Silver Hammer Mining Corp. (CSE: HAMR) (OTCQB: HAMRF) (FSE: 7BW0) (the "Company" or "Silver Hammer") is pleased to announce it has recently completed a property-wide aerial magnetic-radiometric survey at its Eliza Silver Project near Ely, Nevada. The preliminary results are encouraging and identify extensions to existing targets and highlight multiple new priority exploration targets. The final results are currently being processed by Condor North Consulting ULC.

"We are pleased to highlight the positive results of the property-wide airborne magnetic and radiometric survey at our high-grade silver and copper Eliza Project," commented President & CEO Peter A. Ball. "The Company continues to push forward with its 'Plan of Operations' permitting and evaluation of the Eliza Project. Current observations highlight strong correlation between historical and recent surface sampling, mapping and structural analysis and the June 2023 preliminary geophysical surveys. With the addition of new potential drill targets being identified, we look forward to the final technical analysis of the raw data to assist in the next steps at Eliza."

Eliza Project Survey Technical Highlights

The geodetic system used for the Eliza geophysical survey was WGS 84 in UTM Zone 11N. A total of 360-line km were flown with a helicopter over the property. The survey was flown at 25 m line spacing on a heading of 090°/270°, while tie lines were flown at 250 m line spacing on a heading of 000°/180°.

Preliminary radiometric modeling shows strong correlation with field observations including the placement of the Eberhardt Fault, a major truncating (290° azimuth) fault that dissects the Hamilton Vein systems. The Belmont and Passynak zones are seen as radiometric highs that extend along a (010°) structural orientation (refer to Figure 1 Airborne Radiometric Survey Results). Other anomalous radiometric highs have been identified along the same (010°) orientation indicating potential off-sets and extensions of mineralization south of the Eberhardt Fault.

In total, the mineralized systems identified to date exhibit strong silver and base metal mineralization, visual structural control (010°) and now magnetic and radiometric anomalies which will assist the Company design new drill targets.

Figure 1. Eliza Radiometric Survey Results

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9597/173772_figure1.jpg

About Eliza Project

The Eliza Silver Project is a 5.52 square kilometer land package, which includes the past-producing California Mine patented US lode claim and is located along strike of the Hamilton Mining District, Nevada's highest-grade silver district, which produced 40 million ounces silver with grades up to 20,000 g/t between 1876-1890.

Information gained from a detailed geologic map indicate that Eliza and the Hamilton District contain high-grade silver mineralization hosted by the same formation. No modern-day exploration or significant work/drilling has been completed on the project in over half a century. Disclaimer note: Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company's project.

District scale folding of local sedimentary rocks appears to have provided structural open space fault and fracture zones, (010° azimuth) which allowed mineralizing fluids to migrate through receptive host rocks, resulting in replacement deposits hosted by Devonian-aged Nevada (Guilmette) Limestone and late Devonian to early Mississippian-aged Pilot Shale and Joana Limestone. Historically, these zones were mined in the adjacent Hamilton Mining District (1870's) reporting high grade Pb-Ag-Zn-Cu hosted in dolomite-limestone replacement zones of the Nevada (Guilmette) Limestone with reported grades up to 2,177 g/t Ag, (Humphrey, 1960). Igneous rocks have not been identified on the property; however, two Cretaceous-aged granitic intrusions are exposed at the Mount Hamilton Mine, 7.5 km to the northwest.

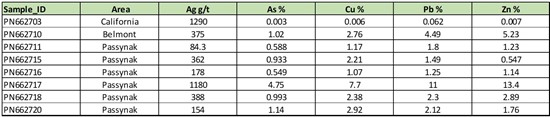

Geologic mapping, rock and soil sampling efforts have defined three main zones of interest: Passynak, Belmont and California. All three zones show evidence of historic mine development and production. The highest-grade samples collected by the Company were from the Passynak and Belmont mines. Samples represent dolomitic micro-breccia replacements within the Joana Limestone. The replacement zones exhibit micro brecciation textures, stockwork or sheeted calcite veinlets, magnetite, limonite stain, and commonly show copper oxides.

