TDG Gold Corp. (TSXV:TDG) (the "Company" or "TDG") is pleased to announce drill results from drillholes SH21-007 and SH21-008 from its 2021 diamond drill program with both holes drilled approximately 150 metres ("m") north of the historical Shasta Creek Zone open pit. Drill intercepts include 38.0 m of 3.04 grams per tonne ("gt") gold ("Au") with 101 gt silver ("Ag") [4.30 gt AuEq*] in drillhole SH21-008. Assay results were received directly from SGS Canada Inc. ("SGS") from TDG's Shasta project which is located in the Toodoggone District of north-central B.C. Results have been received directly from SGS Canada Inc. ("SGS") and whilst SGS has completed its QAQC protocols for these results, a comprehensive internal Data Quality Analysis ("DQA") by TDG is still underway with subsequent assay results from the Shasta project still pending. Therefore, the results for the purposes of this news release are still considered preliminary

The northern section of TDG's Shasta project consists of the northerly portions of the Creek and JM Zones and also the Upper Creek Zone. Collectively, these zones at Shasta represent an opportunity to explore and evaluate the continuity and grade of the historical ore body in an area that was under-explored. The 2021 drilling in this area was designed to step west from the Shasta Fault, test underneath the historical mine workings and confirm the grade of mineralization reported from historical results as part of data validation in anticipation of the Mineral Resource Estimate work underway by Moose Mountain Technical Services. Results presented here are for SH21-007 and SH21-008 (Table 1).

Table 1. Significant Results from Holes SH21-007 & SH21-008.

