April 14, 2025

Trigg Minerals (ASX:TMG,OTCQB:TMGLF) is an emerging force in the global critical minerals sector, dedicated exclusively to the development of antimony—an essential metal recognized by the United States, Australia, and the European Union for its critical role in national security, energy transition technologies, and advanced manufacturing.

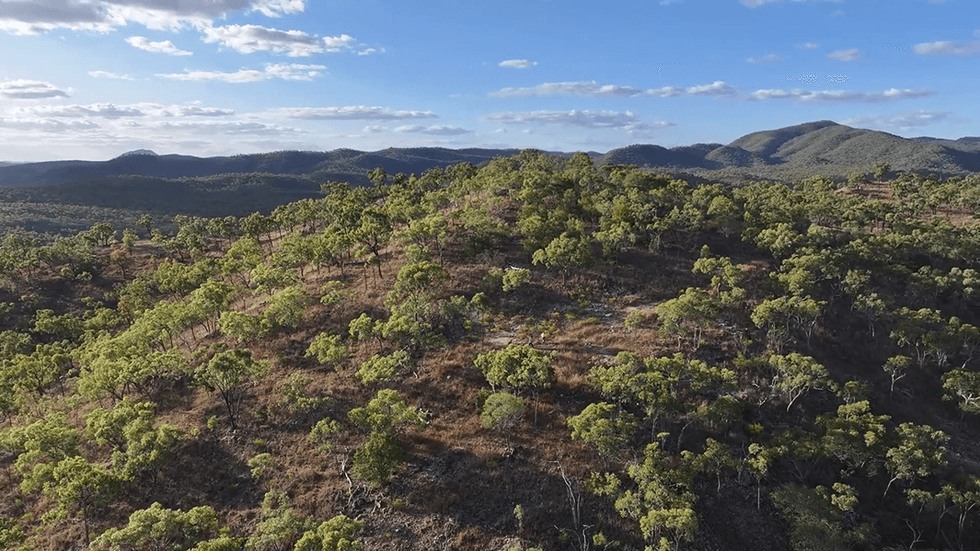

The company’s flagship Wild Cattle Creek deposit, part of the Achilles antimony project in New South Wales, is the highest-grade undeveloped antimony resource in Australia and one of the few large-scale, standalone antimony projects worldwide. As global supply chains recalibrate and geopolitical tensions mount, Trigg Minerals is strategically positioned to deliver a secure, sovereign supply of antimony to Western markets amid a deepening global shortfall.

The company is advancing an aggressive drilling and resource growth program at Wild Cattle Creek, targeting an increase from its current JORC-compliant resource of 1.52 Mt @ 1.97 percent antimony (29,902 tonnes contained metal) to over 100,000 tonnes—potentially placing it among the world’s top three antimony deposits.

Company Highlights

- Trigg Minerals is an ASX-listed company entirely focused on antimony, a critical mineral vital for solar panels, flame retardants, semiconductors and military applications.

- The flagship Achilles project’s Wild Cattle Creek deposit hosts a high-grade JORC resource of 1.52 Mt @ 1.97 percent antimony for ~30,000 tonnes contained antimony—Australia’s highest-grade undeveloped antimony deposit.

- The company’s aggressive expansion plan includes a near-term drilling program targeting a threefold increase in contained antimony to over 100,000 tonnes, positioning Trigg among the top three antimony deposits globally.

- Trigg is attracting growing attention as a potential partner to support Western antimony supply chains amid rising demand and geopolitical tension.

- Operating in New South Wales—a Tier 1 jurisdiction—Trigg benefits from government incentives, including co-investment, exploration support and deferred royalty schemes.

- China controls 83 percent of global antimony production and recently banned exports to the US, creating a strategic opening for Western suppliers like Trigg.

This Trigg Minerals profile is part of a paid investor education campaign.*

Click here to connect with Trigg Minerals (ASX:TMG) to receive an Investor Presentation

TMG:AU

Sign up to get your FREE

Trigg Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

12 November 2025

Trigg Minerals

Developing America’s next sources of antimony and tungsten – critical minerals essential for defence, energy and advanced technologies.

Developing America’s next sources of antimony and tungsten – critical minerals essential for defence, energy and advanced technologies. Keep Reading...

09 December 2025

Antimony Canyon Drill Permit Approved, Contractor Appointed

Trigg Minerals (TMG:AU) has announced Antimony Canyon Drill Permit Approved, Contractor AppointedDownload the PDF here. Keep Reading...

24 November 2025

High-Grade Antimony Zone Extends 1km North at ACP

Trigg Minerals (TMG:AU) has announced High-Grade Antimony Zone Extends 1km North at ACPDownload the PDF here. Keep Reading...

13 November 2025

Significant consolidation of district-scale tungsten

Trigg Minerals (TMG:AU) has announced Significant consolidation of district-scale tungstenDownload the PDF here. Keep Reading...

03 November 2025

CSAMT Findings - a Large-Scale Hydrothermal Antimony System

Trigg Minerals (TMG:AU) has announced CSAMT Findings - a Large-Scale Hydrothermal Antimony SystemDownload the PDF here. Keep Reading...

02 November 2025

Trigg Secures High-Grade Tungsten Mines & Two Drill Programs

Trigg Minerals (TMG:AU) has announced Trigg Secures High-Grade Tungsten Mines & Two Drill ProgramsDownload the PDF here. Keep Reading...

9h

David Erfle: Gold, Silver Under Pressure, Key Price Levels to Watch

David Erfle, editor and founder of Junior Miner Junky, explains why gold and silver prices took a hit not long after war in the Middle East was announced. While the near term could be volatile, he said the long-term outlook for precious metals is strong. Don't forget to follow us @INN_Resource... Keep Reading...

10h

Tavi Costa: Gold, Silver Stocks to Rerate, "Explosive" Energy, Copper Opportunities

Tavi Costa, CEO of Azuria Capital, explains where he's looking to deploy capital right now, mentioning mining, energy and emerging markets. "When I apply macro analysis into markets, there's a few things that look exceptionally cheap today that could be extremely asymmetric," he commented.... Keep Reading...

10h

One Bullion Advances Toward Drill-Ready Targets at Botswana Gold Assets

One Bullion (TSXV:OBUL,OTCPL:OBULF) CEO and President Adam Berk shared the advantages of working in the mining-friendly jurisdiction of Botswana and big milestones ahead in 2026.Surveys are expected to commence within the next few weeks at the company's Maitengwe and Vumba projects, which will... Keep Reading...

09 March

Byron King: Gold, Silver, Oil/Gas — Stock Ideas and Strategy Now

Byron King, editor at Paradigm Press, shares his approach to the gold and silver sectors as tensions in the Middle East intensify, also touching on oil and gas. Overall he sees hard assets becoming increasingly key as global uncertainty escalates."Own gold, own silver — physically own the metal... Keep Reading...

09 March

Jaime Carrasco: Gold Going "Much Higher," Silver Force Majeure Inevitable

Jaime Carrasco, senior portfolio manager and senior financial advisor at Harbourfront Wealth Management, shares his outlook for gold and silver, saying prices must rise much higher. He also talks about how to build a strong precious metals portfolio. "We're moving from a credit-based economy, a... Keep Reading...

09 March

Garrett Goggin: Gold, Silver in New Era, My Stock Strategy Now

Garrett Goggin, founder of Golden Portfolio, says although gold and silver haven't gone mainstream yet, the metals — and the mining sector overall — have entered a new era. "It's a real mind shift — it's a new era in mining right here," he said.Don't forget to follow us @INN_Resource for... Keep Reading...

Latest News

Sign up to get your FREE

Trigg Minerals Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00