Tinka Resources Limited ("Tinka" or the "Company") (TSXV:TK)(BVL:TK)(OTCQB:TKRFF) is pleased to announce results for five holes in the Company's ongoing 2022 drill program at the Ayawilca project in Central Peru. Results reported are for three resource extension holes at South Ayawilca (A22-192, 194 and 195), and two exploration holes at Central Ayawilca (A22-190 and 191). Results are pending for two holes (A22-193 and 196) and the eighth drill hole in the program, A22-197, is in progress. Approximately 10 to 12 more drill holes are planned in the zinc resource definition program

Drill hole A22-195 returned very high-grade zinc results (6 metres grading 18.8% zinc) within a repeated section of favourable limestone, approximately 10 metres below the main contact with the basement phyllite. This high-grade zinc discovery is expected to extend the Zinc Zone indicated resource at South Ayawilca by around 60 metres to the northeast, with mineralization remaining open in that direction. Previous holes in the vicinity may have been stopped prematurely and did not test the lateral continuity of the repeated limestone in the basement.

In another positive development for the program, strong tin-copper mineralization was also intersected underneath zinc mineralization in hole A22-190 at Central Ayawilca (32 metres grading 0.36% tin, 0.33% copper and 13 g/t silver), confirming the tenor of a previous drill hole intersection (48 metres grading 0.47% tin and 0.20% copper in hole A15-043). The tin-copper mineralization (or "Tin Zone") occurs as cassiterite and chalcopyrite in massive iron sulphide replacement bodies hosted in limestone, and as vein-style stockwork mineralization in underlying phyllite. Tin Zone mineralization at Central Ayawilca is interpreted to plunge northwards at a shallow angle and is open at depth.

Key highlights:

South Ayawilca Zinc Zone resource extensions

- A22-195: 6.0 metres at 18.8% zinc from 392.6 metres depth including 3 metres at 27.7% zinc from 395.9 m.

- A22-194: 26.8 metres at 4.2% zinc from 293.0 metres depth including 1.0 metre at 31.6% zinc from 310.1 m.

- A22-192: 16.7 metres at 3.2% zinc, 0.4% lead and 18 g/t silver from 312.3 metres depth.

Central Ayawilca zinc exploration

- A22-191: 36.8 metres at 3.6% zinc from 264.0 metres depth including 6.3 metres at 6.0% zinc from 264.0 m.

- A22-190: 17.9 metres at 3.1% zinc, 0.2% lead and 10g/t silver from 330.4 metres depth.

Tin Zone exploration:

- A22-190: 32.0 metres at 0.36% tin, 0.33% copper and 13 g/t silver from 398 metres depth, including 9.4 metres at 0.52% tin, 0.28% copper and 11 g/t silver from 412.7 m.

The mineralization in the above holes is associated with sulphide bodies interpreted to be gently-dipping. True thicknesses of the mineralized intercepts are estimated to be at least 80% of the downhole thicknesses.

Dr. Graham Carman, Tinka's President and CEO, stated: "The zinc grades intercepted in drill hole A22-195 are exceptional, backing up our belief that the Zinc Zone at South Ayawilca remains open along strike to the northeast. Drilling for the rest of 2022 will target additional high-grade zinc mineralization and an increase in the Measured and Indicated zinc resources at South and West Ayawilca. A second drill rig, which we expect to mobilize within the next few days, will speed up the drilling and enable the Company to drill simultaneously at both South and West Ayawilca."

"While the Tin Zone was not incorporated into the 2021 Preliminary Economic Assessment for the Ayawilca project, the tin-copper-silver mineralization has the potential to add significant value to the project if it can be shown to be economic. An inferred mineral resource of 8.4 Mt at 1.0% tin was estimated for the Ayawilca Tin Zone in August 2021. An important next step for the Tin Zone mineralization will be the results of key metallurgical test work being completed at a specialist laboratory in Australia, which will be available in Q4 2022", Dr. Carman concluded.

