TSX.V: TORC OTCQB: TORCF

TinOne Resources Inc. (TSXV: TORC) (OTCQB: TORCF) (" TinOne " or the " Company ") is pleased to announce it has completed its Phase 1 drill program at its Great Pyramid Tin (Sn) Project (" Great Pyramid " or the " Project ") located in the tier one mining jurisdiction of Tasmania, Australia .

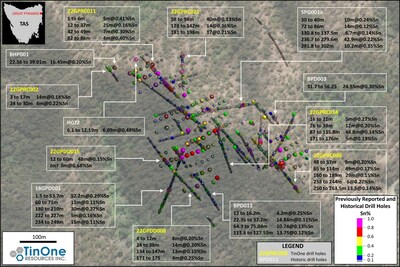

Drilling has now concluded with a total of 4,687 metres completed and data compilation and modelling are underway. The program has been successful in continuing to define significant tin mineralization near surface, at depth and adjacent to historical drilling.

Highlights

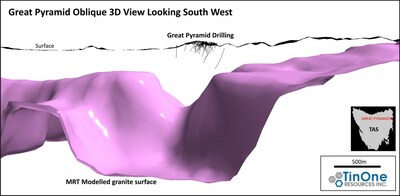

- Great Pyramid mineralization extended to approximately 380 metres below surface.

- Interpreted granite source not encountered, therefore mineralization remains entirely open at depth.

- Mineral Resources Tasmania geophysical modelling interprets granite at depth below Great Pyramid in the range of 700 – 1300 metres.

- Mineralization remains open in all directions laterally.

- Integrated stratigraphic-structural model being developed to assist numeric modelling.

"We are very pleased to have completed our Great Pyramid Phase 1 drill program safely and within budget," commented Chris Donaldson , Executive Chairman. "The results of the program have been outstanding in delivering consistent tin intersections from within the area of historical activity and, importantly, outside this area. These results and geological interpretation indicate that the Great Pyramid system is of significant scale and has only been partially tested, to date. Our geological team is developing its detailed interpretation and will be using this information to plan our next phases of drilling which will be focussed on fully testing the system."

Key Results

The 2022 program was designed to:

- Test the depth and lateral dimensions of mineralization within the vicinity of the historical drilling and resource estimate;

- Obtain grade and continuity data utilising modern drill and analytical techniques, within the area of the historic exploration activity; and

- Test a large-scale IP chargeability anomaly adjacent to the historic resource.

Tables 1 and 2 present full results from the 2022 program and compiled results from all historical drilling known from the Great Pyramid area. The tables show that the 2022 program returned results in line with historical data and includes outstanding intersections of higher grade such as:

- 22GPRC012 78 metres @0.51% Sn (see Company news release September 06, 2022 )

- 22GPRC016 51 metres @0.29% Sn (see Company news release September 06, 2022 )

- 22GPRC021 14 metres @0.36% Sn (see Company news release January 18, 2023 )

- 22GPRC022 15 metres @0.45% Sn (see Company news release October 11, 2022 ).

The 2022 Great Pyramid drill program was highly successful in confirming the presence and tenor of significant tin mineralization in the area of historical drilling activity and historical resource estimate. Weighted average tin grade for all 2022 recorded intersections 1 was 0.23% Sn which is in accord with historical drill data (Tables 1 and 2).

In addition, the program successfully defined significant mineralization at depth below the historical resource estimate in the area of sparse historical drilling. Highlights at depth included:

- 22GPRC003 (see Company news release November 22, 2022 )

- 18 metres @0.31% Sn from 308 metres downhole

- 5.4 metres @0.46% Sn from 330.6 metres downhole

- 13 metres @0.22% Sn from 359 metres downhole

- 22GPRC006 (see Company news release September 06, 2022 )

- 49 metres @0.17% Sn from 65 metres downhole

- Including 8 metres @0.3% Sn from 86 metres downhole

These TinOne drill holes and the historical data have not defined the lower limit of the system, which remains entirely open at depth.

A relatively minor component of the program was directed to testing the lateral extent of mineralization due to access, with the network of historical drill access tracks being utilized to obtain a more cost effective drill program for this first round of drilling. However, despite this, the program has also delivered significant results laterally away from the historical drilling and resource estimate, with highlights including:

- 22GPRC021 (see Company news release January 18, 2023 )

- 40 metres @0.13% Sn from 58 metres downhole

- 14 metres @0.36% Sn from 128 metres downhole

- 17 metres @0.21% Sn from 181 metres downhole

- 22GPRC002 (see Company news release June 29, 2022 )

- 14 metres @0.18% Sn from 3 metres downhole

- 6 metres @0.22% Sn from 24 metres downhole

These drill holes and historical drill data have not defined the lateral limits of the Great Pyramid system, which remains open laterally in all directions (Figure 2).

| _____________________________ |

| 1 See Table 1 and 2 notes for parameters. |

| |

Three drill holes (22GPDD010, 22GPRC018A, 22GPRC019, 22GPDD023) were drilled (for a total of 1275.9 metres) to test IP chargeability anomalies to the northeast and east of the area of historical exploration activity. These holes intersected sedimentary rocks of the Mathinna Supergroup with strong hornfels effects at depth and variable amounts of pyrite (interpreted to be both diagenetic and hydrothermal) and minor base metal sulphides. No significant tin mineralization was encountered. The chargeability anomalies may be explained by the presence of pyrite, however more detailed analysis, including petrophysical property measurements, will be undertaken and integration into the broader Great Pyramid geological model undertaken.

