Yukon Metals Corp. (CSE: YMC, FSE: E770, OTCQB: YMMCF) (" Yukon Metals " or the " Company ") is pleased to announce results from its inaugural exploration program on the 11,755-hectare AZ project, located approximately 36km south of Beaver Creek, Yukon. AZ is the largest of Yukon Metals' seventeen properties across 42,500 hectares in the Yukon.

Highlights:

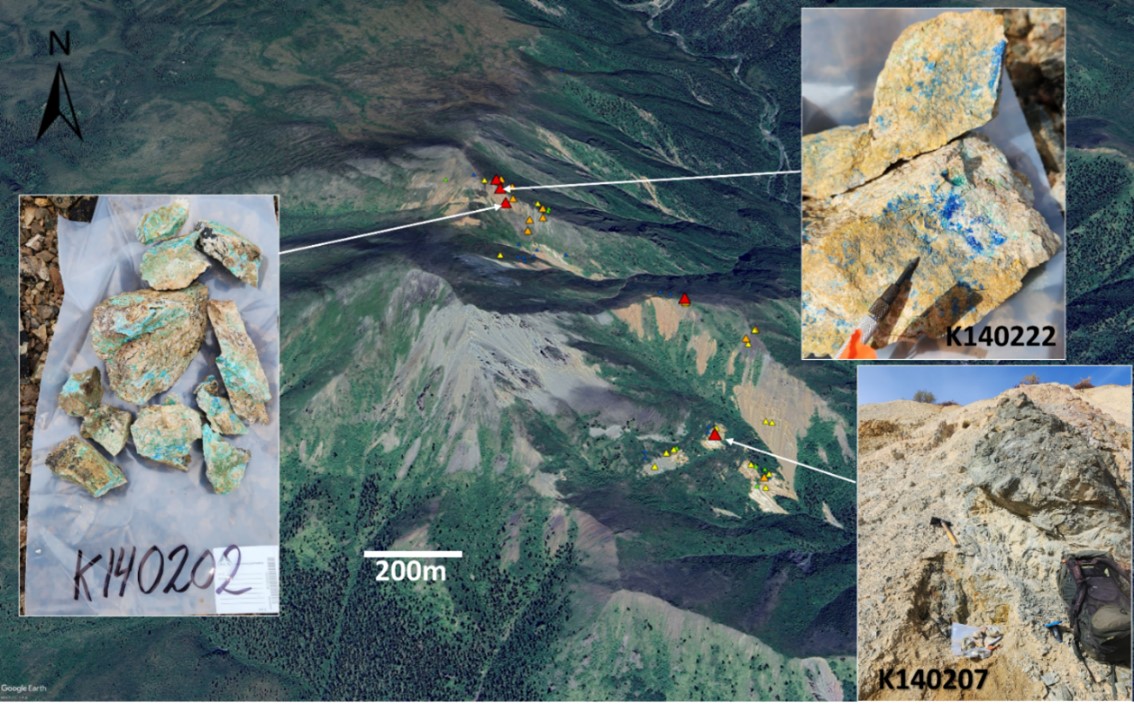

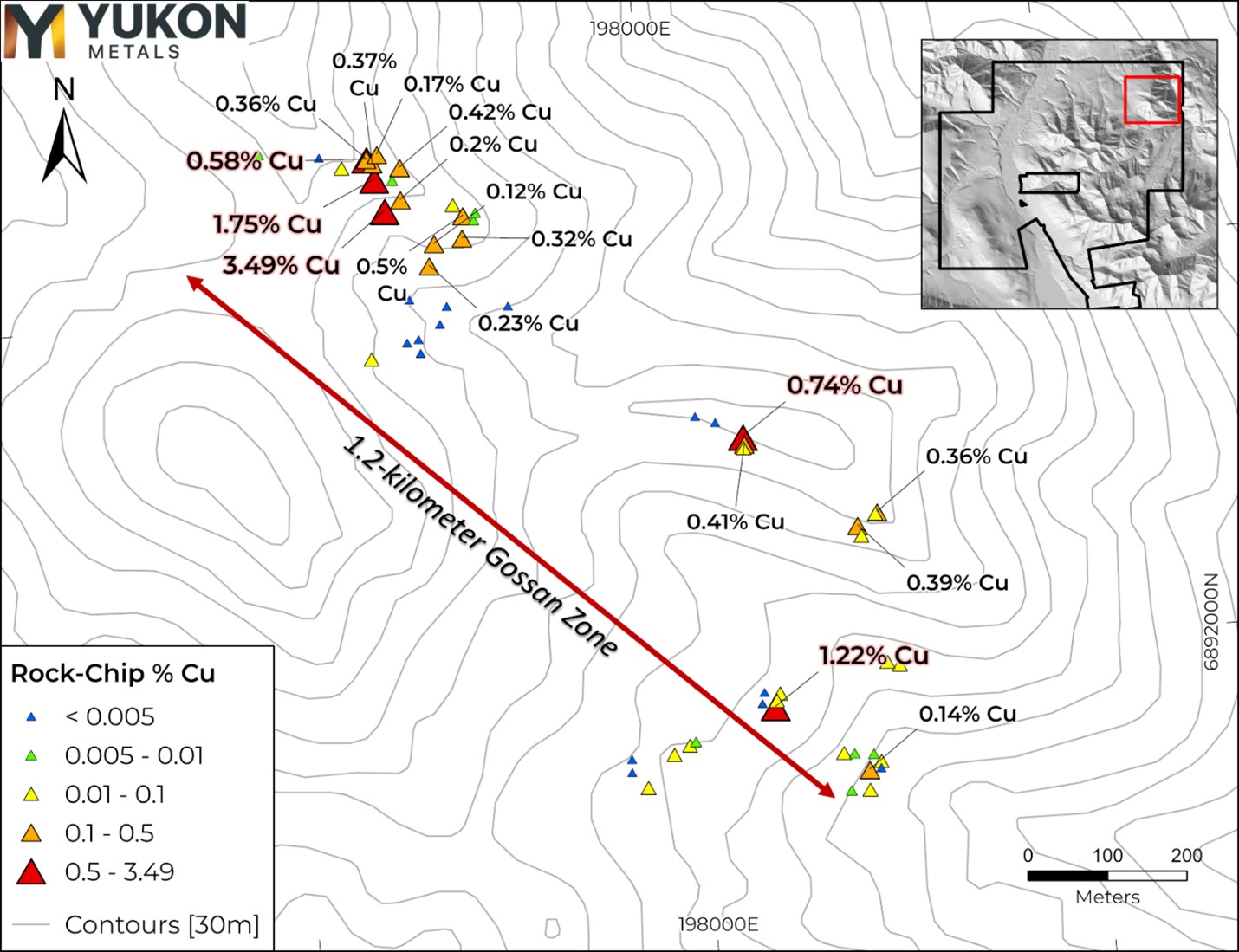

- Yukon Metals discovered extensive surface copper mineralization with values up to 3.49% Cu at Chair Mountain (Figures 1 & 2).

