Phase 1 drilling demonstrates strong, porphyry-style alteration/mineralization.

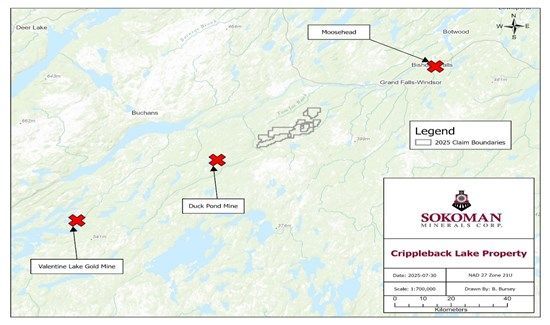

Sokoman Minerals Corp. (TSXV: SIC,OTC:SICNF) (OTCQB: SICNF) ("Sokoman" or the "Company") is pleased to provide an update on its 100%-owned Crippleback Lake Property (the "Property"), which straddles the Valentine Lake Shear Zone midway between the Valentine Gold Mine (Equinox Gold) and the Company's Moosehead Gold Project in central Newfoundland. Recent staking and claim purchases have expanded the Property to 530 claims (13,250 hectares) covering favourable geology and structures hosting critical mineral and precious metal occurrences (Figure 1) believed to be related to a coppergold porphyry andor epithermal system.

The Property was originally staked by Sokoman in 2016 due to its position along the Valentine Lake Shear Zone and, strikingly similar geological environment to the Valentine Lake gold deposits, currently in pre-production development by Equinox Gold. The Property is underlain in part by the Crippleback Lake Quartz Monzonite, an equivalent, Neoproterozoic-aged igneous complex to the Valentine Lake Intrusive Complex, which hosts the Valentine Lake Gold deposit located 70 km southwest of the Property. The Rogerson Lake Conglomerate, the footwall to the Valentine Lake mineralization, also cuts through the Property. The Teck Resources, Duck Pond Mine, VMS deposits, which closed in 2015, are also located 15 km to the southwest.

(NB: Rock, core and soil assays and mineralization reported are not to be considered as indicative of mineralization over the entire Property, nor are they to be considered indicative of mineralization similar to other deposits in the region.)

Timothy Froude, P.Geo., President and CEO, states, "Our work to date, in conjunction with exploration over the past 50 years, has outlined what we believe to be a system consistent with porphyry copper/gold and/or epithermal gold systems worldwide. We are supported in this belief by Dr. Stephen Piercey, who has examined several holes from the 2024 Phase 1 diamond drilling program and states; "This area has historically been the focus for VMS exploration, but the abundance of sericite-illite alteration, coupled with local montmorillonite and vuggy silica alteration, and anomalous base metal (Zn-Pb) and pyrite mineralization associated with the latter alteration types is distinctive from VMS. This suggests that these rocks have experienced extensive magmatic hydrothermal alteration. The alteration appears to be like phyllite/quartz-sericite-pyrite and argillic alteration types found in distal portions of porphyry systems. This represents an exciting new target for this region."

Froude adds, "It is important to note that our drilling has intersected what we believe to be a portion of the alteration halo surrounding an enriched core zone. The next steps will be to define vectors that lead towards a potential higher-grade core that may exist either along strike or to depth."

Historical Work

The Crippleback Lake Property has been explored since the 1960s, almost exclusively for base metals, with the bulk of past work carried out by Noranda Exploration Company, Limited ("Noranda") in the 1970s, including geophysical, geological and geochemical surveys with limited follow-up diamond drilling. From 1974 to 1976, Noranda focused on the south side of Crippleback Lake, defining an extensive soil geochemical anomaly in zinc (92-677 ppm), lead (30-210 ppm) and copper (42-396 ppm) over a 1.6 km trend. Noranda did not report gold assays for soil samples. The strong soil geochemical anomaly was not drill tested by Noranda; however, two holes, targeting a weak geophysical (electromagnetic) anomaly, were drilled one km to the southeast, returning insignificant mineralization. Noranda's work is on file with the Department of Industry, Energy, and Technology (DIET) in St. John's, NL.

