March 25, 2025

Manuka Resources Limited (“Manuka” or the “Company”) has announced Taranaki VTM Project Delivers Robust Pre-Feasibility Study.

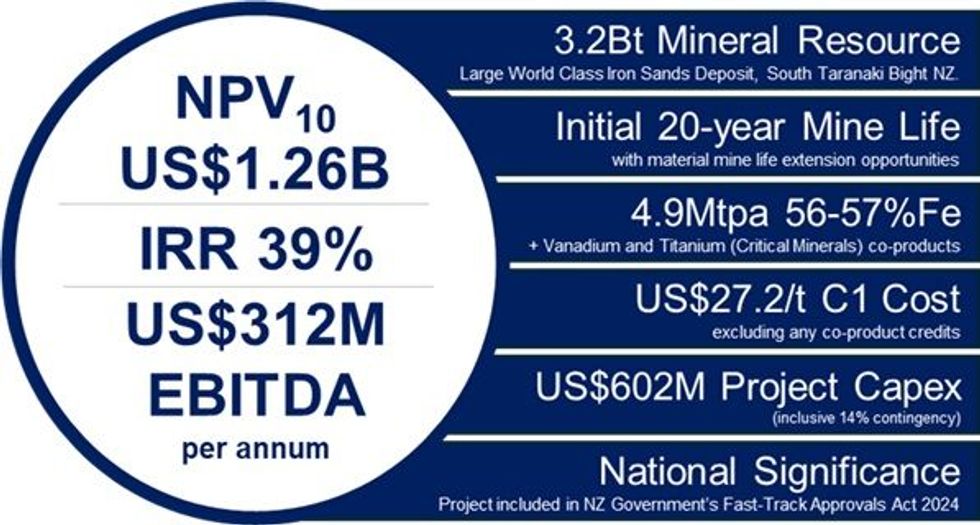

Highlights

- Updated Pre-Feasibility Study1 (“PFS”) released for the New Zealand-based Taranaki VTM Project (“the Project”) owned by Manuka Resources Limited (“MKR”, the “Company”) subsidiary, Trans-Tasman Resources Limited (“TTR”).

- Initial 20-year Production Target underpinned by 75% Indicated Resources and 25% Inferred Resources located on granted Mining Permit MP55581.

- Project to deliver a significant contribution to local development in the Taranaki region of New Zealand and assist the NZ government in delivering against its critical minerals policy objectives.

- The Project was included in Schedule 2 (projects to be directly referred to an Expert Panel) of the recently passed New Zealand Fast Track Approvals Act 20242.

- Following completion of the current approval process, the Company intends to progress to a Bankable Feasibility Study (“BFS”) consisting of detailed vessel engineering and the development of procurement and funding strategies.

- The Company will shortly submit its approval application and commence the New Zealand Fast Track approvals process.

MKR Director and TTR Executive Charman Alan Eggers commented:

"The Taranaki VTM Project is an exciting, financially robust and potentially company- making opportunity that provides Manuka shareholders with strategic exposure to critical minerals. The outstanding PFS results released today build upon a substantial body of technical and environmental work completed over the past 10 years.

The Project is one of national significance for New Zealand whose stated objective is to double mineral export earnings from NZ$1.5B to NZ$3B per annum over the next decade. The Taranaki VTM Project is forecast to generate NZ$854M revenue per annum representing over 50% of the targeted increase.

Importantly, the Project will deliver substantial benefits to the Taranaki and Whanganui regions with over 300 new full-time local jobs and NZ$238M per annum expenditure injected into the local economy.

With the updated PFS complete, we are now looking forward to progressing the Project through the New Zealand Fast-Track approvals process and turning our attention to workstreams related to Project delivery and execution”

Project Overview

The Taranaki VTM Project (“the Project”) is located offshore along the west coast of the North Island of New Zealand in the South Taranaki Bight within water depths of between 20m to 50m and comprises granted mining permit MMP55581 and granted exploration permit MEP54068 covering a large world-class Resource of vanadium and titanium bearing iron sands located on the seabed floor (Figure 1, Table 1).

Both vanadium and titanium have recently been named on New Zealand’s Critical Minerals List.

The Project PFS contemplates the mining of iron sands from the shallow seabed floor within MP55581 via an underwater seabed crawler at a rate of 50Mtpa. The crawler will pump sediment as seawater slurry to a surface vessel (Integrated Mining Vessel, “IMV”) (Figure 2) where the sand will undergo beneficiation into a saleable vanadiferous titanomagnetite (“VTM”) concentrate with an iron grade of ~57% Fe, 0.50% V2O5 and titanium of 8.4% TiO2.

