November 19, 2024

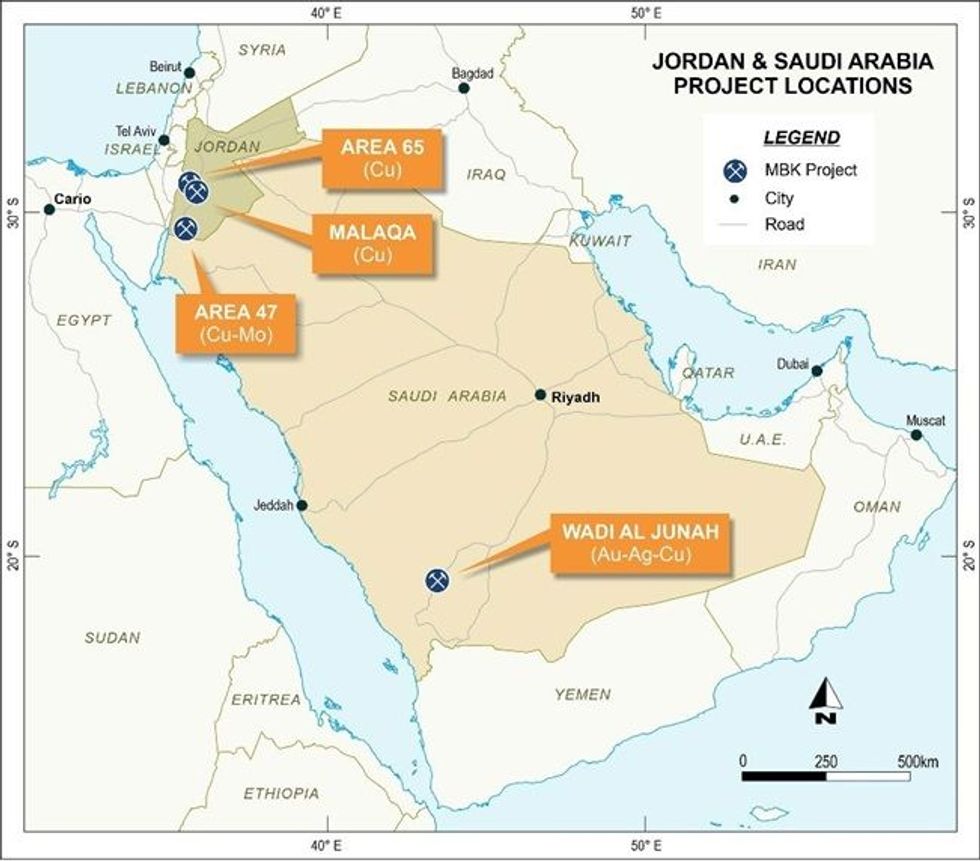

Metal Bank Limited (ASX: MBK) (‘Metal Bank’, ‘MBK’ or the ‘Company’) is pleased to announce further details regarding the Wadi al Junah Copper-Zinc-Gold-Silver Project (‘Wadi al Junah’ or ‘the Project’), which has been awarded to Consolidated Mining Company (CMC) following a highly competitive Saudi government exploration licensing Round 6.

Highlights

- As announced on 6 November, MBK’s Saudi Arabian JV company, has been awarded the Wadi Al Junah Project as part of the Saudi Government’s Exploration Licensing Round 6

- Wadi Al Junah is prospective for volcanogenic massive sulphide (VMS) copper-zinc- gold-silver mineralisation and for shear zone gold-silver, with several untested priority targets

- The Project is 35km east of the Al Hajar Au-Ag-(Cu-Zn) deposit previously mined by Ma’aden and is proximal to the regional centre of Bisha, and close to major access routes, local towns and workforce

- Saudi exploration strategy is supported by a well capitalised in-country JV Company in CMC and significant Saudi government incentives to de-risk and fast-track exploration

- Metal Bank continues to assess new potential project areas in Saudi Arabia prospective for copper, gold and other critical minerals – several tenement applications in progress

