November 13, 2023

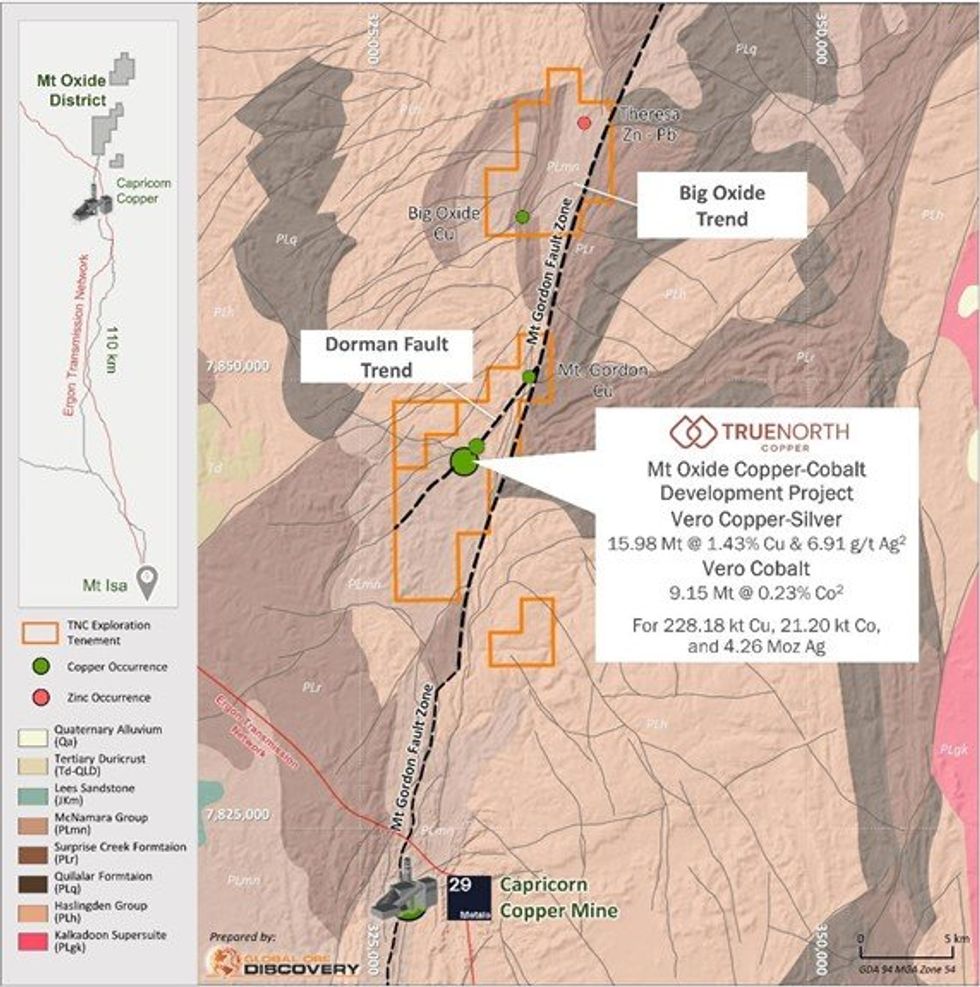

True North Copper Limited (ASX:TNC) (True North, TNC or the Company) is pleased to report further phenomenal assay results from drillhole MOXD225, drilled as part of an initial Vero Resource drilling program. The Vero Resource is part of TNC’s 100% owned Mt Oxide Project (located 140km north of Mount Isa, Queensland, see Figure 1).

HIGHLIGHTS

- MOXD225 intercepted two wide intervals of high-grade copper mineralisation. Highlights include

- 26.20m (16.48m*) @ 4.45% Cu, 42.9g/t Ag and 1,964 ppm Co from 258.80m

- 10.90m (6.87m*) @ 7.32% Cu, 72.2g/t Ag and 2,915 ppm Co from 265.50m

- 46.60m (34.02m*) @ 2.18% Cu, 26.3g/t Ag and 487 ppm Co from 352.50m

- 4.20m (3.07m*) @ 11.15% Cu, 129.5g/t Ag and 135 ppm Co from 352.50m

- 26.20m (16.48m*) @ 4.45% Cu, 42.9g/t Ag and 1,964 ppm Co from 258.80m

- MOXD223 intercepted strong pyrite mineralisation with chalcopyrite and chalcocite best intercepts include:

- 4.20m (3.02m*) @ 2.72% Cu, 32.4g/t Ag and 173 ppm Co from 231.25m

- 6.50m (4.68m*) @ 1.40% Cu, 13.4g/t Ag and 62 ppm Co from 364.50m

- Results continue to confirm the Vero Resource hosts a large-scale, copper-cobalt-silver system with multiple, wide high- grade Cu-Co steeply dipping shoots and lenses.

- 3D geological interpretation, which will be used in resource estimation updating, will commence once all assay results have been returned. Metallurgical sampling is in progress.

- Assays for the final drillhole MOXD226A are expected by late November 2023.

COMMENT

True North Copper Managing Director, Marty Costello said:

We are thrilled to share these outstanding results from our recent Vero drilling program. The intersections in MOXD225 reveal remarkably high-grade copper and cobalt lenses, with two intersections impressively both returning over 100 Cu% m (downhole width by copper grade).

