October 29, 2023

White Cliff Minerals Ltd (“White Cliff” or “the Company”) is pleased to present its Quarterly Report and Cash Flow Report.

HIGHLIGHTS

- Appointment of experienced mining executive, Roderick McIllree as Executive Chairman.

- Sale of Abraxis Mining Pty Ltd for total consideration $200k cash.

- The transaction is part of an ongoing review of the entire portfolio of projects with further divestments of non-core projects expected over time.

- The Company is currently assessing several, large projects with compelling metrics in stable and transparent jurisdictions.

- Cash and cash equivalents of $5.04 million1 as of the end of September 2023.

OPERATIONS

Hines Hill - REE Project

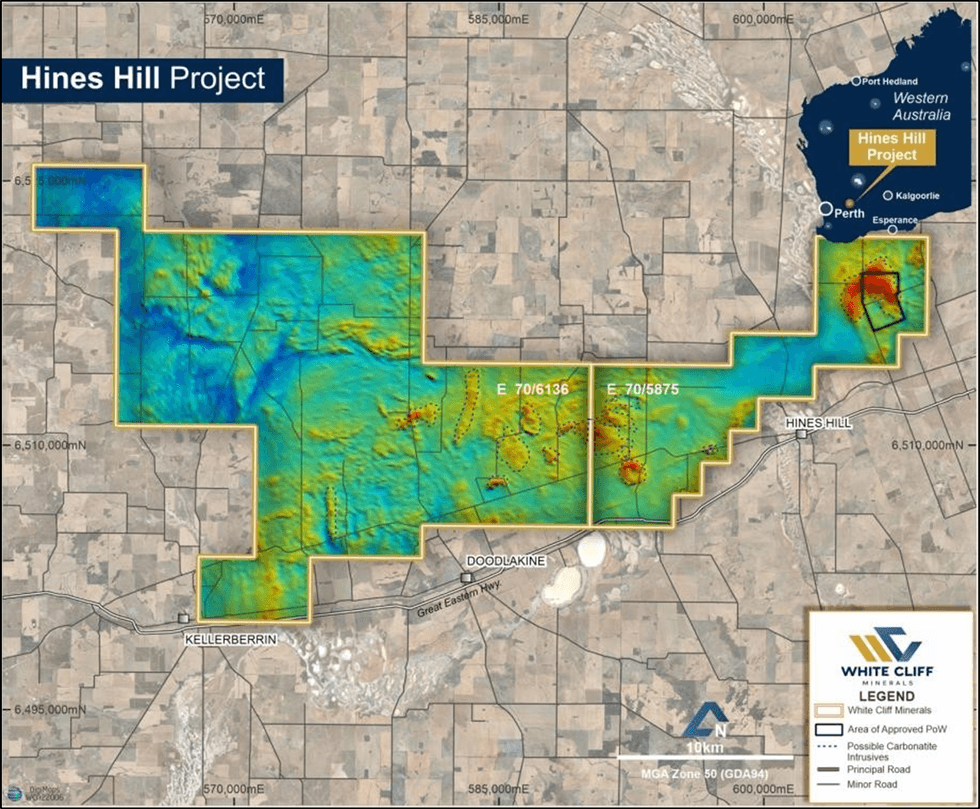

The Hines Hill REE project consists of two adjoining tenements (Figure 1), located in the wheatbelt region, ±200km east of Perth along the Great Eastern Highway. The tenement area of ~576Km2 covers extensive grain growing properties.

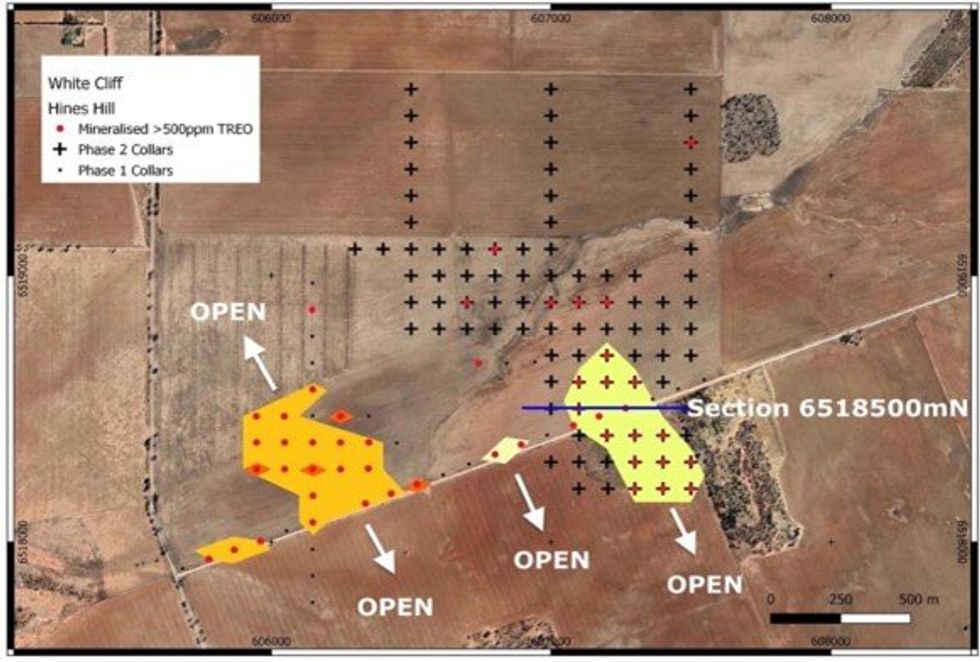

During the quarter, a follow up aircore drilling program of 88 drill holes has intersected shallow zones up to 2,066ppm TREO (from 16 metres in drillhole HHC066), with mineralisation open in multiple directions (refer to ASX announcement dated 24 July 2023).