Hole | From | To | Length | Au | Ag | AuEq* |

| (m) | (m) | (m) | (g/t) | (g/t) | (g/t) |

|

|

|

|

|

|

|

SH21-07 | 67.6 | 106.0 | 38.4 | 0.71 | 32 | 1.11 |

SH21-08 | 66.0 | 104.0 | 38.0 | 3.04 | 101 | 4.30 |

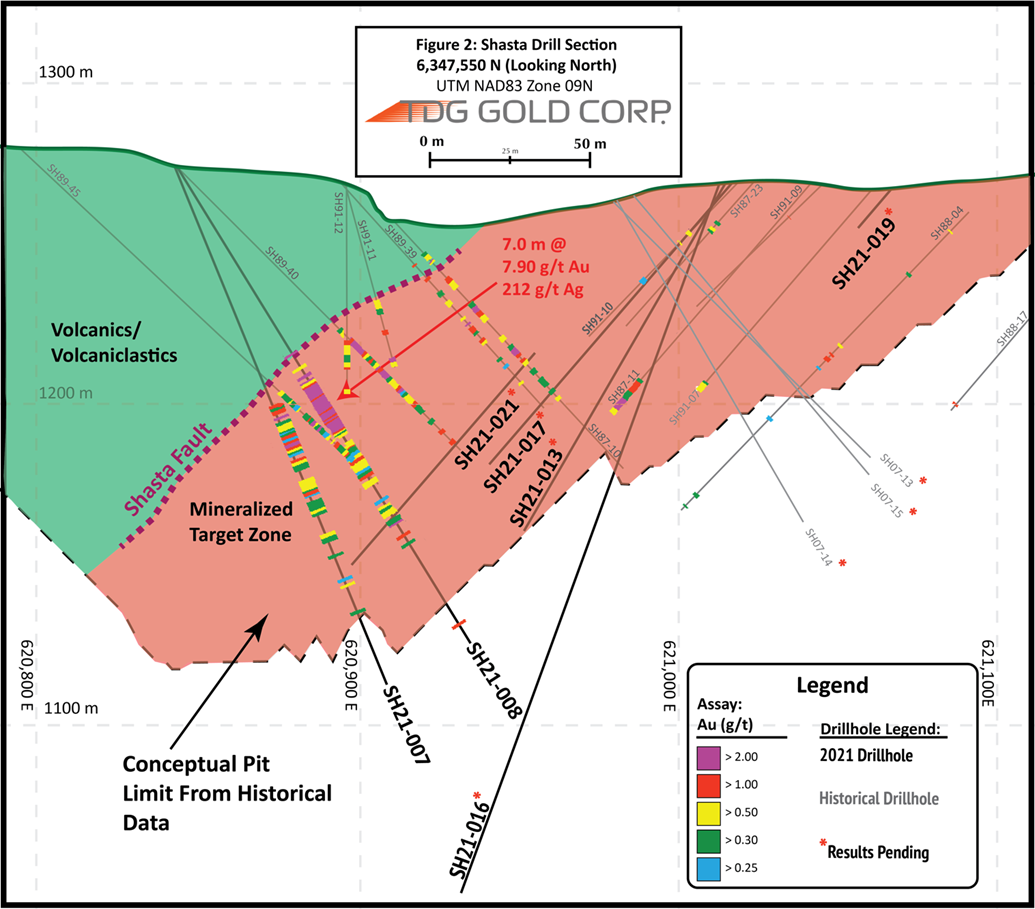

including | 72.0 | 79.0 | 7.0 | 7.90 | 220 | 10.64 |

SH21-08 | 116.0 | 126.0 | 10.0 | 0.82 | 34 | 1.25 |

| *Gold equivalent ("AuEq") calculated using 80:1 silver to gold ratio. | ||||||

| ** Intervals are core-length weighted. True width is estimated between 75 to 95 % of core length. | ||||||

