- WORLD EDITIONAustraliaNorth AmericaWorld

March 18, 2025

Sitka Gold Corp. (TSXV: SIG) (FSE: 1RF) (OTCQB: SITKF) ("Sitka" or the "Company") is pleased to announce that it has completed the first diamond drill hole of its 30,000 metre drilling program planned for this year at its 100% owned, road accessible RC Gold Project ("RC Gold" or the "Project") in Yukon. DDRCCC-25-075 ("Hole 75") is the first drill hole to be completed as part of the winter phase of diamond drilling currently underway at RC Gold. Hole 75, one of the deepest holes ever drilled at the Blackjack zone, went to a length of 715.97 metres to test both the lateral and vertical extent of high-grade gold mineralization that was discovered in Hole 68 which was the best drill hole completed at Blackjack to date. Visible gold was observed over 130 times in Hole 75 and initial review of the drill core suggests strong gold mineralization extends at least 70 metres to the northeast from Hole 68.

- DDRCCC-25-075 ("Hole 75") was drilled to a length of 715.97 metres to test depth continuity of Blackjack gold mineralization and encountered over 130 instances of visible gold

- Hole 75 confirms strong gold mineralization extends approximately 70 metres northeast from Hole 68

- Hole 75 is the first hole to be completed as part of Sitka's fully funded 30,000 metre drill program planned for 2025, the largest drill program ever conducted at RC Gold

- DDRCCC-25-076, currently in progress, is designed to test gold mineralization at deeper depths than any previous drilling

Figure 1. Examples of instances of visible gold observed throughout hole DDRCCC-25-075. Visible gold is found in sheeted quartz veins and is often associated with bismuthinite, scheelite, and arsenopyrite. Assays for this drill hole are currently pending. Additional images of visible gold observed in Hole 75 can be viewed HERE.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6144/245011_0397ef7c24a078a4_002full.jpg

"The 2025 drilling campaign at RC Gold is off to a remarkable start with the first drill hole of the year returning a multitude of visual gold occurrences," said Cor Coe, Director and CEO of Sitka Gold Corp. "Hole 75 was located to follow-up on the strong results of Hole 68 which intersected 678.1 m of 1.04 g/t gold including 93.0 m grading 2.57 g/t gold starting at 589.5 metres, the deepest and longest intersection of gold mineralization to date at the Blackjack deposit which remains open in all directions. The increasing grades at depth in Hole 68 suggest that drilling is vectoring towards the source of this impressive gold system and initial observations of Hole 75 confirm that strong gold mineralization persists at least 70 metres northeast of the high-grade intervals returned in Hole 68. We eagerly await the results from Hole 75 which will aid in further understanding the dimensions of the Blackjack zone at depth where higher gold grades may support a potential underground mining operation below the limits of the recently announced pit constrained resource of 1,291,000 ounces of gold grading 1.01 g/t gold in an indicated category and 1,044,000 ounces of gold grading 0.94 g/t gold in an inferred category at Blackjack(1). DDRCCC-25-076, currently in progress, is now being drilled from the same pad at a steeper angle than Hole 75 and is designed to test the Blackjack zone to even deeper depths than previous drilling."

(1) Simpson R. January 21, 2025. Clear Creek Property, RC Gold Project NI 43-101 Technical Report Dawson Mining District, Yukon Territory

Figure 2. A plan map of the Blackjack gold deposit showing the location of diamond drill holes DDRCCC-25-075 (yellow trace), DDRCCC-25-076 (green trace - in progress) and proposed holes WBJ25-B and WBJ25-C (blue traces) which are designed to further extend gold mineralization to the northeast.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6144/245011_0397ef7c24a078a4_003full.jpg