CMC is a Saudi Arabian limited liability company owned by MBK (60%) and Central Mining Holding Company (‘CMH’, 40%). CMH is a member of the Al Qahtani Holdings group, and was the JV partner of Citadel Resources which, under the leadership of Inés Scotland as Managing Director, was responsible for the exploration and development of the Jabal Sayid copper project in Saudi Arabia (prior to its acquisition by Equinox). CMC will be responsible for managing and implementing the work program for the Wadi Al Junah project utilising the technical expertise of MBK, as the exploration JV partner, in combination with the KSA expertise of the Al Qahtani Group. CMC has a current capitalisation of SAR5m (~AUD2.1m).

Wadi al Junah with an area of 427km2 was the largest of the projects offered in Round 6 and is proximal to the major regional centre and airport of Bisha, with major access routes passing through the license area and local towns and workforce close by. The Project is located in the prospective Wadi Shwas Gold Belt, a region under-explored for shear zone gold, VMS copper-zinc-gold-silver and intrusion-related gold and base metal deposits. It is supported by several mineral occurrences with encouraging geological observations, and gold, silver and copper grades in historic regional- scale reconnaissance mapping, which have not been followed up by modern work.

MBK’s technical team has prepared a comprehensive two-year work program, with an initial focus on following up the previous limited and surface based exploration for mineral occurrences of copper, gold and silver. MBK is aiming to be drill-ready within the next six months.

Commenting on this acquisition, Metal Bank’s Chair, Inés Scotland said:

“The successful tender for the Wadi al Junah project in Saudi Arabia by our JV company CMC via a tightly contested and highly competitive exploration round speaks to our commitment, capability and technical expertise in achieving our strategy of acquiring prospective tenure within Saudi Arabia, which we believe remains underexplored and highly prospective.

Wadi al Junah represents our first project back in Saudi Arabia, a region in which MBK’s management team has extensive experience and a proven track record of success, having previously developed the Jabal Sayid project. We are well-supported by both our JV partner and the significant government incentives provided by the Kingdom of Saudi Arabia in search for the next Jabal Sayid. The Arabian Shield has so much underexplored potential, and we are ready to get our initial phase of exploration underway as quickly as possible.”