Figure 1: Property Location Map

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6079/262534_be68a595e4128b85_002full.jpg

Property Exploration

From 2016 to 2019, Sokoman's exploration included: C-horizon tills, B-horizon soil sampling and prospecting over the initial 111 claim property targeting Valentine Lake-style (intrusion-hosted) gold mineralization along the Valentine Lake Shear Zone (VLSZ). Prospecting in the southwest of the property, along the interpreted shear zone, gave grab rock sample Au values from

In 2021, the Property was optioned to Trans Canada Gold Corp, which flew a high-resolution magnetic survey and carried out limited prospecting but then returned the Property to Sokoman in 2022.

In 2023, Sokoman's prospecting along a "refurbished" logging road in the northern portion of the Property discovered disseminated copper (chalcopyrite) with zinc, lead and fluorite mineralization in roadside outcrops. Grab samples gave values from

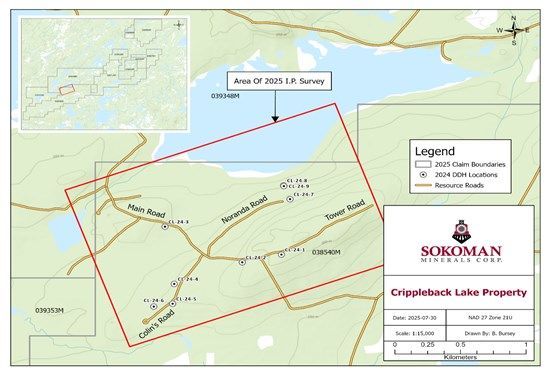

In late 2024, logging operations prevented a trenching program, so a six-line, reconnaissance IP, geophysical survey and a Phase 1 diamond drilling program (nine holes / 1,839 m) was carried out in areas not in conflict with the logging operations.

2024 Phase 1 Drilling

The drilling (Figure 2) targeted multiple soil, rock and geophysical anomalies, both historical (1970s) and recent (2023/24) discoveries by Sokoman. Nine diamond drill holes were completed in a 1.5 km by 1 km area in the north-central portion of the Property along the contact between the Crippleback Lake Monzonite and related (coeval) volcanic rocks.

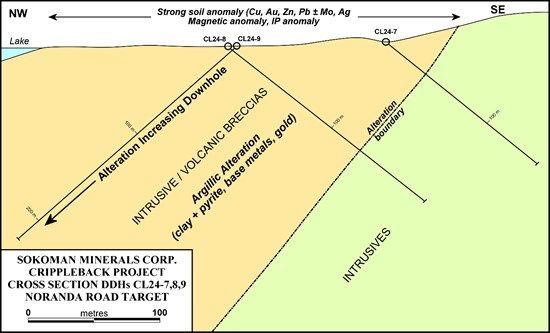

The most significant and impressive argillic (clay) alteration observed from core logging, confirmed by hyperspectral scanning (Terraspec) by the Geological Survey of Newfoundland, was intersected in drill holes CL-24-3, 7, 8, and 9. Significantly, holes CL-24-3 (301 m total length) and CL-24-9 (220 m total length), collared into and remained in alteration/mineralization until both were shut down for logistical reasons, still in strong alteration with sulphide mineralization. Holes CL-24-7, 8, and 9 comprise a three-hole section in the strongest portion of Noranda's 1975 soil geochemical anomaly, verified by follow-up by Sokoman in 2024. CL-24-3 was drilled approximately 1 km SW of, and along strike from, CL-24-7, 8, and 9, and cut 301 m of continuous alteration with disseminated and stringer sulphide mineralization. Two holes (CL-24-1 and 2) were drilled to test copper/fluorite mineralization in the Main Road and Tower Road occurrences, with CL-24-4,5, and 6 drilled approximately 500 m south of CL-24-3 to test for copper/zinc/lead mineralization in outcrop on Colin's Road. All holes intersected variable and locally strong clay alteration +/- sulphide (pyrite, chalcopyrite, sphalerite, galena, stibnite, and arsenopyrite) mineralization.

CL-24-9 - Strong clay alteration in Crippleback Lake Monzonite with stringer sulphide mineralization

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6079/262534_be68a595e4128b85_003full.jpg

Figure 2: 2024 Diamond Drill Holes / 2025 IP Survey Area

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6079/262534_be68a595e4128b85_004full.jpg

A total of 1,405 saw-cut, core samples ranging from 0.15 m to 3 m long (average length of 0.82 m) were sent for Au and 34 element ICP analysis at Eastern Analytical Ltd. in Springdale, NL with a random subset of 285 samples sent for MA 250 Ultra trace ICP-MS analysis for 59 elements at Bureau Veritas (BV) in Vancouver, BC. The BV analyses included porphyry copper and epithermal gold pathfinder elements such as selenium and tellurium.

