October 02, 2023

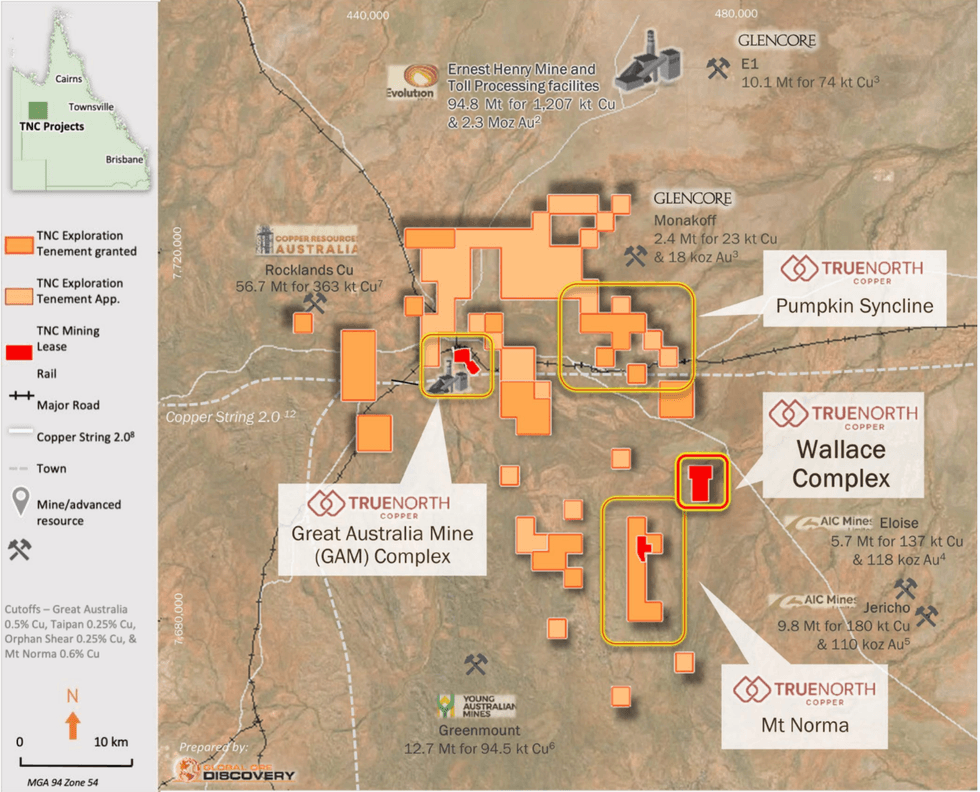

True North Copper Limited (ASX:TNC) (True North, TNC or the Company) is pleased to announce resource extension drilling and Induced Polarisation (IP) survey results at Wallace North, part of its Conclurry Project in Queensland, identified multiple open zones of high-grade copper and gold mineralisation. Wallace North has a current combined Indicated and Inferred resource of 1.39Mt @ 1.38% Cu and 0.90 g/t Au.

Highlights:

- Drill results highlighted significant growth potential including:

- Defining the down plunge continuity of a 100m wide, 250m deep high-grade copper gold shoot open at depth

- Intersecting the top of an untested shoot, potentially 200m wide and open to depth.

- Significant high-grade copper and gold mineralisation across drillhole results included:

WNR0001

− 10.0m (8.74m*) @ 2.22% Cu, 1.41g/t Au from 146.00m

WNR0006

− 6.0m (5.05m*) @ 0.43% Cu, 12.99g/t Au from 151.00m− 4.0m (3.35m*) @ 3.38% Cu, 1.81g/t Au from 88.00m

WNR0002

− 7.0m (5.55m*) @ 2.14% Cu, 1.13g/t Au from 110.00m

WNR0005

− 5.0m (3.82m*) @ 2.18% Cu, 7.31g/t Au from 182.00mInc. 2.0m (1.53m*) @ 2.89% Cu, 17.08g/t Au from 185.00m

WNR0007

− 3.0m (2.51m*) @ 3.57% Cu, 2.48g/t Au from 109.00m− 7.0m (5.90m*) @ 3.10% Cu, 1.32g/t Au from 214.00m

- New IP geophysics and historic EM indicate substantial depth extent to the Wallace North system and highlight new targets with similar signatures to recent discoveries of gold-endowed iron-sulphide-copper-gold deposits in the Mt Isa Inlier.