Geological Interpretation

The tin systems of northeastern Tasmania are regarded as classical examples of granite-related tin-polymetallic systems (Taylor, R.G. 1979, The geology of tin deposits ). Well known systems such as Anchor (Taheri and Bottrill, 2005, Devonian granites and associated mineralization in northeast and northwest Tasmania ), Aberfoyle 2 , Lutwyche 2, Story's Creek 2 , Rex Hill 2 (see TinOne news release July 07, 2022 ) and Royal George 2 are hosted in or directly associated with Devonian granites of the S-type alkali feldspar suite and it is generally regarded that the granites are the source of hydrothermal fluids and metals for formation of the systems. In the Aberfoyle , Lutwyche and Story's Creek systems, the bulk of mineralization is hosted in Mathinna Supergroup sedimentary rocks above the granite body, with deeper mining levels and drilling demonstrating the connection. In these systems a clear zoning from tin-rich at higher levels above the granite zoning downward to higher tungsten content adjacent to and within the granite. The Aberfoyle system is known over a vertical extent of in excess of 300 metres.

It is highly significant that in most respects (mineralogy, metal association, alteration character), the Great Pyramid system conforms to the granite-related model, yet no granite has yet been encountered in the project area.

Mineral Resources Tasmania (MRT) developed an integrated geophysical and geological model for the Scamander Mineral Field, including Great Pyramid (Scamander 3D geological and geophysical model). The Great Pyramid system occurs on a steep gradient ("shoulder") in the MRT model, and the model estimated that the upper granite surface exists at between 700 and 1300 metres below the Great Pyramid system (Figure 3).

( https://www.mrt.tas.gov.au/geoscience/3d_geological_and_geophysical_modelling/scamander_3d_geological_and_geophysical_modelling ).

The TinOne 2022 drill program provided support for this model and the granite association of the Great Pyramid system with the key evidence being the consistent presence in deeper holes of spotted hornfels 3 . However, despite drilling to depths of almost 400 metres below surface, no granite has yet been encountered at Great Pyramid. In the other Mathinna Supergroup hosted systems in Tasmania (e.g. Aberfoyle , Lutwyche, Story's Creek), mineralization continues to the granite contact and also within the granite. By comparison (and in context of the MRT model and observed geology), it can be interpreted that the Great Pyramid system may extend for a significant distance below current drill levels and potentially continue into the interpreted underlying granite.

| ____________________________ |

| 3 Hornfels – a contact metamorphic rock formed by the heating of sedimentary (or other) rocks by the intrusion of a magma, including granite. |

| |

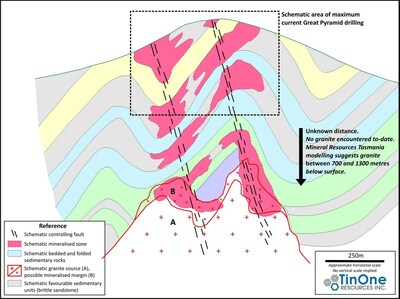

The mineralization encountered to date at Great Pyramid is interpreted to have two inter-related control mechanisms (Figure 4).

- Structure - north easterly striking, steeply dipping structures (TinOne observations, historical exploration reports by Aberfoyle Ltd and BHP Ltd) that transect the sedimentary package and are interpreted to have acted as conduits for mineralizing hydrothermal fluids arising from the granite at depth.

- Sedimentary rock type - not all of the sedimentary sequence is equally favourable for the production of elevated tin grades and therefore certain units are more strongly mineralized. These units tend to be the more quartz-rich sandstone parts of the sequence and it is interpreted that their brittle fracture patterns within the favourable structural domains promotes mineralization. A challenge is that the Mathinna Supergroup sedimentary rocks were strongly folded at a time before intrusion of the granite magma and formation of the related mineralization.

The interaction of the folded sedimentary geometries, structural zones and interpreted granite is schematically shown in Figure 4. The figure highlights the potential geometries and relationships expected at Great Pyramid and illustrates why in some places the mineralization is more laterally continuous than in other places. The figure also illustrates that, based on knowledge from other deposits in northeastern Tasmania , mineralization could be expected to continue in favourable host rocks into the interpreted granite contact.

Next Steps

With the successful completion of the Phase 1 drill program, the TinOne technical team has significantly advanced its understanding of the Great Pyramid system and focus has now shifted to interpretation and integration of the various data sets. This interpretation and modelling phase will develop an understanding of the inter-related controls discussed above and guide more efficient targeting of additional drilling and future resource estimation.

TinOne has engaged a PhD-trained expert in the structural geology of northeastern Tasmania and a PhD-trained expert sedimentologist to work together with the TinOne team and an external resource geologist to develop an integrated structural-sedimentological-geostatistical model. This model will inform additional drilling, principally targeting lateral extensions and a resource estimation at the appropriate time.