Most of the drill holes intersected significant alteration/mineralization consistent with a magmatic-hydrothermal system, potentially a porphyry Cu-(Au) and/or a high sulfidation, epithermal gold system, including locally intense clay alteration with associated base and precious metal enrichment. To better understand the style and significance of the alteration/mineralization intersected at the Crippleback Lake Property, the Company has engaged Dr. Stephen J. Piercey, PhD, P.Geo., FGC of Memorial University and Piercey Geosciences Inc. in St. John's, NL, to evaluate the mineralized system. Dr. Piercey is an expert in hydrothermal ore deposits and has undertaken research and consulting for various clients globally. Dr. Piercey has already examined in detail several of the Crippleback Lake Property drill holes.

Cross Section Through CL-24-7, 8, 9

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6079/262534_be68a595e4128b85_005full.jpg

The diamond drilling has:

1) Confirmed the copper/silver/fluorite-bearing mineralized exposures along the Main and Tower Roads Cl-24-1, 2, and 3

2) Confirmed copper/lead/zinc/silver mineralization in the Colin's Road area (CL-24-4, 5, and 6) along with a silver/gold/antimony zone in CL-24-6

3) Confirmed Noranda's strong 1975 soil geochemical anomaly along the Noranda Road in CL-24-7, 8, and 9

4) Broad enrichment in gold in argillic alteration zone in holes CL-24-3, 7, 8 and 9

Overall, the drilling defined variable, but consistent, clay (argillic) alteration with associated Au, Cu, Pb and Zn enrichments in most holes, including locally elevated pathfinder metals selenium (Se), which ranged from 0.03 to 43.90 ppm Se, and tellurium (Te), which ranged from 0.12 to 23.12 ppm Te. (Analysis for Se and Te were completed at Bureau Veritas Labs in Vancouver, BC, from a subset of samples from the complete set of samples analyzed at Eastern Analytical Ltd. in Springdale, NL.) Selected highlights from the complete set of assays are as follows:

Crippleback Lake Phase 1 Drilling - Selected Highlights Table

| DDH # | From | To | Length | Au ppb | Ag ppm | Cu ppm | Cu % | Pb ppm | Pb % | Zn ppm | Zn % | Sb ppm | |

| CL-24-1 | 49.80 | 59.00 | 9.20 | 2.55 | 1434 | 0.14 | 692 | 0.07 | 548 | 0.05 | |||

| incl | 55.35 | 59.00 | 3.65 | 4.20 | 2607 | 0.26 | 1305 | 0.13 | 741 | 0.07 | |||

| CL-24-2 | 9.67 | 19.9 | 10.23 | 1.00 | 314 | 0.03 | 317 | 0.03 | 133 | 0.01 | |||

| incl | 9.67 | 11.9 | 2.23 | 2.50 | 1080 | 0.11 | 1124 | 0.11 | 132 | 0.01 | |||

| CL-24-3 | 107.00 | 253.00 | 146.00 | 35 | 1.00 | 90 | 0.01 | 675 | 0.06 | 1290 | 0.13 | ||

| incl | 173.00 | 253.00 | 80.00 | 52 | 1.49 | 147 | 0.01 | 1100 | 0.11 | 2072 | 0.20 | ||

| incl | 238.70 | 253.00 | 14.30 | 110 | 2.93 | 223 | 0.01 | 1265 | 0.12 | 2580 | 0.25 | ||

| CL-24-4 | 63.00 | 79.40 | 16.40 | 2.00 | 747 | 0.08 | 1674 | 0.16 | 2021 | 0.20 | |||

| incl | 63.00 | 67.80 | 4.80 | 5.46 | 618 | 0.06 | 4402 | 0.44 | 5414 | 0.50 | |||

| and | 96.35 | 99.30 | 2.95 | 1.29 | 4400 | 0.44 | 405 | 0.04 | 855 | 0.08 | |||

| CL-24-6 | 195.25 | 199.00 | 3.75 | 434 | 11.5 | 1010 | 0.10 | 401 | 0.04 | 1762 | 0.17 | 665 | |

| CL-24-7 | 3.00 | 20.00 | 17.00 | 36 | 1.53 | 125 | 0.01 | 1036 | 0.10 | 926 | 0.09 | ||

| CL-24-8 | 12.00 | 52.00 | 40.00 | 52 | 1.06 | 496 | 0.05 | 70 | 0.007 | 316 | 0.03 | ||

| CL-24-9 | 31.00 | 123.80 | 92.80 | 50 | tr | 91 | 0.009 | 32 | 0.003 | 207 | 0.02 |

Click here to view the complete Phase 1 drilling assay data for Crippleback Lake.

