November 05, 2023

Global Oil & Gas Limited (ASX: GLV) (Global or Company) is pleased to provide an update on its Tumbes Basin TEA project offshore Peru.

Highlights

- Acquisition of comprehensive historical dataset complete, including more than 3,800 km2 of 3D seismic data.

- Only one exploration well has been drilled in the 4,858km2 TEA area using 3D seismic data.

- Opportunity to explore a proven hydrocarbon bearing basin which remains virtually undrilled using modern 3D seismic data.

- The Company will now reprocess an aggregate of 1,000km2 of 3D seismic, targeting highly prospective area(s) with a view to refining advanced exploration targets and to allow the deployment of Quantitative Interpretation and Artificial Intelligence based interpretation methodologies.

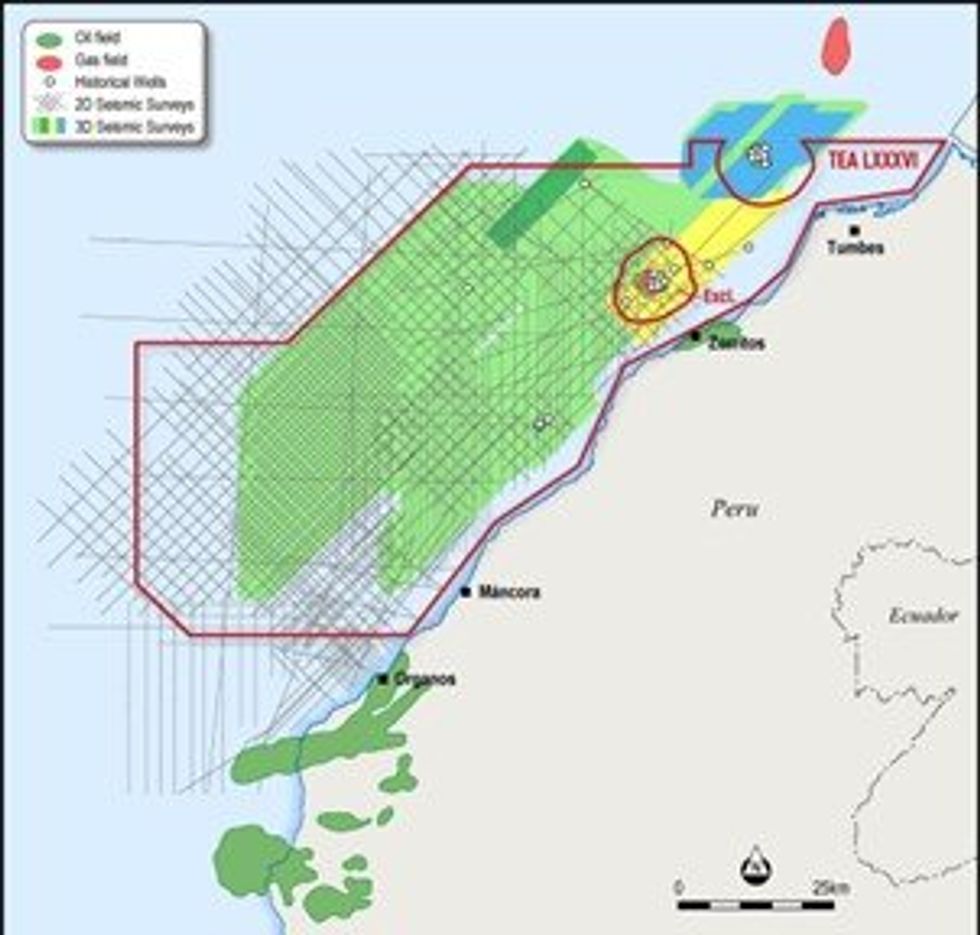

Global’s US based Joint Venture partner, Jaguar Exploration Limited (Jaguar) has obtained over 3,800km2 of 3D seismic data covering more than 66% of the Tumbes Basin TEA area (Figure One).

In addition, more than 7,000 km of 2D seismic data and information from more than 50 wells relevant to the TEA area have also been received as well as numerous technical studies and independent resource and reserve audits. This information will be collated and incorporated into a prospectivity study which is now underway.

Despite the many discoveries of oil and gas made within and immediately adjacent to the Tumbes TEA it is significant to note that only two wells have been drilled since these 3D seismic data were acquired. One of those was a step-out well on an existing field to test the downdip extent of the oil column while the other was a genuine exploration well. The Tumbes TEA therefore presents the Company with a rare opportunity to explore a proven hydrocarbon basin which remains virtually unexplored using modern 3D seismic data.

The Jaguar technical team have started work on the first phase of the interpretation project. The next milestone will be to high-grade areas within the Tumbes TEA where the 3D seismic data will undergo reprocessing. This should improve the fidelity of the data.

The processing algorithms being used are designed to optimise the impact of new Quantitative Interpretation and Artificial Intelligence methodologies that will be used as part of the prospect definition process.

The plethora of seismic data and identification of technical studies and independent audits detailing resources for several prospects inside the block is a significant step forward for the Company in advancing the Peruvian offshore opportunity.

Further updates will be provided once the high-graded areas are defined.

Click here for the full ASX Release

This article includes content from Global Oil & Gas Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

GLV:AU

The Conversation (0)

30 January

Angkor Resources Announces AGM Results and Appointment of New Director

(TheNewswire) GRANDE PRAIRIE, ALBERTA TheNewswire - (January 30, 2026): Angkor Resources Corp. (TSXV: ANK,OTC:ANKOF) ("ANGKOR" OR "THE COMPANY") announces the voting results from its Annual General Meeting of Shareholders (the "Meeting"), held on Thursday, January 29, 2026, including the... Keep Reading...

30 January

Syntholene Energy Announces Co-Listing in the United States on OTCQB Market Under Symbol SYNTF

Co-Listing Expands U.S. Investor Access and Visibility in World's Largest Aviation and Capital MarketsSyntholene Energy CORP (TSXV: ESAF,OTC:SYNTF) (OTCQB: SYNTF) (FSE: 3DD0) ("Syntholene" or the "Company") announces that its common shares have been approved for quotation and have commenced... Keep Reading...

30 January

Quarterly Activities/Appendix 5B Cash Flow Report

Kinetiko Energy (KKO:AU) has announced Quarterly Activities/Appendix 5B Cash Flow ReportDownload the PDF here. Keep Reading...

28 January

Is Now a Good Time to Invest in Oil Stocks?

Investing in oil stocks can be a lucrative endeavor, but determining the right time to enter a sector known for volatile swings can be tricky.Over the past five years, the oil market’s inherent volatility has been on clear display. Major declines in consumption brought on by the COVID-19... Keep Reading...

28 January

Quarterly Activities/Appendix 4C Cash Flow Report

MEC Resources (MMR:AU) has announced Quarterly Activities/Appendix 4C Cash Flow ReportDownload the PDF here. Keep Reading...

28 January

December 2025 Quarterly Report and Appendix 4C

BPH Energy (BPH:AU) has announced December 2025 Quarterly Report and Appendix 4CDownload the PDF here. Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00