Table 1: TinOne Resources Great Pyramid RC and core drill results.

| Hole | Intersection | From | Sn | Comments |

| 22GPDD001A | 23 | 0 | 0.23 | Diamond cored hole. Inside historical resource area |

| | 26 | 29 | 0.22 | Diamond cored hole. Inside historical resource area |

| | 11 | 61 | 0.45 | Diamond cored hole. Inside historical resource area |

| | 8 | 120 | 0.28 | Diamond cored hole. Inside historical resource area |

| | 5 | 148 | 0.38 | Diamond cored hole. Below historical resource area |

| 22GPRC002 | 14 | 3 | 0.18 | Outside historical resource area |

| | 6 | 24 | 0.22 | Outside historical resource area |

| 22GPRC003 | 39 | 3 | 0.25 | Inside historical resource area |

| Incl | 16 | 18 | 0.34 | |

| | 18 | 308 | 0.31 | Diamond tail. Below historical resource area |

| | 5.4 | 330.6 | 0.46 | Diamond tail. Below historical resource area |

| | 13 | 359 | 0.22 | Diamond tail. Below historical resource area |

| | 14.1 | 379.15 | 0.15 | Diamond tail. Below historical resource area |

| | 6.2 | 398.8 | 0.12 | Diamond tail. Below historical resource area |

| | 7.15 | 420.85 | 0.16 | Diamond tail. Below historical resource area |

| 22GPRC004 | 17 | 41 | 0.13 | Outside historical resource area |

| | 8 | 243 | 0.15 | Diamond tail. Below historical resource area |

| 22GPRC005 | 30 | 8 | 0.26 | Inside historical resource area |

| | 23 | 64 | 0.12 | Below historical resource area |

| 22GPRC006 | 9 | 48 | 0.20 | Below historical resource area |

| Incl | 8 | 86 | 0.30 | |

| | 49 | 65 | 0.17 | Diamond tail. Below historical resource area |

| | 29 | 160 | 0.15 | Diamond tail. Below historical resource area |

| | 6 | 238 | 0.27 | Diamond tail. Below historical resource area |

| | 13.5 | 250 | 0.14 | Diamond tail. Below historical resource area. To end of hole |

| 22GPRC007 | 21 | 2 | 0.30 | Inside historical resource area, to end of hole, abandoned in |

| 22GPDD008 | 8 | 4 | 0.20 | Diamond cored hole. Inside historical resource area |

| | 14 | 24 | 0.20 | Diamond cored hole. Inside historical resource area |

| | 13 | 134 | 0.15 | Diamond cored hole. Outside historical resource area |

| | 4 | 171 | 0.25 | Diamond cored hole. Outside historical resource area |

| 22GPRC009 | | | | No significant mineralization |

| 22GPDD010 | | | | Diamond cored hole. No assayed returned yet |

| 22GPRC011 | 5 | 1 | 0.41 | Predominantly outside historical resource area |

| | 25 | 12 | 0.16 | Predominantly outside historical resource area |

| | 7 | 42 | 0.30 | Predominantly outside historical resource area |

| | 4 | 82 | 0.40 | Predominantly outside historical resource area |

| 22GPRC012 | 78 | 11 | 0.51 | Predominantly outside historical resource area |

| Incl | 23 | 34 | 1.09 | Outside historical resource area |

| | 8 | 122 | 0.27 | Outside historical resource area |

| 22GPRC013 | 20 | 3 | 0.14 | Inside historical resource area |

| | 14 | 36 | 0.16 | Below historical resource area |

| | 6 | 105 | 0.13 | Below historical resource area |

| 22GPRC014 | 5 | 16 | 0.27 | Inside historical resource area |

| | 12 | 26 | 0.20 | Inside historical resource area |

| | 48.8 | 87 | 0.14 | Outside historical resource area. Part RC, part diamond tail |

| | 5 | 171 | 0.13 | Diamond tail. Outside historical resource area |

| 22GPDD015 | 48 | 12 | 0.15 | Diamond hole. Predominantly within historical resource area |

| Incl | 3 | 34 | 0.68 | |

| 22GPRC016 | 51 | 2 | 0.29 | Inside historical resource area |

| Incl | 20 | 4 | 0.43 | |

| 22GPRC017 | 9 | 39 | 0.20 | Outside historical resource area |

| | 11 | 66 | 0.10 | Outside historical resource area |

| 22GPRC018A | | | | No significant assays – diamond tail yet to be assayed |

| 22GPRC019 | | | | No significant assays |

| 22GPRC021 | 40 | 58 | 0.13 | Outside historical resource area |

| | 14 | 128 | 0.36 | Outside historical resource area. Part RC, part diamond tail |

| | 17 | 181 | 0.21 | Outside historical resource area |

| 22GPRC022 | 15 | 22 | 0.45 | Inside historical resource area, to end of hole, abandoned in |

| 22GPDD023 | | | | Diamond cored hole. No significant results. Only partially |

| 22GPRC024 | 21 | 16 | 0.22 | Inside historical resource area |

| | 14 | 47 | 0.10 | Inside historical resource area |

| |

| NOTES: All intersections are calculated with a cut-off grade of 0.1% Sn with maximum consecutive internal waste of 4 metres. |

| All intersections are downhole widths, true widths are uncertain. |

| TinOne drill hole numbering is in the form 22GPRCXXX for reverse circulation ( RC) holes and 22GPRDDXXX for diamond holes with numbering allocated in sequence. |

| Analytical results have been received for holes 22GPRC002, 003, 004, 005, 006, 007, 009, 011, 012, 013, 014, 016, 017, 018A, 019, 021, 022 and 024. Hole 22GPRC020 failed at 12 metres and was not assayed. The target area for this hole was drilled by 22GPRC021. |

| Diamond holes completed to-date and with assays pending are 22GPDD10 and 22GPDD023 (Part). Diamond tail extensions have been completed for RC pre-collar holes 22GPRC003, 22GPRC004, 22GPRC005, 22GPRC006, 22GPRC014 and 22GPRC021 with assays pending for 22GPRC018A. |

| |

Table 2: Great Pyramid historical drill results.