Discussion of 2022 drill program results

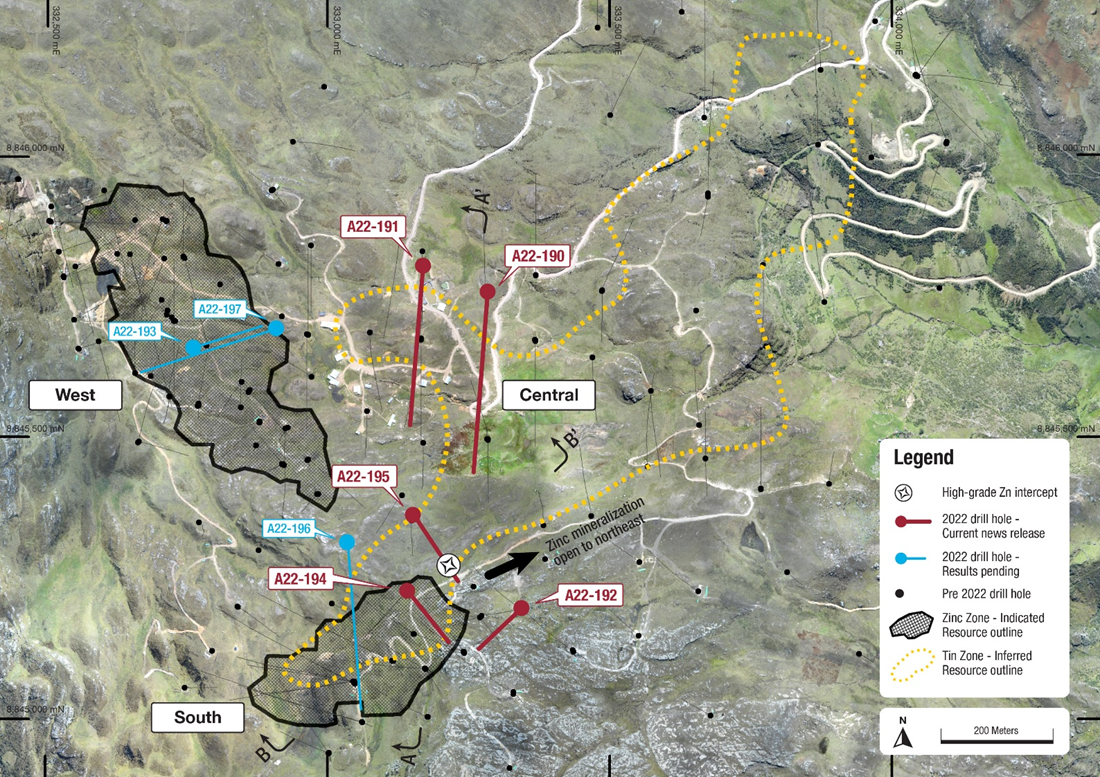

The main objectives of the 2022 drill program at Ayawilca are to target additional high-grade zinc mineralization and to expand the measured and indicated zinc mineral resources. Indicated resources are currently estimated at 19.0 Mt grading 7.2% Zn, 17 g/t Ag & 0.2% Pb and inferred resources are 47.9 Mt @ 5.4% Zn, 20 g/t Ag & 0.4% Pb (dated August 30th, 2021). Figure 1 highlights the location of the 2022 drill holes at the Ayawilca project.

