Company also announces positive results from its 3D geological model at Obalski, revealing high-potential copper-gold targets

TomaGold Corporation (TSXV: LOT,OTC:TOGOF; OTCPK: TOGOF) (" TomaGold " or the " Company ") is pleased to announce the beginning of its drilling program on its Chibougamau projects in Quebec. As outlined in its June 20, 2025 press release , the Company has initiated a 53-hole exploration drilling program targeting its key projects, namely Obalski, Berrigan Mine, Radar, David, and Dufault, with the goal of uncovering new gold-copper mineralization on strategically selected, well-defined targets.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20250814750419/en/

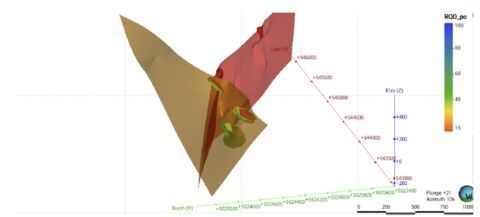

Figure 1 Shear structural model correlated with low RQD values (shown as disc-shaped contacts)

Results from 3D Geological and Structural Interpretation on Obalski

TomaGold is also pleased to announce the results of its most recent 3D geological and structural interpretation of the Obalski project (the "Project") , located two kilometres south of Chibougamau, Québec, within the mineral-rich Abitibi Greenstone Belt.

This comprehensive modeling effort led to the identification of multiple copper-gold (Cu-Au) mineralized zones controlled by well-defined shear systems, offering substantial upside for future exploration and drilling. This work integrates historical drilling data, geophysical surveys (resistivity and metal factor), and structural interpretation, resulting in a refined geological framework for the Project that confirms several high probability yet untested mineralized targets.

TomaGold's CEO David Grondin stated: "This model provides us with a far more detailed and accurate picture of the lithological, structural, and mineralization architecture at Obalski. It confirms historical mineralization trends and identifies a series of compelling, high-confidence exploration targets observed elsewhere in the Chibougamau Mining Camp, based on recent work by the TomaGold technical team. We now have a clear roadmap to expand mineralized zones with precision-guided exploration using surface bedrock and soil sampling, outcrop stripping and sampling, and SONIC and diamond drilling."

Technical Highlights and Key Conclusions

The updated geological model successfully reconciles decades of reportedly dissimilar and inconsistent datasets into a unified and standardized 2D and 3D framework of lithologies, structures, mineralization, geochemistry, and assay results. This integration significantly improves confidence in target definition and enhances geological continuity across the Project.

Key Findings:

1. Identification of Two Major Shear Systems

The interpretation confirms the presence of two dominant shear systems:

- A N110° (SE-NW) trending shear structure associated with copper-gold mineralization in quartz veins and chlorite-carbonate altered zones.

- A younger 020° (NE-SW) trending shear that offsets the former structure and appears to host predominantly gold mineralization.

The intersection of these two systems creates structurally favorable zones with increased permeability, representing high-priority targets for hydrothermal fluid migration and metal deposition. This structural configuration is clearly illustrated in Figure 1.

2. Spatial Association Between Mineralization and Intrusive Contacts

Numerical models of copper assays revealed that Cu enrichment is concentrated along the margins of intrusive units—particularly dioritic and granitic contacts . These observations support a genetic link between magmatic activity and mineralization. The highest assay clusters occur near structurally disrupted intrusive contacts. This correlation is well depicted in Figures 2 and 3.

3. Well-Defined Mineralized Zone and Orientation

The integrated model delineates a mineralized zone trending north-northeast with a moderate plunge of approximately 32° toward the east. This geometry aligns with regional shear zones and provides a clear vector for down-plunge drilling extensions , shown in Figure 4.

4. Predictive Mineralization Modelling Validates Untested High-Potential Zones

The 3D distance-based predictive model combines geophysics, lithology, and geochemistry to estimate the probability of mineralization. The zones with the highest potential for mineralization (shown in purple and dark blue shells in Figure 5 below) are concentrated along structural intersections and lithological boundaries between pillowed volcanics and intrusive rocks.

Exploration Upside and Targeting Strategy

The integration of geological, structural, and assay data defines multiple high-priority exploration targets , which are summarized as follows:

- Structural intersections of the N110° (SE-NW) and NE-SW trending shears offer the greatest potential for mineralized shoots.

- Intrusive-volcanic contacts (especially where sheared) consistently correlate with higher copper and gold grades.

- Down-plunge extensions along the 32° plunge trend remain open and under-drilled.

- The southeastern area of the Project , where folding and intrusive complexity are observed (potential dioritic trap), presents a newly recognized exploration opportunity.

- Parallel, underexplored structures may host additional mineralized lenses.

This targeting strategy is supported by both structural logic and assay correlations, enhancing drill efficiency and reducing exploration risk.

Recommendations and Next Steps

To optimize future exploration success, the report recommends the following:

- Increasing the assay dataset through systematic sampling of drill holes, particularly across lithological and structural contacts.

- Standardizing core logging protocols , with a focus on alteration, structure, and geochemical pathfinder elements.

- Re-logging historic cores with updated multi-element and trace element geochemistry (e.g., pXRF and spectral analysis).

- Expanding geophysical coverage , including high-resolution passive and active seismic surveys (in collaboration with the Smart Exploration Centre ).

- Widening the geochemical scope beyond Au and Cu to include Ag, Zn, Bi, Te, and other pathfinder elements.

These recommendations aim to improve the definition and confidence in currently modelled mineralized zones while identifying new areas of potential.

The technical content of this press release has been reviewed and approved by Jean Lafleur, P.Geo., the Company's Vice President of Exploration and a qualified person under National Instrument 43-101.

About TomaGold

TomaGold Corp. (TSXV: LOT,OTC:TOGOF, OTCPK: TOGOF) is a Canadian junior mining company focused on the acquisition, exploration, and development of high-potential precious and base metal projects, with a primary focus on gold and copper in Quebec and Ontario. The Company's core assets are located in the Chibougamau Mining Camp in northern Quebec, where it owns the Obalski gold-copper-silver project and holds options to acquire 12 additional properties, including the Berrigan Mine, Radar, David, and Dufault projects. TomaGold also holds a 24.5% joint venture interest in the Baird gold property near the Red Lake Mining Camp in Ontario. In addition, the Company has lithium and rare earth element (REE) projects in the James Bay region, strategically positioned near significant recent discoveries.

Cautionary Statement on Forward-Looking Information

This news release includes certain statements that may be deemed "forward-looking statements". All statements in this news release, other than statements of historical facts, that address events or developments that the Company expects to occur, are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements. Factors that could cause the actual results to differ materially from those in forward-looking statements include the potential results of exploration and drilling activities, market prices, continued availability of capital and financing, and general economic, market or business conditions. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. Forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made. Except as required by applicable securities laws, the Company undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates, opinions, or other factors should change.

Neither TSX Venture Exchange nor its Regulations Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

View source version on businesswire.com: https://www.businesswire.com/news/home/20250814750419/en/

David Grondin

President and Chief Executive Officer

(514) 583-3490

www.tomagoldcorp.com