- WORLD EDITIONAustraliaNorth AmericaWorld

June 25, 2024

Latest results support Boss’ strategy to significantly increase Honeymoon’s annual production capacity and mine life

Boss Energy Limited (ASX: BOE; OTCQX: BQSSF) is pleased to announce high-grade drill results on theGould’s Dam satellite deposit.

Highlights

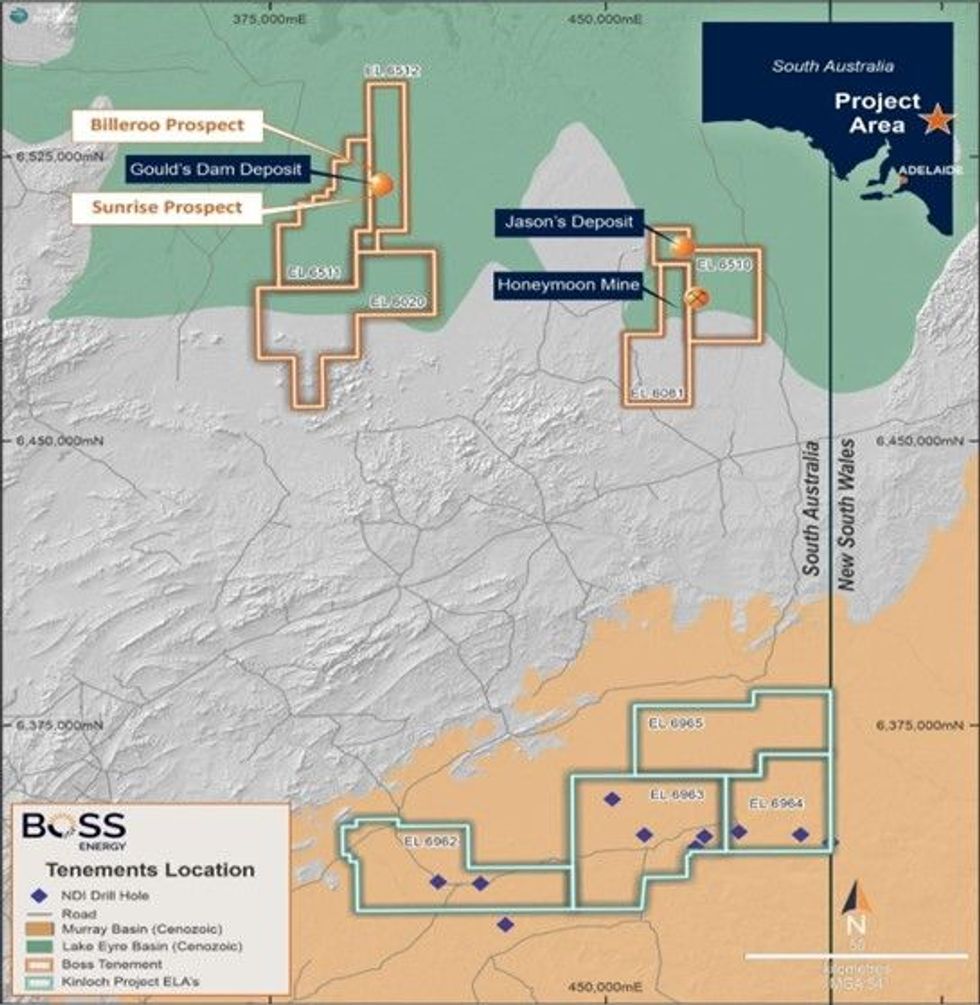

- Gould’s Dam is located ~80km northwest of the Honeymoon Mine and currently contains a JORC-compliant resource of 25Mlbs of indicated and inferred U308

- The results highlight the potential for Gould’s Dam to help lift Honeymoon’s production rate from the current nameplate capacity of 2.45M lbs a year to the Export Permit limit of 3.3M lbs a year and/or extend the mine’s useful life

- The latest drilling is targeting three key areas within the inferred resource envelope at Gould’s Dam – Sunrise, Billeroo and Beulah; The program will assist with wellfield planning and other pre-development work

- Infill and step-out drilling at Sunrise and Billeroo targets is almost complete. A total of 96 mud rotary holes have been drilled to date for 12,911m, with uranium mineralisation highlights including (PFN results, ppm pU3O8):

- 4.00m @ 2,925ppm pU3O8GT 11,700 (WRM0151 from 122.75m)

- 4.25m @ 2,230ppm pU3O8GT 9,478(WRM0109 from 120.75m)

- 3.25m @ 1,406ppm pU3O8GT 4,570 (WRM0128 from 123.75m)

- 5.25m @ 800ppm pU3O8GT 4,200 (WRM0099 from 117.00m)

- 2.25m @ 1,717ppm pU3O8GT 3,863 (WRM0159 from 121.75m)

- 1.25m @ 2,877ppm pU3O8GT 3,596 (WRM0114 from 124.50m)

- 1.75m @ 1,990ppm pU3O8GT 3,483 (WRM0142 from 120.25m)