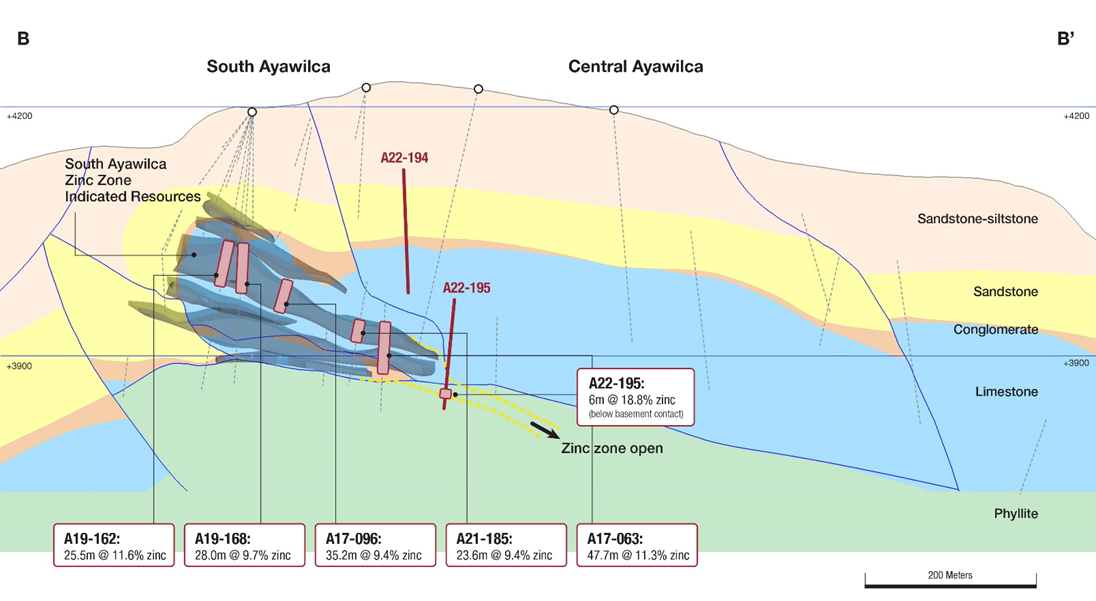

Three holes were drilled to test the potential expansion of zinc mineralization at South Ayawilca to the east and northeast. Hole A22-192 is believed to have intersected the southern edge of the high-grade zinc mineralization at South, while A22-194 and A22-195 both intersected zones of high-grade zinc. Hole A22-195 intersected 6 metres grading 18.8% zinc within a repeated limestone, the favoured lithology for sulphide replacement, approximately 10 metres below the main contact with the basement phyllite. The upper contact with the repeated limestone is interpreted as a low angle thrust, and the possibility exists for more extensive limestone beneath the main phyllite contact. Previous drill holes nearby may have been stopped too soon, without testing the lateral continuity of the repeated limestone in drill hole A22-195 (see Figure 2 - longitudinal section).

