a price of $0.50 per Unit, inclusive of the full exercise of the 15% over-allotment... Keep Reading...

04 February

FPX Nickel Reports Confirmatory Results from Geotechnical Drilling at the Baptiste Nickel Project

FPX Nickel Corp. (TSX-V: FPX, OTCQX: FPOCF) ("FPX" or the "Company") is pleased to report assay results from select drill holes completed during its 2025 engineering field investigation program at the Baptiste Nickel Project ("Baptiste" or the "Project") in central British Columbia.As previously... Keep Reading...

16 January

Top 5 Canadian Mining Stocks This Week: Homeland Nickel Gains 132 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.The Ontario government said Tuesday (January 13) that it is accelerating permitting and... Keep Reading...

08 January

Nickel Market Recalibrates After Explosive Trading Week

Nickel prices stabilized on Thursday (January 8) after a turbulent week that saw the market swing sharply higher before retreating as traders reassessed the balance between existing supply risks and a growing overhang of inventory.Three-month nickel on the London Metal Exchange (LME) hovered... Keep Reading...

Latest News

Sign up to get your FREE

Queensland Pacific Metals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00