- Further development of Wallace North will include resource restatement, mining and metallurgical studies, downhole and ground-based geophysics and follow-up drillhole targeting (with completion expected Q1 2024).

Comment

True North Copper’s Managing Director, Marty Costello said:

“A successful resource expansion drilling and IP survey program at our fully permitted, 100%-owned, high-grade copper and gold Wallace North Project has identified multiple zones of high-grade copper and gold mineralisation outside the current resource shell, including Hole WNR0001, which included 10m (true width 8.74m) at 2.22% copper and 1.41g/t gold.

Additionally, the high-grade gold intercept of WNR0006 was a highlight with 6m (true width of 5.05m) of 0.43% copper and an impressive 12.99g/t gold.

The current Wallace North Resource is 1.39Mt has a copper grade of 1.39% and gold grade of 0.9g/t, but it does not have a Reserve. Thanks to this completed resource expansion drilling and IP surveying, along with our recently concluded advanced grade control drilling program, which included 150 drillholes and more than 9400m of drilling, we can now finalise an updated resource for Wallace North.

Wallace North is an important part of our Cloncurry Hub mining plans. This drilling program confirms there are several high- grade copper and gold zones within the Wallace North approved mining footprint, open at depth and warranting further exploration. More drilling will be undertaken across these zones and the anomalies we identified as part of recent IP surveys.

We are conducting revised metallurgical tests in conjunction with the upcoming technical tasks related to the development of the initial Wallace North Reserve Statement. This testing aims to validate effective extraction and processing methods. The prevalent copper mineralisation in the resource, as observed from our drilling, is chalcopyrite, which typically responds well to standard flotation. Given the gold is intertwined with the copper mineralisation, there is a strong possibility of extracting gold in a concentrated form during ore processing.”

Summary of TNC’s Drill Intersections to date

True North Copper has received assay results from eight (8) reverse circulation (RC) drillholes (WNR0001 to WNR0008) completed at its Wallace North Resource. These constitute both infill and extension holes to the 2023 resource1 (Figure 2 and Figure 3). Significant downhole intercepts are provided in Table 1 and illustrated in plan, long and cross-sections Figure 2, Figure 3, Appendix 1 .

Click here for the full ASX Release

This article includes content from True North Copper, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

TNC:AU

The Conversation (0)

11 October 2024

True North Copper

On the path to becoming Australia’s next responsible copper producer

On the path to becoming Australia’s next responsible copper producer Keep Reading...

10h

ASX Copper Mining Stocks: 5 Biggest Companies in 2026

Copper prices have been volatile throughout 2025 and into 2026, fueled by economic uncertainty from an ever-changing US trade policy and strong supply and demand fundamentals. The International Copper Study Group, the leading copper market watcher, reported an apparent refined copper surplus of... Keep Reading...

10h

What Was the Highest Price for Copper?

Strong demand in the face of looming supply shortages has pushed copper to new heights in recent years.With a wide range of applications in nearly every sector, copper is by far the most industrious of the base metals. In fact, for decades, the copper price has been a key indicator of global... Keep Reading...

19 February

Northern Dynasty Shares Plunge as DOJ Backs EPA Veto of Alaska’s Pebble Mine

Northern Dynasty Minerals (TSX:NDM,NYSEAMERICAN:NAK) shares plunged on Wednesday (February 18) after the US Department of Justice (DOJ) filed a court brief backing the Environmental Protection Agency’s (EPA) January 2023 veto of the company’s long-contested Pebble project in Alaska.The brief... Keep Reading...

18 February

BHP Reports Strong Half-Year Copper Results, Boosts Guidance for 2026

BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has published its financial results for the half-year ended December 31, 2025.The mining giant said its copper operations, which span multiple continents, accounted for the largest share of its overall earnings for the first time, coming in at 51 percent of... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

17 February

Nine Mile Metals Announces Certified Assays from DDH-WD-25-02 of 2.78% CUEQ over 32.10 METERS, Including 4.78% CUEQ over 11.52 Meters and 5.64% CUEQ over 6.02 Meters

Nine Mile Metals LTD. (CSE: NINE,OTC:VMSXF) (OTC Pink: VMSXF) (FSE: KQ9) (the "Company" or "Nine Mile") is pleased to announce it has received certified assays for drill hole WD-25-02 at the Wedge Mine situated in the renowned Bathurst Mining Camp, New Brunswick (BMC). WD-25-02 HIGHLIGHTS: DDH... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00