(TheNewswire)

-

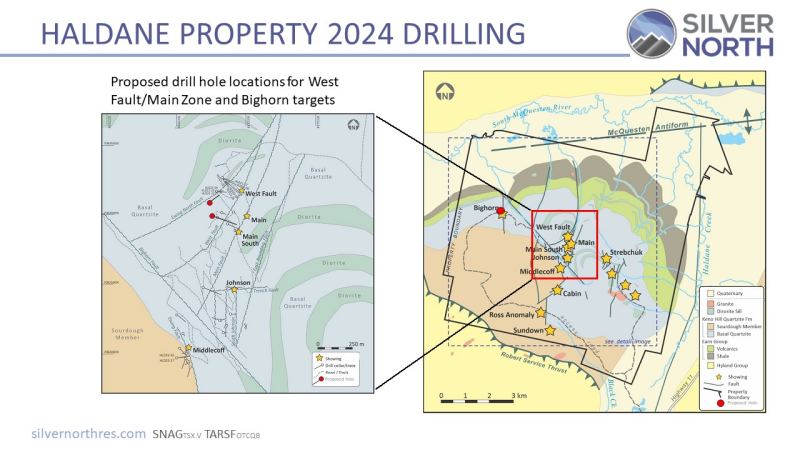

Drilling to test high-grade silver targets at the West Fault, Main Fault and Bighorn

Vancouver, BC, September 10, 2024 TheNewswire Silver North Resources Ltd. (TSX-V: SNAG, OTCQB: TARSF) " Silver North " or the " Company ") is pleased to announce that the 2024 drilling campaign has commenced at the wholly owned Haldane Property in the historic Keno Hill Silver District, Yukon. Approximately 1,000 metres of drilling is planned for 3 holes testing the West Fault, Main Fault and Bighorn targets. The 8,579 hectare Haldane Property is located 25 km west of Keno City, YT and hosts numerous occurrences of silver-lead-zinc-bearing quartz siderite veins as seen elsewhere in the district.

"Silver North's second drill program of 2024 targeting high grade silver mineralization is underway," stated Jason Weber, P.Geo., President and CEO of Silver North. "This is an exciting time for Silver North shareholders as we await the analytical results from Tim and now are drilling three high priority targets at Haldane. We aim to build on the strike and down dip extents at West Fault, attempt to intersect the Main Fault at depth and build on the only hole testing the Bighorn target."

Drilling will target the West Fault, Main Fault and Bighorn areas. Drilling at West Fault will aim to expand upon high grade silver mineralization intersected in recent drilling such as 3.14 metres (true width) averaging 1,351 g/t silver, 2.43% lead and 2.91% zinc. The West Fault structure has been traced for over 650 metres of strike length and is interpreted to extend to 1.1 km in length before merging with the 2.2 km long Main Fault structure.

Drilling at the West Fault will target the interpreted southwest plunge of the mineralization with an approximate 50 m step-out from the high-grade result returned from HLD21-24 (3.14 metres (true width) averaging 1,351 g/t silver, 2.43% lead and 2.91% zinc). A second hole targeting the West Fault and Main Fault will test the West Fault approximately 190 m along strike to the southwest from HLD21-24 and approximately 75m downdip from HLD11-06 that returned 3.04 metres averaging 0.472 g/t gold, 190.8 g/t silver, 4.33% lead and 2.61 % zinc from a very poorly recovered highly oxidized intersection of the vein. This hole is intended to continue to intersect the Main Fault approximately 275m downdip and between the Main and Main South surface showings. A nearby shallow drill hole from 2011 returned 3.08 m averaging 0.122 g/t gold, 83.8 g/t silver, 0.14% lead and 1.39% zinc from poorly recovered and highly oxidized vein material at the overburden – bedrock interface.

Drilling will also target the silver-bearing vein mineralization intersected in the only hole drilled at the Bighorn Target. Drilling in 2019 intersected four separate veins, the best of which returned 2.35 m averaging 125 g/t silver and 4.39% lead. The structure hosting mineralization at Bighorn has been traced for over 525 m of strike length within a 900 m long lead-silver soil geochemical anomaly. The current drilling will target approximately 200 m along strike to the north from the 2019 intersection and will test a combination of soil samples highly anomalous in silver and lead and anomalous trench sampling results from the highly oxidized and weathered main BT structure at Bighorn that returned 22.6 m of 0.12% lead and 6.1 g/t silver.

About Silver North Resources Ltd.

Silver North's primary assets are its 100% owned Haldane silver project (next to Hecla Mining Inc.'s Keno Hill Mine project) and the Tim silver project (under option to Coeur Mining, Inc.).

The Company is listed on the TSX Venture Exchange under the symbol "SNAG", trades on the OTCQB market in the United States under the symbol "TARSF", and under the symbol "I90" on the Frankfurt Stock Exchange.

Mr. Jason Weber, P.Geo., President and CEO of Silver North Resources Ltd. is a Qualified Person as defined by National Instrument 43-101. Mr. Weber supervised the preparation of the technical information contained in this release.

For further information, contact:

Jason Weber, President and CEO

Sandrine Lam, Shareholder Communications

Tel: (604) 807-7217

Fax: (888) 889-4874

To learn more visit: www.silvernorthres.com

X: https://x.com/SilverNorthRes

LinkedIn:

Copyright (c) 2024 TheNewswire - All rights reserved.