West Point Gold Corp. (TSXV: WPG) (OTCQB: WPGCF) (FSE: LRA0) ("West Point Gold" or the "Company") is pleased to announce that it has updated its exploration target at Tyro Main Zone ("Exploration Target") based on the 5,541m of drilling completed since releasing its maiden exploration target in January 2024 (link here).

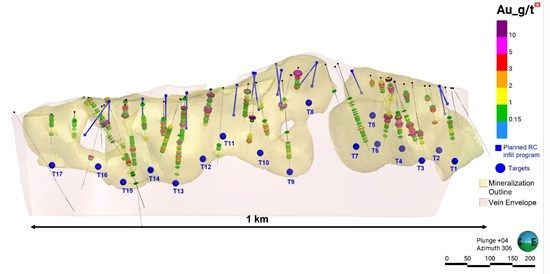

West Point Gold believes that the Exploration Target at the Tyro Main Zone has the potential for 19.5 to 31.2 million tonnes ("Mt") grading 2.0 to 3.0 g/t Au. This updated Exploration Target is based on the 6,227 metres of drilling completed to date, along with geological mapping, surface trenching and underground geochemical sampling. The tonnage range of the Exploration Target is based on the volumes of modelled wireframes including the Tyro vein envelope as well as the mineralized outline (Figure 1). See the heading below "Tyro Main Zone Exploration Target" for additional details. The potential tonnage and grade ranges are conceptual in nature. Currently, there is insufficient exploration drilling to define a mineral resource, and it is uncertain if further exploration will result in the Exploration Target being delineated as a mineral resource.

Additionally, the Company is pleased to announce that it plans to resume drilling in early September, as part of its planned 10,000 m drill campaign. The 10,000 m program is designed to extend the Tyro Main Zone to depth, infill the Tyro Main Zone, and test multiple compelling step-out targets, primarily the Sunset vein and follow-up drilling at Frisco Graben.

"Our drill campaigns at the Tyro Main Zone have delivered an improvement of the Exploration Target, particularly with respect to gold grade. The Tyro Main Zone and associated Exploration Target only represent 1 kilometre of a 3.4 kilometre structure. Tyro remains open to the northeast towards Frisco Graben, the southwest towards the Sunset vein and at depth, notably below the northeast, which returned broad high-grade gold intercepts earlier this year," stated Quentin Mai, CEO. "Our improved understanding of project geology has us well-positioned to test multiple step-out targets on the project this year with our drill program starting in early September."

Figure 1. Longitudinal view of the Tyro Main Zone showing the mineralization outline coincident with the Tyro Vein Envelope wireframe along with the proposed shallow (September 2025) drill holes and deeper targets (October 2025 to May 2026).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5717/265071_4e48ef25f4d6baa8_002full.jpg

Tyro Main Zone Exploration Target

The Tyro Main Zone Exploration Target consists of the historical Tyro Mine (with production from two levels of underground workings and a small slot pit) and the Decimal Hill area. The 1,000-metre extent considered in this Exploration Target is contained within 19.5 to 31.2 Mt grading 2.0 to 3.0 g/t Au and is located entirely on three patented claims controlled by West Point Gold.

The work completed to date by West Point Gold at the Tyro Main Zone includes:

4,963 m of Reverse Circulation ("RC") drilling

1,264 m of Diamond Core ("Core") drilling

348 m of surface trench sampling

107 surface rock chip samples

56 chip channel samples from the underground workings

Detailed geologic mapping of the mine workings, patented claims and surrounding BLM claims

The work mentioned above has allowed the Company to better define the Exploration Target through cross section interpretation and logged lithology, which in turn served as a foundation for the modelling of the Tyro Vein and Envelope wireframes. Such wireframes collectively capture almost all gold mineralized intercepts, demonstrating that the supporting geological data were useful and fairly accurate to improve the spatial definition of the Exploration Target, while honouring gold mineralization. The resulting Exploration Target confirms a nearly continuous tabular body (Figure 1) surrounded by a mineralized quartz 'stockwork' envelope, which combined has a footprint that may extend 1km along strike x 40-60 m wide x 250-300 m depth.

