Perestroika Prospect - Eldorado Gold (Québec) Inc. Option Drill Results Including:

4.60 m @ 12.35 g/t Au from 269.40 m - PE-25-019

Including - 0.50 m @ 107.50 g/t Au from 270.00 m

Val-d'Or Mining Corporation (TSXV: VZZ) ("the Company") is pleased to announce on the results from the 2025 diamond drilling program on the Perestroika Prospect. The property is located in Courville Township, Québec, approximately 40 kilometres northeast of Val-d'Or, Québec. This property is under option to Eldorado Gold (Québec) Inc. who may earn a 70% interest in each of the Murdoch Creek, Claw Lake, Cook Lake and Perestroika properties, on the terms detailed below.

2025 Diamond Drill Program Outline and Objectives:

The 2025 diamond drilling program was budgeted at $0.84 M USD. Drilling activities were conducted over the February to March period with follow-up detailed logging, sampling and data compilation work as the holes were logged and analytical results received. A total of twelve (12) holes were completed (PE-25-009 to PE-25-020), for a cumulative sum of 5,004 metres drilled, utilizing two diamond drill rigs. Eldorado Gold is the project operator.

This is a Phase II diamond drilling program, intended to follow-up on promising gold values intercepted in the 2024 program. For specific details on the regional and property geology and the highlighted gold assay intersections from the 2024 drill program, including a drill hole location map and table of assay highlights, the reader is referred to the Val-d'Or Mining Corporation's December 19, 2024 news release.

The objectives of the 2025 drill program were as follows:

To follow-up on DDH GPS-09-01 (3.05m @ 20.69 g/t Au) and PE-24-004 (8.60m @ 4.45 g/t Au (incl. 0.50m @ 18.16 g/t Au and 0.90m @ 12.33 g/t Au.);

To define and delineate the existence of lithological and structural controls (i.e. plunge) on the previously intersected gold mineralized veins; and

To test for additional shear zones and structures elsewhere the property.

Table I: 2025 Diamond Drill Hole Information

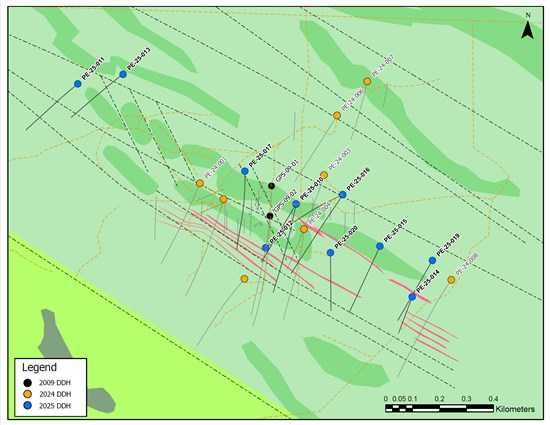

Map I: Perestroika Prospect Drill Plan 2025

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7049/267986_2bed2ca13494ab90_001full.jpg

Assays greater than 1g/t Au - See Table II - Assay Composites Intervals

The drilling results have expanded the mineralized footprint from the 2024 program to the southeast, northwest and south of GPS-09-01 and GPS-09-02, along strike and parallel to the mineralized trend.

Drillholes PE-25-14, PE-25-015, PE-25-019, and PE-25-020 followed up on the results of PE-24-008 (27.60 metres @ 0.53 g/t Au from 240.70 m), over approximately 350 metres (see above map). Wide zones of lower-grade mineralization were intersected, such as 18.40 m @ 1.28 g/t Au (145.60 m - 164.00 m) in PE-25-014, in addition to high-grade vein hosted mineralized zones such as 0.50 m @ 107.50 g/t Au from 270.00 m intersected in PE-25-019.

Immediately south of GPS-09-01 and GPS-09-02, PE-25-020 intersected 0.50 m @ 73.20 g/t Au from 38.10 m and 2.20 m @ 1.97 g/t Au from 56.5 m.

To the northwest along the mineralized corridor, PE-25-013 intersected 1.30 m @ 46.39 g/t Au from 29.70 m, located approximately 750 m northwest of GPS-09-01 and GPS-09-02.