Wadi al Junah Copper-Zinc-Gold-Silver Summary

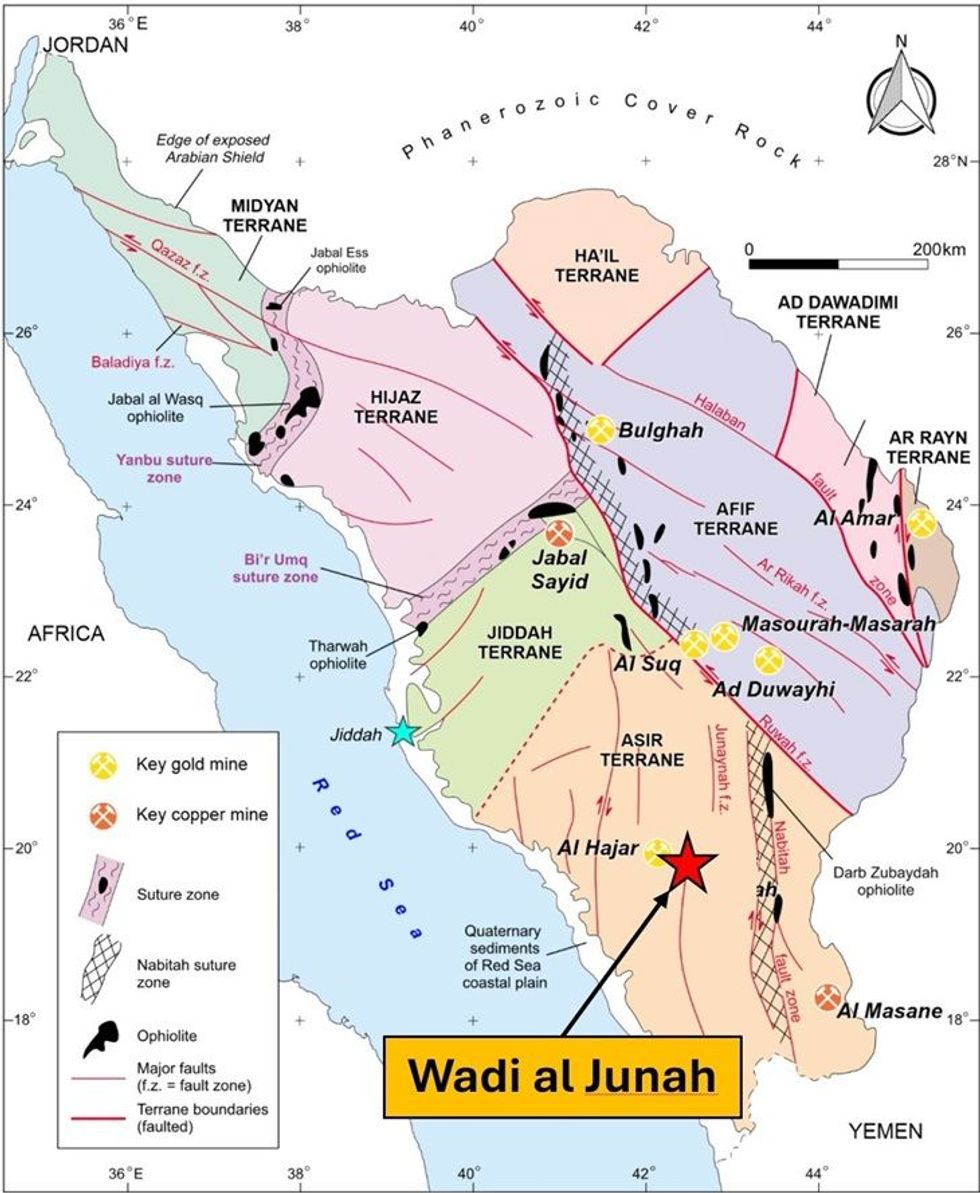

The Wadi al Junah project area covers an area of 427sq km within the Asir province of the Arabian Shield, southwest Saudi Arabia (Figures 1 and 2). It is approximately 375km south-east of Jeddah, 150km east-northeast of the port of Al Quinfidhad and around 35km east of the Al Hajar Au-Ag-(Cu- Zn) deposit previously mined by Ma’aden. It is proximal to the major regional centre and airport of Bisha, with major access routes passing through the license area and local towns and workforce close by. The majority of the project area is accessed by local tracks and wadi valleys in moderate topography.

Geology

Wadi al Junah is situated within the central Asir terrane of the Archaean Arabian Shield (Figure 2) within the ~80km long north-trending Wadi Shwas Gold Belt. The Shwas VMS belt on the western margin of the Wadi Shwas Gold Belt is host to the Al Hajar Au-Ag-Cu-Zn deposit, and numerous other VMS base metal and Au mineral occurrences of Proterozoic age are present in the region (Figure 3).

Three known mineral occurrences occur in the tenement area – Haniyat (Ag-Cu-+/-Au+/-Zn), Wadi al Maytha (Ag-Cu) and Wadi Umm Rahka (Ag-Cu). Very limited rock chip sampling as part of regional scale mapping work in the 1960’s and 1970’s includes results up to 1.53% Cu, 0.44g/t Au and 160g/t Ag from these prospects, which were never followed up1.

Click here for the full ASX Release

This article includes content from Metal Bank Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

Sign up to get your FREE

Metal Bank Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

19 February 2025

Metal Bank

Copper and gold-focused exploration in Australia and the Middle East

Copper and gold-focused exploration in Australia and the Middle East Keep Reading...

Latest News

Sign up to get your FREE

Metal Bank Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00