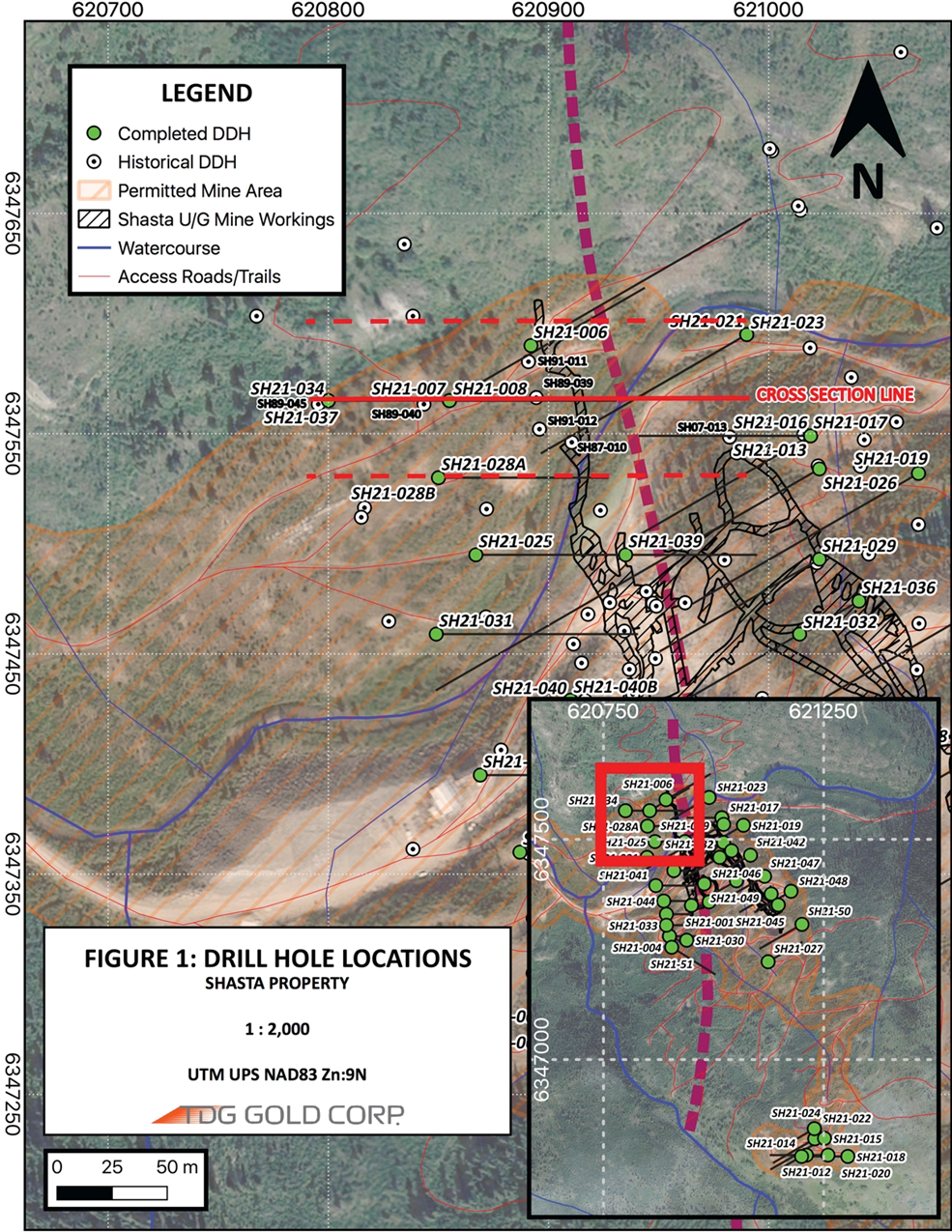

Historically, drilling and mining was concentrated adjacent to the Shasta Fault, and the entirety of core was not sent for assay analysis. Holes drilled in 2021 within the northern section of the Shasta project consisted of infill drilling between historical holes and to test continuity of mineralization to the north (Figure 1). Select historical results are presented in Table 2 and a cross-section in Figure 2. Results are still pending for 2021 drillholes SH21-006, SH21-013, SH21-017, SH21-019, SH21-021 and SH21-023; and also for re-assays of the 2007 drillholes SH07-13, SH07-14 and SH07-15.

SH21-007 and SH21-008 both intersected the Shasta Fault at the predicted depth. As reported in TDG's news release of September 28, 2021 (see here), the footwall to the fault encountered a broad zone of silicified volcaniclastics with stockwork quartz veining, strong pervasive potassic alteration with a sulphide assemblage comprised of pyrite, chalcopyrite and acanthite, a package of host rocks, mineralization and alteration typical of the Shasta mineralization seen in historical holes.

Figure 1. Plan view of the northern Shasta Creek Zone (Holes SH21-007 & SH21-008).

Table 2. Significant Results from Historical Holes Adjacent to SH21-007 & SH21-008.

Hole | From | To | Length | Au | Ag | AuEq** |

| (m) | (m) | (m) | (g/t) | (g/t) | (g/t) |

|

|

|

|

|

|

|

| SH89-040 | 71.0 | 108.0 | 37.0 | 1.84 | 106 | 3.16 |

| SH89-045 | 109.6 | 138.7 | 29.1 | 0.77 | 37 | 1.23 |

| SH89-039 | 56.0 | 67.0 | 11.0 | 0.85 | 42 | 1.37 |

| SH91-011* | 41.8 | 44.8 | 3.1 | 0.10 | 6 | 0.18 |

| SH91-012* | 46.3 | 63.1 | 16.8 | 0.51 | 18 | 0.73 |

| SH87-010 | 14.2 | 84.0 | 69.8 | 0.74 | 39 | 1.22 |

| *The only assayed core. | ||||||

| **Gold equivalent ("AuEq") calculated using 80:1 silver to gold ratio. | ||||||

| ** Intervals are core-length weighted. True width from historical core is unknown. | ||||||

Figure 2. Cross-section of 6,347,550 N (Holes SH21-007 & SH21-008).

All 2021 drill holes are HQ sized drill cores. Particulars for drill holes (location, depth, etc.) are presented in Table 3. The geology of the 2021 drill holes described in TDG's September 28, 2021 news release… (here). Assay results for remaining 2021 drillholes and 2007 re-assays are still pending at this time.

…Note, in TDG's September 28, 2021 news release, drillholes SH21-007 and SH21-008 were mis-plotted, which has been corrected in this news release. This error does not materially change the content of either news release.

Table 3. Drillhole particulars.

HOLE | UTME (NAD83) | UTMN (NAD83) | Azimuth(°) | Dip(°) | Final Depth (m) |

SH21-007 | 620,855 | 6,347,565 | 90 | -60 | 151 |

SH21-008 | 620,855 | 6,347,565 | 60 | -60 | 204 |

QA/QC

Samples for the Shasta 2021 drill program followed chain of custody between collection, processing and delivery to an SGS laboratory in Burnaby, B.C. The drill cores were delivered to the core shack at TDG's Baker Mine site, and processed by geologists who inserted certified reference materials, blanks and duplicates (pulp and coarse) into the sampling sequence. 2021 Drill core was cut in half (1/2 HQ core) and placed in zip-tied polyurethane bags, then in security-sealed rice bags before being delivered directly from the Baker Mine, to Bandstra Transportation Systems in Prince George, B.C., and ultimately to SGS laboratory Burnaby, B.C. 2007 drill core was split (mechanically). Core samples were prepared for analysis according to SGS method PRP89: dry samples to 105°C, crush to 75 % passing 2 mm, split 250 g, pulverize 85 % passing 75 microns.

Samples were analyzed following procedures summarized in Table 4, where information about methodology can be found on the SGS Canada Website, in the analytical guide (here).

Table 4. Au and Ag Analytical Methods.

