July 21, 2024

CuFe Ltd (ASX: CUF) (CuFe or the Company) is pleased to provide an update on the status of CuFe’s Tennant Creek Cu-Au project, which is owned 55% by CuFe and 45% by Gecko Mining Company Pty Ltd. The project has an existing JORC 2012 resource of 7.3MT at 1.7% Copper and 0.6g/t Gold (refer to CuFe’s ASX release dated 3 April 2023).

HIGHLIGHTS

- Detailed technical review has identified 4 high priority exploration targets to grow CuFe Tennant Creek global resources.

- Review has provided detailed information to initiate assessment of heritage and regulatory approvals for initial near term exploration program including approximately 5,000m of drilling.

- It has identified the potential to grow the Orlando resource based on existing drilling following an external review of the 2023 Orlando Resource and historical underground drill data.

- Detailed analysis to further define targets continues, including reprocessing and interpretation of historical geophysical data.

CuFe Executive Director, Mark Hancock, commented “With the ongoing exploration success of other juniors in the region, the sustained improvement in the copper market and historical highs in the gold price we have initiated a detailed technical review of our Tennant Creek project. The aim is to expand existing resources and highlight the exploration potential remaining in the area. We have developed a detailed suite of targets that we can translate to on ground exploration with an initial drill program to be executed post heritage and regulatory approvals. We see a lot of potential to add resources to underpin the future recommencement of mining in this world class mineral field.”

Technical Review and Scope

A detailed technical review of the Tenant Creek geology, historical data sets and exploration targets has been undertaken by Mr John Dobe as a technical consultant to CuFe. Mr Dobe is a geologist with >30 years of global exploration experience (predominantly Homestake/Barrick) specialising in project generation and project evaluations at all stages of exploration, from grassroots through to brownfields. John has a detailed understanding of mineral deposits with particular focus on porphyry Cu-Au, IOCG, epithermal Au, orogenic Au, Sediment-hosted Cu, SEDEX, and VHMS deposits.

The scope of the review included auditing and consolidation of historical drill hole geological and geophysical databases, exploration target review, generation and ranking. The outcomes of the review have helped derive an exploration strategy with the aim of growing the global resources at the CuFe Tennant Creek Project.

Review Findings and Target Ranking

The Gecko and Orlando Corridors are well explored and current resources are mostly well defined with multiple generations of surface and underground drilling including RAB, vacuum, RC and Diamond. The sharp and well-defined nature of the mineralisation does provide further opportunities for additional resources extensions immediately adjacent to the known deposits. Geophysical data is also abundant and wide ranging including IP, Helitem, magnetics, gravity and seismic.

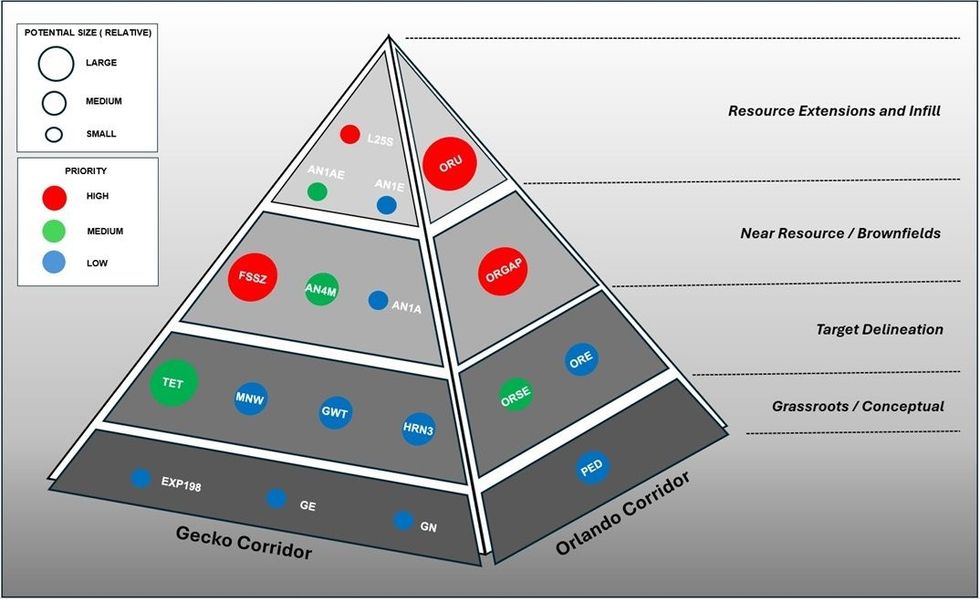

Exploration targets in aim of growing the global resource have been identified within the Orlando and Gecko Corridor and have been allocated the following categories:

1. Resource extensions and infill

2. Near Resource / brownfields

3. Target Delineation

4. Grassroots / Generative

Resource extensions and infill targets have a higher degree of certainty and potential than those that are grassroots generative and conceptual in nature.

Targets have also been ranked by priority on the basis of their complexity, exploration maturity and prospectivity. Their relative potential size has been estimated based on technical review/analysis and conceptual models and projections (See Figure 1).

