Silver Bullet Mines Corp. (TSXV: SBMI) (OTCQB: SBMCF) ('SBMI' or 'the Company') is pleased to announce it has commenced daily processing of what it reasonably believes to be high-grade silver and gold mineralized material from the Super Champ Mine in Arizona.

The material is being processed at the Company's wholly owned mill in Globe, Arizona. The Company intends to process over six tons per hour for eight hours per day, five days per week, to produce silver and gold concentrate (see photo below of concentrate line on the shaker table). The Company plans to in the near future increase the number of hours for the mill to be in production through the addition of another shift. The Company intends that material on an ongoing basis will be extracted from the mine and transported to the mill site for processing.

Concentrate Line on Shaker Table

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8464/262621_53875bf024794be8_001full.jpg

SBMI previously reported the head grade of the material as being over 28 oz/ton silver and recovery at 89% (news release of November 12, 2024). SBMI on March 19, 2025 announced a concentrate grade of the Super Champ material of 530 ounces per ton silver, and on November 12, 2024 announced an independent accredited lab had assayed for gold in the Super Champ concentrate, returning .52 ounces (16.16 grams/ton). SBMI reasonably believes it can maintain that head grade and the concentrate grade.

All immediate production from the Super Champ Mine is committed to a third party buyer pursuant to a Firm Offer disclosed by the Company on July 9, 2025. The Firm Offer provides for an initial payment equal to 90% of the estimated value of the concentrate within 5 days of the buyer picking up concentrate from the Company's mill, with the remaining amount to be reconciled after verification of the concentrate by the buyer. At the intended rate of processing the first shipment should be ready for the buyer to pick up in the near term.

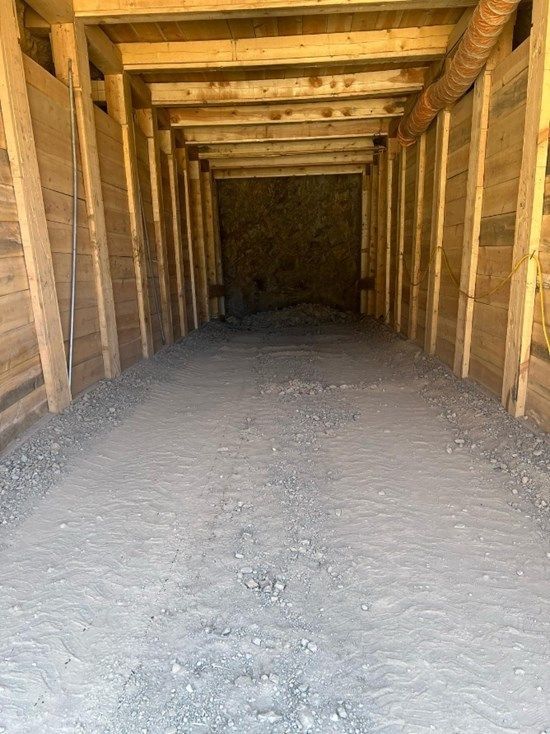

To ensure the adits were safe, the Company timbered the entire 125 foot lower adit and moved over 10,000 tons of material from the upper adit (see photo below of timber in lower adit). SBMI can now safely move forward with mining from both adits.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8464/262621_53875bf024794be8_002full.jpg

To complete the site work at the Super Champ, to expand the King Tut Gold Mine footprint (SBMI's latest property acquisition), to advance the Washington Mine in Idaho, and for general working capital, the Company has entered into a strategic financing. The financing is by way of a nonbrokered private placement of Units. The participants have agreed to provide funds of $1,120,800, with each Unit priced at a premium to the market at $0.21 with a full warrant exercisable at $0.28 for 3 years. The Company plans to close the placement immediately. Should any others wish to participate please contact the Company immediately.

For further information:

John Carter

Silver Bullet Mines Corp., CEO

cartera@sympatico.ca

+1 (905) 302-3843

Peter M. Clausi

Silver Bullet Mines Corp., VP Capital Markets

pclausi@brantcapital.ca

+1 (416) 890-1232

Cautionary and Forward-Looking Statements

This news release contains certain statements that may constitute forward-looking statements as they relate to SBMI and its subsidiaries. Forward-looking statements are not historical facts but represent management's current expectation of future events, and can be identified by words such as "believe", "expects", "will", "intends", "plans", "projects", "anticipates", "estimates", "continues" and similar expressions. Although management believes that the expectations represented in such forward-looking statements are reasonable, there can be no assurance that they will prove to be correct.

By their nature, forward-looking statements include assumptions and are subject to inherent risks and uncertainties that could cause actual future results, conditions, actions or events to differ materially from those in the forward-looking statements. If and when forward-looking statements are set out in this new release, SBMI will also set out the material risk factors or assumptions used to develop the forward-looking statements. Except as expressly required by applicable securities laws, SBMI assumes no obligation to update or revise any forward-looking statements. The future outcomes that relate to forward-looking statements may be influenced by many factors, including but not limited to: the impact of SARS CoV-2 or any other global pathogen; reliance on key personnel; the thoroughness of its QA/QA procedures; the continuity of the global supply chain for materials for SBMI to use in the exploration for and the production and processing of mineralized material; the results of exploration and development activities; the results of mining and mill operations; shareholder and regulatory approvals; activities and attitudes of communities local to the location of the SBMI's properties; risks of future legal proceedings; income tax matters; fires, floods and other natural phenomena; the rate of inflation; counterparty risk with respect to any buyer of the Company's products; availability and terms of financing; distribution of securities; commodities pricing; currency movements, especially as between the USD and CDN; effect of market interest rates on price of securities; and, potential dilution. SARS CoV-2 and other potential global pathogens create risks that at this time are immeasurable and impossible to define.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/262621