June 18, 2024

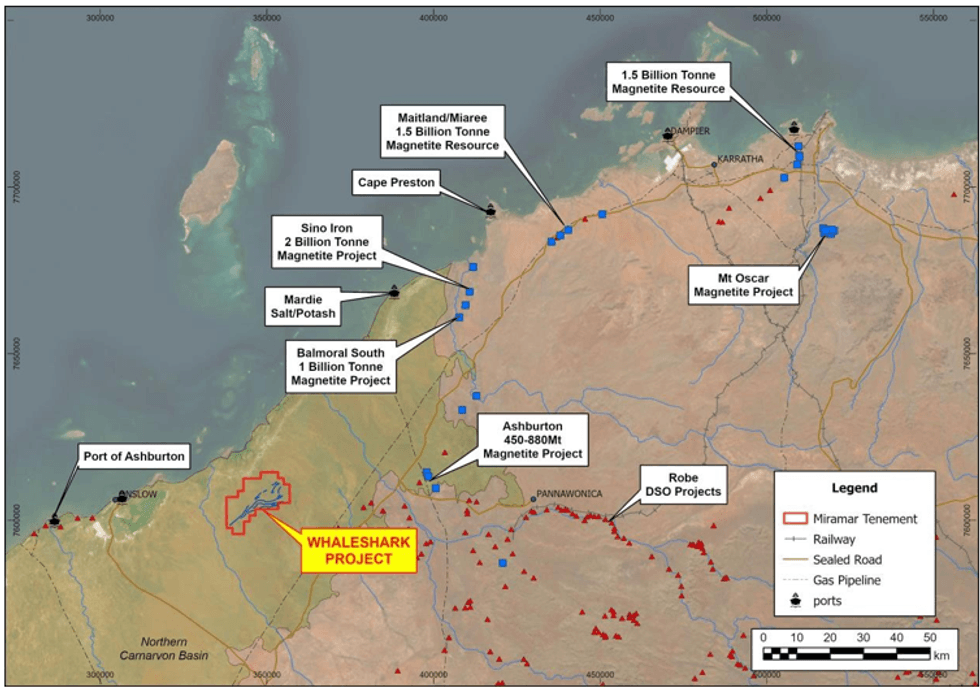

Miramar Resources Limited (ASX:M2R, “Miramar” or “the Company”) is pleased to provide an update on exploration activities at the Company’s 100%-owned Whaleshark Project, in the Gascoyne region of WA, where the Company has outlined a significant magnetite Exploration Target of 411Mt - 2,353Mt at 25-30% Fe in proximity to substantial mining, processing, power, transport and shipping infrastructure.

- Significant magnetite Exploration Target outlined at Whaleshark in proximity to substantial mining, processing, power, transport and shipping infrastructure

- Project-wide passive seismic survey maps basement topography

Miramar’s Executive Chairman, Mr Allan Kelly, said that along with significant copper and gold potential, the Whaleshark Project had the potential to host a substantial “green iron” project.

“There is strong demand for magnetite from steel producers looking to reduce their carbon emissions through production of Direct Reduced Iron (DRI), which requires the higher grades obtained from magnetite iron ore to be effective,” Mr Kelly said.

“Whaleshark has several large magnetite-rich banded iron formations that have not been previously targeted or explored for magnetite iron mineralisation,” he said.

“Data from the passive seismic survey recently completed confirms that these magnetite-rich banded iron formation lie under relatively shallow cover,” he added

“Importantly, the Whaleshark Project is located in proximity to substantial existing and proposed mining, processing, power, transport and shipping infrastructure,” he said.

Magnetite Exploration Target

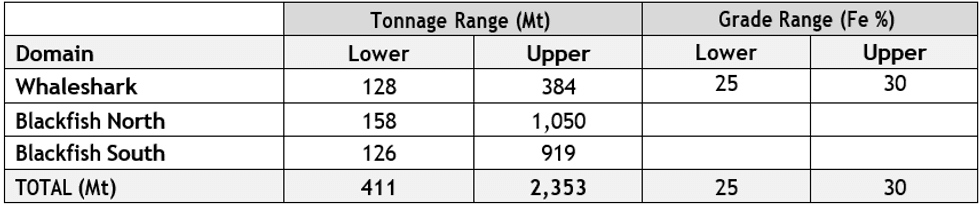

The Company has estimated an initial magnetite “Exploration Target” for the Whaleshark Project as summarised in Table 1.

By using modelled geophysical data, geological logging and assay results from historical drilling within the Whaleshark magnetic anomaly and extrapolating those results to the two banded iron formations south of the Whaleshark Granodiorite, the Company has outlined a significant potential volume of magnetite iron ore, with the midpoint in the order of 1 Billion tonnes.

The scale of the potential magnetite iron mineralisation at Whaleshark compares favourably with several large magnetite projects within WA (Figure 2).

Cautionary Statement:

The above Exploration Target has been prepared and reported in accordance with the 2012 edition of the JORC Code. The potential quantity and grade are conceptual in nature and there has been insufficient exploration to estimate a Mineral Resource. It is uncertain if further exploration will result in the estimation of a JORC-compliant Mineral Resource.

Click here for the full ASX Release

This article includes content from Miramar Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

gold-explorationnickel-explorationresource-stockscopper-stocksasx-m2rasx-stocksnickel-stockscopper-explorationcopper-investinggold-stocks

M2R:AU

The Conversation (0)

06 February 2024

Miramar Resources

Aiming to create shareholder value through the discovery of world-class mineral deposits

Aiming to create shareholder value through the discovery of world-class mineral deposits Keep Reading...

19 February

Northern Dynasty Shares Plunge as DOJ Backs EPA Veto of Alaska’s Pebble Mine

Northern Dynasty Minerals (TSX:NDM,NYSEAMERICAN:NAK) shares plunged on Wednesday (February 18) after the US Department of Justice (DOJ) filed a court brief backing the Environmental Protection Agency’s (EPA) January 2023 veto of the company’s long-contested Pebble project in Alaska.The brief... Keep Reading...

18 February

BHP Reports Strong Half-Year Copper Results, Boosts Guidance for 2026

BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has published its financial results for the half-year ended December 31, 2025.The mining giant said its copper operations, which span multiple continents, accounted for the largest share of its overall earnings for the first time, coming in at 51 percent of... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00