March 07, 2023

Wolfsberg Lithium Project is well positioned to become a leading producer of battery grade lithium hydroxide in Europe

European Lithium Limited (ASX: EUR, FRA:PF8, OTC: EULIF) (European Lithium or the Company) is pleased to present the results of its Definitive Feasibility Study (Wolfsberg DFS or DFS) for its wholly owned Wolfsberg Lithium Project, located in Austria (Wolfsberg Lithium Project or Wolfsberg Project). The Wolfsberg DFS has been delivered by DRA Projects (Pty) Ltd (DRA), a diversified global engineering, project delivery and operations management group.

HIGHLIGHTS

- The Definitive Feasibility Study (DFS) demonstrates that the Wolfsberg Lithium project is set to deliver high returns, leveraging low operating costs, and benefiting from a lithium market which is anticipated to be in structural undersupply during most of the life of mine;

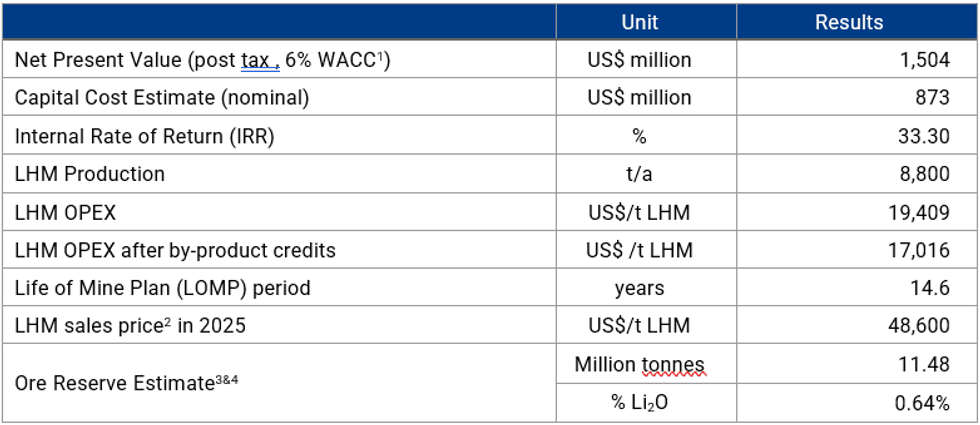

- Battery grade Lithium Hydroxide Monohydrate (LHM) production is ~ 8,800 tpa for 14.6 years;

- LHM OPEX (after byproducts) is US$ 17,016/t LHM on average compared to reported spot prices for LHM in February 2023 of US$ 79,500 DDP Antwerp;

- LHM prices2 modelled in the DFS are projected to be at a 39% discount to current spot prices in 2025 and then escalate by 2% per annum;

- Estimated CAPEX is US$ 866 million which supports a post-tax NPV of US$ 1.5 billion @ WACC1 6%;

- Acceleration of decarbonization and energy transition in Europe combined with the rapid adoption of electric vehicles provides further upside; and

- Construction of downstream project facilities expected Q4, 2023.

The financial results of the DFS are set out in the table below:

Executive Summary

The Wolfsberg Project is held through European Lithium AT GmbH, a 100% owned subsidiary of European Lithium. European Lithium is aiming to be Europe’s first and largest local supplier of critical lithium hydroxide monohydrate (LHM) in the region.

Tony Sage, Chairman, commented on the DFS results: “The robust DFS provided by DRA provides confidence in the commercialisation of the Wolfsberg Project. This positive news has come during a buoyant market for lithium and an increased urgency for decisive action to accelerate the green energy transition, especially in Europe. Our next steps include finalisation of the listing of Critical Metals on NASDAQ and continuing our discussions with our financiers. Through the business combination with Sizzle, Critical Metals Corp. expect to access substantial opportunities available in the U.S. market.”

