April 23, 2025

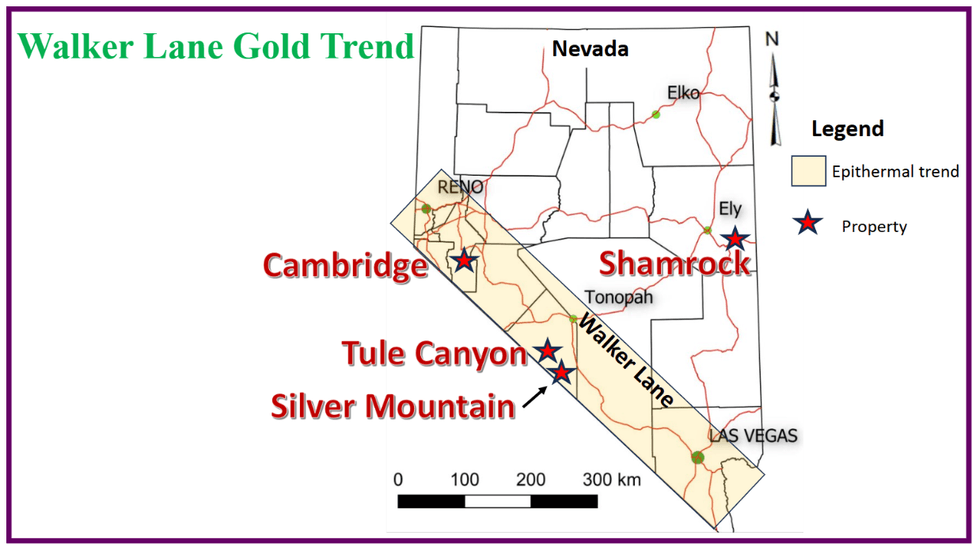

Walker Lane Resources (TSXV:WLR) is executing an exploration strategy focused on advancing high-impact projects across premier North American mining jurisdictions. The company’s portfolio spans the prolific Walker Lane Gold Trend in Nevada, as well as key exploration assets in British Columbia, the Yukon, and Newfoundland.

Near-term efforts are centered on two high-priority, drill-ready targets — Tule Canyon in Nevada and Amy in British Columbia — supported by the continued advancement of Silver Hart, Walker Lane’s flagship silver-lead-zinc asset in the Yukon, toward a development decision. All projects are accessible by road, enabling cost-effective exploration and streamlined logistics.

With a lean capital structure, high-grade and scalable assets, and a clear path from discovery through to early-stage development, Walker Lane is well-positioned to unlock significant value and deliver strong returns for shareholders. The company represents a compelling growth opportunity in the junior mining sector.

Company Highlights

- Walker Lane Resources is focused on high-grade gold, silver and polymetallic exploration, with a balanced project pipeline across multiple Canadian and US jurisdictions.

- Two flagship drill-ready projects – Amy (British Columbia) and Tule Canyon (Nevada) – are scheduled for 2025 drilling, each with compelling surface results, historical workings, and high-impact resource potential.

- The Silver Hart project in the Yukon is being positioned for near-term production through innovative ore-sorting and small-scale open pit development, designed to generate early-stage cash flow.

- Walker Lane holds approximately 1.3 billion shares in North Bay Resources (OTC:NBRI) and is entitled to option payments related to the sale of the Bishop Mill in California.

- The Silverknife project in British Columbia is subject to an option agreement with Coeur Mining, with potential milestone payments and expenditures totaling over $6 million through 2028.

- The company has an established pipeline of prospective exploration stage assets at Cambridge and Silver Mountain (Walker Lane, Nevada) and Logjam (Yukon).

This Walker Lane Resources profile is part of a paid investor education campaign.*

Click here to connect with Walker Lane Resources (TSXV:WLR) to receive an Investor Presentation

WLR:CC

Sign up to get your FREE

Walker Lane Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

01 October 2025

Walker Lane Resources

Advancing high-grade gold and silver assets in prolific Nevada, British Columbia and Yukon

Advancing high-grade gold and silver assets in prolific Nevada, British Columbia and Yukon Keep Reading...

3h

FOKUS MINING CORP. ANNOUNCES RECEIPT OF INTERIM ORDER AND UPDATE REGARDING PROPOSED ACQUISITION BY GOLD CANDLE LTD.

(All amounts expressed in Canadian Dollars unless otherwise noted)Fokus Mining Corporation ("Fokus" or the "Company") (TSXV: FKM,OTC:FKMCF) (OTCQB: FKMCF) announced today the filing of its management information circular (the "Circular") and related materials for the special meeting (the... Keep Reading...

4h

Visible Gold Intersected at Roy, Sunbeam

First Class Metals PLC ("First Class Metals", "FCM" or the "Company") the UK listed company focused on the discovery of economic metal deposits across its exploration properties in Ontario, Canada, is pleased to provide an update on the ongoing drilling programme at the Roy prospect on the... Keep Reading...

6h

Galway Metals Enters into Letter of Engagement with Eskar Capital Corporation for Investor Relations Services

TORONTO, ON / ACCESS Newswire / March 12, 2026 / Galway Metals Inc. (TSX-V:GWM)(OTCQB:GAYMF) ("Galway Metals" or the "Company") is pleased to announce that it has entered into a six (6) month Capital Markets Advisory Agreement (the "Agreement") with Eskar Capital Corporation ("Eskar Capital"),... Keep Reading...

11h

Peruvian Metals Announces Private Placement

Peruvian Metals Corp. (TSXV: PER,OTC:DUVNF) ("Peruvian Metals" or the "Company") is pleased to announce that it has arranged a non-brokered private placement for gross proceeds of up to $750,000 which will be used to make improvements and additions for expansion to its Aguila Norte processing... Keep Reading...

16h

Additional Strong Assays Results Extend High-Grade Antimony Mineralisation at Oaky Creek

Red Mountain Mining Limited (ASX: RMX, US CODE: RMXFF, or “Company”) a Critical Minerals exploration and development company with an established portfolio in Tier-1 Mining Districts in the United States and Australia, is pleased to announce that it has received continued strong assay results... Keep Reading...

11 March

Jeffrey Christian: Gold, Silver Prices to Rise, Risk Highest Since WWII

Jeffrey Christian, managing partner at CPM Group, sees gold and silver prices continuing to rise as global political and economic risks persist. "We look at the world right now and we see a world where the risks and uncertainties are greater now than at any time since Pearl Harbor. December... Keep Reading...

Latest News

Sign up to get your FREE

Walker Lane Resources Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00