Certificate | Hole | Method Au | Method Ag | Method Au-Overlimit | Method Ag-Overlimit |

| BBM21-13116 | SH21-07 | GO_FAI50V10 | GE_IMS40Q12 | N/A | GO_FAG37V |

| BBM21-13135 | SH21-07 | GO_FAI50V10 | GE_IMS40Q12 | N/A | N/A |

| BBM21-12566 | SH21-08 | GE_FAI50V5 | GE_IMS40Q12 | GO_FAG50V | GO_ICP42Q100 |

| BBM21-12567 | SH21-08 | GE_FAI50V5 | GE_IMS40Q12 | N/A | GO_ICP42Q100 |

| BBM21-12578 | SH21-08 | GE_FAI50V5 | GE_IMS40Q12 | N/A | N/A |

Quality assurance and control ("QAQC") is maintained internally at the lab through rigorous use of internal certified reference materials, blanks, and duplicates. An additional QAQC program was administered by TDG Gold through the use of certified reference materials ("CRMs"), duplicate samples and blank samples that were blindly inserted into the sample batch. If a QAQC sample returns an unacceptable value an investigation into the results is triggered and when deemed necessary, the samples that were tested in the batch with the failed QAQC sample are re-tested. For the purposes of this press release, results are ‘preliminary' and thus have not undergone SGS internal QAQC or TDG's DQA investigations.

Qualified Person

The technical content of this news release has been reviewed and approved by Steven Kramar, MSc., P.Geo., a qualified person as defined by National Instrument 43-101.

This news release includes historical drilling information that has been reviewed by the Company's geological team. The Company's review of the historical records and information reasonably substantiate the validity of the information presented in this news release; however, the Company cannot directly verify the accuracy of the historical data, including the procedures used for sample collection and analysis. Therefore, the Company encourages investors to exercise appropriate caution when evaluating these results. Further data review is underway, in order to verify the validity of the data for the anticipated NI 43-101 compliant mineral resource estimate.

About TDG Gold Corp.

TDG is a major mineral claim holder in the historical Toodoggone Production Corridor of north-central British Columbia, Canada, with over 23,000 hectares of brownfield and greenfield exploration opportunities under direct ownership or earn-in agreement. TDG's flagship projects are the former producing, high-grade gold-silver Shasta, Baker and Mets mines, which are all road accessible, produced intermittently between 1981-2012, and have over 65,000 m of historical drilling. In 2021, TDG has advanced the projects through compilation of historical data, new geological mapping, geochemical and geophysical surveys, and, for Shasta, drill testing of the known mineralization occurrences and their extensions. The Company has entered into a binding agreement to acquire the Nueva Esperanza silver-gold advanced exploration and development project located in the Maricunga Belt of northern Chile, subject to closing conditions being satisfied. TDG currently has 78,361,085 common shares issued and outstanding.

ON BEHALF OF THE BOARD

Fletcher Morgan

Chief Executive Officer

For further information contact:

TDG Gold Corp.,

Telephone: +1.604.536.2711

Email: info@tdggold.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains forward-looking statements that are based on the Company's current expectations and estimates. Forward-looking statements are frequently characterized by words such as "plan", "expect", "project", "intend", "believe", "anticipate", "estimate", "suggest", "indicate" and other similar words or statements that certain events or conditions "may" or "will" occur. Such forward-looking statements involve known and unknown risks, uncertainties and other factors that could cause actual events or results to differ materially from estimated or anticipated events or results implied or expressed in such forward-looking statements. Such factors include, among others: the actual results of current exploration activities; conclusions of economic evaluations; changes in project parameters as plans to continue to be refined; possible variations in ore grade or recovery rates; accidents, labour disputes and other risks of the mining industry; delays in obtaining governmental approvals or financing; and fluctuations in metal prices. There may be other factors that cause actions, events or results not to be as anticipated, estimated or intended. Any forward-looking statement speaks only as of the date on which it is made and, except as may be required by applicable securities laws, the Company disclaims any intent or obligation to update any forward-looking statement, whether as a result of new information, future events or results or otherwise. Forward-looking statements are not guarantees of future performance and accordingly undue reliance should not be put on such statements due to the inherent uncertainty therein.

SOURCE: TDG Gold Corp.

View source version on accesswire.com:

https://www.accesswire.com/681970/TDG-Gold-Corp-Drills-380-metres-of-304-gt-Gold-and-101-gt-Silver-at-Shasta-Creek-North-Toodoggone-BC