Assays greater than 1g/t Au

---------------------------------------------------------------------------------------------------------------------

- PE-25-10: 0.50 m @ 14.45 g/t Au from 65.50 m - 66.00 m

---------------------------------------------------------------------------------------------------------------------

- PE-25-012: 1.00 m @ 5.51 g/t Au from 44.30 m - 45.30 m

- PE-25-012: 6.20 m @ 1.71 g/t Au from 87.80 m - 94.00 m

- PE-25-012: 0.5 m @ 6.44 g/t Au from 123.70 m - 124.20 m

- PE-25-012: 0.5 m @ 6.70 g/t Au from 126.00 m - 126.50 m

- PE-25-012: 16.30 m @ 4.01 g/t Au from 127.50 m - 143.80 m

- Including - 0.50 m @ 66.30 g/t Au from 128.50 m - 129.00 m

- Including - 0.50 m @ 15.90 g/t Au from 137.20 m - 137.70 m

- Including - 0.60 m @ 10.60 g/t Au from 141.20 m - 141.80 m

- PE-25-012: 1.00 m @ 15.75 g/t Au from 250.50 m - 251.50 m

- Including - 0.50 m @ 27.00 g/t Au from 251.00 m - 251.50 m

---------------------------------------------------------------------------------------------------------------------

- PE-25-013: 1.30 m @ 46.39 g/t Au from 29.70 m - 31.00 m

- Including - 0.80 m @ 39.20 g/t Au from 29.70 m - 30.50 m

- Including - 0.50 m @ 57.90 g/t Au from 30.50 m - 31.00 m

---------------------------------------------------------------------------------------------------------------------

- PE-25-014: 1.20 m @ 3.72 g/t Au from 84.00 m - 85.20 m

- PE-25-014: 0.50 m @ 17.0 g/t Au from 96.00 m - 96.50 m

- PE-25-014: 1.10 m @ 4.51 g/t Au from 105.00 m - 106.10 m

- PE-25-014: 18.40 m @ 1.28 g/t Au from 145.60 m - 164.00 m

- Including - 0.7 m @ 8.43 g/t Au from 152.95 m - 153.65 m

---------------------------------------------------------------------------------------------------------------------

- PE-25-015: 3.00 m @ 7.48 g/t Au from 225.50 m - 228.50 m

- Including - 0.55 m @ 37.00 g/t Au from 226.85 m - 227.40 m

- PE-25-015: 1.30 m @ 5.03 g/t Au from 242.40 m - 243.70 m

- PE-25-015: 5.55 m @ 4.37 g/t Au from 261.00 m - 266.55 m

- Including - 0.55 m @ 15.50 g/t Au from 261.00 m - 261.55 m

- Including - 0.80 m @ 18.45 g/t Au from 265.75 m - 266.55 m

- PE-25-015: 1.25 m @ 2.87 g/t Au from 311.00 m - 312.25 m

- PE-25-015: 2.75 m @ 2.42 g/t Au from 318.00 m - 320.75 m

---------------------------------------------------------------------------------------------------------------------

- PE-25-016: 1.80 m @ 5.65 g/t Au from 293.00 m - 294.80 m

- Including - 0.80 m @ 10.55 g/t Au from 293.00 m - 293.80 m

---------------------------------------------------------------------------------------------------------------------

- PE-25-017: 0.80 m @ 19.65 g/t Au from 130.20 m - 131.00 m

- PE-25-017: 0.50 m @ 9.02 g/t Au from 255.50 m - 256.00 m

- PE-25-017: 0.50 m @ 8.09 g/t Au from 376.20 m - 376.70 m

---------------------------------------------------------------------------------------------------------------------

- PE-25-018: 4.20 m @ 2.16 g/t Au from 423.30 m - 427.50 m

- PE-25-018: 1.75 m @ 3.44 g/t Au from 474.50 m - 476.25 m

- Including - 0.50 m @ 9.64 g/t Au from 475.10 m - 475.60 m

---------------------------------------------------------------------------------------------------------------------