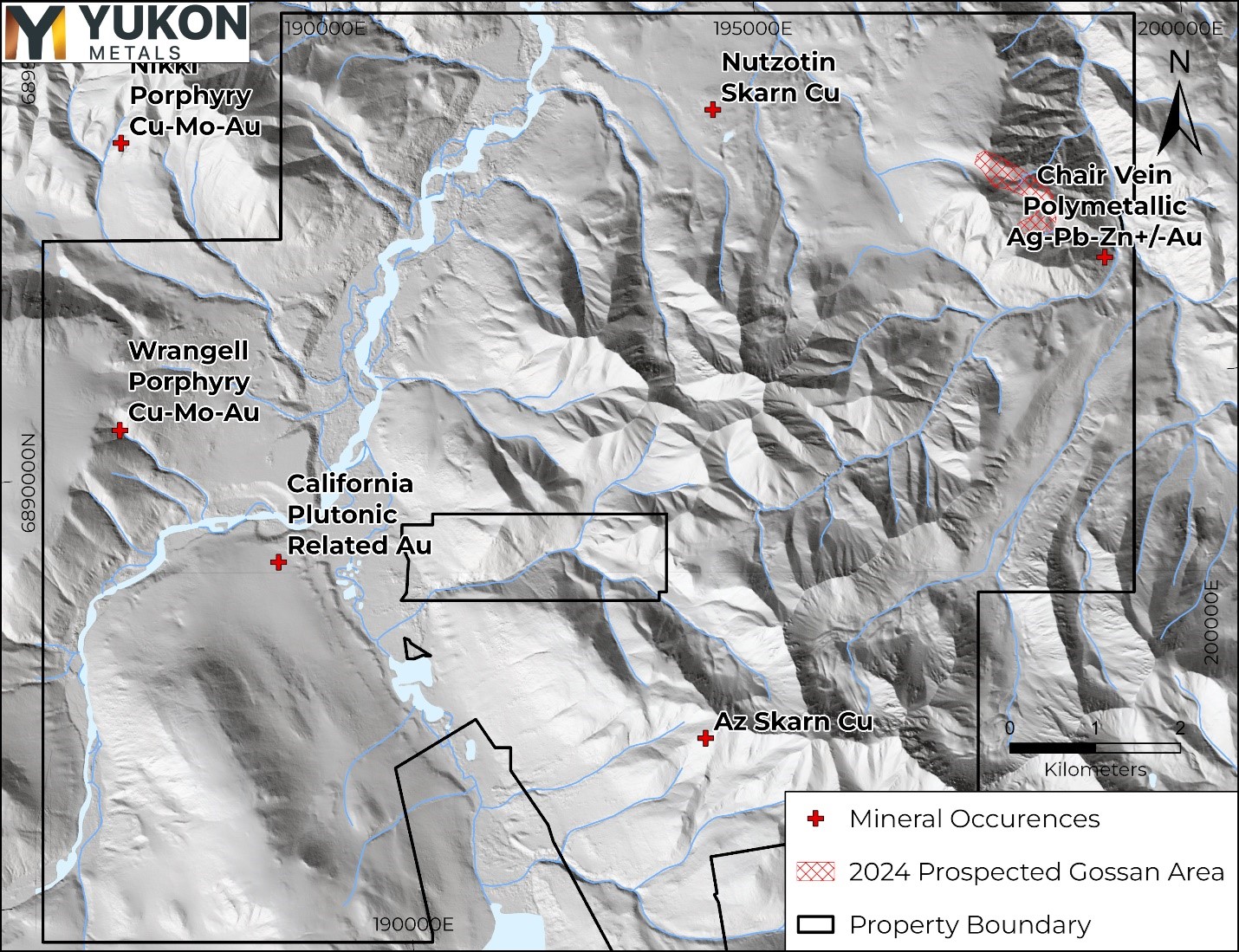

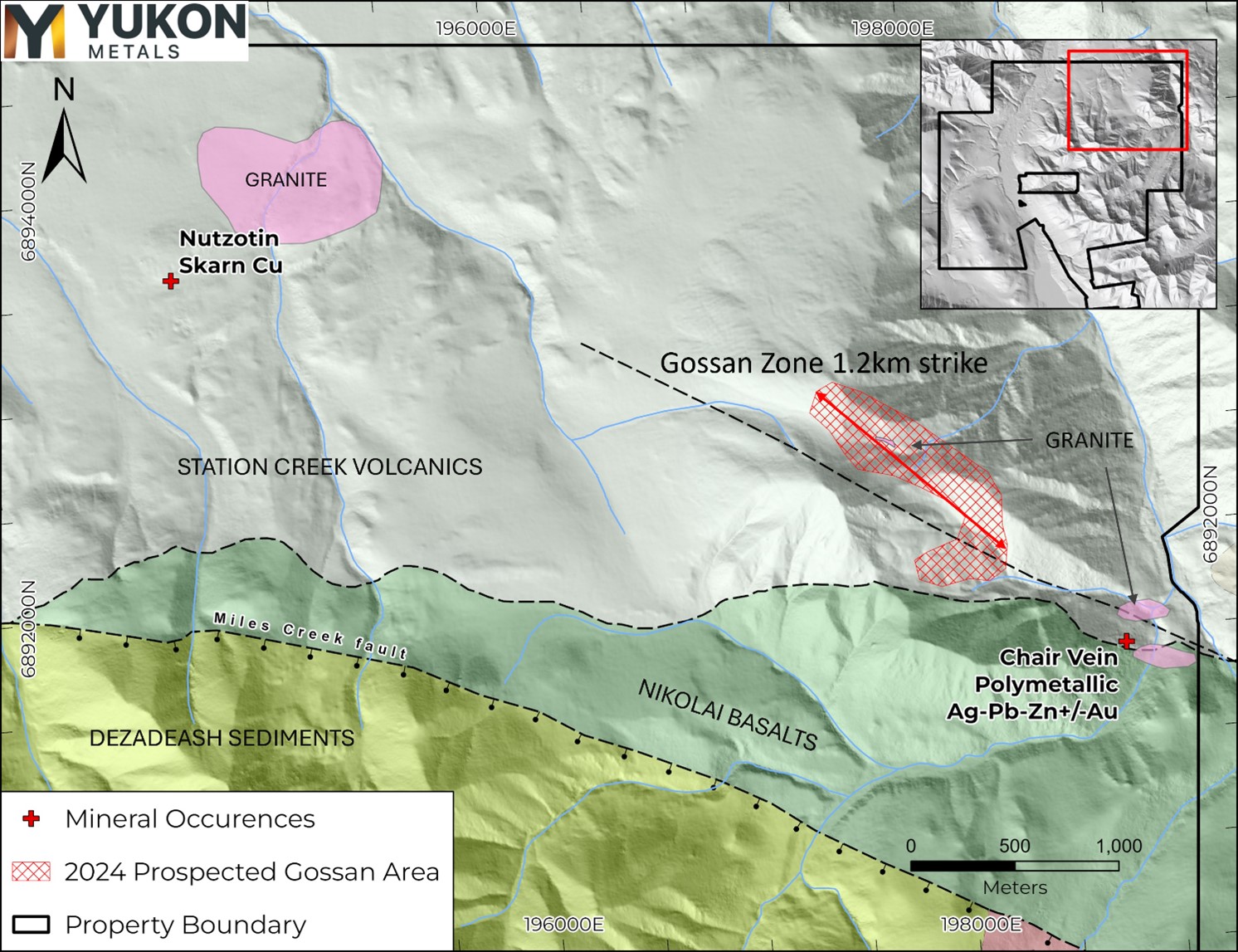

- The Chair Mountain Project, 6km from the Alaska Highway, is part of YMC's massive AZ property, encompassing numerous underexplored mineral occurrences (Figure 3).

- Surface sampling identified copper mineralization across a prominent, 1.2km-long gossan zone of rust-colored, iron-stained rock (Figure 4).

Rory Quinn, President & CEO stated , " Yukon Metals is moving forward with an exciting phase of exploration, including advancing drilling at AZ's Chair Mountain and conducting detailed mapping and sampling to define additional targets. Drilling is planned at three key projects: the Star River gold-silver property, the Birch copper-gold property, and the AZ property, which holds significant potential for copper, precious, and critical metals discoveries."

