February 24, 2023

West High Yield (TSXV:WHY) focuses on critical minerals with a high-grade magnesium project nearing production. The company’s Record Ridge property will soon capitalize on the opportunity to create a new supply of magnesium outside of China and Russia. West High Yield has an experienced management team ready to bring its project to production.

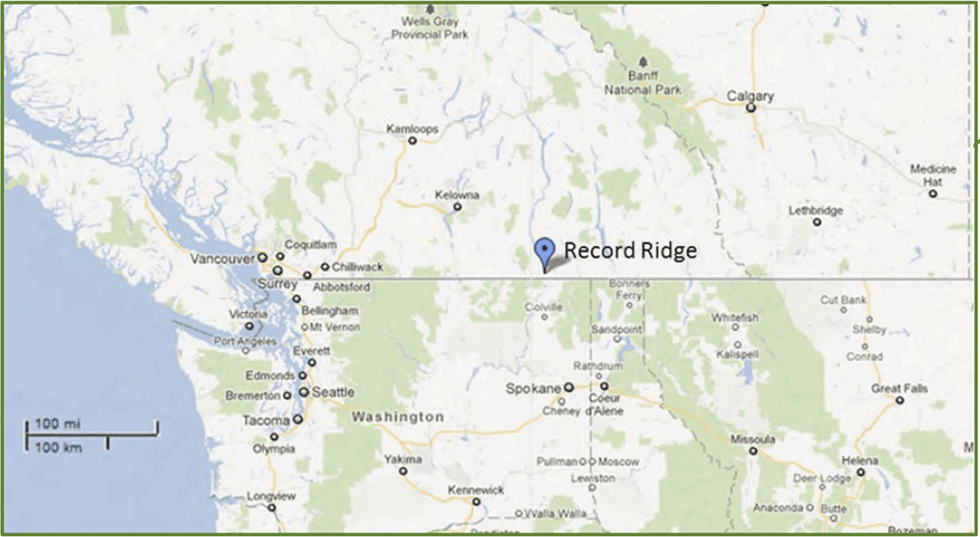

The 100 percent owned Record Ridge project in British Columbia is poised to create a secure, strategic domestic supply chain to cater to North America’s magnesium demand. The company is currently awaiting permits to begin production. Once production commences, West High Yield will begin generating cash flow through the sale of ore and seek new offtake agreements.

The Record Ridge asset has one of the largest and highest-grade magnesium deposits in North America, and globally. The company’s resource estimate shows 43 million tonnes of ore at 24.6 percent magnesium, which implies it is a world-class asset containing 10.6 million tonnes of magnesium. In addition, West High Yield’s pre-feasibility study indicates strong economics with an after-tax NPV of 5 percent of $872 million, an internal rate of return (IRR) of 72 percent over a 172-year mine life, and payback in 1.5 years.

Company Highlights

- West High Yield is an exploration and development mining company focusing on its advanced-stage magnesium asset nearing production.

- The company’s flagship Record Ridge asset has the potential to strengthen the secure critical mineral on-shore North American magnesium supply chain and reduce dependence on China and Russia’s production.

- Magnesium is used throughout several verticals, such as aerospace, clean energy and pharmaceuticals.This multiple application critical mineral continues to widen the gap between growing demand and dwindling supply creating an opportunistic tailwind for WHY Resources and the development of the Record Ridge Project.

- Record Ridge is currently awaiting a mining permit before beginning construction.

- West High Yield has completed a pre-feasibility study indicating robust economics that encourages the company to move forward.

- The company prioritizes clean energy operations to reduce emissions and ensure a positive ESG rating, creating a low cost high-pedigree magnesium product and results in virtually no CO2 emissions.

- An experienced management team leads the company toward fully realizing the potential of its assets.

This West High Yield profile is part of a paid investor education campaign.*

Click here to connect with West High Yield (TSXV:WHY) to receive an Investor Presentation

WHY:CA

Sign up to get your FREE

West High Yield Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

22 October 2025

West High Yield

Focused on critical minerals with near-term strategic high-grade magnesium/silica/nickel/iron project

Focused on critical minerals with near-term strategic high-grade magnesium/silica/nickel/iron project Keep Reading...

26 January

West High Yield Resources Ltd. Advances Processing Pilot Program, and Announces Permitting Advancement and Closing of Non-Brokered Private Placement

West High Yield (W.H.Y.) Resources Ltd. (TSXV: WHY,OTC:WHYRF) (FSE: W0H) (the "Company" or "West High Yield") is pleased to announce: (i) the initiation of its proprietary processing pilot program at its magnesiumsilica Record Ridge industrial minerals project (the "Project"); (ii) significant... Keep Reading...

07 January

West High Yield Resources Ltd. Announces Closing of Non-Brokered Private Placement

West High Yield (W.H.Y.) Resources Ltd. (TSXV: WHY,OTC:WHYRF) (FSE: W0H) (the "Company" or "West High Yield") announces that it is closing a single tranche (the "Closing") of a conditionally approved non-brokered private placement offering (the "Offering") of units (the "Units").The Closing... Keep Reading...

22 December 2025

West High Yield Resources Ltd. Provides Letter to Shareholder from Presdent and CEO

West High Yield (W.H.Y.) Resources Ltd. (TSXV: WHY,OTC:WHYRF) (FSE: W0H) (the "Company" or "West High Yield") today released the following letter from President and Chief Executive Officer Frank Marasco Jr.Letter from President and CEODear Shareholders,As we close out 2025, I would like to... Keep Reading...

02 December 2025

West High Yield Resources Ltd. Corporate Update: Initial Reclamation Bond Posted, Permit Conditions Advancing, and Construction Pathway Strengthening for 2026

West High Yield (W.H.Y.) Resources Ltd. (TSXV: WHY,OTC:WHYRF) (FSE: W0H) (the "Company" or "West High Yield") is pleased to provide a corporate update highlighting the posting of the initial reclamation bond for its Record Ridge magnesium and critical minerals project (the "Record Ridge Project"... Keep Reading...

01 December 2025

West High Yield Resources Ltd. Announces Exercise of Warrants

West High Yield (W.H.Y.) Resources Ltd. (TSXV: WHY,OTC:WHYRF) (FSE: W0H) (the "Company" or "West High Yield") announces the exercise of share purchase warrants (the "Warrants") of the Company.Three holders of Warrants exercised 250,000 Warrants resulting in the issuance of 250,000 common shares... Keep Reading...

21 November 2025

First Nation-Owned Minago Project Pushes Manitoba into Critical Minerals Spotlight

A First Nation-owned mining project in Northern Manitoba is drawing national attention after new assessments suggest it could become a major North American source of magnesium.Norway House took full ownership of the Minago nickel property in November 2024, and has since rebranded it as a... Keep Reading...

Latest News

Sign up to get your FREE

West High Yield Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00