The potential tonnage and grade ranges of the Exploration Target are conceptual in nature. Currently, there is insufficient exploration drilling to define a mineral resource, and it is uncertain if further exploration will result in the Exploration Target being delineated as a mineral resource.

Upcoming Exploration Plans

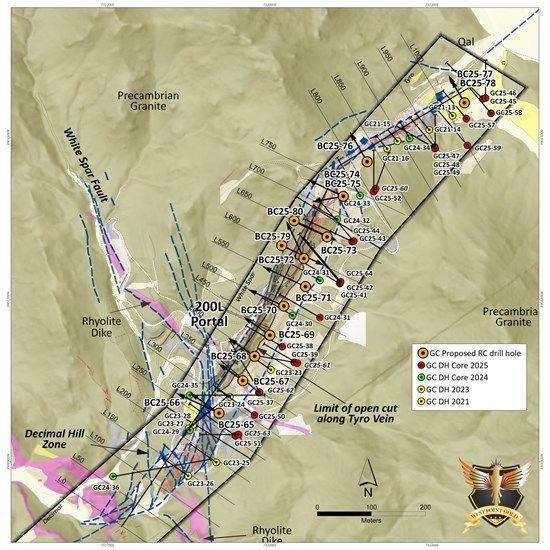

Initial drilling is planned to focus on the upper extent of the Tyro Main Zone, between and above previously drilled holes (Figure 2). This initial drilling, approximately 1,200 metres, is expected to be completed in September and is part of the broader 10,000 metre drill program planned for Gold Chain this year.

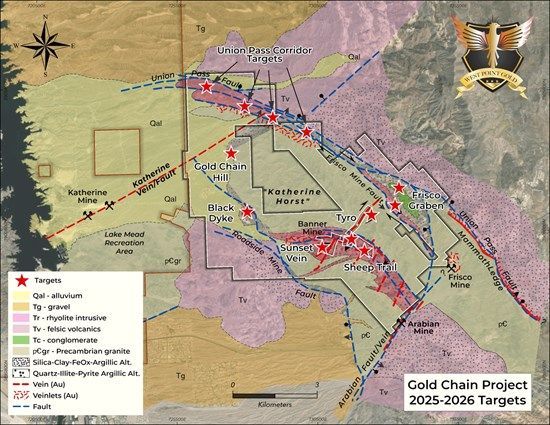

Following this initial drill program, the Company will continue drilling at Tyro to extend gold mineralization along strike and to depth, particularly at northeast Tyro where drilling returned exceptional results earlier this year. Drilling during the H1 2025 campaign was successful in better defining the vein complex along 800m of strike and down to an elevation of 675m ASL or about 175m below the surface. Additionally, the Company is currently preparing drill programs at the Sunset vein (Figure 4), Sheep Trail mine, Black Dyke mine, Gold Chain Hill and Lower Union Pass Corridor targets, along with follow-up drilling at the Frisco Graben (Figure 3).

Owing to the multiple targets identified in Figure 3, the Company will be able to explore these prospective sites incrementally which allows for a more complete response to geologic and analytical results. Additional areas, not considered to be drill ready, will be mapped and sampled in late 2025.

Figure 2. Plan view of the Tyro Main Zone showing geology and drilling conducted in 2021, 2023, 2024 and 2025. The holes proposed for the September program are highlighted in orange.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5717/265071_4e48ef25f4d6baa8_003full.jpg

Figure 3. Geologic Overview of the Gold Chain Project showing targets for the 2025-2026 drilling campaign.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5717/265071_4e48ef25f4d6baa8_004full.jpg

Figure 4. Drill site preparation in the hanging wall of the Sunset vein.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5717/265071_westpointgoldcorp_4.jpg

Qualified Person

Robert Johansing, M.Sc. Econ. Geol., P. Geo., the Company's Vice President, Exploration, is a qualified person ("QP") as defined by NI 43-101 and has reviewed and approved the technical content of this press release. Mr. Johansing has also been responsible for overseeing all phases of the drilling program, including logging, labelling, bagging and transport from the project to American Assay Laboratories of Sparks, Nevada.