Significant results from Phase 2 include:

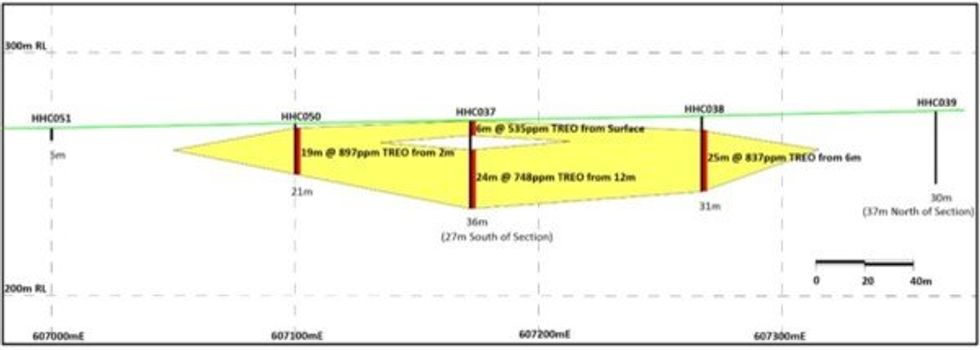

- 19m @ 897ppm TREO (203ppm MREO) from 2m (HHC050)

- 13m @ 802ppm TREO (183ppm MREO) from 6m (HHC062)

- 6m @ 1,040ppm TREO (240ppm MREO) from 2m (HHC128)

- 5m @ 2,066ppm TREO (434ppm MREO) from 16m (HHC066)

The drilling completed to date appears to define multiple subparallel north northwest/south southeast trending zones open essentially in these directions. The shallow thicker eastern mineralised area (Figures 2 and 3) tested in the second phase of drilling appears to show a palaeochannel type character with acquisition of accurate topographic data required to confirm. The western mineralised zones (Figure 3) are thinner and more planar in character with a gentle west dip.

Other Project Exploration

Reconnaissance field trips have been undertaken focusing on REE and Lithium mineralisation across the Mineral Fields and Border Exploration projects, as well as at the Company’s Preston River Lithium project, which is located 30km north of the world class Greenbushes Lithium Mine.

These first pass field trips by White Cliff geologists were completed with the aim of getting baseline soil samples and rock chips across prospective geological units. A total of 1,656 soil samples and 78 rock chip samples were taken:

- Preston River Lithium Project, 271 soil samples and 29 rock chip samples

- Diemals REE and Lithium Project, 483 soil samples and 20 rock chip samples

- Barballin REE Project, 187 soil samples and 6 rock chip samples

- Munbinia REE Project, 694 soil samples and 9 rock chip samples

- Ashton Hills Project, 21 soil samples and 29 rock chip samples

Samples have been submitted to and registered with ALS Laboratories Perth, and are expected during August. All samples submitted to ALS Laboratories Perth, are for multi-element assay and will be assessed for all commodities.

Click here for the full ASX Release

This article includes content from White Cliff Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

12 February

Albemarle Lifts Lithium Demand Forecast as Energy Storage Surges

Albemarle (NYSE:ALB) is raising its long-term lithium demand outlook after a breakout year for stationary energy storage, underscoring a shift in the battery materials market that is no longer driven solely by electric vehicles.The US-based lithium major reported fourth quarter 2025 net sales of... Keep Reading...

21 January

Official signing of the Portuguese State Grant

Savannah joins other grant recipient companies at official signing ceremony

Savannah Resources Plc, the developer of the Barroso Lithium Project in Portugal, a 'Strategic Project' under the European Critical Raw Materials Act and Europe's largest spodumene lithium deposit (the 'Project'), was delighted to join with other recipients of State grants yesterday at the... Keep Reading...

21 January

Excellent Results from 2025 Core Drilling Program at McDermitt

Jindalee Lithium Limited (Jindalee, or the Company; ASX: JLL, OTCQX: JNDAF) is pleased to report assay results from the drilling program at the McDermitt Lithium Project completed late 2025. All holes returned strong lithium and magnesium intercepts from shallow depths, including:R92: 36.5m @... Keep Reading...

08 January

Top 5 US Lithium Stocks (Updated January 2026)

The global lithium market enters 2026 after a punishing 2025 marked by oversupply, weaker-than-expected EV demand and sustained price pressure, although things began turning around for lithium stocks in Q4. Lithium carbonate prices in North Asia fell to four-year lows early in the year,... Keep Reading...

07 January

5 Best-performing ASX Lithium Stocks (Updated January 2026)

Global demand for lithium presents a significant opportunity for Australia and Australian lithium companies.Australia remains the world’s largest lithium miner, supplying nearly 30 percent of global output in 2024, though its dominance is easing as other lithium-producing countries such as... Keep Reading...

05 January

CEOL Application for Laguna Verde Submitted

CleanTech Lithium PLC ("CleanTech Lithium" or "CleanTech" or the "Company") (AIM: CTL, Frankfurt:T2N), an exploration and development company advancing sustainable lithium projects in Chile, is pleased to announce it has submitted its application (the "Application") for a Special Lithium... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00