West Point Gold Corp. (TSXV: WPG) (OTCQB: WPGCF) (FSE: LRA0) ("West Point Gold" or the "Company") is pleased to announce that it has entered into a share purchase agreement, dated September 15, 2025, to acquire a 100% interest in the Baxter Spring Project, via the acquisition of Baxter Gold Corp. ("Baxter"), a private Canadian corporation and its US subsidiary. The Baxter Spring Project is located in the Manhattan Mining District, approximately 40 kilometres (km) south of Kinross's Round Mountain Mine and West Point Gold's Jefferson Canyon project, in Nye County, Nevada.

Historical exploration at Baxter Spring includes 128 drill holes, including approximately 11,000 metres (m) of reverse circulation (RC) drilling and 1,850 m of core drilling, along with surface geochemical and geophysical surveys.

Historical drilling on the project is highlighted by:

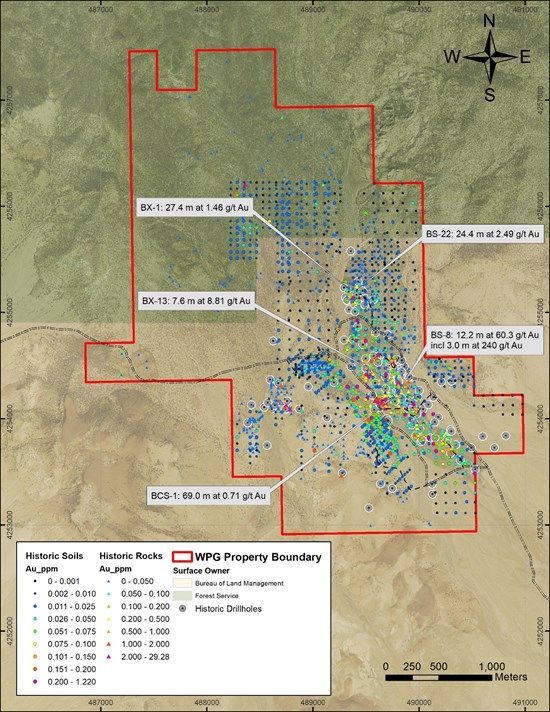

- 24.4 m at 2.49 g/t Au (BS-22, Homestake Mining, 1982)

- 12.2 m at 60.3 g/t Au including 3.0 m @ 240 g/t Au (BS-8, Homestake Mining, 1982)

- 27.4 m at 1.46 g/t Au (BX-1, Naneco, 1988)

- 7.6 m at 8.81 g/t Au (BX-13, Naneco, 1988)

- 69.0 m at 0.71 g/t Au (BCS-1, Homestake Mining, 1984)

Quentin Mai, CEO, stated, "While Gold Chain remains our flagship asset, Baxter Spring provides an attractive opportunity to acquire an advanced exploration project in a premier location that strengthens our position in the region. Baxter Spring features historical mining, extensive drilling with impressive results, as well as geophysical and geochemical surveys. We believe the replacement cost of the work completed to date far exceeds the value of the shares West Point Gold is paying to acquire the project. This opportunity is largely the result of Baxter Spring being a secondary project held by several other companies, where it had not seen recent work. We continue to expect the majority of our time and capital to be spent on the Gold Chain project going forward, and there are several simple, low-cost programs at Baxter Spring that we plan to complete in Q4 2025, in preparation for drilling in 2026."

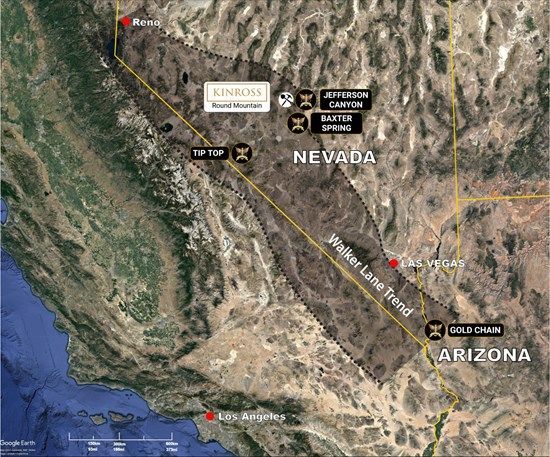

Figure 1: Property Location Map

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5717/266557_f513f547f48baa00_002full.jpg

