July 14, 2022

Okapi Resources Limited (ASX: OKR, OTCQB: OKPRF) (Okapi or the Company) is pleased to announce that it has started its extensive field exploration program at the Newnham Lake and Perch Uranium Projects in the Athabasca Basin. The exploration program will consist of prospecting, outcrop, and boulder sampling with potential soil and vegetation sampling to help identify favorable structural scenarios suitable for hosting uranium mineralisation and will utilise the results from the satellite analysis and compilation work received from Axiom Exploration Group to assist exploration efforts in specific areas of interest.

Highlights:

- Surface Exploration has started at the Newnham Lake & Perch Uranium Projects

- Focused on uranium mineralisation potential hosted within Archean Basement rocks

- The aim of the exploration program is to prioritise drill targets for testing in the Athabasca Basin Winter of 2023

Okapi’s Managing Director, Mr Andrew Ferrier said:

“We are excited about our maiden field exploration program in the Athabasca basin. Our properties at Newnham Lake and Perch remain our highest priority, with historical drilling showing anomalous radioactivity within multiple drillholes, favourable lithologies and untested basement hosted potential at a relatively shallow depth. The field program is mainly helicopter supported and plenty of pre-planning work was required to allow us to commence our exploration program. I thank our team and consultants in getting everything organised on time and on schedule.”

Figure 1: Exploration geologists in the field at Newnham Lake

Project Overview - Newnham Lake & Perch Projects

Okapi’s 100% owned Newnham Lake and Perth Projects which straddle the north-eastern margin of the Athabasca Basin. Both Projects consist of 15 mining claims totalling close to 18,500 hectares. The properties are located at the northeast margin of the Athabasca Basin approximately 75 km east-southeast of the hamlet of Stony Rapids and 60 km east of the community of Black Lake, Saskatchewan.

Summer Exploration Program

The initial phase of the Company’s exploration programs involved recently completed satellite image data analysis over the entire Newnham Lake and Perch Projects; the company also completed an extensive data review and summary of all the historical exploration work carried out on the two projects.

The analysis of satellite image data included synthetic aperture radar data (SAR), multispectral Sentinel and Aster data. The data collected was processed, analysed, and interpreted and has generated several target areas that concentrate across east-west structural corridors, and the intersection of those with north-south and northeast-southwest trending faults.