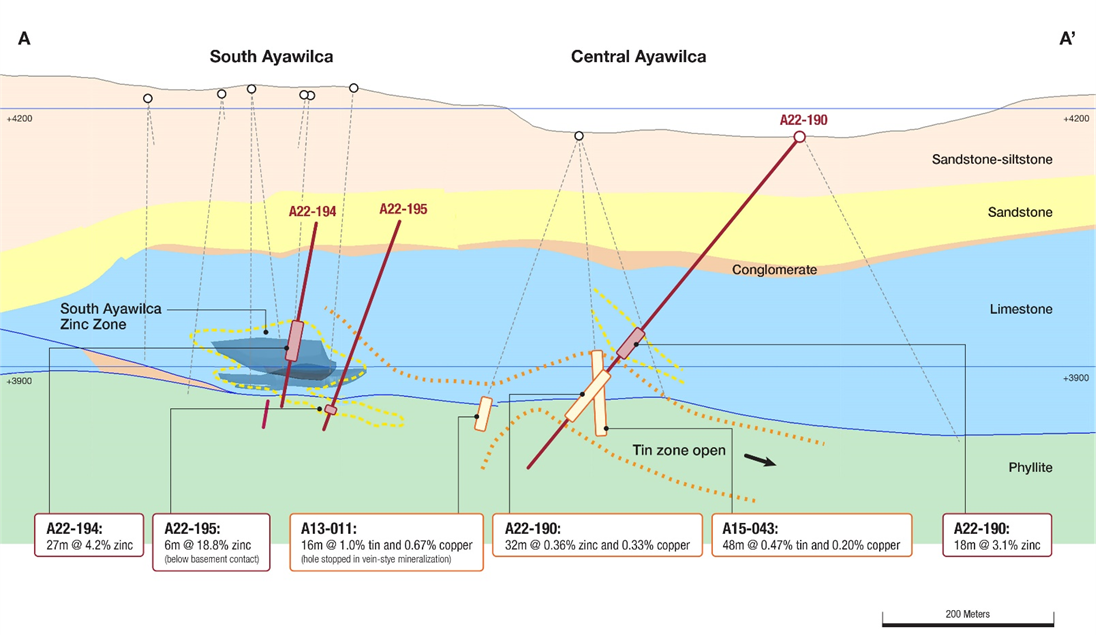

Holes A22-190 and A22-191 were drilled at Central Ayawilca to test for the lateral extensions of a previous zinc intercept (19 metres grading 9.0% zinc in hole A12-08) and to confirm the extent of the tin mineralization at depth. Both holes intersected moderate grade zinc mineralization, while the strong tin grades in hole A22-190 confirmed good continuity with previous drill holes (see Figure 3 - cross section).

Table 1. Summary of drill hole geochemical results for 2022 drill program

| Hole | From (m) | To (m) | Interval (m) | Zn % | Pb % | Ag g/t | In ppm | Sn % | Cu % |

| A22-190 | 298.30 | 306.70 | 8.40 | 3.0 | 0.40 | 6 | 14 | ||

| and | 330.40 | 348.25 | 17.85 | 3.1 | 0.23 | 10 | 20 | ||

| and | 361.50 | 450.00 | 88.50 | 7 | 0.22 | 0.21 | |||

incl | 363.00 | 371.35 | 8.35 | 2 | 0.45 | 0.07 | |||

incl | 398.00 | 430.00 | 32.00 | 13 | 0.36 | 0.33 | |||

incl | 412.65 | 422.00 | 9.35 | 11 | 0.52 | 0.28 | |||

| A22-191 | 115.30 | 115.70 | 0.40 | 5.5 | 2.53 | 212 | 5 | ||

| and | 264.00 | 300.80 | 36.80 | 3.6 | 0.02 | 3 | 58 | ||

incl | 264.00 | 270.30 | 6.30 | 6.0 | 0.07 | 5 | 13 | ||

incl | 298.00 | 300.80 | 2.80 | 8.0 | 0.00 | 6 | 314 | ||

| A22-192 | 312.30 | 329.00 | 16.70 | 3.2 | 0.44 | 18 | 17 | ||

incl | 324.00 | 324.90 | 0.90 | 8.5 | 0.04 | 14 | 101 | ||

| A22-194 | 196.15 | 197.35 | 1.20 | 33.9 | 0.03 | 29 | 145 | ||

| and | 293.00 | 319.80 | 26.80 | 4.2 | 0.02 | 8 | 131 | ||

incl | 310.10 | 311.05 | 0.95 | 31.6 | 0.01 | 21 | 381 | ||

| A22-195 | 392.60 | 398.60 | 6.00 | 18.8 | 0.01 | 8 | 91 | ||

incl | 395.85 | 398.60 | 2.75 | 27.7 | 0.01 | 10 | 130 |

Notes on sampling and assaying

Drill holes are diamond HQ size core holes with recoveries generally above 80% and often close to 100%. The drill core is marked up, logged, and photographed on site. The cores are cut in half at the Company's core storage facility, with half-cores stored as a future reference. Half-core was bagged on average over 1 to 2 metre composite intervals and sent to ALS and SGS laboratories in Lima for assay in batches. Standards and blanks were inserted by Tinka into each batch prior to departure from the core storage facilities. At the laboratory samples are dried, crushed to 100% passing 2mm, then 500 grams pulverized for multi-element analysis by ICPMS using multi-acid digestion. Samples assaying over 1% zinc, lead, or copper and over 100 g/t silver were re-assayed using precise ore-grade AAS techniques. Samples within massive sulphide zones were also assayed for tin using XRF techniques.