- PE-25-019: 2.00 m @ 3.41 g/t Au from 213.00 m - 215.00 m

- PE-25-019: 4.60 m @ 12.35 g/t Au from 269.40 m - 274.00 m

- Including - 0.50 m @ 107.50 g/t Au from 270.00 m - 270.50 m

---------------------------------------------------------------------------------------------------------------------

- PE-25-020: 0.50 m @ 73.20 g/t Au from 38.10 m - 38.60 m

- PE-25-020: 2.20 m @ 1.97 g/t Au from 54.30 m - 56.50 m

- PE-25-020: 1.00 metre @ 2.85 g/t Au from 146.40 m - 147.40 m

- PE-25-020 : 0.50 m @ 8.32 g/t Au from 218.20 m - 218.70 m

---------------------------------------------------------------------------------------------------------------------

These intersections do not represent true widths. The intersections highlighted in this press release represents drill indicated intersections along the core length.

The mineralization intersected is characterized as mostly being hosted in flat extensional quartz-ankerite veins and veinlets. Gold mineralization is closely associated with fine disseminated pyrite with sericite (white mica) alteration.

The mineralized corridor is located between two third order shear zones and is closely associated with a swarm of felsic tonalitic to intermediate dioritic dykes.

Eldorado Gold (Québec) Inc. Option Agreements:

The Company, Eldorado Gold and Golden Valley Mines & Royalties Inc., as it then was ("Golden Valley") entered into an Assignment Agreement dated January 25, 2023, pursuant to which Golden Valley assigned to the Company all its rights and obligations under an Option Agreement dated October 8, 2021 ("the Option Agreement") between Golden Valley and Eldorado. As the assignee under the Option Agreement, the Company has granted to Eldorado an option ("the Option") to acquire an additional 40% interest in the properties ("the Properties") subject to the Option Agreement, one of which is the Perestroika Property in Québec. The Company currently holds a 70% interest in the Properties, and Eldorado currently holds a 30% interest in the Properties.

In order to maintain and to exercise the Option, Eldorado must incur minimum expenditures of $10,500,000 on or before the fifth anniversary of the date of the conditions precedent under the Option Agreement being satisfied, as well as comply with its obligations under the terms of the Option Agreement to keep the Properties in good standing. Prior to exercising the Option, Eldorado will make an annual payment to the Company of $50,000 per year. Upon the exercise of the Option by Eldorado, it and the Company will enter into a joint venture agreement on the terms set out in the Option Agreement.

Mr. Glenn J. Mullan, PGeo, President and CEO of Val-d'Or Mining, is the Qualified Person (as that term is defined in National Instrument 43-101 - Standards of Disclosure for Mineral Projects) who has reviewed this news release and is responsible for the technical information reported herein.

Eldorado Gold has not approved and is not responsible for the contents of this news release.

About Val-d'Or Mining Corporation

Val-d'Or Mining Corporation is a junior natural resource issuer involved in the process of acquiring and exploring its diverse mineral property assets, most of which are situated in the Abitibi Greenstone Belt of NE Ontario and NW Québec. To complement its current property interests, the Company regularly evaluates new opportunities for staking and/or acquisitions. Outside of its principal regional focus in the Abitibi Greenstone Belt, the Company holds several other properties in Northern Québec (Nunavik) covering different geological environments and commodities (Ni-Cu-PGE's).

The Company has expertise in the identification and generation of new projects, and in early-stage exploration. The mineral commodities of interest are broad, and range from gold, copper-zinc-silver, nickel-copper-PGE to industrial and energy minerals. After the initial value creation in the 100%-owned, or majority-owned properties, the Company seeks option/joint venture partners with technical expertise and financial capacity to conduct more advanced exploration projects.

For additional information, please contact:

Glenn J. Mullan

2772 chemin Sullivan

Val-d'Or, Québec J9P 0B9

Tel.: 819-824-2808, x 204

Email: glenn.mullan@goldenvalleymines.com

Forward-Looking Statements:

This news release contains certain statements that may be deemed "forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results or realities may differ materially from those in forward looking statements. Forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made. Except as required by law, the Company undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/267986