The scientific and technical data contained in this news release was peer reviewed by M. Antonio Celis C., Principal Geologist of Motherlode Consulting and P.Geo under Engineers and Geoscientists of British Columbia (EGBC), an independent qualified person to West Point Gold, who is co-responsible for ensuring that the information provided in this news release is accurate and who acts as a "qualified person" under National Instrument 43-101 Standards of Disclosure for Mineral Projects. Mr. Celis has been responsible for the geological modelling and overall data presentation accompanying the technical content of this press release.

The results summarized above have been carefully reviewed with reference to the QA/QC results. Standard sample chain of custody procedures were employed during drilling and sampling campaigns until delivery to the analytical facility.

About West Point Gold Corp.

West Point Gold Corp. (formerly Gold79 Mines Ltd.) is a publicly listed company focused on gold discovery and development at four prolific Walker Lane Trend projects covering Nevada and Arizona, USA. West Point Gold is focused on developing a maiden resource at its Gold Chain project in Arizona, while JV partner Kinross is advancing the Jefferson Canyon project in Nevada.

For further information regarding this press release, please contact:

Aaron Paterson, Corporate Communications Manager

Phone: +1 (778) 358-6173

Email: info@westpointgold.com

Stay Connected with Us:

LinkedIn: linkedin.com/company/west-point-gold

X (Twitter): @westpointgoldUS

Facebook: facebook.com/Westpointgold/

Website: westpointgold.com/

FORWARD-LOOKING STATEMENTS:

Certain statements contained in this press release constitute forward-looking information. These statements relate to future events or future performance. Forward-looking statements include estimates and statements that describe the Company's future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. The use of any of the words "could", "intend", "expect", "believe", "will", "projected", "estimated" and similar expressions and statements relating to matters that are not historical facts are intended to identify forward-looking information and are based on the Company's current belief or assumptions as to the outcome and timing of such future events including, among others, assumptions about future prices of gold, silver, and other metal prices, currency exchange rates and interest rates, favourable operating conditions, political stability, obtaining government approvals and financing on time, obtaining renewals for existing licenses and permits and obtaining required licenses and permits, labour stability, stability in market conditions, availability of equipment, availability of drill rigs, and anticipated costs and expenditures. The Company cautions that all forward-looking statements are inherently uncertain, and that actual performance may be affected by a number of material factors, many of which are beyond the Company's control. Such factors include, among other things: risks and uncertainties relating to West Point Gold's ability to complete any payments or expenditures required under the Company's various option agreements for its projects; and other risks and uncertainties relating to the actual results of current exploration activities, the uncertainties related to resources estimates; the uncertainty of estimates and projections in relation to production, costs and expenses; risks relating to grade and continuity of mineral deposits; the uncertainties involved in interpreting drill results and other exploration data; the potential for delays in exploration or development activities; uncertainty related to the geology, grade and continuity of mineral deposits; the possibility that future exploration, development or mining results may vary from those expected; statements about expected results of operations, royalties, cash flows, financial position may not be consistent with the Company's expectations due to accidents, equipment breakdowns, title and permitting matters, labour disputes or other unanticipated difficulties with or interruptions in operations, fluctuating metal prices, unanticipated costs and expenses, uncertainties relating to the availability and costs of financing needed in the future and regulatory restrictions, including environmental regulatory restrictions. The possibility that future exploration, development or mining results will not be consistent with adjacent properties and the Company's expectations; operational risks and hazards inherent with the business of mining (including environmental accidents and hazards, industrial accidents, equipment breakdown, unusual or unexpected geological or structural formations, cave-ins, flooding and severe weather); metal price fluctuations; environmental and regulatory requirements; availability of permits, failure to convert estimated mineral resources to reserves; the inability to complete a feasibility study which recommends a production decision; the preliminary nature of metallurgical test results; fluctuating gold prices; possibility of equipment breakdowns and delays, exploration cost overruns, availability of capital and financing, general economic, political risks, market or business conditions, regulatory changes, timeliness of government or regulatory approvals and other risks involved in the mineral exploration and development industry, and those risks set out in the filings on SEDAR+ made by the Company with securities regulators. Although the Company believes that the assumptions and factors used in preparing the forward-looking information in this corporate press release are reasonable, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. The Company expressly disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, future events or otherwise, other than as required by applicable securities legislation.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/265071