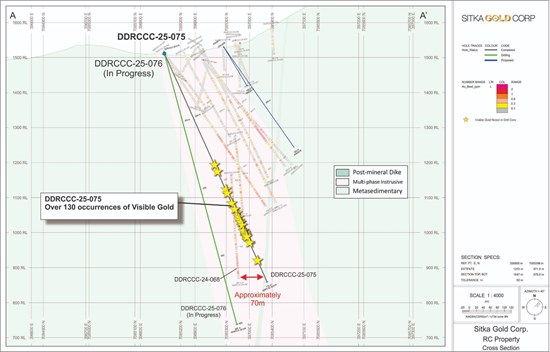

Figure 3. A cross section showing the trace of diamond drill hole DDRCCC-25-075 and the location of over 130 occurrences of visible gold (yellow stars) down the hole. Hole 75 intersected mineralized intrusive rock approximately 70 m to the northeast of Hole 68 which crosses this section orthogonally. While the presence of visible gold is a good indicator of robust gold mineralization it is not a requirement for strong gold mineralization to be present, as was the case in DDRCCC-23-047, one of the best drill holes completed to date at Blackjack. While visible gold was only observed once in Hole 47 it returned 219.0 m of 1.34 g/t gold including 124.8 m of 2.01 g/t gold and 55.0 m of 3.11 g/t gold (see news release dated September 26, 2023). The proposed trace for DDRCCCC-25-076, currently in progress, is also shown and is designed to test gold mineralization deeper than any previous drilling.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6144/245011_0397ef7c24a078a4_004full.jpg

DDRCCC-25-075

Drill hole DDRCCC-25-075 was drilled to a length of 715.97 m at an azimuth of 037o and a dip of -65o to test the horizontal continuity of mineralization intersected in hole DDRCCC-24-068 from the 2024 drill campaign. This drill hole intersected several broad zones of feldspar megacrystic, quartz monzonite cross cutting hornfels biotite schist of the Yuzesyu Formation. These intrusions, and locally the metasediments, are cut by abundant 1-2 cm sheeted quartz veins with cm scale quartz sericite alteration halos. A significant zone of strongly altered, variable textured quartz monzonite was intersected from ~350 m to 620 m. Over 130 instances of visible gold were observed in sheeted quartz veins, often associated with bismuthinite, scheelite, and arsenopyrite throughout the interval, consistent with observations of mineral associations in all previous drilling.

Figure 4. Strongly altered and variably textured quartz monzonite from 562.7 m to 571.7 m in Hole 75. Pink flagging tape marks veins where occurrences of visible gold were noted by Sitka's sharp-eyed field crew.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6144/245011_0397ef7c24a078a4_005full.jpg

Figure 5. A plan map of the Clear Creek Intrusive Complex (CCIC) showing the updated resource areas at Blackjack and Eiger, and the six additional areas that have drill targets indicated by the mauve hatched areas. The map highlights the numerous drill targets that Sitka has outlined within the CCIC which all are connected by the road network on the project and occur in a relatively small area measuring five (5) km north-south and twelve (12) km east-west. Additional areas highlighted by strong gold in soil anomalies are being advanced to the drill ready stage with additional geological work in 2025.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6144/245011_0397ef7c24a078a4_006full.jpg

About the flagship RC Gold Project

The RC Gold Project consists of a 431 square kilometre contiguous district-scale land package located in the heart of Yukon's Tombstone Gold Belt. The project is located approximately 100 kilometres east of Dawson City, which has a 5,000 foot paved runway, and is accessed via a secondary gravel road from the Klondike Highway which is usable year-round and is an approximate 2 hour drive from Dawson City. It is the largest consolidated land package strategically positioned mid-way between the Eagle Gold Mine and the past producing Brewery Creek Gold Mine.

The RC Gold Project now has pit-constrained mineral resources that are contained in two zones: the Blackjack and Eiger gold deposits with 1,291,000 ounces of gold grading 1.01 g/t gold in an indicated category and 1,044,000 ounces of gold grading 0.94 g/t in an inferred category at Blackjack and 440,000 ounces of gold grading 0.50 g/t gold in an inferred category at Eiger. These resource estimate numbers are supported by the recently updated technical report for RC Gold, prepared in accordance with NI 43-101 standards, entitled "Clear Creek Property, RC Gold Project NI 43-101 Technical Report Dawson Mining District, Yukon Territory", prepared by Ronald G. Simpson, P. Geo., of GeoSim Services Inc. with an effective date of January 21, 2025. This report is available on SEDAR+ (http://www.sedarplus.ca) and on the Company's website (www.sitkagoldcorp.com).

Both of these deposits begin at surface, are potentially open pit minable and amenable to heap leaching, with initial bottle roll tests indicating that the gold is not refractory and has high gold recoveries of up to 94% with minimal NaCN consumption (see News Release July 13, 2022).