The Project is scheduled to produce VTM concentrate at a rate of 4.9Mtpa. The balance of the mined sand (~45Mtpa) will be returned continuously to the seabed floor behind the surface vessel where it will be restored to its natural state within two years.

Production Overview

The iron sands will be mined using two seabed crawlers (Figure 3), one operating and one standby. Sand extraction (50Mtpa) will occur in lanes, on average 5m deep with the crawler advancing at a rate of 0.04km/h and pumping 8,000 tph of sand as a seawater slurry to the IMV.

The ROM sand will be screened, magnetically separated and ground before final magnetic separation to produce a clean concentrate. All processing will be done wet using seawater throughout the process. The final concentrate will be dewatered to ~10% moisture and stored temporarily on the IMV before being slurried with fresh water from a reverse osmosis (RO) desalination plant.

The slurry will be pumped to a floating storage and offloading vessel (“FSO”) where it will be dewatered and stored in the FSO holds. Once fully loaded, the FSO sails to a sheltered area (if required by prevailing weather conditions) where it offloads the cargo to an ore carrier, typically a Capesize vessel for shipment to market.

Tailings will be disposed of in real-time via a fall pipe extending forward off the port side of the IMV such that the tailings are deposited as far as possible from the face of mine. The tailings disposal fall pipe will be of a similar design to a trailing suction hopper dredge drag arm. The tailings will first be dewatered via hydro cyclones with the wastewater disposed of separately along the tailings fall pipe.

Operations will be 24 hours a day, 7 days per week with an estimated 28% downtime due to inclement weather conditions, servicing and maintenance.

Click here for the full ASX Release

This article includes content from Manuka Resources Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

vanadium investingsilver investingiron investinggold stocksasx stocksgold explorationgold investingasx:mkr

MKR:AU

The Conversation (0)

26 March 2025

Manuka Resources

Near-term production from both its silver and gold projects located in the Cobar Basin, Central West, New South Wales

Near-term production from both its silver and gold projects located in the Cobar Basin, Central West, New South Wales Keep Reading...

05 August 2025

Results of Fully Underwritten Entitlement Offer

Manuka Resources (MKR:AU) has announced Results of Fully Underwritten Entitlement OfferDownload the PDF here. Keep Reading...

31 July 2025

June 2025 Quarter Activities and Cashflow Reports

Manuka Resources (MKR:AU) has announced June 2025 Quarter Activities and Cashflow ReportsDownload the PDF here. Keep Reading...

29 July 2025

Maiden Mt Boppy Open Pit Ore Reserve

Manuka Resources (MKR:AU) has announced Maiden Mt Boppy Open Pit Ore ReserveDownload the PDF here. Keep Reading...

10 July 2025

Further Information to 26 June Announcement

Manuka Resources (MKR:AU) has announced Further Information to 26 June AnnouncementDownload the PDF here. Keep Reading...

08 July 2025

Reinstatement to Quotation

Manuka Resources (MKR:AU) has announced Reinstatement to QuotationDownload the PDF here. Keep Reading...

5h

Byron King: Gold, Silver, Oil/Gas — Stock Ideas and Strategy Now

Byron King, editor at Paradigm Press, shares his approach to the gold and silver sectors as tensions in the Middle East intensify, also touching on oil and gas. Overall he sees hard assets becoming increasingly key as global uncertainty escalates."Own gold, own silver — physically own the metal... Keep Reading...

5h

Jaime Carrasco: Gold Going "Much Higher," Silver Force Majeure Inevitable

Jaime Carrasco, senior portfolio manager and senior financial advisor at Harbourfront Wealth Management, shares his outlook for gold and silver, saying prices must rise much higher. He also talks about how to build a strong precious metals portfolio. "We're moving from a credit-based economy, a... Keep Reading...

5h

Garrett Goggin: Gold, Silver in New Era, My Stock Strategy Now

Garrett Goggin, founder of Golden Portfolio, says although gold and silver haven't gone mainstream yet, the metals — and the mining sector overall — have entered a new era. "It's a real mind shift — it's a new era in mining right here," he said.Don't forget to follow us @INN_Resource for... Keep Reading...

15h

Nicola Mining Provides Update on NASDAQ Listing

Nicola Mining Inc. (TSXV: NIM,OTC:HUSIF) (OTCQB: HUSIF) (FSE: HLIA) (the "Company" or "Nicola") is pleased to provide an update on its proposed NASDAQ listing, which it originally disclosed in its news release of October 27, 2025. There are approximately 220 Canadian companies trading via cross... Keep Reading...

06 March

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

06 March

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00