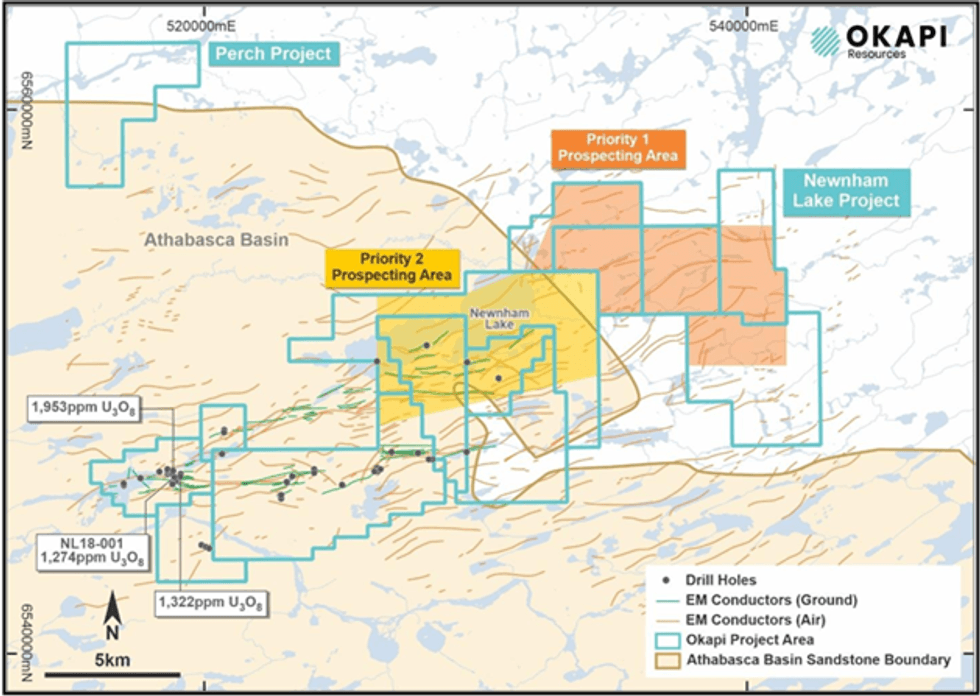

Surface exploration investigations focusing on the relatively under-explored areas that make up the northeastern Priority 1 and Priority 2 areas at Newnham Lake (Figure 2), and the areas north of the unconformity contact in exposed Archean rocks at Perch, has now begun. These areas have been identified as Archean Basement rocks at, or near, the surface that exhibit alteration and oxidation characteristics consistent with potential to host Uranium mineralisation.

Figure 2: Newnham Lake & Perch Projects - Prospecting Areas

Newnham Lake Project

At the Newnham Lake project, there are four areas of interest, not in order of priority, A through D, for the surface exploration program underway a shown in Figure 3. The program is focusing on the edge of the Athabasca Basin, with the goal of identifying areas that may cover basement fault extension and areas with multiple intersecting faults. These target areas are deemed prospective for basement-hosted uranium mineralization:

Zone A is focused on the historically recognized Karen Lake area, containing the Karen Lake Seeps uranium showing. In addition to the multiple intersecting fault zones, there are historical radioactive pegmatitic (more than 10,000 counts per second) and granitic boulders (more than 1000 cps) in the area.

Zones B and C are focused on testing east-west trending fault intersections with north-south to northeast- southwest trending faults that coincide with magnetic lows and local interpreted electromagnetic conductors, testing for surficial expression of those features.

Zone C is also testing the Camp Lake and Cyprian Fault extents on the southern portion of the Newnham Lake property.

Zone D is testing the northern extent of the Cyprian Fault on the property, where it is coincident with magnetic lows, historic radioactive boulders, gravity low anomalies as well as coincident with east-west trending fault intersections. All four zones also show areas of elevated hydrothermal alteration and gossan, interpreted from recent satellite image analysis.

Click here for the full ASX Release

This article includes content from Okapi Resources Limited , licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

OKR:AU

The Conversation (0)

1h

Eagle Energy Metals and Spring Valley Acquisition Corp. II Announce Closing of Business Combination

Eagle Energy Metals Corp. (“Eagle”), a next-generation nuclear energy company with rights to the largest conventional, measured and indicated uranium deposit in the United States, today announced that it has completed its business combination with Spring Valley Acquisition Corp. II (OTC: SVIIF)... Keep Reading...

23 February

Basin Energy Hits 1,112 ppm TREO, Fast Tracks 2026 Uranium and REE Strategy at Sybella-Barkly

Basin Energy (ASX:BSN) is moving to accelerate its 2026 exploration efforts following "exciting" results from its maiden drilling program at the Sybella-Barkly project in Queensland. In a recent interview, Managing Director Pete Moorhouse revealed that the company has confirmed a significant... Keep Reading...

19 February

Drilling Confirms Potential REE System at Sybella Barkly

Basin Energy (BSN:AU) has announced Drilling Confirms Potential REE System at Sybella BarklyDownload the PDF here. Keep Reading...

18 February

Niger’s Seized Uranium Remains in Geopolitical Limbo

A stockpile of 1,000 metric tons of uranium seized from a French-operated mine in Niger is now sitting at a military airbase in Niamey that was recently attacked by Islamic State militants, raising fresh concerns over security and the material’s uncertain future.The uranium, which is processed... Keep Reading...

12 February

Deep Space Energy Secures US$1.1 Million to Advance Lunar Power and Satellite Resilience Goals

Latvian startup Deep Space Energy announced it has raised approximately US$1.1 million in a combination of private investment and public funding to advance a radioisotope-based power generator designed to operate on the Moon.The company closed a US$416,500 pre-seed round led by Outlast Fund and... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00