April 17, 2024

Trident Royalties (AIM:TRR,OTC:TDTRF) provides investors with exposure to lithium, gold, copper, silver, iron ore, and other commodities (excluding thermal coal) through its diversified commodity portfolio. Trident is establishing itself as a royalty company using a unique royalty model that brings under its umbrella the entire gamut of the mining industry. This should attract investors willing to participate in the growth of metals such as lithium and copper, without taking the risk associated with investing directly in the mining companies themselves.

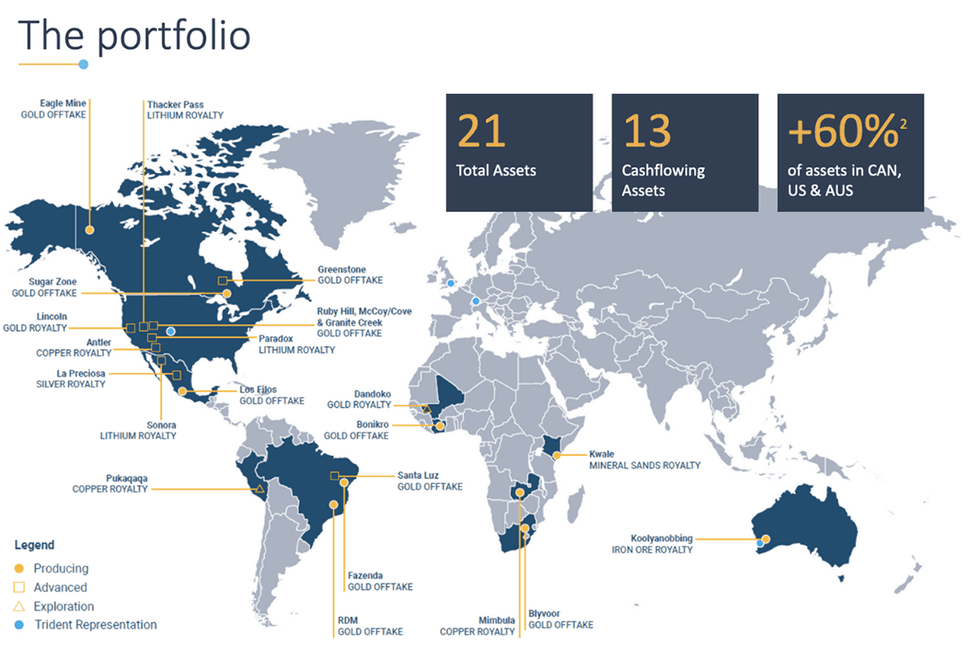

The company has acquired 21 assets (royalties and gold offtake agreements), of which 13 are currently cash-flowing. While the current revenue mix is weighted toward gold, asset-level developments across the portfolio, specifically at the Thacker Pass (lithium) and Mimbula (copper) projects, continue to indicate a higher mix of lithium and copper royalty revenue going forward. Thacker Pass is on track to be the largest lithium producer in North America within the next three years.

Trident has developed a portfolio that not only provides material revenue today but includes a tangible growth profile to significantly grow revenue over the next few years. A significant portion of future revenue is underpinned by assets already in construction, including Thacker Pass, Mimbula (in production, ramping-up) and Greenstone (discussed in detail below). Longer-term revenue growth is supported by a mix of expansions and new project development.

Company Highlights

- Trident Royalties is a diversified mining royalty company which provides investors with exposure to the full breadth of mining commodities, including precious, base and battery metals, and bulk/industrial minerals (excluding thermal coal). The company is listed on the AIM market of the London Stock Exchange under the ticker ‘TRR’ and on the US OTCQB market under the ticker ‘TDTRF’.

- Since its listing on London's AIM market in June 2020, the company has acquired 21 assets, of which 13 are currently cash-flowing.

- The company’s broad asset base, which includes exposure to lithium, gold, copper, silver, iron ore and other commodities, differentiates it from its peers, which are mainly limited to precious metals.

- Greater than 60 percent of its asset NAV (by Unrisked Asset NAV – Tamesis Partners, 8 November 2023) is located in resource-friendly countries such as Canada, Australia and the US, which reduces jurisdictional risk.