AZ

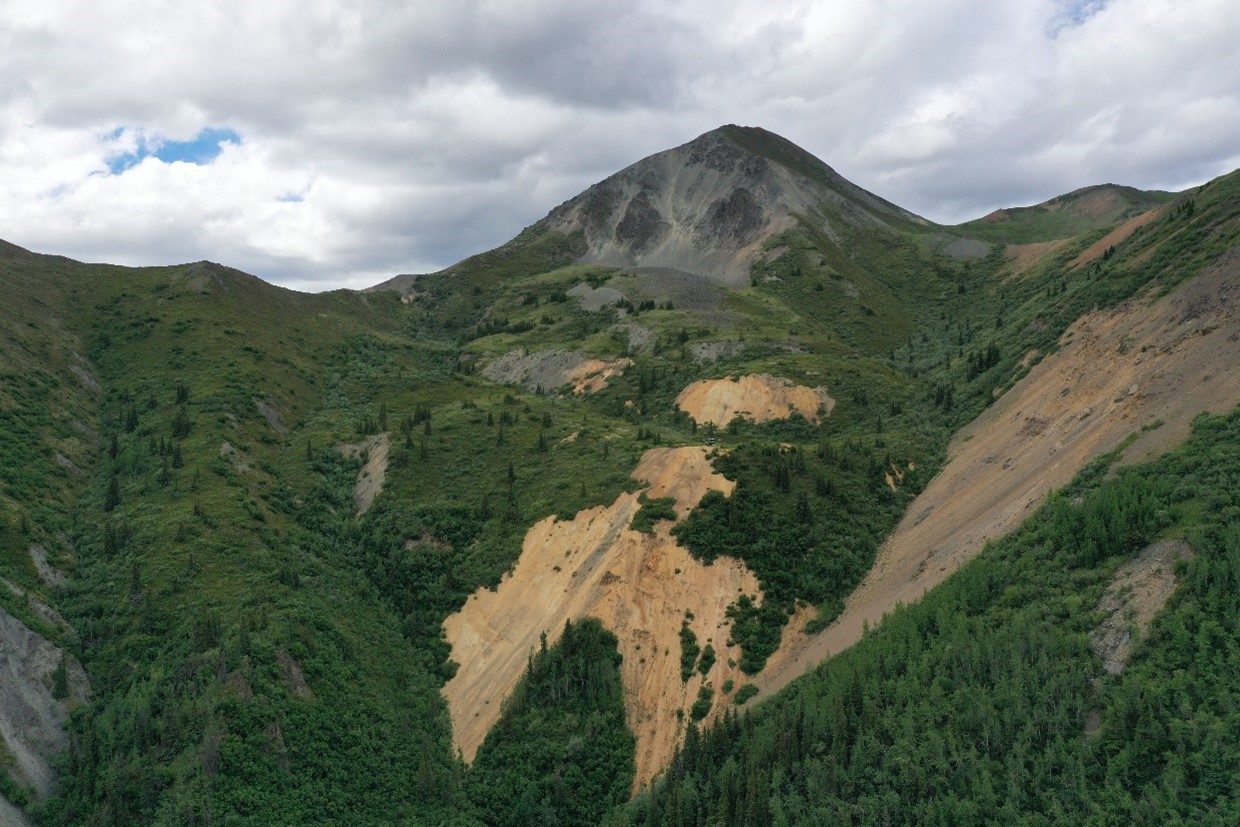

In September 2024, Yukon Metals conducted a helicopter-supported mapping and sampling program on its AZ property. A prominent zone of orange iron-stained and altered rocks was followed over 1.2 kilometres on the north and eastern flanks of Chair Mountain. Consistent copper mineralization was found along the prospected area. Of the sixty rock-chip samples taken, 18 samples showing significant copper content, assayed from 0.12-3.49%.

Rock-chip samples were collected in quartz veins within basalt and andesite volcanic rocks in both outcrop and float exposures near the ridge tops. This area is coincident with a major topographic lineament, mapped regionally as a NW trending fault zone, that extends a further kilometer down to Sanpete Creek (a past alluvial gold producer) and the property boundary to the southeast.

Figure 1- Sample K140202 Grading 3.49% Cu

Figure 2- Chair Mountain

Figure 3- Oblique View Overlooking Chair Mountain & 2024 Prospecting Location

| Sample | Cu % | Au ppm | Zn ppm | Type |

| K140202 | 3.49 | 16.10 | Float | |

| K140222 | 1.75 | 0.01 | 30.40 | Float |

| K140207 | 1.22 | 0.01 | 40.60 | Outcrop |

| K140272 | 0.74 | 0.16 | 54.80 | Outcrop |

| K140253 | 0.58 | 27.50 | Outcrop | |

| K140267 | 0.50 | 84.50 | Outcrop | |

| K140268 | 0.42 | 147.00 | Outcrop | |

| K140271 | 0.41 | 0.01 | 86.50 | Subcrop |

| K140273 | 0.39 | 0.02 | 81.50 | Outcrop |

| K140252 | 0.37 | 50.40 | Outcrop | |

| K140254 | 0.36 | 0.01 | 17.40 | Outcrop |

| K140274 | 0.36 | 0.01 | 87.80 | Subcrop |

| K140203 | 0.32 | 0.02 | 27.80 | Subcrop |

| K140216 | 0.23 | 0.01 | 19.60 | Float |

| K140220 | 0.20 | 0.01 | 39.80 | Float |

| K140269 | 0.17 | 0.01 | 35.70 | Outcrop |

| K140212 | 0.14 | 0.12 | 5580.00 | Float |

| K140161 | 0.12 | 85.70 | Float | |

| K140204 | 0.09 | 0.28 | 2230.00 | Outcrop |

