Overview

Trident Royalties (AIM:TRR,OTC:TDTRF) is a mining royalty company which provides investors with exposure to lithium, gold, copper, silver, iron ore, and other commodities (excluding thermal coal). Its diversified commodity portfolio aims to bridge the gap in the royalty sector, which is currently dominated by precious metal royalty companies. Trident is establishing itself as a royalty company with the intent of building a portfolio which broadly reflects the diverse spectrum of the entire mining sector.

Mining royalties are contractual arrangements that provide a mining company with a lump-sum upfront payment in exchange for a share of its future revenues. Royalties offer several advantages over other investment structures, including no dilution risk from future financings (as royalties are typically structured as a fixed percentage of revenue), while retaining exposure to resource growth and project expansion upside. Royalty companies enjoy various benefits, including diversification, high profit margins, and reduced risk. By investing in multiple mines simultaneously, royalty companies can mitigate the impact of an underperforming mine, as they continue to generate revenue from others. Investing in royalty companies offers investors exposure to the price movements of the underlying commodity while eliminating exposure to the risks associated with the capital and operating costs of the mine.

For mining companies, royalty financing offers several benefits compared to traditional forms of funding. For example, in contrast to debt, royalty financing comes with extended terms, no fixed payments, and is generally simpler to implement, with limited covenants. While, in contrast to equity, royalties are non-dilutive to share capital.

Historically, the royalty model has mostly been confined to the precious metals sector and, as such, has been unavailable for many investors looking for exposure to other metal classes and broader mining industry, as a whole. Trident’s royalty model is unique as it aims to bring under its umbrella the entire gamut of the mining industry, providing exposure to commodities such as lithium, copper, iron ore and other metals. This should attract investors willing to participate in the growth of metals such as lithium and copper, without taking the risk associated with investing directly in the mining companies themselves.

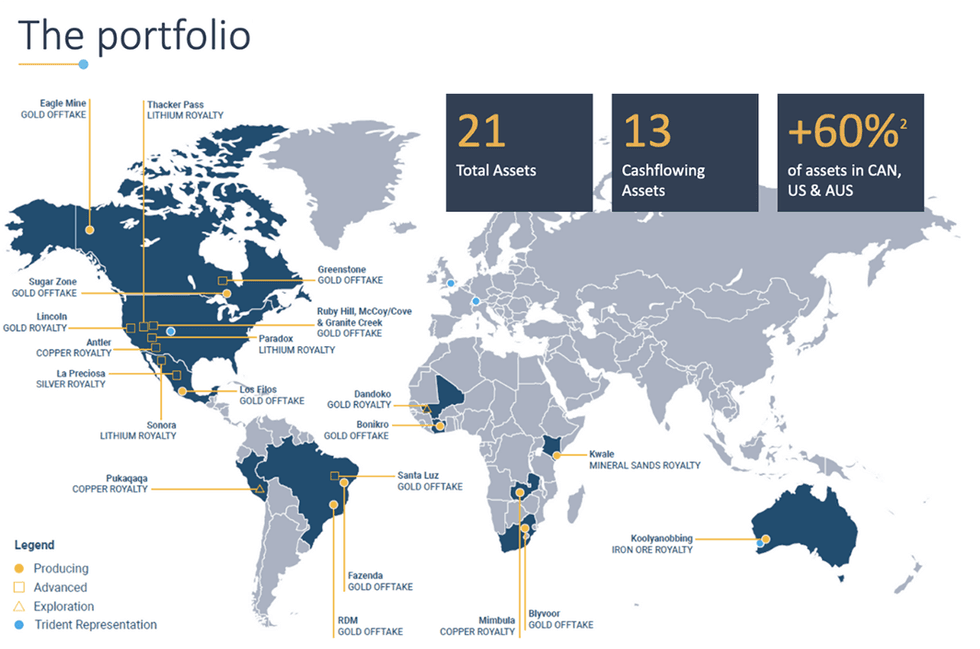

Since listing in mid-2020, the company has acquired 21 assets (royalties and gold offtake agreements), of which 13 are currently cash-flowing. While the current revenue mix is weighted toward gold, asset-level developments across the portfolio, specifically at the Thacker Pass (lithium) and Mimbula (copper) projects, continue to indicate a higher mix of lithium and copper royalty revenue going forward. Thacker Pass is on track to be the largest lithium producer in North America within the next three years. The cash flow from this royalty, at current lithium prices and full production, should be roughly $21 million per annum (assuming partial operator buy-back occurs, LCE price of $25k/t, 80 k/t per year production rate).