To date, 73 diamond drill holes have been drilled into this system by the Company for a total of approximately 25,851 metres. Other targets drilled to date include the Saddle, Josephine, Rhosgobel and Pukelman zones. The resource expansion drilling in 2023 at Blackjack produced results of up to 219.0 m of 1.34 g/t gold Including 124.8 m of 2.01 g/t gold and 55.0 m of 3.11 g/t gold in drill hole DDRCCC-23-047 (see news release dated September 26, 2023) and in 2024 results of up to 678.1 metres of 1.04 g/t gold starting from surface in DDRCCC-24-068, Including 409.5 metres of 1.36 g/t gold, 93.0 metres of 2.57 g/t gold and 5.5 metres of 17.59 g/t gold (see news release dated October 21, 2024).

A planned 30,000 metre diamond drilling program for 2025 is currently underway at RC Gold.

RC Gold Deposit Model

Exploration on the Property has mainly focused on identifying an intrusion-related gold system ("IRGS"). The property is within the Tombstone Gold Belt which is the prominent host to IRGS deposits within the Tintina Gold Province in Yukon and Alaska. Notable deposits from the belt include: Fort Knox Mine in Alaska with current Proven and Probable Reserves of 230 million tonnes at 0.3 g/t Au (2.471 million ounces; Sims 2018)(1); Eagle Gold Mine with current Measured and Indicated Resources of 233 million tonnes at a grade of 0.57 g/t Au at the Eagle Main Zone (4.303 million ounces; Harvey et al, 2022)(2); the Brewery Creek deposit with current Indicated Mineral Resource of 22.2 million tonnes at a gold grade of 1.11 g/t (0.789 million ounces; Hulse et al. 2020)(3); the Florin Gold deposit with a current Inferred Mineral Resource of 170.99 million tonnes grading 0.45 g/t (2.47 million ounces; Simpson 2021)(4); the AurMac Project with a in n Inferred Mineral Resource of 347.49 million tonnes grading 0.63 gram per tonne gold (7.00 million ounces)(5) and the Valley Deposit, with a current Indicated Mineral Resource of 4.05 million oz gold at 1.66 g/t and an additional Inferred Mineral Resource of 3.26 million oz at 1.25 g/t gold(6).

(1) Sims J. Fort Knox Mine Fairbanks North Star Borough, Alaska, USA National Instrument 43-101 Technical Report. June 11, 2018. https://s2.q4cdn.com/496390694/files/doc_downloads...

(2) Harvey N., Gray P., Winterton J., Jutras M., Levy M.,Technical Report for the Eagle Gold Mine, Yukon Territory, Canada. Victoria Gold Corp. December 31, 2022. https://vgcx.com/site/assets/files/6534/vgcx_-_202...

(3) Hulse D, Emanuel C, Cook C. NI 43-101 Technical Report on Mineral Resources. Gustavson Associates. May 31, 2020. https://minedocs.com/22/Brewery-Creek-PEA-01182022...

(4) Simpson R. Florin Gold Project NI 43-101 Technical Report. Geosim Services Inc. April 21, 2021. https://sedar.com/GetFile.do?lang=EN&docClass=24&i... d=4984158

(5) Thornton T., Jutras M., Malhotra D. Technical Report Aurmac Property Mayo Mining District, Yukon Territory, Canada. JDS Energy and Mining Inc. February 6, 2024. https://banyangold.com/site/assets/files/5251/bany...

(6) Burrell H., Redmond D.J., Haggarty P., Rogue Gold Project: NI 43-101 Technical Report and Mineral Resource Estimate, Yukon Territory, Canada. Snowline Gold Corp. May 15, 2024. https://snowlinegold.com

Upcoming Events

Sitka Gold will be attending and/or presenting at the following events*:

- Swiss Mining Institute - Zurich, Switzerland: March 18 - 19, 2025

- 121 Mining Investment - London, England: May 12 - 13, 2025

- Canaccord Global Metals and Mining Conference - Henderson, NV: May 20 - 22, 2025

- Yukon Mining Alliance - Dawson City, Yukon: July 9 - 14, 2025

*All events are subject to change.

About Sitka Gold Corp.

Sitka Gold Corp. is a well-funded mineral exploration company headquartered in Canada with over $14 million in its treasury and no debt. The Company is managed by a team of experienced industry professionals and is focused on exploring for economically viable mineral deposits with its primary emphasis on gold, silver and copper mineral properties of merit. Sitka is currently advancing its 100% owned, 431 square kilometre flagship RC Gold Project located within the Tombstone Gold Belt in the Yukon Territory. The Company is also advancing the Alpha Gold Project in Nevada and currently has drill permits for its Burro Creek Gold and Silver Project in Arizona and the Coppermine River Project in Nunavut.