| K140205 | 0.03 | 0.11 | 3400.00 | Outcrop |

Table 1- Highlighted significant 2024 rock-chip samples.

Figure 4- Rock-chip samples showing percent copper at Chair Mountain, AZ Property.

About the AZ Project

Yukon Metals owns 100% of the AZ base and precious metals project located 35km south of the community of Beaver Creek, Yukon. On behalf of Yukon Metals, prior to closing of the original property transaction, Ron Berdahl staked the area north of the original AZ claims, which covered an additional 7,625 ha in 372 additional claims (see NR issued June 12, 2024). This area covers an additional 4 historic mineral occurrences including Wrangell, California, Nutzotin, and Chair Mountain, listed respectively by the Yukon Geologic Survey as Porphyry Cu-Mo-Au, Intrusion Related Au, Skarn Cu, and Polymetallic Vein Hosted Ag-Pb-Zn +/- Au (Figure 5).

Figure 5- AZ property map with noted historical mineral occurrences.

Chair Mountain

Limited historical work was completed around Chair Mountain, starting in 1987, where the initial prospecting program collected only 11 samples (AR 091955). Follow-up work in 1989 within trenches near Sanpete Creek found quartz veining containing sulfides. Sample #62951 from Trench 89-4 in a 25cm-thick vein sample (true width unknown) assayed 51 ppb Au, 5.6 ppm Ag, 1,400 ppm Cu, 8,880 ppm Pb and >20,000 ppm Zn. Overlimit zinc was never assayed. Sample #62954 from Trench 89-4 assayed 59 ppb Au, 1.2 ppm Ag, 278 ppm Cu, 429 ppm Pb, 13,380 ppm Zn (AR 091955).

Strongly silicified, argillically altered and limonitic basalt flows are noted along the eastern side of Chair Mountain along with minor chalcopyrite occurrences to the north. Limited sampling in 2006 noted rock-chip float samples downstream of the eastern flank of the mountain returning values up to 0.74 g/t Au. Sampling of quartz vein float returned 0.40 g/t Au with copper ranging from 8 to 819 ppm (AR 094599).