| Hole | Intersection | From | Sn | Year | Company | Comments |

| 18GPD001 | 52.2 | 1.5 | 0.29 | 2018 | TNT Mines Ltd | Diamond hole |

| | 11 | 60 | 0.11 | | | |

| | 30 | 180 | 0.27 | | | |

| | 15 | 234 | 0.11 | | | |

| BHP001 | 16.45 | 22.56 | 0.20 | 1965 | BHP | Percussion hole |

| BHP002 | 15.24 | 0 | 0.22 | 1965 | BHP | Percussion hole |

| | 10.98 | 24.38 | 0.12 | 1965 | BHP | |

| BHP005 | 16.46 | 4.27 | 0.12 | 1965 | BHP | Percussion hole |

| BHP006 | 3.66 | 29.87 | 0.47 | 1965 | BHP | Percussion hole |

| BHP007 | 34.75 | 0.61 | 0.25 | 1965 | BHP | Percussion hole |

| BHP008 | 14.63 | 20.73 | 0.15 | 1965 | BHP | Percussion hole |

| BHP011 | 17.07 | 0 | 0.23 | 1965 | BHP | Percussion hole |

| BHP013 | 13.41 | 0 | 0.22 | 1965 | BHP | Percussion hole |

| BHP014 | 49.38 | 9.75 | 0.14 | 1965 | BHP | Percussion hole |

| BHP015 | 6.1 | 0 | 0.34 | 1965 | BHP | Percussion hole |

| | 9.15 | 13.41 | 0.19 | 1965 | BHP | |

| BHP020 | 32.11 | 6.9 | 0.36 | 1965 | BHP | Percussion hole |

| BHP026 | 29.26 | 11.58 | 0.17 | 1965 | BHP | Percussion hole |

| BPD001 | 39.4 | 15.7 | 0.15 | 1980 | BHP | Diamond hole |

| BPD002b | 28 | 0 | 0.21 | 1980 | BHP | Percussion hole |

| BPD003 | 24.55 | 31.7 | 0.30 | 1981 | BHP | Diamond hole |

| BPD005 | 14.8 | 0 | 0.17 | 1981 | BHP | Diamond hole |

| BPD007 | 19 | 0 | 0.16 | 1981 | BHP | Diamond hole |

| | 38.61 | 66.25 | 0.30 | 1981 | BHP | |

| BPD009a | 26.65 | 21.75 | 0.18 | 1981 | BHP | Diamond hole |

| BPD009b | 14 | 4 | 0.53 | 1981 | BHP | Percussion hole |

| | 18 | 24 | 0.14 | 1981 | BHP | |

| BPD010 | 33.3 | 14.8 | 0.25 | 1981 | BHP | Diamond hole |

| BPD011 | 14.84 | 22.36 | 0.11 | 1981 | BHP | Diamond hole |

| | 10.74 | 64.3 | 0.13 | | | |

| | 13.75 | 113.8 | 0.12 | | | |

| DDS001 | 16.61 | 164.59 | 0.10 | 1965 | BHP | Diamond hole |

| GPY001 | 10.66 | 28.96 | 0.15 | 1970 | Aberfoyle Ltd | Diamond hole |

| GPY002 | 18.29 | 3.05 | 0.13 | 1970 | Aberfoyle Ltd | Diamond hole |

| | 24.38 | 45.72 | 0.21 | 1970 | Aberfoyle Ltd | |

| GPY003 | 28.95 | 10.67 | 0.43 | 1970 | Aberfoyle Ltd | Diamond hole |

| | 35.05 | 44.2 | 0.28 | | | |

| GPY005 | 56.39 | 0 | 0.27 | 1970 | Aberfoyle Ltd | Diamond hole |

| GPY006 | 44.2 | 0 | 0.39 | 1970 | Aberfoyle Ltd | Diamond hole |

| MD001 | 10.66 | 137.7 | 0.20 | 1976 | Tas. Mines Dept | Diamond hole |

| MD003 | 12 | 27.88 | 0.23 | 1977 | Tas. Mines Dept | Diamond hole |

| MD004 | 10.82 | 15.68 | 0.20 | 1978 | Tas. Mines Dept | Diamond hole |

| | 11.07 | 75.2 | 0.18 | | | |

| SPG1a | 10 | 30 | 0.24 | 1983 | Shell | Percussion with diamond tail from 121m |

