Stallion Uranium Corp. (the " Company " or " Stallion " ) ( TSX-V: STUD ; OTCQB: STLNF ; FSE: FE0 ) is pleased to announce that, it has entered into a technology data acquisition agreement (the " Agreement ") dated April 24 th 2025, amongst the Company and Matthew J. Mason (the " Lessor ") to enhance exploration efforts across its expansive uranium land package in the Athabasca Basin, Saskatchewan. The Lessor holds the exclusive license to certain proprietary technology and know how that can be used to assist in area prioritization selection for the purposes of exploration for minerals (the " Technology " or " Haystack ").

Highlights About the Technology:

- Haystack holds the exclusive rights to an intelligent Geological Target Identification platform called Matchstick TI which offers an innovative leap in mineral exploration technology.

- Haystack's predictive technology is revolutionizing the mineral exploration industry with its AI-powered deposit discovery software and proprietary drilling technology. Specializing in predictive exploration and drilling for energy metals, the company accelerates the exploration process while reducing costs. Headquartered in Vancouver, BC, Canada, the company is at the forefront of innovation in sustainable resource discovery.

- At the heart of Haystack sits a proprietary algorithm that models geological features in space and time, delivering a remarkable 77% accuracy rate in predicting target locations.

- This cutting-edge technology reduces financial risk and accelerates discovery in Greenfield and Frontier Exploration using readily available public data.

- Developed over a decade in Cambridge, UK, Haystack fuses Theoretical Physics, Data Science, and Pattern Recognition to accurately pinpoint mineral targets, transforming the way exploration is conducted.

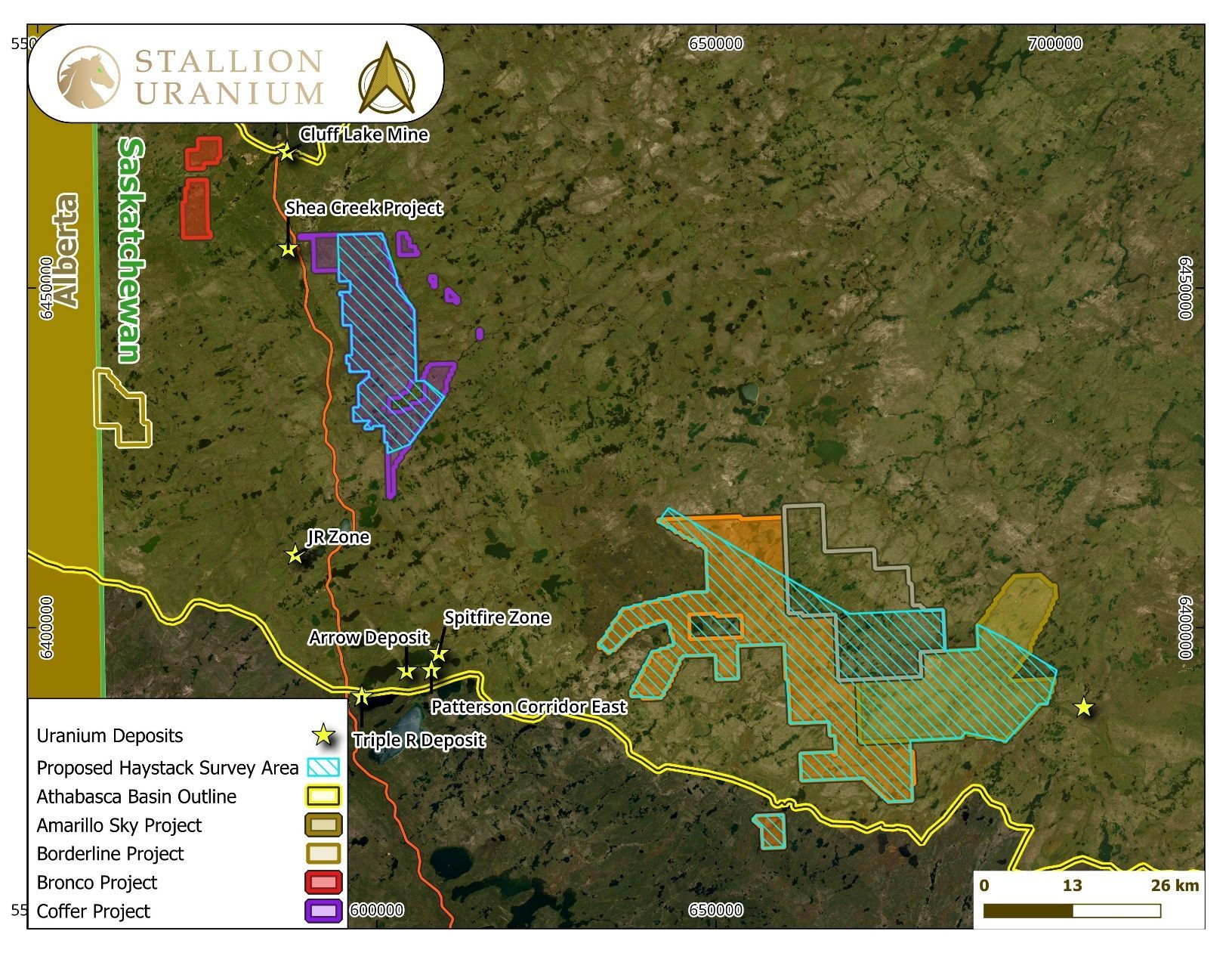

- Stallion intends to utilize this technology to confirm current targets, and outline any additional targets on the current land position of 1,700 sq/km.

