April 04, 2024

Summit Minerals Limited (ASX: SUM, “Summit” or the “Company”) is pleased to announce that it has completed a review and restatement of the Stallion Uranium Mineral Resource, which Manhattan Corporation previously prepared in 20172. Both Stallion estimates have been reported in accordance with JORC 2012.

HIGHLIGHTS

- Mineral Resource Estimate (MRE) for the Stallion Uranium deposit has been restated as an initial step in restating and delivering maiden MREs for all deposits in the Stallion Project.

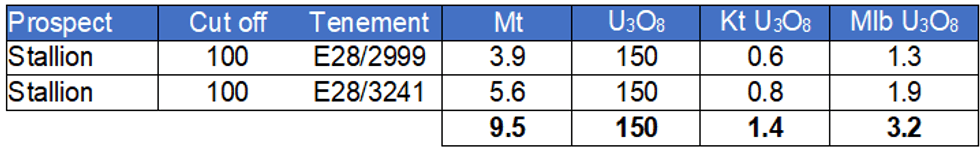

- The restated MRE for the Stallion deposit, reported in accordance with JORC 2012 at a 100 ppm U3O8 cut-off, contains an Inferred Mineral Resource of 9.5Mt at 150 ppm (1.4 Kt U3O8; see Table 1 below) for a contained 3.2 Mlb U3O8.

- The project is supported by the potential economic extraction through ISR (In Situ Recovery), which typically has a lower operating recovery of around AUD$15-25 per pound of uranium oxide1.

- Mr Arnold van der Heyden of H & S Consultants Pty Ltd (HSC), an independent, competent person, performed the resource estimation.

A Mineral Resource estimate for the Inferred Mineral resource of 9.5 million tonnes (“Mt”), grading 150 ppm U3O8, totalling 3.2Mlb U3O8 at the 100 ppm U3O8 cutoff. The resource estimate was prepared by HSC and reported in accordance with the JORC Code 2012 (See Appendix 1-JORC Table 1).

Resource blocks inside the Queen Victoria Springs Nature Reserve (QVSNR) were excluded from the estimate, slightly reducing the Stallion MRE from the 3.3 Mlb U3O8 previously stated by Manhattan (ASX: MHC).

The work involved rebuilding the resource database, reviewing previous work, and confirming compliance with the JORC Code (2012).

