November 01, 2023

Frontier Energy Limited (ASX: FHE; OTCQB: FRHYF) (Frontier or the Company) engaged independent specialist energy and resources consultancy ResourcesWA, to undertake an assessment (the Report) of Western Australia’s major electricity network, the South West Interconnected System (SWIS).

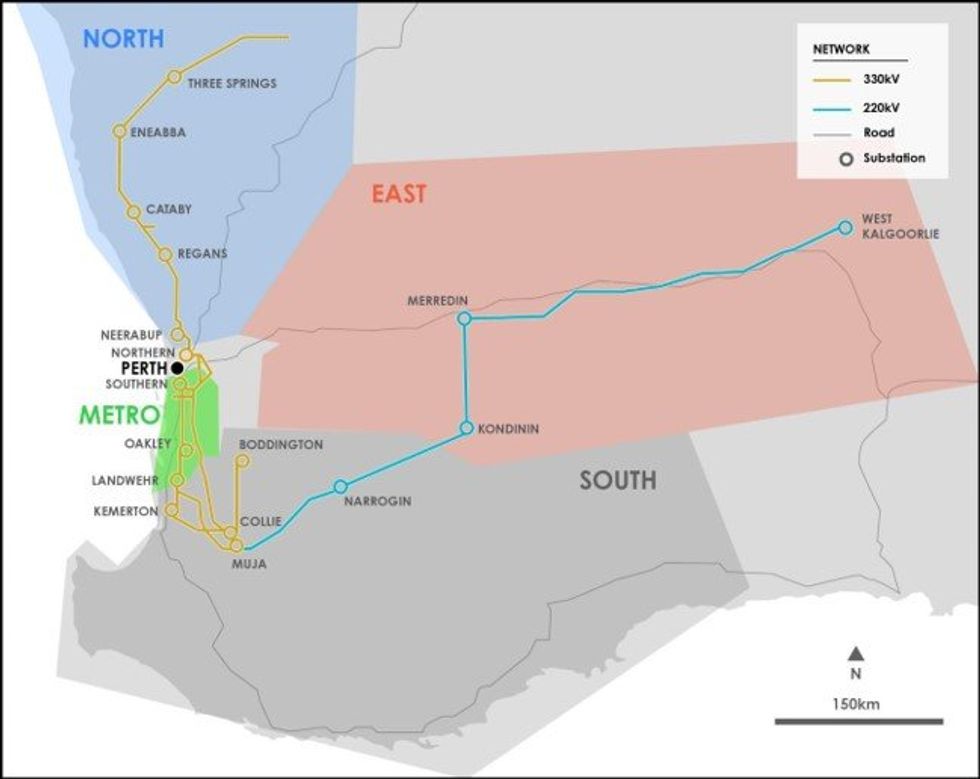

The Report focused on evaluating potential capacity for large scale connections at existing substations and terminals across the 330kV and 220kV transmission network, from now until 2032.

This Report was commissioned by the Company to gain a better understanding of new large- scale developments on the SWIS, similar to the potential of the Bristol Spring Renewable Energy Project (the Project) in the short to medium term.

The development of multiple, large scale energy projects on the SWIS would affect wholesale electricity prices (if supply outstripped demand) and therefore potential returns on Frontier’s Stage One Project development that is planned to commence in 2024.

The Report however concluded that “there are no other opportunities that exist on the SWIS for the development of a connected generator of the scale of the Bristol Spring Renewable Energy Project in the short or medium term”. The reasons for this include:

- The North Region is limited due to the existing thermal constraints on the 330kV and 132kV transmission networks in this region (see map below for region locations);

- The East Region does not present any opportunities for large scale network connected generation in the near term due to limitations of the 220kV transmission. Limitations on transfer capacity from Merredin west limit new generation in the middle area of the East Region, with new wind developments at Kondinin absorbing transmission capacity between Merredin and Collie;

- The South Region Terminals present immediate and near term opportunities for large scale network connection.

However, within the 330kV network both Oakley and Kemerton are dependent upon existing industrial loads, with Kemerton already at its upper limits due to industrial loads within the Kemerton industrial area.