| | 14 | 72 | 0.12 | | | |

| | 42.9 | 236.7 | 0.22 | | | |

| | 10.2 | 291.8 | 0.15 | | | |

| H001 | 16.84 | 4.5 | 0.31 | 1970 | Aberfoyle Ltd | Percussion hole |

| H002 | 10.67 | 12.19 | 0.14 | 1970 | Aberfoyle Ltd | Percussion hole |

| | 9.14 | 30.48 | 0.13 | 1970 | Aberfoyle Ltd | Percussion hole |

| H003 | 9.14 | 13.72 | 0.22 | 1970 | Aberfoyle Ltd | Percussion hole |

| H004 | 42.67 | 0 | 0.22 | 1970 | Aberfoyle Ltd | Percussion hole |

| H005 | 30.48 | 13.72 | 0.45 | 1970 | Aberfoyle Ltd | Percussion hole |

| H006 | 16.77 | 9.14 | 0.33 | 1970 | Aberfoyle Ltd | Percussion hole |

| H007 | 7.62 | 1.52 | 0.35 | 1970 | Aberfoyle Ltd | Percussion hole |

| | 30.48 | 15.24 | 0.16 | | | |

| H008 | 27.43 | 0 | 0.29 | 1970 | Aberfoyle Ltd | Percussion hole |

| | 13.72 | 32 | 0.25 | | | |

| H010 | 13.72 | 1.52 | 0.34 | 1970 | Aberfoyle Ltd | Percussion hole |

| | 10.67 | 32 | 0.11 | | | |

| H014 | 32.01 | 1.52 | 0.25 | 1970 | Aberfoyle Ltd | Percussion hole |

| H015 | 21.34 | 1.52 | 0.24 | 1970 | Aberfoyle Ltd | Percussion hole |

| H016 | 22.86 | 4.57 | 0.22 | 1970 | Aberfoyle Ltd | Percussion hole |

| H017 | 35.06 | 1.52 | 0.27 | 1970 | Aberfoyle Ltd | Percussion hole |

| H018 | 19.82 | 9.14 | 0.13 | 1970 | Aberfoyle Ltd | Percussion hole |

| H019 | 21.34 | 0 | 0.29 | 1970 | Aberfoyle Ltd | Percussion hole |

| H020 | 10.67 | 7.62 | 0.14 | 1970 | Aberfoyle Ltd | Percussion hole |

| | 12.19 | 22.86 | 0.41 | | | |

| H021 | 10.67 | 0 | 0.27 | 1970 | Aberfoyle Ltd | Percussion hole |

| | 16.77 | 19.81 | 0.15 | | | |

| H022 | 6.1 | 0 | 0.33 | 1970 | Aberfoyle Ltd | Percussion hole |

| | 15.24 | 12.19 | 0.17 | | | |

| H024 | 6.1 | 0 | 0.37 | 1970 | Aberfoyle Ltd | Percussion hole |

| | 22.86 | 10.67 | 0.21 | | | |

| H025 | 12.19 | 6.1 | 0.16 | 1970 | Aberfoyle Ltd | Percussion hole |

| H026 | 24.38 | 7.62 | 0.25 | 1970 | Aberfoyle Ltd | Percussion hole |

| H028 | 30.48 | 0 | 0.18 | 1970 | Aberfoyle Ltd | Percussion hole |

| H032 | 9.14 | 7.62 | 0.33 | 1970 | Aberfoyle Ltd | Percussion hole |

| H034 | 10.67 | 22.86 | 0.23 | 1970 | Aberfoyle Ltd | Percussion hole |

| H036 | 10.67 | 1.52 | 0.20 | 1970 | Aberfoyle Ltd | Percussion hole |

| H037 | 18.29 | 16.76 | 0.18 | 1970 | Aberfoyle Ltd | Percussion hole |

| H038 | 12.19 | 12.19 | 0.11 | 1970 | Aberfoyle Ltd | Percussion hole |

| H041 | 30.48 | 0 | 0.36 | 1970 | Aberfoyle Ltd | Percussion hole |

| H042 | 36.58 | 0 | 0.26 | 1970 | Aberfoyle Ltd | Percussion hole |

| H043 | 28.96 | 0 | 0.39 | 1970 | Aberfoyle Ltd | Percussion hole |

| H044 | 24.38 | 0 | 0.39 | 1970 | Aberfoyle Ltd | Percussion hole |

| H045 | 15.24 | 1.52 | 0.18 | 1970 | Aberfoyle Ltd | Percussion hole |

| H046 | 16.77 | 4.57 | 0.27 | 1970 | Aberfoyle Ltd | Percussion hole |

| H047 | 6.09 | 3.05 | 0.34 | 1970 | Aberfoyle Ltd | Percussion hole |

| H049 | 15.24 | 1.52 | 0.14 | 1970 | Aberfoyle Ltd | Percussion hole |

| | 9.14 | 30.48 | 0.14 | | | |

| H051 | 27.44 | 1.52 | 0.49 | 1970 | Aberfoyle Ltd | Percussion hole |

| H052 | 22.86 | 1.52 | 0.33 | 1970 | Aberfoyle Ltd | Percussion hole |

| H053 | 9.15 | 4.57 | 0.27 | 1970 | Aberfoyle Ltd | Percussion hole |

| | 4.57 | 18.29 | 0.58 | | | |

| H054 | 24.39 | 4.57 | 0.72 | 1970 | Aberfoyle Ltd | Percussion hole |

| H055 | 25.91 | 1.52 | 0.37 | 1970 | Aberfoyle Ltd | Percussion hole |

| H056 | 24.38 | 6.1 | 0.34 | 1970 | Aberfoyle Ltd | Percussion hole |