- Management’s track record for value creation is impressive, delivering shareholder returns of 80 percent since listing.

- Trident has an attractive pipeline of future cash-flowing opportunities in battery and base metals. In particular, the Thacker Pass Lithium Project in the U.S. and the Mimbula Copper Project in Zambia hold significant potential for increased revenue to Trident. Thacker Pass is projected to deliver ~US$15 million in annual royalty revenue within the next three years (Revenue estimates by Tamesis Partners (8 November 2023)

This Trident Royalties profile is part of a paid investor education campaign.*

Click here to connect with Trident Royalties (AIM:TRR,OTC:TDTRF) to receive an Investor Presentation

TDTRF

The Conversation (0)

03 September 2024

Cancellation of Trident Shares to Trading on AIM

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF SUCH JURISDICTION On 13 June 2024, the boards of Deterra Global Holdings Pty Ltd... Keep Reading...

02 September 2024

Trident Royalties PLC Announces Scheme Of Arrangement Becomes Effective

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF SUCH JURISDICTION RECOMMENDED CASH ACQUISITION of TRIDENT ROYALTIES PLC by DETERRA GLOBAL... Keep Reading...

29 August 2024

Trident Royalties PLC Announces Court Sanction of Scheme of Arrangement

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN PART, DIRECTLY OR INDIRECTLY IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR REGULATIONS OF SUCH JURISDICTION On 13 June 2024, the boards of Deterra Global Holdings Pty Ltd... Keep Reading...

28 August 2024

Trident Royalties PLC Announces Holding in Company

TR-1: Standard form for notification of major holdings 1. Issuer DetailsISIN GB00BF7J2535 Issuer Name TRIDENT ROYALTIES PLC UK or Non-UK Issuer UK 2. Reason for Notification An acquisition or disposal of voting rights 3. Details of person subject to the notification obligationName Bank of... Keep Reading...

27 August 2024

Trident Royalties PLC Announces Holding in Company

TR-1: Standard form for notification of major holdings 1. Issuer Details ISIN GB00BF7J2535 Issuer Name TRIDENT ROYALTIES PLC UK or Non-UK Issuer UK 2. Reason for Notification An acquisition or disposal of voting rights 3. Details of person subject to the notification obligation Name Bank of... Keep Reading...

8h

Benchmark: Surging Copper Prices Highlight Looming Global Supply Challenges

Copper prices surged through 2025 and into 2026, placing the red metal firmly back into the spotlight as concerns about a looming global supply shortfall mount among market watchers. Analysts say the tightening outlook reflects a powerful mix of rising demand — driven by urbanization, the energy... Keep Reading...

04 March

Teck VP Highlights China's Major Role in Evolving Copper Markets

Copper prices have surged since the middle of 2025, as tariffs, rising demand and supply disruptions came together to create the perfect storm for metals traders.These factors are helping raise awareness of the challenges copper producers will face in the coming years, as supply deficits are... Keep Reading...

04 March

BHP: Targeted AI Platforms Boost Efficiency, Safety and More

Modern society has a metals problem. The demands of modern consumer culture, the energy transition and the emergence of artificial intelligence (AI) and robotics have created a dilemma.As demand rises, the supply of many metals is at a bottleneck brought about by a number of factors, from... Keep Reading...

04 March

VIDEO - BTV Visits Atlas Salt, Graphene Manufacturing, Telescope Innovations, Nevada Organic Phosphate, Maple Gold, Intrepid Metals and Nine Mile Metals

Watch on BNN Bloomberg nationalWednesday, March 4 at 7:30 PM EST & Saturday, March 7 at 8 PM EST Tune into BTV and Discover Investment Opportunities. As the resource cycle accelerates, BTV Business Television highlights companies turning exploration, innovation and strategic growth into... Keep Reading...

03 March

Hudbay to Acquire Arizona Sonoran, Creating North America’s Third Largest Copper District

Hudbay Minerals (TSX:HBM,NYSE:HBM) is doubling down on Arizona, striking a deal to acquire Arizona Sonoran Copper Company in a transaction that would create North America’s third-largest copper district.The deal gives Hudbay 100 percent ownership of the Cactus project in southern Arizona, adding... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00