The Collie region, including the Muja and Bluewaters substations, have substation connection and transfer capacity within the 330kV network, and will present opportunities following the closure of the coal-fired power stations (planned for 2029). However, the region is surrounded by State forests, limiting land availability, with the majority of cleared land currently mined for coal and requiring rehabilitation post 2030; and - Until 2030, only Landwehr Terminal (where the Project is located) can readily accommodate new large scale renewable connections of 250MW or greater. It is expected that a number of Behind the Meter connections will be developed by industry whilst smaller scale renewable and large scale battery storage are expected to be developed in conjunction with existing generators at selected substations and terminals.

The Report supports the Australian Energy Market Operator annual Wholesale Electricity Market Electricity Statement of Opportunities (ESOO Report), which stated “the urgency of advancing generation, storage, demand side management and transmission projects to bolster reliability and support a rapid and orderly energy transition. Its findings emphasise the need for additional capacity procurement and expedited progress of capacity projects in the SWIS.” The ESOO Report also highlighted demand is forecast to increase significantly over the next decade to at least 78% (Expected Case), with an Upside Case increasing by more than 220%.

A copy of the ESOO "Report is attached to this announcement.

Frontier Managing Director, Sam Lee Mohan, commented: “While we always believed the Bristol Springs Renewable Energy Project was the best undeveloped renewable energy project in WA, we did not appreciate that it is the only project of its size that can access the SWIS network in the short to medium term. This again highlights what a unique opportunity the Company has with the Project, as well as the growing importance of the Project to the State, at a time when energy prices are continuing to rise and energy security is becoming more important than ever.

The next few months are shaping up as the most significant in the Company’s history with multiple major events on the horizon. First, we expect to complete the acquisition of Waroona Energy Inc. in December 2023. This transaction will then be followed by a DFS for Waroona’s Stage One Solar development (120MW) as well as the Peaking Plant Study expected to be released in 1Q24.”

This article includes content from Frontier Energy, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

FHE:AU

The Conversation (0)

06 February 2024

Frontier Energy

Clean energy to help fill WA’s growing power supply gap

Clean energy to help fill WA’s growing power supply gap Keep Reading...

04 February

Charbone Announces its First Hydrogen Supply Hub in the Ontario Market

(TheNewswire) Brossard, Quebec, February 4, 2026 TheNewswire Charbone CORPORATION (TSXV: CH,OTC:CHHYF; OTCQB: CHHYF; FSE: K47) ("Charbone" or the "Company"), a North American producer and distributor specializing in clean Ultra High Purity ("UHP") hydrogen and strategic industrial gases, is... Keep Reading...

04 February

Charbone annonce l'etablissement de son premier pole d'approvisionnement en hydrogene sur le marche Ontarien

(TheNewswire) Brossard, Quebec, le 4 février 2026 TheNewswire - CORPORATION Charbone (TSXV: CH,OTC:CHHYF; OTCQB: CHHYF; FSE: K47) (« Charbone » ou la « Société »), un producteur et distributeur nord-américain spécialisé dans l'hydrogène propre Ultra Haute Pureté (« UHP ») et les gaz industriels... Keep Reading...

02 February

10 Biggest EV Stocks to Watch in 2026

The energy revolution is here to stay, and electric vehicles (EVs) have become part of the mainstream narrative. The shift toward green energy is gathering momentum, with governments adding more incentives to accelerate this transition. Increasing EV sales are good news for battery metals... Keep Reading...

01 February

MOU with Yinson and Himile to Advance LCO2 Tank Production

Provaris Energy (PV1:AU) has announced MOU with Yinson and Himile to Advance LCO2 Tank ProductionDownload the PDF here. Keep Reading...

22 January

RZOLV Technologies Signs Operating Agreement with Environmental Research and Development to Advance Agitated Tank Leach Demonstration Facility in Arizona

RZOLV Technologies Inc. (TSXV: RZL) (FSE: S711), ("RZOLV" or the "Company"), a clean-technology company developing non-cyanide hydrometallurgical solutions for gold recovery, today announced that it has entered into an operating agreement with Environmental Research and Development ("ERD") to... Keep Reading...

22 January

RZOLV Technologies Signs Operating Agreement with Environmental Research and Development to Advance Agitated Tank Leach Demonstration Facility in Arizona

Rzolv Technologies Inc. (TSXV: RZL,OTC:RZOLF) (FSE: S711), ("RZOLV" or the "Company"), a clean-technology company developing non-cyanide hydrometallurgical solutions for gold recovery, today announced that it has entered into an operating agreement with Environmental Research and Development... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00