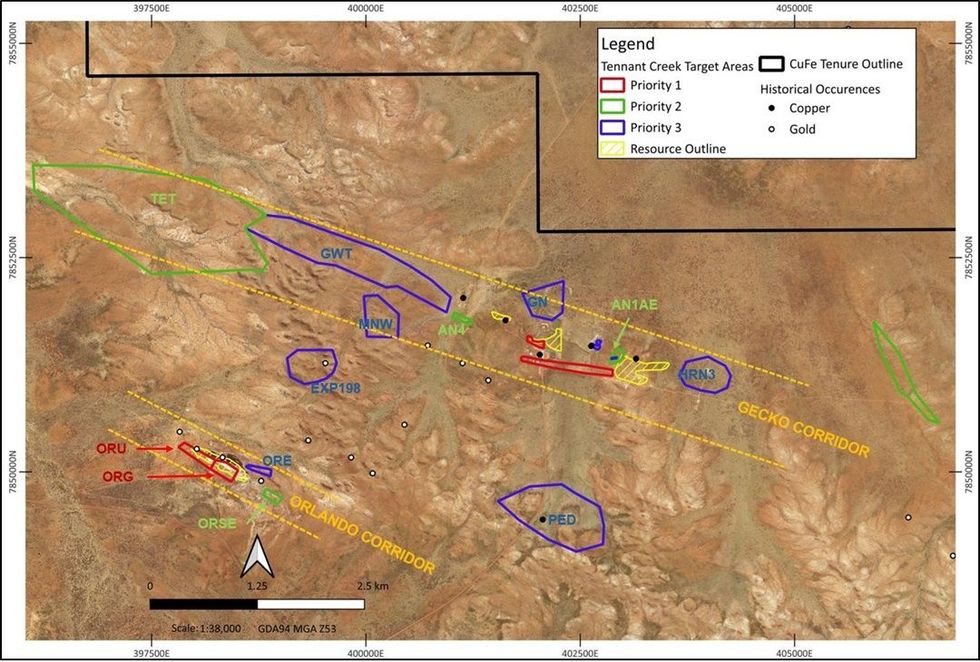

Four high priority targets have fallen out of the technical review that are located with both the Gecko and Orlando corridors. Spatially the targets are shown in Figure 2.

Orlando Corridor

Five targets have been identified within the Orlando Corridor, two of which are high priority, potentially adding to resources by extension and near resources / brownfields discoveries. Orlando underground resource extension includes the interpretation and modelling of the Orlando underground resources that are not included within the current Orlando Resource.

Recently MEC consulting was engaged by CuFe to review the Orlando Resources and historical drilling data. The review confirmed that there is drill hole data that supports extensions of copper and gold mineralisation from the existing open pit, into and around the historical underground workings. Currently this mineralisation is not interpreted and or reported in the existing 2023 Orlando Resource (See Figure 3 and refer to CuFe ASX announcement 3 April 2023). An immediate workstream has been initiated to develop a global resource for the Orlando deposit based on an updated validated drill hole data base including recently sourced Grade Control drilling from the Open Pit mining and historic drilling where QA/QC can be achieved. This target ranks high in terms of priority based on the short lead time with no drilling required and minimal execution costs. It also has the potential to grow the underground resource at Orlando with reasonable confidence considering the drill intercepts are confirmed and historical underground mining has recovered cooper and gold from these levels.

The second high priority target within the Orlando Corridor is an area immediately below the open pit and adjacent to the underground where there is a gap in drill coverage that leaves a portion of the resource open along strike and at depth (See Figure 3). Testing this gap will require deep drilling in the order of 350m but the potential scale of this target justifies its high ranking and priority.

Click here for the full ASX Release

This article includes content from CUFE LTD, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

CUF:AU

Sign up to get your FREE

CuFe Limited Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

The Conversation (0)

17 July 2025

CuFe Limited

Multi-commodity exploration and development assets in Western Australia and Northern Territory with a focus on copper, gold, iron ore and niobium.

Multi-commodity exploration and development assets in Western Australia and Northern Territory with a focus on copper, gold, iron ore and niobium. Keep Reading...

02 February

Government Funding to Unlock Critical Metals Processing

CuFe Limited (CUF:AU) has announced Government Funding to Unlock Critical Metals ProcessingDownload the PDF here. Keep Reading...

29 January

Quarterly Activities and Cashflow Report

CuFe Limited (CUF:AU) has announced Quarterly Activities and Cashflow ReportDownload the PDF here. Keep Reading...

28 October 2025

Quarterly Activities and Cashflow Report

CuFe Limited (CUF:AU) has announced Quarterly Activities and Cashflow ReportDownload the PDF here. Keep Reading...

20 October 2025

Review Highlights High Grade Bismuth Intercepts at Orlando

CuFe Limited (CUF:AU) has announced Review Highlights High Grade Bismuth Intercepts at OrlandoDownload the PDF here. Keep Reading...

14 October 2025

Placement to Raise $5.4 Million

CuFe Limited (CUF:AU) has announced Placement to Raise $5.4 MillionDownload the PDF here. Keep Reading...

Latest News

Sign up to get your FREE

CuFe Limited Investor Kit

and hear about exciting investment opportunities.

- Corporate info

- Insights

- Growth strategies

- Upcoming projects

GET YOUR FREE INVESTOR KIT

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00