Figure 6- Chair Mountain area geology from Israel et. al, 2007 with granite mapping from AR 094599 and the 2024 Yukon Metals field program.

Nutzotin Showing

The Nutzotin area lies 2.5km northwest of Chair Mountain along strike of a large fault mapped by the Yukon Geologic Survey in 2007 (Figure 6) Two skarn showings were uncovered in this area in the late 1960's which reportedly yielded 10.3% copper and 16.4 g/t silver with trace gold. Historical chip sampling over three trenches returned variable copper values, with the best returning 0.6% copper over 12m (AR 095814).

During a 2006 exploration program, a composite grab sample #RC276270 over a granite stock northeast of the skarn showings returned significant copper mineralization of 1,485 ppm. Silt sample #TC276691 downstream of the stock returned 0.183 g/t gold (AR 094599). The stock reportedly shows moderate to strong orange ankeritic alteration and pyritization with abundant quartz veining, noted as commonly chalcopyrite-bearing. A small exploration program in 2012 by Strategic Metals uncovered a new mineralized zone on the northern contact of the stock with soil samples ranging between 134 to 1,105 ppm copper (AR 096422). Limited outcrop exposure, permafrost, and extensive volcanic ash over the soil profile has previously challenged exploration efforts in this area.

AZ Showing

The AZ occurrence was prospected by Ron Berdahl in the early 1990's while working for Noranda. Copper mineralization is noted on the AZ occurrence; Rock float assays returned an average of 10% Cu, 126 g/t Ag and 7.08 g/t Au from four samples in 1993 (YMC press release June 3, 2024). The author further stated, "anomalous copper gold-bearing skarn underneath the float showing suggests a local source for the mineralized float on the property." In this region, small placer operations were active on Sanpete, Pan and Gold Creeks in the 1930's.