Baxter Spring Project

Baxter Spring is an advanced-stage exploration project in Nye County, Nevada, and is located approximately 40 km south of Kinross' Round Mountain Mine and the Company's Jefferson Canyon property, which is optioned to Kinross. The project is approximately 40 km north of Tonopah, and is accessible via a paved road. Baxter Spring consists of 137 unpatented federal lode claims covering approximately 2,830 acres (1,145 hectares). The claims are on land administered by both the United States Bureau of Land Management (southern half) and the United States Forest Service (northern half). The majority of historical exploration work has been completed on the southern portion of the project, where West Point Gold will initially concentrate its efforts.

Historical exploration work includes 128 historical drill holes, including approximately 11,000 m of RC drilling and 1,850 m of core drilling, along with surface geochemical and geophysical surveys.

Figure 2: Baxter Spring project area showing historical data including rock and soil samples along with drill holes. Gold grades and downhole widths are provided for select holes.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5717/266557_f513f547f48baa00_003full.jpg

Historical work identified multiple zones of mineralization, with shallower drilling identifying vein structures within the zone of oxidation and within 300 m of the surface. Gold mineralization is contained in quartz-adularia-iron oxide (pyrite) veinlets associated with localized decalcification and pervasive silicification. Gold mineralization has been identified along a northwest-trending package of Ordovician sediments, which dip southwesterly beneath felsic volcanic rocks which are locally mineralized. The intersection of this rock package with northeast-trending structures provides a preliminary vector for down-plunge exploration. Radiometric dating of adularia suggests an age of ~15 million years (Ma), corresponding to the Miocene epoch.

Additionally, deeper drilling intersected Lower Plate rocks of the Roberts Mountain Formation at depths of 400 to 700 m, including those exhibiting hydrothermal alteration features associated with Carlin-type epithermal gold mineralization. Neither the shallow nor the deeper drilling has defined a resource or established a geologic model for these gold occurrences.

The Baxter Spring project is subject to a 2% net smelter returns royalty payable to Pilot Gold (USA) Inc., a wholly-owned subsidiary of Liberty Gold Corp.

Historical Exploration Results, Database and Next Steps

Baxter Spring comes with a historical database compiled from exploration conducted from 1980 to 2012. Despite the significance of past exploration work completed, much of it predated the current NI 43-101 standards.

The data presented in this release for the Baxter Spring Project was sourced from a private report prepared for Baxter Gold Corp. by Avrom Howard, MSc, PGeo, dated November 30, 2023. Additional data was received from Pilot Gold (USA).

In 2025, West Point Gold plans to complete the following activities for the Baxter Spring project:

- Compile all historical exploration work, geological mapping and, in particular, drilling data.

- Generate a series of digital layers allowing West Point Gold to view lithology, structure, alteration, and rock geochemistry.

- Combine the above digital models with the drill hole data for 3D modelling.

- Select field studies following the modelling to better define the lithologies, structures, alteration and geochemistry associated with surface-subsurface gold mineralization.

- Design follow-up and step-out drill holes to confirm and expand gold mineralization.

- Commence permitting for a 5,000 m drill program in 2026.

Agreement to Acquire Baxter Spring Mining Corp. and the Baxter Spring Project

West Point Gold has entered into a share purchase agreement, dated September 15, 2025, to acquire all of the issued and outstanding shares of Baxter in exchange for 13,500,000 common shares of the Company valued at $0.435 per common share. Baxter holds a 100% interest in the Baxter Spring project via its wholly-owned US subsidiary Baxter Spring Mining (US) Corp. The parties to the share purchase agreement are at arm's length. No finder fees are payable in connection with this transaction.

All share consideration to be provided to the shareholders of Baxter will be subject to a statutory hold period of four months plus one day from the closing date of the transaction. Further voluntary contractual hold periods have been agreed to with the shareholders of Baxter, resulting in no shares being free trading after the statutory hold period has elapsed. These voluntary hold periods are: 25% (3,375,000 shares) six months from the closing date; 25% (3,375,000 shares) twelve months from the closing date; 25% (3,375,000 shares) eighteen months from the closing date; and 25% (3,375,000 shares) twenty-four months from the closing date.

This acquisition remains subject to the approval of the TSX Venture Exchange.