We are in the process of constructing a new geological model that will inform Vero Resource re-estimation and advance ongoing mining studies. Metallurgical sampling and test program design is also progressing as we continue to maximise the Mt Oxide Project’s highly prospective potential.

Assay results continue to confirm the Vero Resource’s phenomenal mineralisation. However, we are also committed to strategic exploration across the entire Mt Oxide Project and identifying other high-grade copper, cobalt and silver deposits.

We look forward to updating our shareholders with the remaining assay results from the Vero Resource drilling program.

Summary of Drill Intersections

Drillholes MOXD222-225

MOXD222-225 were drilled in August and September 2023 (Figure 2) with the aim of extending the steeply dipping high grade breccia style mineralisation down dip and along strike as well as infilling the shallowly dipping stratiform replacement and stockwork vein style mineralisation at the Vero Copper-Silver-Cobalt Deposit (15.98 Mt at 1.43% Cu and 6.91 g/t Ag total combined Measured, Indicated, and Inferred resource and a separate 9.15 Mt at 0.23% Co total combined Measured, Indicated, and Inferred resource2).

Intercepts from MOXD223, MOXD224 and MOXD225 confirm the grade and tenor of the shallow flat lying mineralisation and intercepts from MOXD225 have infilled the steep mineralisation at an approximately 25m spacing (Table 1). These intercepts will likely have a positive impact on the confidence and contained metal in future resource estimates.

MOXD226A – final drillhole of Vero Resource drilling program

Assay results from the final hole in TNCs initial drilling program at the Vero Resource MOXD226A, which also intercepted exceptional visual copper mineralisation1, are expected in late November. Visual estimates (as previously announced 23 October 20231) from MOXD226A include:

- 70.75m* from 224.55m consisting of four sub domains highlights include:

- 19.60m* from 224.55m with vis. est. of 2-3% chalcocite, 0.3% covellite and 6% pyrite

- 21.15m* from 244.15m with vis. est. of 1-2% chalcopyrite, 1% bornite, 0.5% chalcocite, 0.5% covellite and 4% pyrite

- 18.95m* from 276.35m with vis. est. of 2% chalcocite, 2% covellite, and 13% pyrite

- 8.15m* from 343.15m with vis. est. 4% chalcocite, 1% covellite, 1-2% pyrite

Vero Resource development priorities

Following receipt of final assays, 3D geological interpretation will commence to feed into future resource estimations. Metallurgical sampling and test program design has commenced. Surface geological and geochemical exploration is in planning stages and expected to commence Q4 2023.

Click here for the full ASX Release

This article includes content from True North Copper, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

TNC:AU

The Conversation (0)

11 October 2024

True North Copper

On the path to becoming Australia’s next responsible copper producer

On the path to becoming Australia’s next responsible copper producer Keep Reading...

06 February

Top 5 Canadian Mining Stocks This Week: Giant Mining Gains 70 Percent

Welcome to the Investing News Network's weekly look at the best-performing Canadian mining stocks on the TSX, TSXV and CSE, starting with a round-up of Canadian and US news impacting the resource sector.Statistics Canada released January’s jobs report on Friday (February 6). The data shows that... Keep Reading...

05 February

Top Australian Mining Stocks This Week: Solstice Minerals Soars on Strong Copper Drill Results

Welcome to the Investing News Network's weekly round-up of the top-performing mining stocks listed on the ASX, starting with news in Australia's resource sector.In global news, Australia took part in a ministerial meeting hosted by the US this week. The gathering was aimed at exploring a... Keep Reading...

04 February

Glencore Signs MOU with Orion Consortium on Potential US$9 Billion DRC Asset Deal

Glencore (LSE:GLEN,OTCPL:GLCNF) has entered into preliminary talks with a US-backed investment group over the potential sale of a major stake in two of its flagship copper and cobalt operations in the Democratic Republic of Congo (DRC).In a joint statement, Glencore and the Orion Critical... Keep Reading...

03 February

Drilling Ramping-up Following Oversubscribed Fundraise

Critical Mineral Resources plc (“CMR”, “Company”) is pleased to report that following the recently completed and heavily oversubscribed fundraise, diamond drilling with two rigs is ramping-up over the coming weeks as the weather improves. Drilling during H1 is designed to produce Agadir... Keep Reading...

02 February

Rick Rule: Oil/Gas Move is Inevitable, but Copper is Next Bull Market

Rick Rule, proprietor at Rule Investment Media, is positioning in the oil and gas sector, but thinks a bull market is two or two and a half years away. In his view, copper is likely to be the next commodity to begin a bull run.Click here to register for the Rule Symposium. Don't forget to follow... Keep Reading...

02 February

BHP Expands 2026 Xplor Program with Record 10 Companies

Mining major BHP (ASX:BHP,NYSE:BHP,LSE:BHP) has named the early stage explorers selected for its 2026 Xplor program, expanding the intake to a record 10 companies.According to a Monday (February 2) press release, the latest cohort is the largest since the initiative launched in 2023, surpassing... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Trading Halt

11h

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00