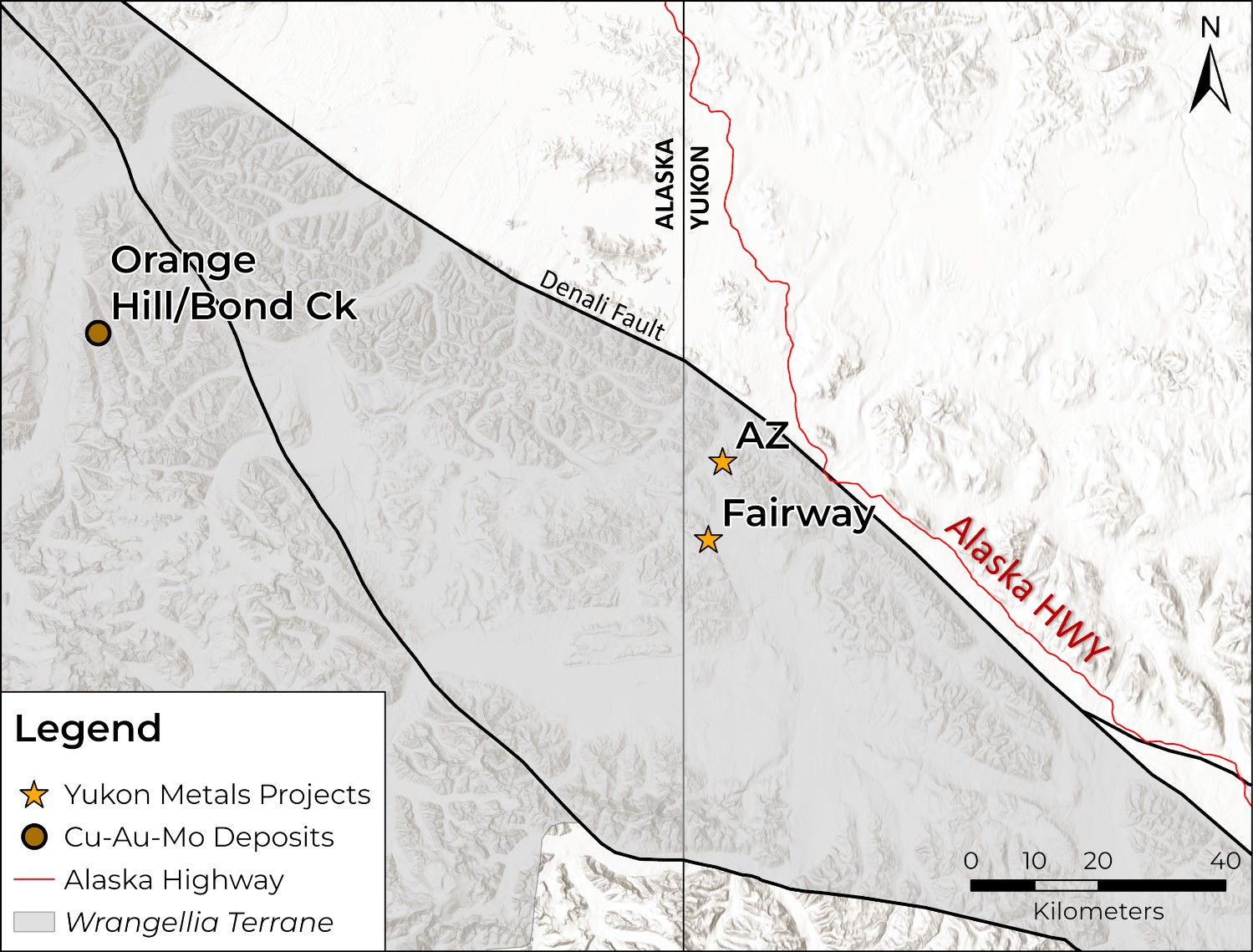

Regional Setting

The AZ property occurs in a similar geologic setting to deposits just across the Yukon-Alaska border. The Wrangellia Terrane on the Alaska side is host to several unmined porphyry copper deposits in the Wrangell-St.Elias National Park and Preserve, which occur in or associated with Cretaceous intrusions. The most notable being the Bond Creek and Orange Hill deposits. Historical tonnage and grade estimates, reported by the US Geological Survey (Richter et al., 1975), estimate that the Bond Creek deposit may contain approximately 500 million tons grading 0.3% copper and 0.02% molybdenum, while the Orange Hill deposit may contain approximately 320 million tons grading 0.35% copper and 0.02% molybdenum.

These historical estimates are not NI 43-101 compliant and should not be relied upon. They are presented for historical reference and to highlight the prospectivity of the AZ property with respect to nearby discoveries.

Figure 7- AZ property in relation to Wrangellia Terrane rocks and Orange Hill/ Bond Creek Historical Deposits.

Methodology

Sampling

Rock samples were sent to ALS Minerals for analysis with sample preparation in Whitehorse, Yukon and analysis in North Vancouver, British Columbia.

Samples were prepared by crushing to 70% passing 2mm, 250g split pulverised better than 85% passing 75 microns (Prep-31A). Pulp samples were analysed for 48 elements by four acid digestion and ICP-MS super-trace analysis (ME-MS61L). All samples were analyzed for gold by fire assay and AAS with a 50g nominal sample weight (Au-AA24). Samples over 10,000 ppm Copper were assayed by method Cu-OG62.

Rock samples taken while prospecting referenced in this release are selective in nature and collected to determine the presence or absence of mineralization and may not be representative of the mineralization hosted on the project.

Figure 8- AZ Project Location Map

Qualified Person

The technical content of this news release has been reviewed and approved by Helena Kuikka, P.Geo., VP Exploration for Yukon Metals and a Qualified Person (as defined by National Instrument 43-101).

About Yukon Metals Corp.

Yukon Metals is well financed and represents a property portfolio built on over 30 years of prospecting by the Berdahl family, the prospecting team behind Snowline Gold's portfolio of primary gold assets . The Yukon Metals portfolio consists primarily of copper-gold and silver-lead-zinc assets, with a substantial gold and silver component. The Company is led by an experienced Board of Directors and Management Team across technical and finance disciplines.

Yukon Metals is focused on fostering sustainable growth and prosperity within Yukon's local communities, while simultaneously enhancing stakeholder value. Our strategy centers around inclusivity and shared prosperity, offering both community members and investors the chance to contribute to, and benefit from, our ventures.

The Yukon

The Yukon ranks 10 th most prospective for mineral potential across global jurisdictions according to the Fraser Institute's 2023 Survey of Mining Companies and is host to a highly experienced and conscientious local workforce, fostered by a long culture of exploration coupled with deep respect for the land. Recent major discoveries with local roots such as Snowline Gold's Rogue Project - Valley Discovery, demonstrate the Yukon's potential to generate fresh district-scale mining opportunities.

Yukon Metals CORP.

"Rory Quinn"

Rory Quinn, President & CEO

Email: roryquinn@yukonmetals.com

For additional information please contact:

Kaeli Gattens

Vice President, Investor Relations & Communications

Yukon Metals Corp.