Gold Chain share payment

Further to its press release dated August 29, 2025, the Company announces that it has issued 129,698 common shares of the Company at CAD$0.341 per share in connection with a US$32,000 (CAD$44,227) share payment due under the option agreement covering a portion of the Company's landholdings for the Gold Chain project. The common shares issued have a statutory hold period until January 13, 2026.

Qualified Person

Robert Johansing, M.Sc. Econ. Geol., P. Geo., the Company's Vice President of Exploration, is a qualified person ("QP") as defined by NI 43-101 and has reviewed and approved the technical content of this press release. The QP has not completed sufficient work to verify the historical information on the Baxter Spring property, particularly in regard to historical drill results. However, the QP believes that prior drilling and analytical results were completed to industry standard practices at the time they were completed.

About West Point Gold Corp.

West Point Gold Corp. (formerly Gold79 Mines Ltd.) is a publicly listed company focused on gold discovery and development at four prolific Walker Lane Trend projects covering Nevada and Arizona, USA. West Point Gold is focused on developing a maiden resource at its Gold Chain project in Arizona, while JV partner Kinross is advancing the Jefferson Canyon project in Nevada.

For further information regarding this press release, please contact:

Aaron Paterson, Corporate Communications Manager

Phone: +1 (778) 358-6173

Email: info@westpointgold.com

Stay Connected with Us:

LinkedIn: linkedin.com/company/west-point-gold

X (Twitter): @westpointgoldUS

Facebook: www.facebook.com/Westpointgold/

Website: www.westpointgold.com

FORWARD-LOOKING STATEMENTS:

Certain statements contained in this press release constitute forward-looking information. These statements relate to future events or future performance. Forward-looking statements include estimates and statements that describe the Company's future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. The use of any of the words "could", "intend", "expect", "believe", "will", "projected", "estimated" and similar expressions and statements relating to matters that are not historical facts are intended to identify forward-looking information and are based on the Company's current belief or assumptions as to the outcome and timing of such future events including, among others, assumptions about future prices of gold, silver, and other metal prices, currency exchange rates and interest rates, favourable operating conditions, political stability, obtaining government approvals and financing on time, obtaining renewals for existing licenses and permits and obtaining required licenses and permits, labour stability, stability in market conditions, availability of equipment, availability of drill rigs, and anticipated costs and expenditures. The Company cautions that all forward-looking statements are inherently uncertain, and that actual performance may be affected by a number of material factors, many of which are beyond the Company's control. Such factors include, among other things: risks and uncertainties relating to West Point Gold's ability to complete any payments or expenditures required under the Company's various option agreements for its projects; and other risks and uncertainties relating to the actual results of current exploration activities, the uncertainties related to resources estimates; the uncertainty of estimates and projections in relation to production, costs and expenses; risks relating to grade and continuity of mineral deposits; the uncertainties involved in interpreting drill results and other exploration data; the potential for delays in exploration or development activities; uncertainty related to the geology, grade and continuity of mineral deposits; the possibility that future exploration, development or mining results may vary from those expected; statements about expected results of operations, royalties, cash flows, financial position may not be consistent with the Company's expectations due to accidents, equipment breakdowns, title and permitting matters, labour disputes or other unanticipated difficulties with or interruptions in operations, fluctuating metal prices, unanticipated costs and expenses, uncertainties relating to the availability and costs of financing needed in the future and regulatory restrictions, including environmental regulatory restrictions. The possibility that future exploration, development or mining results will not be consistent with adjacent properties and the Company's expectations; operational risks and hazards inherent with the business of mining (including environmental accidents and hazards, industrial accidents, equipment breakdown, unusual or unexpected geological or structural formations, cave-ins, flooding and severe weather); metal price fluctuations; environmental and regulatory requirements; availability of permits, failure to convert estimated mineral resources to reserves; the inability to complete a feasibility study which recommends a production decision; the preliminary nature of metallurgical test results; fluctuating gold prices; possibility of equipment breakdowns and delays, exploration cost overruns, availability of capital and financing, general economic, political risks, market or business conditions, regulatory changes, timeliness of government or regulatory approvals and other risks involved in the mineral exploration and development industry, and those risks set out in the filings on SEDAR+ made by the Company with securities regulators. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this corporate press release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company expressly disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, other than as required by applicable securities legislation.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/266557