*For more detailed information on the Company's properties please visit our website at www.sitkagoldcorp.com.

The scientific and technical content of this news release has been reviewed and approved by Gilles Dessureau, P.Geo., Vice President of Exploration of the Company, and a Qualified Person (QP) as defined by National Instrument 43-101.

ON BEHALF OF THE BOARD OF DIRECTORS OF

SITKA GOLD CORP.

"Donald Penner"

President and Director

For more information contact:

| Donald Penner | or | Cor Coe |

| President & Director | CEO & Director | |

| 778-212-1950 | 604-817-4753 | |

| dpenner@sitkagoldcorp.com | ccoe@sitkagoldcorp.com |

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary and Forward-Looking Statements

This release includes certain statements and information that may constitute forward-looking information within the meaning of applicable Canadian securities laws. Forward-looking statements relate to future events or future performance and reflect the expectations or beliefs of management of the Company regarding future events. Generally, forward-looking statements and information can be identified by the use of forward-looking terminology such as "intends" or "anticipates", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "should", "would" or "occur". This information and these statements, referred to herein as "forward‐looking statements", are not historical facts, are made as of the date of this news release and include without limitation, statements regarding discussions of future plans, estimates and forecasts and statements as to management's expectations and intentions and the Company's anticipated work programs.

These forward‐looking statements involve numerous risks and uncertainties and actual results might differ materially from results suggested in any forward-looking statements. These risks and uncertainties include, among other things, market uncertainty and the results of the Company's anticipated work programs.

Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. The Company does not undertake to update any forward-looking statement, forward-looking information or financial out-look that are incorporated by reference herein, except in accordance with applicable securities laws. We seek safe harbor.

SIG:CA

The Conversation (0)

4h

Byron King: Gold, Silver, Oil/Gas — Stock Ideas and Strategy Now

Byron King, editor at Paradigm Press, shares his approach to the gold and silver sectors as tensions in the Middle East intensify, also touching on oil and gas. Overall he sees hard assets becoming increasingly key as global uncertainty escalates."Own gold, own silver — physically own the metal... Keep Reading...

4h

Jaime Carrasco: Gold Going "Much Higher," Silver Force Majeure Inevitable

Jaime Carrasco, senior portfolio manager and senior financial advisor at Harbourfront Wealth Management, shares his outlook for gold and silver, saying prices must rise much higher. He also talks about how to build a strong precious metals portfolio. "We're moving from a credit-based economy, a... Keep Reading...

4h

Garrett Goggin: Gold, Silver in New Era, My Stock Strategy Now

Garrett Goggin, founder of Golden Portfolio, says although gold and silver haven't gone mainstream yet, the metals — and the mining sector overall — have entered a new era. "It's a real mind shift — it's a new era in mining right here," he said.Don't forget to follow us @INN_Resource for... Keep Reading...

14h

Nicola Mining Provides Update on NASDAQ Listing

Nicola Mining Inc. (TSXV: NIM,OTC:HUSIF) (OTCQB: HUSIF) (FSE: HLIA) (the "Company" or "Nicola") is pleased to provide an update on its proposed NASDAQ listing, which it originally disclosed in its news release of October 27, 2025. There are approximately 220 Canadian companies trading via cross... Keep Reading...

06 March

Adrian Day: Gold Dips Bought Quickly, Price Run Not Over Yet

Adrian Day, president of Adrian Day Asset Management, shares his latest thoughts on what's moving the gold price, emphasizing that its bull run isn't over yet. "It's monetary factors that are driving gold — that's what's fundamentally driving gold," he said. "Monetary factors, lack of trust in... Keep Reading...

06 March

Brien Lundin: Gold, Silver Stock Run Just Starting, Get in Now

Brien Lundin, editor of Gold Newsletter and New Orleans Investment Conference host, shares his stock-picking strategy at a time when high metals prices are beginning to lift all boats. In his view, gold and silver equities may still only be in the second inning. Don't forget to follow us... Keep Reading...

Latest News

Interactive Chart

Latest Press Releases

Related News

TOP STOCKS

American Battery4.030.24

Aion Therapeutic0.10-0.01

Cybin Corp2.140.00