- WORLD EDITIONAustraliaNorth AmericaWorld

April 07, 2024

Description:

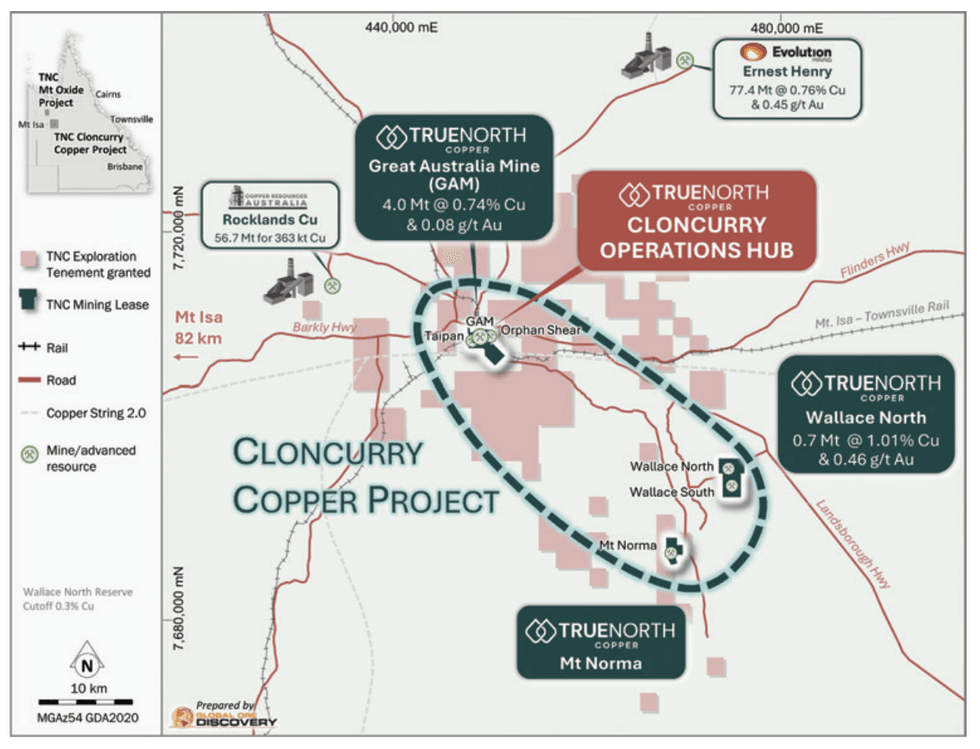

True North Copper (ASX:TNC) offers investors strong risk-adjusted returns from current prices and several upside from its Cloncurry copper project, according to a report published by Australian market research firm Morgans.

With its portfolio of complementary copper assets in a world-class mining district in Australia, Morgans’ analyst Tom Sartor believes the value of in-situ copper at TNC’s assets will increase in line with the copper market.

“We like TNC’s: 1) multi-year production/cash flow potential; 2) self-funding potential; 3) mine life/exploration upside; and 4) higher grade development prospect at Mt Oxide,” the report said.

TNC has announced it will commence mining ore at Wallace North in the fourth quarter of 2024, following the company’s mining restart study for the Cloncurry copper project (CCP). In January 2024, TNC secured an offtake agreement with Glencore and a US$28-million dollar loan facility from Nebari Natural Resources Fund.

“Execution of the CCP re-start to plan is company-defining in 2024 as TNC has an opportunity to achieve self-funding status and allay market fear of liquidity risk,” wrote Sartor in the report.

Highlights of the report:

- Upsides include multi-year production and cash flow potential from CCP mine restart; self-funding potential; mine life expansion potential and exploration upside; and higher grade development prospect at TNC’s Mt Oxide project.

- TNC’s aim to become a self-funding, NorthWest Queensland-focused copper producer-developer remains intact. In fact, several value-adds since the reverse takeover, including CCP de-risking, orebody confidence and exploration success are being overlooked as liquidity dominates market attention.

- Price catalysts include successful CCP mining/tolling re-start and demonstration of CCP commerciality and positive cash generation by late 2024. The Morgans report notes it expects “quarterly cash outflows to continue through 2024 as the ramp-up of revenues will take time to catch-up to and overtake expenses linked to the mining contractor ramp-up, pre-stripping and logistics required to unlock it.”

For the full analyst report, click here.

This content is intended only for persons who reside or access the website in jurisdictions with securities and other applicable laws which permit the distribution and consumption of this content and whose local law recognizes the scope and effect of this Disclaimer, its limitation of liability, and the legal effect of its exclusive jurisdiction and governing law provisions [link to Governing Law section of the Disclaimer page].

Any investment information contained on this website, including third party research reports, are provided strictly for informational purposes, are general in nature and not tailored for the specific needs of any person, and are not a solicitation or recommendation to purchase or sell a security or intended to provide investment advice. Readers are cautioned to seek the advice of a registered investment advisor regarding the appropriateness of investing in any securities or investment strategies mentioned on this website.

TNC:AU

The Conversation (0)

11 October 2024

True North Copper

On the path to becoming Australia’s next responsible copper producer

On the path to becoming Australia’s next responsible copper producer Keep Reading...

2h

Hudbay to Acquire Arizona Sonoran, Creating North America’s Third-Largest Copper District

Hudbay Minerals (TSX:HBM,NYSE:HBM) is doubling down on Arizona, striking a deal to acquire Arizona Sonoran Copper Company in a transaction that would create North America’s third-largest copper district.The deal gives Hudbay 100 percent ownership of the Cactus project in southern Arizona, adding... Keep Reading...

02 March

Nine Mile Metals Announces Phase 1 Bulk Sample Update at Nine Mile Brook High Grade Lens of 13.71% CuEq over 15.10m

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce that it is conducting Bulk Sample Metallurgical Analysis on the Nine Mile Brook VMS High Grade Lens with SGS Canada and Glencore Canada. Glencore and SGS will be... Keep Reading...

26 February

T2 Metals Acquires High-Grade Aurora Gold-Silver Project in the Yukon from Shawn Ryan

Past Drilling Results Include 3.4m @ 24.45 g/t Au at AJ Prospect

T2 Metals Corp. (TSXV: TWO) (OTCQB: TWOSF) (WKN: A3DVMD) ("T2 Metals" or the "Company") is pleased to announce signing of an Option Agreement (the "Option") with renowned explorer Shawn Ryan ("Ryan") and Wildwood Exploration Inc. (together with Ryan, the "Optionor") to earn a 100% interest in... Keep Reading...

25 February

Copper Prices Rally on Tariff Fears, Weak US Dollar

Copper prices continue to rise, driven by supply and demand fundamentals and boosted by tariff fears.Prices for the red metal reached a record high on January 29, and while they have since moderated somewhat, several factors have injected fresh concerns and volatility into the market.Among them... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00