| H057 | 10.67 | 7.62 | 0.13 | 1970 | Aberfoyle Ltd | Percussion hole |

| H061 | 12.2 | 1.52 | 0.18 | 1970 | Aberfoyle Ltd | Percussion hole |

| H062 | 32.01 | 12.19 | 0.18 | 1970 | Aberfoyle Ltd | Percussion hole |

| H063 | 7.62 | 3.05 | 0.39 | 1970 | Aberfoyle Ltd | Percussion hole |

| | 10.67 | 22.86 | 0.16 | | | |

| H064 | 9.14 | 3.05 | 0.34 | 1970 | Aberfoyle Ltd | Percussion hole |

| H065 | 9.15 | 27.43 | 0.42 | 1970 | Aberfoyle Ltd | Percussion hole |

| H066 | 24.39 | 1.52 | 0.25 | 1970 | Aberfoyle Ltd | Percussion hole |

| H068 | 12.19 | 10.67 | 0.23 | 1970 | Aberfoyle Ltd | Percussion hole |

| H069 | 10.67 | 24.38 | 0.19 | 1970 | Aberfoyle Ltd | Percussion hole |

| H072 | 6.09 | 6.1 | 0.48 | 1970 | Aberfoyle Ltd | Percussion hole |

| H080 | 10.67 | 1.52 | 0.31 | 1970 | Aberfoyle Ltd | Percussion hole |

| H081 | 27.43 | 6.1 | 0.15 | 1970 | Aberfoyle Ltd | Percussion hole |

| H082 | 25.91 | 15.24 | 0.34 | 1970 | Aberfoyle Ltd | Percussion hole |

| H087 | 16.77 | 12.19 | 0.13 | 1970 | Aberfoyle Ltd | Percussion hole |

| H092 | 10.67 | 4.57 | 0.13 | 1970 | Aberfoyle Ltd | Percussion hole |

| H095 | 16.76 | 15.24 | 0.13 | 1970 | Aberfoyle Ltd | Percussion hole |

| H096 | 10.66 | 13.72 | 0.22 | 1970 | Aberfoyle Ltd | Percussion hole |

| H097 | 6.09 | 21.34 | 1.23 | 1970 | Aberfoyle Ltd | Percussion hole |

| H102 | 10.67 | 3.05 | 0.23 | 1970 | Aberfoyle Ltd | Percussion hole |

| H103 | 18.29 | 1.52 | 0.64 | 1970 | Aberfoyle Ltd | Percussion hole |

| H105 | 9.15 | 9.14 | 0.35 | 1970 | Aberfoyle Ltd | Percussion hole |

| | 10.66 | 28.96 | 0.18 | | | |

| H107 | 10.67 | 24.38 | 0.12 | 1970 | Aberfoyle Ltd | Percussion hole |

| H108 | 21.34 | 4.57 | 0.18 | 1970 | Aberfoyle Ltd | Percussion hole |

| | 12.19 | 30.48 | 0.15 | | | |

| H109 | 10.67 | 3.05 | 0.20 | 1970 | Aberfoyle Ltd | Percussion hole |

| H111 | 10.67 | 10.67 | 0.86 | 1970 | Aberfoyle Ltd | Percussion hole |

| | 9.15 | 27.43 | 0.21 | | | |

| H114 | 13.72 | 19.81 | 0.19 | 1970 | Aberfoyle Ltd | Percussion hole |

| H122 | 27.43 | 3.05 | 0.26 | 1970 | Aberfoyle Ltd | Percussion hole |

| H123b | 39.62 | 3.05 | 0.27 | 1970 | Aberfoyle Ltd | Percussion hole |

| H124 | 10.67 | 25.91 | 0.19 | 1970 | Aberfoyle Ltd | Percussion hole |

| H126 | 7.62 | 21.34 | 0.45 | 1970 | Aberfoyle Ltd | Percussion hole |

| H128 | 9.14 | 3.05 | 0.27 | 1970 | Aberfoyle Ltd | Percussion hole |

| H130 | 10.67 | 15.24 | 0.23 | 1970 | Aberfoyle Ltd | Percussion hole |

| | 9.14 | 30.48 | 0.15 | | | |

| H131 | 10.67 | 3.05 | 0.43 | 1970 | Aberfoyle Ltd | Percussion hole |

| H132 | 27.43 | 6.1 | 0.22 | 1970 | Aberfoyle Ltd | Percussion hole |

| H135 | 10.66 | 21.34 | 0.14 | 1970 | Aberfoyle Ltd | Percussion hole |

| |

| NOTES: All intersections are calculated with a cut-off grade of 0.1% Sn with maximum consecutive internal waste of 4 metres. |

| All intersections are downhole widths, true widths are uncertain. |

| |

| 18GPD001 analyzed by lithium borate fusion ICP-MS or XRF. |

| BHP*** series holes analyzed at an unknown laboratory by unknown method. |

| BPD*** series holes analyzed at ALS Brisbane by XRF. |

| DDS001 analysed at BHP Newcastle, method unknown. |

| GPY*** series holes analyzed at the Aberfoyle Mine laboratory at Rossarden, method unknown. |

| MD*** series holes analyzed at Tasmania Mine Department laboratory in Launceston, method unknown. |