2025 Exploration Program

The 2025 exploration program, consisting of a Phase 2 IP survey, additional soil sampling along and across strike, prospecting and rock sampling, has begun. The 25 line km IP survey is planned to define/expand coverage over the area of alteration/mineralization in all directions around the 2024 drilling. Future work would include additional geophysics and, if warranted, diamond drilling and/or trenching to test targets. The bulk of this work would take place in Q4 2025.

QP

This news release has been reviewed and approved by Timothy Froude, P.Geo., a "Qualified Person" under National Instrument 43-101, and President and CEO of Sokoman Minerals Corp.

Analytical Techniques / QA/QC

All core, rock and soil samples are submitted to Eastern Analytical Ltd. in Springdale, Newfoundland, for ICP 34 analysis as well as gold analysis. All core samples submitted for assay are saw cut by Sokoman personnel, with one-half submitted for assay and one-half retained for reference. Samples are delivered in sealed bags directly to the lab by Sokoman personnel. Eastern Analytical Ltd. is an accredited assay lab that conforms to the requirements of ISO/IEC 17025. Samples to be assayed for gold are analyzed by standard fire assay methods. Industry-approved standards and blanks are included in each batch, as well as random duplicates, as part of Eastern Analytical Ltd.'s internal policies. In addition, a selected batch of pulps (approximately 20% of total samples) from the Phase 1 drilling were forwarded by Eastern Analytical to Bureau Veritas Labs in Vancouver, BC, for additional analysis, specifically the MA 250 procedure consisting of a four acid digestion with Ultra Trace ICP-MS analysis for 59 elements. Bureau Veritas is also an ISO/IEC 17025 accredited lab and adheres to the required policies and procedures.

About Sokoman Minerals Corp.

Sokoman Minerals Corp. is a discovery-oriented company and one of the largest landholders in the province of Newfoundland and Labrador, Canada's emerging gold district. The Company's primary focus is its portfolio of gold projects, including the 100%-owned flagship, advanced-stage Moosehead project, Crippleback Lake, and the district-scale Fleur de Lys project near Baie Verte in northwestern Newfoundland. These projects target Dalradian-type orogenic gold mineralization, similar to the Curraghinalt and Cavanacaw deposits in Northern Ireland. The Company entered a strategic alliance with Benton Resources Inc. through three, large-scale, joint-venture properties including Grey River, Golden Hope, and Kepenkeck in Newfoundland.

In October 2023, Sokoman and Benton completed an agreement with Piedmont Lithium Inc., a major developer of lithium projects and processing plants in the USA, and exactly the right partner to have to advance the lithium project. For full details of the agreement, please refer to the Company's press release dated October 11, 2023.

Projects optioned with optionee fully vested are:

- East Alder Project optioned to Canterra Minerals Inc. (SIC retains shares of CTM plus 1% NSR)

- Startrek Project optioned to Thunder Gold (SIC retains shares of TGOL plus 1% NSR)

For more information, please contact:

Timothy Froude, P.Geo., President & CEO

T: 709-765-1726

E: tim@sokomanmineralscorp.com

Cathy Hume, VP Corporate Development, Director

T: 416-868-1079 x 251

E: cathy@chfir.com

Website: www.sokomanmineralscorp.com

Twitter: @SokomanMinerals

Facebook: @SokomanMinerals

LinkedIn: @SokomanMineralsCorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Corporation should be considered highly speculative. Except for historical information contained herein, this news release contains forward-looking statements that involve risks and uncertainties. Actual results may differ materially. Sokoman Minerals Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof. More detailed information about potential factors that could affect financial results is included in the documents filed from time to time with the Canadian securities regulatory authorities by Sokoman Minerals Corp.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/262534