Building on completion of the Pre-Feasibility Study (PFS) for the Wolfsberg Project in April 2018, the Company conducted extensive infill geological drilling, mineral processing and metallurgical test work, built a pilot test facility which produced 1.7 t of bulk spodumene concentrate, updated its marketing studies and completed environmental mitigation studies. The results of this work has flowed into the Wolfsberg DFS which provides an accurate and detailed analysis of the compelling economics for the Wolfsberg Project.

The DFS has been prepared to international standards with Mineral Resource and Ore Reserve estimates prepared in accordance with the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (the JORC Code, 2012) guidelines, as published by the Joint Ore Reserves Committee of the Australasian Institute of Mining and Metallurgy, Australian Institute of Geoscientists and Minerals Council of Australia.

The Wolfsberg DFS plans an average (steady state) mine production rate of 780 kt/a, peaking at 840 kt/a over the Life of Mine (LOM) which is based on an Ore Reserve of 11.5 Mt, mined over approximately 15 years. The Project will comprise two integrated operations, a mining and processing operation to produce a lithium concentrate (spodumene), and a hydrometallurgical plant to convert the spodumene into battery grade LHM. The hydrometallurgical plant is planned to produce approximately 8.8 kt/a LHM with a total production of approximately 129 kt of LHM over the LOM. The forecast pricing assumptions for LHM are based on a 39% discount to current spot prices in Europe (~ USD 48 600/t) in 2025 which then escalate with United States Consumer Price Index (CPI) from 2026 onwards (refer to paragraph 9.6).

Field surveys for fauna and flora have been completed at the planned mine and concentrator site location. The DFS demonstrates that a mining fleet of battery electric vehicles (BEVs) can be economically viable for the Wolfsberg Project. The study confirms that that the underground portal, concentrator, and all the required surface infrastructure can be located within an area of less than 10 ha, which has significantly reduced the Wolfsberg Project’s environmental footprint.

European Lithium is committed to the sustainable development of its Wolfsberg Project, utilising the most advanced mining and processing technologies to become a reliable low carbon producer of LHM and be a key part of the emerging lithium supply chain in Europe.

Click here for the full ASX Release

This article includes content from European Lithium Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

EUR:AU

The Conversation (0)

07 September 2023

European Lithium

Developing the Advanced Wolfsberg Lithium Deposit in Austria

Developing the Advanced Wolfsberg Lithium Deposit in Austria Keep Reading...

27 August 2025

CRML signs LOI Offtake Agreement with UCORE (DOD Funded)

European Lithium (EUR:AU) has announced CRML signs LOI Offtake Agreement with UCORE (DOD Funded)Download the PDF here. Keep Reading...

20 August 2025

Outstanding New 2024 Diamond Drill Results Tanbreez Project

European Lithium (EUR:AU) has announced Outstanding New 2024 Diamond Drill Results Tanbreez ProjectDownload the PDF here. Keep Reading...

30 July 2025

Quarterly Activities Report and Appendix 5B

European Lithium (EUR:AU) has announced Quarterly Activities Report and Appendix 5BDownload the PDF here. Keep Reading...

24 July 2025

EUR Sells 0.5m CRML Shares for U$1.8m (A$2.7m)

European Lithium (EUR:AU) has announced EUR Sells 0.5m CRML Shares for U$1.8m (A$2.7m)Download the PDF here. Keep Reading...

09 July 2025

EUR Sells 0.5m CRML Shares for U$1.625m (A$2.5m)

European Lithium (EUR:AU) has announced EUR Sells 0.5m CRML Shares for U$1.625m (A$2.5m)Download the PDF here. Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

29 December 2025

SQM, Codelco Seal Landmark Lithium Joint Venture in Salar de Atacama

Sociedad Quimica y Minera (SQM) (NYSE:SQM) and Codelco have finalized their long-awaited partnership, forming a new joint venture that will oversee lithium production in Chile’s Salar de Atacama through 2060.SQM announced on Saturday (December 27) that it has completed its strategic partnership... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Equity Metals Exhibiting at the 2026 PDAC

06 February

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00