September 20, 2023

Warriedar Resources (ASX:WA8) is well-positioned to help stave off the impending shortage in copper supply as other critical minerals. A highly skilled team of experts backs the company while maintaining a robust and stable portfolio of gold assets in Western Australia and Nevada. Warriedar currently holds more than 2 million ounces of high-grade gold resources with three projects – the Golden Range, Fields Find, and Big Springs.

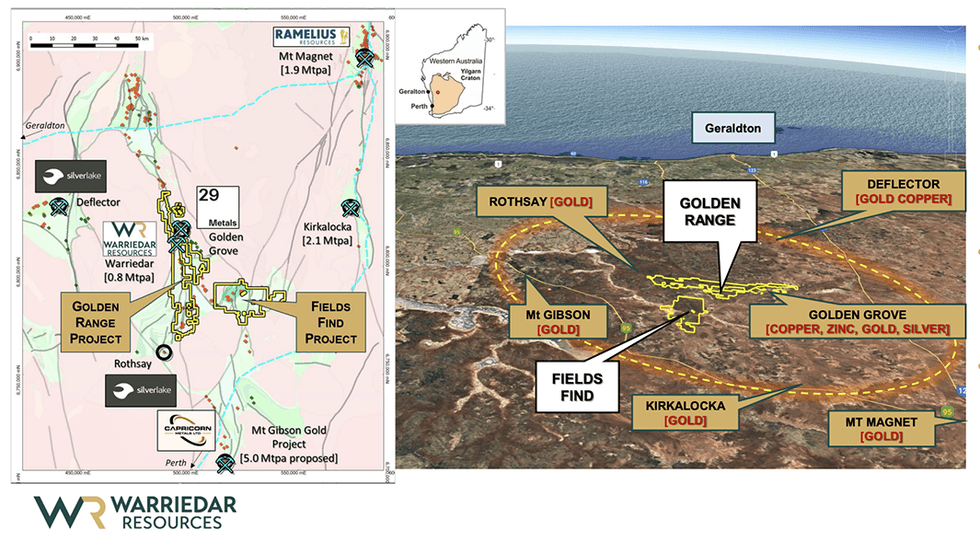

Two of its brownfield projects are located in Western Australia's Murchison Province — a region widely known for its rich copper resource. Both projects are situated on previously mined and underexplored land, and surrounded by successful, operating gold and base metal mines.

Situated in the middle of Western Australia's highly active Murchison exploration and mining province, the Golden Range project is strategically positioned between several major operating mines and advanced exploration projects. Together with the nearby Fields Find project, it represents a belt-scale opportunity, covering a combined area of 813 square kilometres.

Company Highlights

- The copper market is booming, driven by a combination of increased demand for electric vehicles and a global push for sustainability.

- Warriedar Resources is an advanced gold and copper exploration and development company with a portfolio of assets well-positioned to take advantage of the market shift.

- Two of the company's three projects are located in the copper-rich Murchison Province of Western Australia.

- Golden Range, a 950,000-oz gold project with on-site infrastructure that includes an 800-ktpa plant.

- Fields Find, which hosts the historic Warriedar Copper Mine.

- The company also maintains a 1.01-million-ounce gold project in Nevada, USA, known as Big Springs.

- All three projects are underexplored, with significant resource potential.

- Warriedar is backed by a highly skilled team with decades of experience and leadership in mining and exploration.

- The company is expected to have a steady newsflow through 2024 and 2025, with extensive plans for drilling and exploration already outlined.

This Warriedar Resources profile is part of a paid investor education campaign.*

Click here to connect with Warriedar Resources (ASX:WA8) to receive an Investor Presentation

WA8:AU

The Conversation (0)

09 April 2024

Warriedar Resources

Advanced gold and copper exploration in Western Australia and Nevada

Advanced gold and copper exploration in Western Australia and Nevada Keep Reading...

18 November 2024

Targeted Exploration Focus Delivers an Additional 471koz or 99% Increase in Ounces, and a Higher Grade for Ricciardo

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) is pleased to report on an updated MRE for its flagship Ricciardo Gold Deposit, part of the broader Golden Range Project located in the Murchison region of Western Australia. HIGHLIGHTS:Updated Mineral Resource Estimate (MRE) for... Keep Reading...

30 September 2024

Continued Delivery of High Grade Antimony Mineralisation at Ricciardo

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) provides an update on its initial review of the antimony (Sb) potential at the Ricciardo deposit, located within its Golden Range Project in the Murchison region of Western Australia. HIGHLIGHTS:Review of the antimony (Sb)... Keep Reading...

29 September 2024

Further Strong Extensional Diamond Drill Results from Ricciardo

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) provides further assay results from its Golden Range Project, located in the Murchison region of Western Australia. HIGHLIGHTS:All residual assay results received from the recent 2,701m (27 holes) diamond drilling program at... Keep Reading...

26 August 2024

Further Step-Out Gold Success and High-Grade Antimony Discovery

Warriedar Resources Limited (ASX: WA8) (Warriedar or the Company) provides further assay results from its Golden Range Project, located in the Murchison region of Western Australia. The results reported in this release are for a further 6 of the 27 diamond holes drilled in the current program at... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Trading Halt

10h

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00