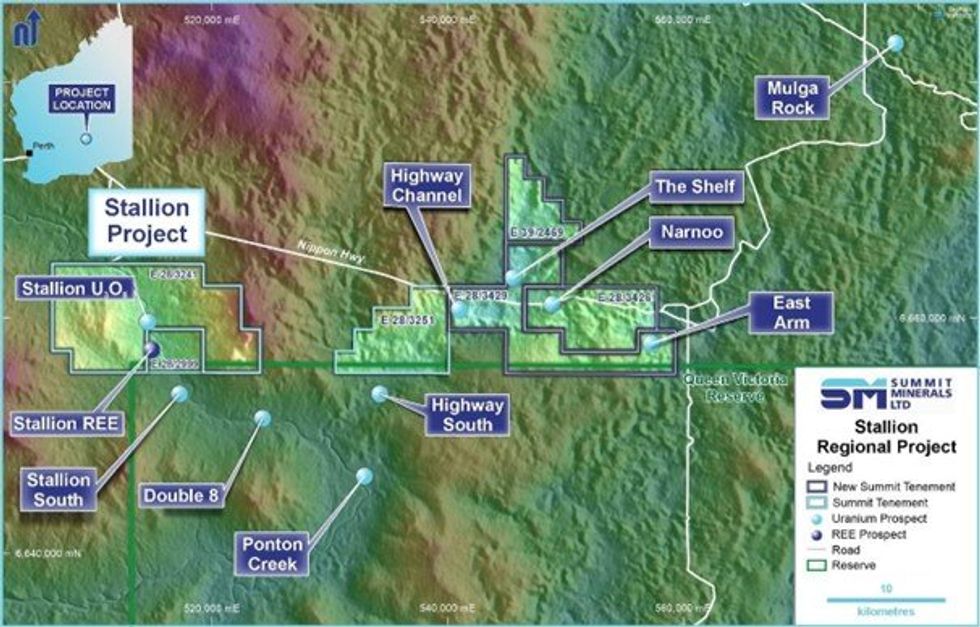

The Stallion uranium project is approximately 175km east-northeast of Kalgoorlie, WA. The Company owns 100% of the 442 km2 of exploration tenements and applications underlain by Tertiary palaeochannels within the Gunbarrel Basin. These palaeochannels are known to host several uranium deposits and drilled uranium prospects (Figure 1).

The Company intends to advance resource expansion work at Stallion.

Summit’s Chief Executive Officer, Gower He, said:

“The board is extremely pleased with the rapid advancements in restating the Uranium Resource at Stallion. Once our additional applications are granted, we are well equipped to quickly advance exploration work to expand our resources as we look to deliver value for our shareholders.

GEOLOGY

Tertiary palaeochannels within the Gunbarrel Basin underlie the Ponton Creek area, which includes the Stallion Project. Carbonaceous sand-hosted uranium mineralisation has been defined by drilling along 55 kilometres of the palaeochannels at Stallion, Stallion South, Double 8, Ponton, Highway, Highway South, and the Shelf prospects (Figure 1). Uranium mineralisation occurs in shallow, reduced sand- hosted tabular deposits between 40 and 70 metres deep. The mineralisation is confined to the palaeochannel and is potentially amenable to in situ metal recovery (“ISR”), the lowest cost method of producing yellowcake with the least environmental impact.

Click here for the full ASX Release

This article includes content from Summit Minerals Limited, licensed for the purpose of publishing on Investing News Australia. This article does not constitute financial product advice. It is your responsibility to perform proper due diligence before acting upon any information provided here. Please refer to our full disclaimer here.

The Conversation (0)

26 February

Definitive Agreement for the Sale of the Marshall Project

Basin Energy (BSN:AU) has announced Definitive agreement for the sale of the Marshall projectDownload the PDF here. Keep Reading...

26 February

Denison Greenlights First Major Canadian Uranium Mine in 20 Years

Denison Mines (TSX:DML,NYSEAMERICAN:DNN) has approved construction of what it says will be Canada’s first new large-scale uranium mine in more than 20 years, setting the stage for work to begin next month at its flagship Phoenix project in northern Saskatchewan.The company announced that its... Keep Reading...

25 February

Uranium American Resources

Uranium American Resources Inc. is a mining company. The Company maintains mining leases on properties in Nevada. The Company is engaged in mining activities in the mineable resource of gold and silver remains in the Comstock Mining District. Its Comstock project is located in northwestern... Keep Reading...

25 February

US Nuclear Growth at Risk as Enrichment Supply Gap Looms

A looming shortage of uranium enrichment services could threaten US nuclear expansion plans, according to the leader of Centrus Energy (NYSE:LEU), one of the country’s largest suppliers of enriched uranium.Amir Vexler, president and CEO of Centrus, is warning that rising demand from existing... Keep Reading...

24 February

Eagle Energy Metals and Spring Valley Acquisition Corp. II Announce Closing of Business Combination

Eagle Energy Metals Corp. (“Eagle”), a next-generation nuclear energy company with rights to the largest conventional, measured and indicated uranium deposit in the United States, today announced that it has completed its business combination with Spring Valley Acquisition Corp. II (OTC: SVIIF)... Keep Reading...

23 February

Basin Energy Hits 1,112 ppm TREO, Fast Tracks 2026 Uranium and REE Strategy at Sybella-Barkly

Basin Energy (ASX:BSN) is moving to accelerate its 2026 exploration efforts following "exciting" results from its maiden drilling program at the Sybella-Barkly project in Queensland. In a recent interview, Managing Director Pete Moorhouse revealed that the company has confirmed a significant... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00