April 23, 2025

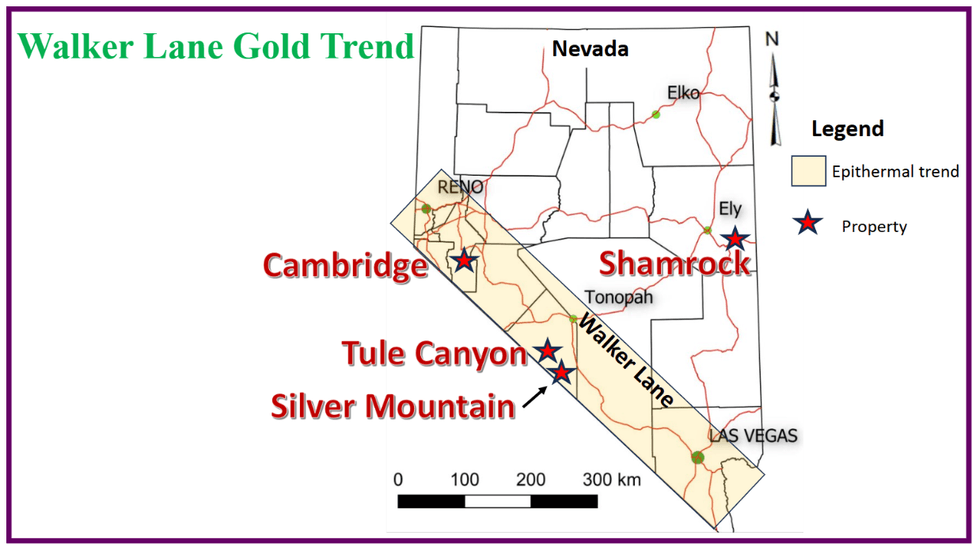

Walker Lane Resources (TSXV:WLR) is executing an exploration strategy focused on advancing high-impact projects across premier North American mining jurisdictions. The company’s portfolio spans the prolific Walker Lane Gold Trend in Nevada, as well as key exploration assets in British Columbia, the Yukon, and Newfoundland.

Near-term efforts are centered on two high-priority, drill-ready targets — Tule Canyon in Nevada and Amy in British Columbia — supported by the continued advancement of Silver Hart, Walker Lane’s flagship silver-lead-zinc asset in the Yukon, toward a development decision. All projects are accessible by road, enabling cost-effective exploration and streamlined logistics.

With a lean capital structure, high-grade and scalable assets, and a clear path from discovery through to early-stage development, Walker Lane is well-positioned to unlock significant value and deliver strong returns for shareholders. The company represents a compelling growth opportunity in the junior mining sector.

Company Highlights

- Walker Lane Resources is focused on high-grade gold, silver and polymetallic exploration, with a balanced project pipeline across multiple Canadian and US jurisdictions.

- Two flagship drill-ready projects – Amy (British Columbia) and Tule Canyon (Nevada) – are scheduled for 2025 drilling, each with compelling surface results, historical workings, and high-impact resource potential.

- The Silver Hart project in the Yukon is being positioned for near-term production through innovative ore-sorting and small-scale open pit development, designed to generate early-stage cash flow.

- Walker Lane holds approximately 1.3 billion shares in North Bay Resources (OTC:NBRI) and is entitled to option payments related to the sale of the Bishop Mill in California.

- The Silverknife project in British Columbia is subject to an option agreement with Coeur Mining, with potential milestone payments and expenditures totaling over $6 million through 2028.

- The company has an established pipeline of prospective exploration stage assets at Cambridge and Silver Mountain (Walker Lane, Nevada) and Logjam (Yukon).

This Walker Lane Resources profile is part of a paid investor education campaign.*

Click here to connect with Walker Lane Resources (TSXV:WLR) to receive an Investor Presentation

WLR:CC

Sign up to get your FREE

Walker Lane Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

01 October 2025

Walker Lane Resources

Advancing high-grade gold and silver assets in prolific Nevada, British Columbia and Yukon

Advancing high-grade gold and silver assets in prolific Nevada, British Columbia and Yukon Keep Reading...

06 March

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

06 March

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

06 March

Venezuela Gold Set for US Market in Brokered Deal

A new US-Venezuela gold deal could soon channel hundreds of kilograms of bullion from the South American nation into American refineries.Venezuela’s state-owned mining company, Minerven, has agreed to sell between 650 and 1,000 kilograms of gold dore bars to commodities trading house Trafigura... Keep Reading...

05 March

Rick Rule: Gold Price During War, Silver Strategy, Oil Stock Game Plan

Rick Rule, proprietor at Rule Investment Media, shares updates on his current strategy in the resource space, mentioning gold, silver, oil and agriculture. He also reminds investors to pay more attention to gold's underlying drivers than to current events.Click here to register for the Rule... Keep Reading...

05 March

Lobo Tiggre: Gold, Oil in Times of War, Plus My Shopping List Now

Lobo Tiggre of IndependentSpeculator.com shares his thoughts on how gold, silver and oil could be impacted by the developing situation in the Middle East. He cautioned investors not to chase these commodities if prices run. Don't forget to follow us @INN_Resource for real-time updates!Securities... Keep Reading...

05 March

TomaGold: New High-grade Deep Discovery at Berrigan Mine

TomaGold (TSXV:LOT) President, CEO and Director David Grondin said the company is focusing on its flagship Berrigan mine in Chibougamau, Québec, following a large, significant discovery at depth.Berrigan is 4 kilometers northwest of the city of Chibougamau and has existed for about 50 years.... Keep Reading...

Latest News

Sign up to get your FREE

Walker Lane Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00