- The Haystack study will be conducted in collaboration with leading data science and geoscience experts, ensuring a comprehensive and innovative approach to target selection. The Company believes this initiative will position Stallion Uranium at the forefront of technological advancements in uranium exploration. Advanced machine learning techniques will be applied to vast datasets collected from historical and modern exploration programs, enabling Stallion to uncover previously overlooked opportunities.

"The application of machine learning in mineral exploration is transforming the industry, and we are excited to integrate this powerful tool into our exploration strategy," said Matthew Schwab, CEO of Stallion Uranium. "By deploying advanced analytics, we aim to enhance our ability to identify high-priority targets, reduce exploration risk, and maximize the potential of our uranium assets."

Figure 1 : Haystack Study Area

Agreement Terms:

Pursuant to the terms of the Agreement, the Lessor will grant the Company a non-exclusive, non-transferable right to access the Technology for a 12-month term (the " Technology Lease "). The Company's use of the Technology pursuant to the Technology Lease shall be limited to such mineral tenures owned or legally occupied by the Company covering an area of approximately 1,400 square kilometers in the Athabasca Basin, Saskatchewan and Alberta (the " Subject Property ").

Pursuant to the terms of the Agreement and in consideration for the grant of the Technology Lease, on the fifth business day following the TSX Venture Exchange's conditional acceptance of the Agreement (the " Closing Date "), the Company will issue an aggregate of 5,000,000 common shares in the capital of the Company (each a " Payment Share ") to the Licensor and the Lessee, as follows: (i) 3,750,000 Payment Shares to the Lessor; and (ii)1,250,000 Payment Shares to the Licensor. The Payment Shares shall be subject to a hold period ending on the date that is four months plus one day following the date of issuance under applicable Canadian securities laws.

Pursuant to the terms of the Agreement, the Licensor shall provide certain services in connection with the application of the Technology to the Subject Property for a minimum of any three consecutive months during the term of the Agreement (the " Services "). In consideration for such Services, the Company has agreed to pay the Licensor a fee of £70,000 per month for each month in which the Services are performed.

The Lessor is an insider to the Company by virtue of holding 10% or more Company's issued and outstanding common shares on a partially diluted basis. The issuance of any securities to an insider will be considered a "related party transaction" within the meaning of Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions (" MI 61-101 "). The Company is relying on exemptions from the formal valuation requirements of MI 61-101 pursuant to section 5.5(a) and the minority shareholder approval requirements of MI 61-101 pursuant to section 5.7(1)(a) in respect of such insider participation as the fair market value of the transaction, insofar as it involves interested parties, does not exceed 25% of the Company's market capitalization.

About Stallion Uranium Corp.:

Stallion Uranium is working to ‘Fuel the Future with Uranium' through the exploration of roughly 1,700 sq/km in the Athabasca Basin, home to the largest high-grade uranium deposits in the world. The company, with JV partner Atha Energy holds the largest contiguous project in the Western Athabasca Basin adjacent to multiple high-grade discovery zones.

Our leadership and advisory teams are comprised of uranium and precious metals exploration experts with the capital markets experience and the technical talent for acquiring and exploring early-stage properties. For more information visit stallionuranium.com .

On Behalf of the Board of Stallion Uranium Corp.:

Matthew Schwab

CEO and Director

Corporate Office:

700 - 838 West Hastings Street,

Vancouver, British Columbia,

V6C 0A6

T: 604-551-2360

info@stallionuranium.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release contains forward-looking statements and forward-looking information within the meaning of Canadian securities legislation (collectively, "forward-looking statements") that relate to the Company's current expectations and views of future events. Any statements that express, or involve discussions as to, expectations, beliefs, plans, objectives, assumptions or future events or performance (often, but not always, through the use of words or phrases such as "will likely result", "are expected to", "expects", "will continue", "is anticipated", "anticipates", "believes", "estimated", "intends", "plans", "forecast", "projection", "strategy", "objective" and "outlook") are not historical facts and may be forward-looking statements and may involve estimates, assumptions and uncertainties which could cause actual results or outcomes to differ materially from those expressed in such forward-looking statements. No assurance can be given that these expectations will prove to be correct and such forward-looking statements included in this material change report should not be unduly relied upon. These statements speak only as of the date they are made.

Forward-looking statements are based on a number of assumptions and are subject to a number of risks and uncertainties, many of which are beyond the Company's control, which could cause actual results and events to differ materially from those that are disclosed in or implied by such forward-looking statements. The Company undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by law. New factors emerge from time to time, and it is not possible for the Company to predict all of them or assess the impact of each such factor or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. Any forward-looking statements contained in this presentation are expressly qualified in their entirety by this cautionary statement .

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/028d9b66-ef57-4c79-b33c-72bd316d6d05