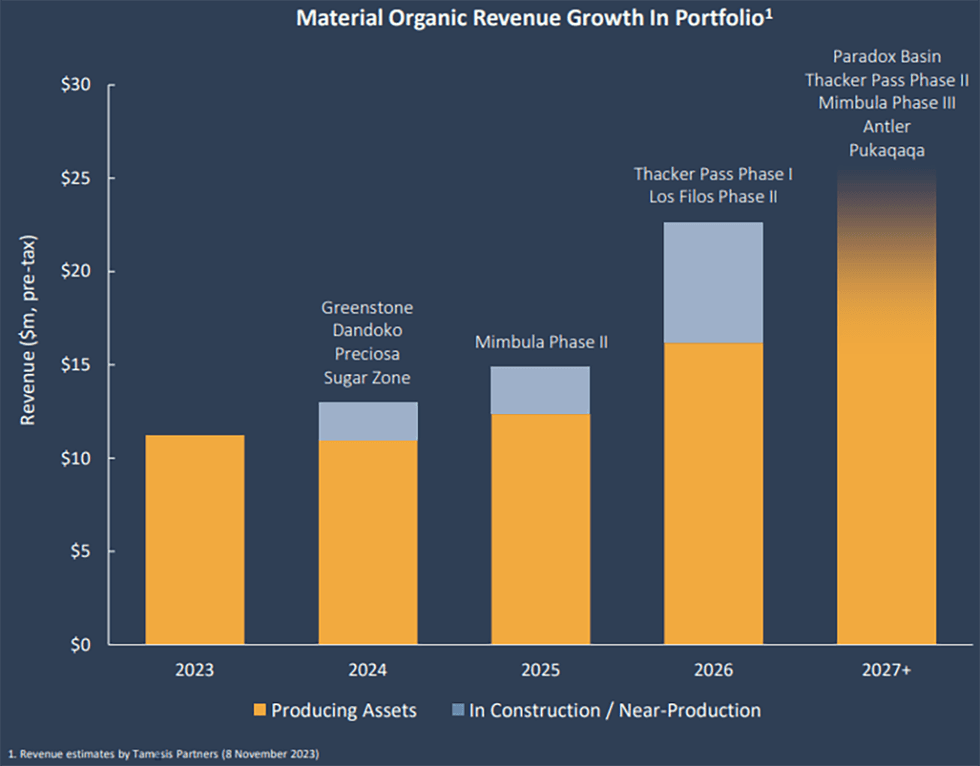

Trident has developed a portfolio which not only provides material revenue today but includes a tangible growth profile to significantly grow revenue over the next few years. A significant portion of future revenue is underpinned by assets already in construction, including Thacker Pass, Mimbula (in production, ramping-up) and Greenstone (discussed in detail below). Longer-term revenue growth is supported by a mix of expansions and new project development.

In addition to the revenue shown below, Trident anticipates two material one-off payments of $8.75 million in 2025 from Avino Silver and $13.2 million in 2026 from Lithium Americas.

Company Highlights

- Trident Royalties is a diversified mining royalty company which provides investors with exposure to the full breadth of mining commodities, including precious, base and battery metals, and bulk/industrial minerals (excluding thermal coal). The company is listed on the AIM market of the London Stock Exchange under the ticker ‘TRR’ and on the US OTCQB market under the ticker ‘TDTRF’.

- Since its listing on London's AIM market in June 2020, the company has acquired 21 assets, of which 13 are currently cash-flowing.

- The company’s broad asset base, which includes exposure to lithium, gold, copper, silver, iron ore and other commodities, differentiates it from its peers, which are mainly limited to precious metals.

- Greater than 60 percent of its asset NAV (by Unrisked Asset NAV – Tamesis Partners, 8 November 2023) is located in resource-friendly countries such as Canada, Australia and the US, which reduces jurisdictional risk.

- Management’s track record for value creation is impressive, delivering shareholder returns of 80 percent since listing.

- Trident has an attractive pipeline of future cash-flowing opportunities in battery and base metals. In particular, the Thacker Pass Lithium Project in the U.S. and the Mimbula Copper Project in Zambia hold significant potential for increased revenue to Trident. Thacker Pass is projected to deliver ~US$15 million in annual royalty revenue within the next three years (Revenue estimates by Tamesis Partners (8 November 2023)

Get access to more exclusive Copper Investing Stock profiles here