| SPG1a analysed at Comlabs, method unknown. |

| H*** series holes analyzed at the Aberfoyle Mine laboratory at Rossarden, method unknown. |

| |

| The reader is cautioned that the historical drill results are based on prior data and reports prepared by previous property owners. The reader is cautioned not to treat them, or any part of them, as current and that a qualified person has not done sufficient work to verify the results and that they may not form a reliable guide to future results. Specifically, in most cases, analytical techniques are not known and no QA/QC protocols are known for most drill holes and as such analytical results may be unreliable. Drill core from historic diamond drill holes DDS001, BPD001, BPD003, BPD005, BPD007, BPD009A, BPD010, BPD011, GPY001, GPY002, GPY003, GPY004, GPY006, MD001, MD003, MD004, SPG1A and 18GPD001 is available in the Mineral Resources Tasmania drill core storage facility for viewing and limited sampling. |

| |

About the Great Pyramid Tin Project

Geological Setting

The Great Pyramid deposit is located around a topographical feature known as Pyramid Hill and is hosted by Silurian to Devonian Mathinna Supergroup sandstones. The mineralization is formed by closely spaced sheeted northeast trending, cassiterite (SnO₂) bearing veins associated with silicification and sericite-pyrite alteration. The deposit style and regional comparisons suggest that a tin-fertile granite exists at depth below the deposit, however this has not been encountered in drilling and the deposit is open at depth. Geological interpretation indicates that certain sedimentary units within the folded Mathinna Supergroup sediments are more favourable hosts and diamond drilling being undertaken by the Company during the current campaign, combined with numerical modelling, will assist in developing a deeper understanding of controls on grade for follow-up drilling.

The deposit is currently known over a strike length of more than 500 metres with an average width of approximately 150 metres. The depth extent of the deposit is unknown with only nine historical drill holes greater than 150 metres deep. These rare deeper holes encountered encouraging tin mineralization to depths of approximately 300 metres below surface 2 .

Historic Resources and Drill Data 1

A historical mineral resource estimate was completed on the Great Pyramid Project (the " Historical Estimate ") for TNT Mines Ltd. 1,2,3,4,5 (Table 2).

Table 2: Historical Estimate on the Great Pyramid Project 1,2,3,4,5

| Great Pyramid Inferred Mineral Resource - JORC 2012 | |||

| Sn% CUT OFF | TONNES (Mt) | GRADE (Sn%) | CONTAINED TIN (kt) |

| 0.1 | 5.2 | 0.2 | 10.4 |

| |

| NOTES |

| 1. Source: "Inferred Mineral Resource for the Great Pyramid Tin Deposit in Tasmania, Abbott, 2014" prepared by Jonathon Abbott of MPR for Niuminco Group Ltd. The effective date for the Historical Estimate is February 26, 2014. |

| 2. The Historical Estimate was prepared using the 2012 Australasian Joint Ore Reserves Committee Code (JORC). The Historical Estimate was not completed using CIM Definition Standards on Mineral Resources and Reserves and is not supported by a technical report completed in accordance with National Instrument 43-101. |

| 3. The estimation of the Historical Estimate utilized close spaced historic percussion (~85%) and lesser diamond drill holes with drill spacing in the estimation area typically 15 x 30m and locally closer. The Inferred Resource was estimated using Multiple Indicator Kriging method of 1.5 metre down-hole composites within a mineralized domain interpreted from tin grade. Continuity of tin grades was characterised by indicator variograms at 14 indicator thresholds. The estimates are extrapolated a maximum of approximately 30 metres from drilling. Gemcom software was used for data compilation, domain wireframing, and coding of composite values, and GS3M was used for resource estimation. Resources were estimated into 15 by 30 by 3 m blocks (across strike, strike, vertical) aligned with the 067o trending drilling grid. Planview dimensions of the blocks approximate average drill hole spacing. For precise volume representation, resource estimates include the proportion of block volumes within the mineralized domain below surface. The modelling included a three-pass octant-based search strategy. Search ellipsoid radii (across strike, along strike, vertical) and minimum data requirements for these searches were: Search 1: 20 by 20 by 4 m (16 data), Search 2: 30 by 30 by 6 m (16 data), Search 3:30 by 30 by 6 (8 data). Model validation included visual comparison of model estimates and composite grades, and trend (swath) plots, along with comparison with estimates from alternative estimation methodologies and previous model estimates. The Historical Estimate is restricted to the area of close spaced drilling and 90% of the resource occurs within 40 metres of surface. Although the limited deeper drilling has encountered mineralized material this was not included in the Historical Estimate. The mineralized domain wireframe used to constrain the estimates was primarily interpreted on the basis of tin assay grades and restricts estimates to the volume tested by reasonably close spaced drilling. The wireframe was trimmed by the cross-cutting dyke and soil units interpreted from drill hole logging and geological mapping. Investigation of alternative interpretations included resource estimation with assumed dominant mineralization controls varying from flat lying to steeply west dipping. These models did not give significantly different total estimates. |