Figure 1. Drill hole map highlighting 2022 drill hole locations and Zinc Zone indicated resources

Figure 2. Southwest-Northeast longitudinal section through South Ayawilca with new holes and selected past drill hole intersections (looking north)

Figure 3. North-South cross section through South and Central Ayawilca (looking west)

Table 2. Drill hole details for 2022 drill program

Drill hole | Easting | Northing | Elevation | Azimuth | Dip | Depth m | Area | Comment |

A22-190 | 333281 | 8845755 | 4167 | 180 | -50 | 498.95 | Central | Results HERE |

A22-191 | 333169 | 8845799 | 4182 | 180 | -55 | 478.80 | Central | Results HERE |

A22-192 | 333345 | 8845195 | 4208 | 232 | -74 | 385.90 | South | Results HERE |

A22-193 | 332766 | 8845659 | 4237 | 068 | -65 | 365.40 | West | Results pending |

A22-194 | 333143 | 8845231 | 4226 | 135 | -73 | 380.20 | South | Results HERE |

A22-195 | 333149 | 8845353 | 4221 | 148 | -65 | 426.90 | South | Results HERE |

A22-196 | 333035 | 8845307 | 4235 | 174 | -45 | 382.10 | South | Results pending |

A22-197 | 332912 | 8845693 | 4220 | 264 | -55 | 400.00 | West | Drilling in progress |

Total | 3318.25 |

Notes: Datum for coordinates: WGS84 18S. Azimuth is true azimuth

The Qualified Person, Dr. Graham Carman, Tinka's President and CEO, and a Fellow of the Australasian Institute of Mining and Metallurgy, has reviewed and verified the technical contents of this release.

On behalf of the Board,

"Graham Carman"

Dr. Graham Carman, President & CEO

Further Information:

www.tinkaresources.com

Mariana Bermudez 1.604.685.9316

info@tinkaresources.com

About Tinka Resources Limited

Tinka is an exploration and development company with its flagship property being the 100%-owned Ayawilca zinc-silver-tin project in central Peru. The Zinc Zone deposit has an estimated Indicated Mineral Resource of 19.0 Mt @ 7.15% Zn, 16.8 g/t Ag & 0.2% Pb and Inferred Mineral Resource of 47.9 Mt @ 5.4% Zn, 20.0 g/t Ag & 0.4% Pb (dated August 30, 2021 - see news release). The Ayawilca Tin Zone has an estimated Inferred Mineral Resource of 8.4 Mt grading 1.0% Sn. Tinka holds 46,000 hectares of mining claims in Central Peru, one of the largest holders of mining claims in the belt. Tinka is actively exploring for copper-gold skarn mineral deposits at its 100%-owned Silvia project.

Forward Looking Statements: Certain information in this news release contains forward-looking statements and forward-looking information within the meaning of applicable securities laws (collectively "forward-looking statements"). All statements, other than statements of historical fact are forward-looking statements. Forward-looking statements are based on the beliefs and expectations of Tinka as well as assumptions made by and information currently available to Tinka's management. Such statements reflect the current risks, uncertainties and assumptions related to certain factors including, without limitations: timing of planned work programs and results varying from expectations; delay in obtaining results; changes in equity markets; uncertainties relating to the availability and costs of financing needed in the future; equipment failure, unexpected geological conditions; imprecision in resource estimates or metal recoveries; success of future development initiatives; competition and operating performance; environmental and safety risks; the Company's expectations regarding the Ayawilca Project PEA; the political environment in which the Company operates continuing to support the development and operation of mining projects; risks related to negative publicity with respect to the Company or the mining industry in general; the threat associated with outbreaks of viruses and infectious diseases, including the novel COVID-19 virus; delays in obtaining or failure to obtain necessary permits and approvals from local authorities; community agreements and relations; and, other development and operating risks. Should any one or more of these risks or uncertainties materialize, or should any underlying assumptions prove incorrect, actual results may vary materially from those described herein. Although Tinka believes that assumptions inherent in the forward-looking statements are reasonable, forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein. Except as may be required by applicable securities laws, Tinka disclaims any intent or obligation to update any forward-looking statement.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

SOURCE: Tinka Resources Ltd.

View source version on accesswire.com:

https://www.accesswire.com/719814/Tinka-Drills-6-Metres-Grading-19-Zinc-at-Ayawilca-Expands-Tin-Zone