Assay results from 2021 Company sampling programs confirmed the existence of a well-developed silver-rich mineral system, which also shows enrichments in copper (Cu), lead (Pb) and zinc (Zn), suggesting the potential for the existence of a blind copper porphyry.

Follow up sampling in 2022 revealed that the replacement zones in limestone are penetrating along axial planar faults and fracture zones and commonly weather into resistant ridges. A total of 25 samples were collected as follow up samples, 17 of which focused on the dolomitic-limestone replacements found exposed in a variety of historic mine shafts and prospect pits. An especially pertinent aspect of the results from this round of sampling is the presence of high-grade Cu, Pb and Zn, in addition to Ag.

Assay results from 2021-22 Company sampling programs confirmed the existence of a well-developed silver-rich mineral system, which also shows enrichments in Cu, Pb and Zn, typical of skarn-hosted base and precious metals and perhaps suggesting the potential for a porphyry at depth.

Table 1. Eliza Notable Rock Samples*

*Please refer to the news release dated May 11, 2022 for related Quality Assurance and Quality Control Sampling Security for results in Table 1.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9597/173772_table1.jpg

Several outlying soil anomalies indicate extension to known mineral systems or new zones. Notable soil sample results are shown in Table 2.

Table 2. Eliza Notable Soil Sample**

**Please refer to the news release dated October 25, 2022 for related Quality Assurance and Quality Control Sampling Security for results in Table 2.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9597/173772_table2.jpg

Qualified Person

Scientific and technical data herein have been reviewed and approved under the supervision of Philip Mulholland, (CPG). Mr. Mulholland is a Qualified Person (QP) under National Instrument 43-101 Standards of Disclosure for Mineral Projects. Mr. Mulholland recently visited the property again in June 2023 and supervised the previous sampling referenced herein from 2022.

About Silver Hammer Mining Corp.

Silver Hammer Mining Corp. is a junior resource exploration company advancing its flagship past-producing Silver Strand Mine in the Coeur d'Alene Mining District in Idaho, as well both the Eliza Silver Project and the Silverton Silver Mine in one of the world's most prolific mining jurisdictions in Nevada. Silver Hammer's primary focus is defining and developing silver deposits near past-producing mines that have not been adequately explored. The Company's portfolio also provides exposure to high-grade copper and gold at its projects.

On Behalf of the Board of Silver Hammer Mining Corp.

Peter A. Ball

President & CEO, Director

E: peter@silverhammermining.com

For investor relations inquiries, contact:

T: 778.344.4653

E: investors@silverhammermining.com

Forward-Looking Statements

This news release contains "forward-looking statements" within the meaning of Canadian securities legislation. Such forward-looking statements concern, without limitation, the Company's strategic plans, timing and expectations for the Company's exploration and drilling programs, estimates of mineralization from drilling, geological information projected from sampling results and the potential quantities and grades of the target zones. Such forward-looking statements or information are based on a number of assumptions, which may prove to be incorrect. Assumptions have been made regarding, among other things: conditions in general economic and financial markets; accuracy of assay results; geological interpretations from drilling results, timing and amount of capital expenditures; performance of available laboratory and other related services; future operating costs; and the historical basis for current estimates of potential quantities and grades of target zones. The actual results could differ materially from those anticipated in these forward-looking statements as a result of risk factors, including the timing and content of work programs; results of exploration activities and development of mineral properties; the interpretation and uncertainties of drilling results and other geological data; receipt, maintenance and security of permits and mineral property titles; environmental and other regulatory risks; project costs overruns or unanticipated costs and expenses; availability of funds; failure to delineate potential quantities and grades of the target zones based on historical data, and general market and industry conditions. Forward-looking statements are based on the expectations and opinions of the Company's management on the date the statements are made. The assumptions used in the preparation of such statements, although considered reasonable at the time of preparation, may prove to be imprecise and, as such, readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statements were made. The Company undertakes no obligation to update or revise any forward-looking statements included in this news release if these beliefs, estimates and opinions or other circumstances should change, except as otherwise required by applicable law.

The CSE does not accept responsibility for the adequacy or accuracy of this release. The Canadian Securities Exchange has neither approved nor disapproved the contents of this press release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/173772