- 3.75m @ 773ppm pU3O8GT 2,899 (WRM0130 from 123.75m)

- 1.50m @ 1,855ppm pU3O8GT 2,783 (WRM0121 from 120.25m)

- 4.50m @ 545ppm pU3O8GT 2,453 (WRM0140 from 103.25m)

- 4.75m @ 506ppm pU3O8GT 2,404 (WRM0157 from 122.50m)

- 4.75m @ 484ppm pU3O8GT 2,299 (WRM0143 from 123.00m)

- plus 1.75m @ 1,294ppm pU3O8GT 2,265(WRM0143 from 128.50m)

- 3.00m @ 756ppm pU3O8GT 2,268 (WRM0084 from 118.50m)

- Exploration will now focus on the Beulah satellite deposit where 40 holes are planned to better define the mineralisation and geological characteristics of this region

- Ongoing detailed geological and mineralisation modelling will support further development work and preparation for an ISR Mining Lease proposal at Gould’s Dam

These results support the Company’s strategy to increase the nameplate production rate and mine life at its 100 per cent-owned Honeymoon Uranium Mine in South Australia.

In light of these strong results, work has commenced on accelerating the development of Gould’s Dam, which is an important satellite project to the nearby Honeymoon Mine.

The current delineation program provides important data which will be used in wellfield planning and other advanced pre-development activity.

It will also enable Boss to complete detailed geological and mineralisation models which will support the ongoing development work and preparation for an ISR Mining Lease proposal for Gould’s Dam.

This will lead into the next phase of mine plan development, including pump testing of the mineralised aquifer within the Gould’s Dam Indicated resource (utilising monitoring wells installed during the 2023 drilling campaign) and core sample test work. This will provide important baseline hydrogeological and metallurgical characteristics of the mineralised aquifers.

Resource Infill Drilling Program

Three key areas within the current Inferred resource envelope at Gould’s Dam were targeted as part of this infill drilling program – namely the Sunrise, Billeroo and Beulah targets (Figure 2). Holes were logged with the Boss Energy in-house PFN tools for uranium grade characterisation, and Borehole Magnetic Resonance (BMR) tools for lithological determination.

Click here for the full ASX Release

This article includes content from Boss Energy Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

BOE:AU

The Conversation (0)

27 June 2024

Boss Energy Limited

Multi-mine uranium producer in Australia and the US

Multi-mine uranium producer in Australia and the US Keep Reading...

28 January 2025

December 2024 Quarterly Results Presentation

Boss Energy Limited (BOE:AU) has announced December 2024 Quarterly Results PresentationDownload the PDF here. Keep Reading...

28 January 2025

Quarterly Cashflow Report - December 2024

Boss Energy Limited (BOE:AU) has announced Quarterly Cashflow Report - December 2024Download the PDF here. Keep Reading...

28 January 2025

Quarterly Activities Report - December 2024

Boss Energy Limited (BOE:AU) has announced Quarterly Activities Report - December 2024Download the PDF here. Keep Reading...

26 February

Definitive Agreement for the Sale of the Marshall Project

Basin Energy (BSN:AU) has announced Definitive agreement for the sale of the Marshall projectDownload the PDF here. Keep Reading...

26 February

Denison Greenlights First Major Canadian Uranium Mine in 20 Years

Denison Mines (TSX:DML,NYSEAMERICAN:DNN) has approved construction of what it says will be Canada’s first new large-scale uranium mine in more than 20 years, setting the stage for work to begin next month at its flagship Phoenix project in northern Saskatchewan.The company announced that its... Keep Reading...

25 February

Uranium American Resources

Uranium American Resources Inc. is a mining company. The Company maintains mining leases on properties in Nevada. The Company is engaged in mining activities in the mineable resource of gold and silver remains in the Comstock Mining District. Its Comstock project is located in northwestern... Keep Reading...

25 February

US Nuclear Growth at Risk as Enrichment Supply Gap Looms

A looming shortage of uranium enrichment services could threaten US nuclear expansion plans, according to the leader of Centrus Energy (NYSE:LEU), one of the country’s largest suppliers of enriched uranium.Amir Vexler, president and CEO of Centrus, is warning that rising demand from existing... Keep Reading...

24 February

Eagle Energy Metals and Spring Valley Acquisition Corp. II Announce Closing of Business Combination

Eagle Energy Metals Corp. (“Eagle”), a next-generation nuclear energy company with rights to the largest conventional, measured and indicated uranium deposit in the United States, today announced that it has completed its business combination with Spring Valley Acquisition Corp. II (OTC: SVIIF)... Keep Reading...

23 February

Basin Energy Hits 1,112 ppm TREO, Fast Tracks 2026 Uranium and REE Strategy at Sybella-Barkly

Basin Energy (ASX:BSN) is moving to accelerate its 2026 exploration efforts following "exciting" results from its maiden drilling program at the Sybella-Barkly project in Queensland. In a recent interview, Managing Director Pete Moorhouse revealed that the company has confirmed a significant... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00