E-mail: kaeligattens@yukonmetals.com

Website: www.yukonmetals.com

Webinar:

For more context, please join the Company in a live event on Thu, Jan 16, 2025, at 11:00 AM PST / 2:00 PM EST . Q&A will follow the presentation.

Click here to register: https://6ix.com/event/yukon-metals-exploration-update

CAUTIONARY NOTE REGARDING FORWARD-LOOKING INFORMATION

This news release contains certain forward-looking information, including information about the metal association and geology of the prospect areas at the AZ project, including Chair Mountain, Nutzotin, Wrangell and California, the accuracy of the copper mineralization, the potential for economic grades of copper, silver and gold, Yukon's potential to generate fresh district-scale mining opportunities, and the Company's future plans and intentions. Wherever possible, words such as "may", "will", "should", "could", "expect", "plan", "intend", "anticipate", "believe", "estimate", "predict" or "potential" or the negative or other variations of these words, or similar words or phrases, have been used to identify the forward-looking information. These statements reflect management's current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking information involves significant risks, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from those discussed or implied in the forward-looking information. Such factors include, among other things: risks and uncertainties relating to Chair Mountain and other properties not being prospective copper-rich, gold-rich or silver-rich geological systems; rock samples analysed not being representative of overall mineralization; the required assumptions of completed helicopter-supported mapping and sampling programs; not having significant scale and a lack of economic grade minerals; the Yukon not having the potential to generate fresh district-scale mining opportunities; and other risks and uncertainties. See the section entitled "Risk Factors" in the Company's listing statement dated May 30, 2024, available under the Company's profile on SEDAR+ at www.sedarplus.ca for additional risk factors. These factors should be considered carefully, and readers should not place undue reliance on the forward-looking information. Although the forward-looking information contained in this news release is based upon what management believes to be reasonable assumptions, the Company cannot assure readers that actual results will be consistent with the forward-looking information. The forward-looking information is made as of the date of this news release, and the Company assumes no obligation to update or revise the information to reflect new events or circumstances, except as required by law.

References

Davidson, G.,(1987). Assessment report on the Chair Gold 1-12, 15-18 mineral claims (YA94380-YA94391, YA94392-YA94395), NTS 115-K-2 . Prepared for G. Harris, Whitehorse Mining District, Yukon Territory. September 1987. AR # 091955

ISRAEL, S., COBBETT, R. and FOZARD, C., 2007. Bedrock geology of the Miles Ridge area, Yukon (parts of NTS 115F/15, 16 and 115K/1, 2) (1:50 000 scale). Yukon Geological Survey, Open File 2007-7.

Mitchell, A., B.Sc. (2012). Assessment report describing soil and rock geochemical sampling at the Nutz Property, Nutz 1-30 YD110353-YD110382, NTS 115/K02 . Prepared for Strategic Metals Ltd. by Archer, Cathro & Associates (1981) Limited. Whitehorse Mining District, Yukon Territory. February 2012. AR # 095814

Richter, D.H., Singer, D.A., and Cox, D.P., 1975, Mineral resources map of the Nabesna quadrangle, Alaska: U.S. Geological Survey Miscellaneous Field Studies Map MF-655-K, 1 sheet, scale 1:250,000.

Schulze, C., B.Sc., (2007). NI 43-101-compliant report on the 2006 exploration program on the White River Nickel Project: ANT, HAND, WENG, RIVER, WR, PIC, and KLUX claim blocks (115K/02, 115F/15, 115F/16) . Prepared for Xstrata plc (formerly Falconbridge Ltd.) by All-Terrane Mineral Exploration Services. Whitehorse Mining District, Yukon Territory. February 26, 2007. AR # 094599

Photos accompanying this announcement are available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/6461d0b3-96e5-4daa-b9b0-687cec933ebd

https://www.globenewswire.com/NewsRoom/AttachmentNg/c4d92cee-fc7c-4d35-a464-283c38edb915

https://www.globenewswire.com/NewsRoom/AttachmentNg/25034118-2fda-413c-a383-60e60b848a71

https://www.globenewswire.com/NewsRoom/AttachmentNg/7d95bdd4-0f0e-4227-bbfa-ae211d48ce6e

https://www.globenewswire.com/NewsRoom/AttachmentNg/732d693a-0c2d-4f10-a6e4-e8ac2fa9446a

https://www.globenewswire.com/NewsRoom/AttachmentNg/7942bb49-3bfc-4643-9808-2205a2cd62e3

https://www.globenewswire.com/NewsRoom/AttachmentNg/11676797-4bc8-429b-9a32-840dcb66b961

https://www.globenewswire.com/NewsRoom/AttachmentNg/4c6e41b5-43b4-4872-ae47-50f96e04410f