| 4. The reader is cautioned that the Historical Estimate is considered historical in nature and as such, is based on prior data and reports prepared by previous property owners. The reader is cautioned not to treat them, or any part of them, as current mineral resources or reserves. A qualified person has not done sufficient work to classify the Historical Estimates as current resources and TinOne is not treating the Historical Estimates as current resources. Significant data compilation, re-drilling, re-sampling and data verification may be required by a qualified person before the Historical Estimates can be classified as a current resource. There can be no assurance that any of the historical mineral resources, in whole or in part, will ever become economically viable. In addition, mineral resources are not mineral reserves and do not have demonstrated economic viability. Even if classified as a current resource, there is no certainty as to whether further exploration will result in any inferred mineral resources being upgraded to an indicated or measured mineral resource category. |

| 5. The Company has determined that the Historical Estimate is reliable, and relevant to be included here because it was estimated using close spaced drilling with modern geostatistical methods and software by an experienced resource geologist and provides a guide to the location of the Great Pyramid mineralized zone. This will be used to assist in targeting drilling to undertake testing of the extent and grade of the mineralized system. |

| |

Quality Assurance / Quality Control

Drill core and RC samples were shipped to ALS Limited in Brisbane, Australia for sample preparation and for analysis. The ALS Brisbane facilities are ISO 9001 and ISO/IEC 17025 certified. Tin and tungsten are analysed by ICP-MS following lithium borate fusion (ALS method ME-MS85), overlimit results are reanalysed by XRF (ALS method XRF15b). Forty-eight element multi-element analyses are conducted by ICP-MS with a four-acid digestion (ALS method ME-MS61).

Control samples comprising certified reference samples, duplicates and blank samples were systematically inserted into the sample stream and analyzed as part of the Company's quality assurance / quality control protocol.

About TinOne

TinOne is a TSX Venture Exchange listed Canadian public company with a high-quality portfolio of tin projects in the Tier 1 mining jurisdictions of Tasmania and New South Wales, Australia . The Company is focussed on advancing its highly prospective portfolio while also evaluating additional tin opportunities. TinOne is supported by Inventa Capital Corp.

Qualified Person

The Company's disclosure of technical or scientific information in this press release has been reviewed and approved by Dr. Stuart Smith ., Technical Advisor for TinOne. Dr. Smith is a Qualified Person as defined under the terms of National Instrument 43-101.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SPECIAL NOTE REGARDING FORWARD LOOKING STATEMENTS

This news release includes certain "Forward–Looking Statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and "forward–looking information" under applicable Canadian securities laws. When used in this news release, the words "anticipate", "believe", "estimate", "expect", "target", "plan", "forecast", "may", "would", "could", "schedule" and similar words or expressions, identify forward–looking statements or information. These forward–looking statements or information relate to, among other things: the development of the Company's projects, including drilling programs; and future mineral exploration, development and production.

Forward–looking statements and forward–looking information relating to any future mineral production, liquidity, enhanced value and capital markets profile of TinOne, future growth potential for TinOne and its business, and future exploration plans are based on management's reasonable assumptions, estimates, expectations, analyses and opinions, which are based on management's experience and perception of trends, current conditions and expected developments, and other factors that management believes are relevant and reasonable in the circumstances, but which may prove to be incorrect. Assumptions have been made regarding, among other things, the price of gold and other metals; no escalation in the severity of the COVID-19 pandemic; costs of exploration and development; the estimated costs of development of exploration projects; TinOne's ability to operate in a safe and effective manner and its ability to obtain financing on reasonable terms.

These statements reflect TinOne's respective current views with respect to future events and are necessarily based upon a number of other assumptions and estimates that, while considered reasonable by management, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward–looking statements or forward-looking information and TinOne has made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation: the Company's dependence on early stage mineral projects; metal price volatility; risks associated with the conduct of the Company's mining activities in Australia ; regulatory, consent or permitting delays; risks relating to reliance on the Company's management team and outside contractors; risks regarding mineral resources and reserves; the Company's inability to obtain insurance to cover all risks, on a commercially reasonable basis or at all; currency fluctuations; risks regarding the failure to generate sufficient cash flow from operations; risks relating to project financing and equity issuances; risks and unknowns inherent in all mining projects, including the inaccuracy of reserves and resources, metallurgical recoveries and capital and operating costs of such projects; contests over title to properties, particularly title to undeveloped properties; laws and regulations governing the environment, health and safety; the ability of the communities in which the Company operates to manage and cope with the implications of COVID-19; the economic and financial implications of COVID-19 to the Company; operating or technical difficulties in connection with mining or development activities; employee relations, labour unrest or unavailability; the Company's interactions with surrounding communities and artisanal miners; the Company's ability to successfully integrate acquired assets; the speculative nature of exploration and development, including the risks of diminishing quantities or grades of reserves; stock market volatility; conflicts of interest among certain directors and officers; lack of liquidity for shareholders of the Company; litigation risk; and the factors identified under the caption "Risk Factors" in TinOne's management discussion and analysis and other public disclosure documents. Readers are cautioned against attributing undue certainty to forward–looking statements or forward-looking information. Although TinOne has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be anticipated, estimated or intended. TinOne does not intend, and does not assume any obligation, to update these forward–looking statements or forward-looking information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements or information, other than as required by applicable

SOURCE TinOne Resources Corp.

![]() View original content to download multimedia: https://www.newswire.ca/en/releases/archive/February2023/02/c4415.html

View original content to download multimedia: https://www.newswire.ca/en/releases/archive/February2023/02/c4415.html